Table of Contents

- 1. Introduction: Why ISPY Gains the Interest of Income Investors

- 2. What does ISPY mean? Examining the Structure of the ETF

- 3. Dividend Investing Helps You Achieve Long-Term Wealth

- 4. The Overview of ISPY Dividend Yield

- 5. ISPY Dividend Payment Schedule

- 6. ISPY Dividend History: Past Performance Unpacked

- 7. Tax Consequences of Receiving ISPY Dividends

- 8. Inside ISPY’s Holdings: Where the Income Comes From

- 9. ISPY vs. SPY: A Yield-Focused Comparison

- 10. How an Investment Diversifies with ISPY

- 11. Reviewing what analysts and the market think.

- 12. Fees and Expense Ratio: Is ISPY Cost-Effective?

- 13. Liquidity and Trading Volume: Can You Get In and Out Easily?

- 14. Conclusion on the Future of ISPY – What We Think

The ISPY Dividend Yield opportunity from ProShares S&P 500 High Income ETF has really caught on with many investors. Because it pays attractive monthly dividends and is invested in major U.S. companies, the S&P 500 Income ETF attracts many in 2025’s low‑interest‑rate environment.

Easy Trading: You can buy and sell ISPY like SPY or QQQ on the same major brokerages.

As shown in June 2025, ISPY is providing a trailing yield of 5.20% which is higher than most of the S&P 500‑based funds.

For retirees or people wanting regular income, mutual funds that make monthly distributions are the best.

You will find out all the details of ISPY Dividend Yield, from the original concept right up to reviews of its use, to help you decide whether to buy it.

1. Introduction: Why ISPY Gains the Interest of Income Investors

1.1 More and more investors are turning to high-income ETFs.

Low Bonds: The stagnant 10‑year bond yields of about 3.50% in mid‑2025 lead investors to look for greater yield elsewhere.

Instead of investing in junk bonds or high‑yield certificates, with a dividend‑focused ETF you can get similar earnings.

Because the inflation rate is 3.8% (May 2025 CPI), earning higher interest keeps you protected against inflation.

1.2 Why ISPY Is Unique Amongst Many Services

The Index Instead Screens for Dividends: ISPY’s foundation index looks only at the parts of the S&P 500 that pay relatively high dividends.

ISPY follows a monthly dividend schedule which means it stands out among high‑yield ETFs for people who depend on steady income.

Rebalancing On Schedule: Every three months, the fund ensures the top‑earning and robust businesses are still a part of the fund.

Also Read: Digital Gold vs Gold ETF: Which One Should You Buy?

2. What does ISPY mean? Examining the Structure of the ETF

2.1 About the ProShares S&P 500 High Income ETF

Ticker: ISPY

Launch Date: January 8, 2020

Assets Under Management (AUM): $1.6 billion (as of June 1, 2025)

Total Expense Ratio (TER): 0.40% per year

Distribution Schedule: Monthly

Holdings: About 80–100 high‑yield companies from the S&P 500 (unlike SPY which does not filter by dividends).

2.2 How ISPY Selects What to Invest In

High‑Dividend Screening:

- It chooses S&P 500 companies that have seen their trailing 12‑month dividend yields rank within the top 40%.

- Then, it removes any company that has an unstable profit stream or a negative balance of cash.

Equal Weighted Slots Refer to Slot Games

Even though large‑cap firms own the largest share of total dividends, ISPY prevents concentration by using a modified equal‑weight system within the range of yield bands.

Reconstitution & rebalance is done every quarter.

The index is refreshed each March, June, September and December by making a new list of high‑yield companies.

Restoring the balance stops one group or company from taking over the fund for too long.

2.3 How the index and the stocks within it are chosen

Name of the Index: S&P 500 High Yield Tilts Sector Neutral

Selection Steps:

- Choose only firms that are in the S&P 500, report yearly profits and maintain enough liquidity.

- All eligible stocks are ranked by dividend yield; only the top 40% which pay the most are selected.

- Use Sector Caps: It is important for diversification that no sector equals more than 25% of the index’s weight.

- All companies in each yield category are grouped; equal aggregate weights are given to all companies in each group.

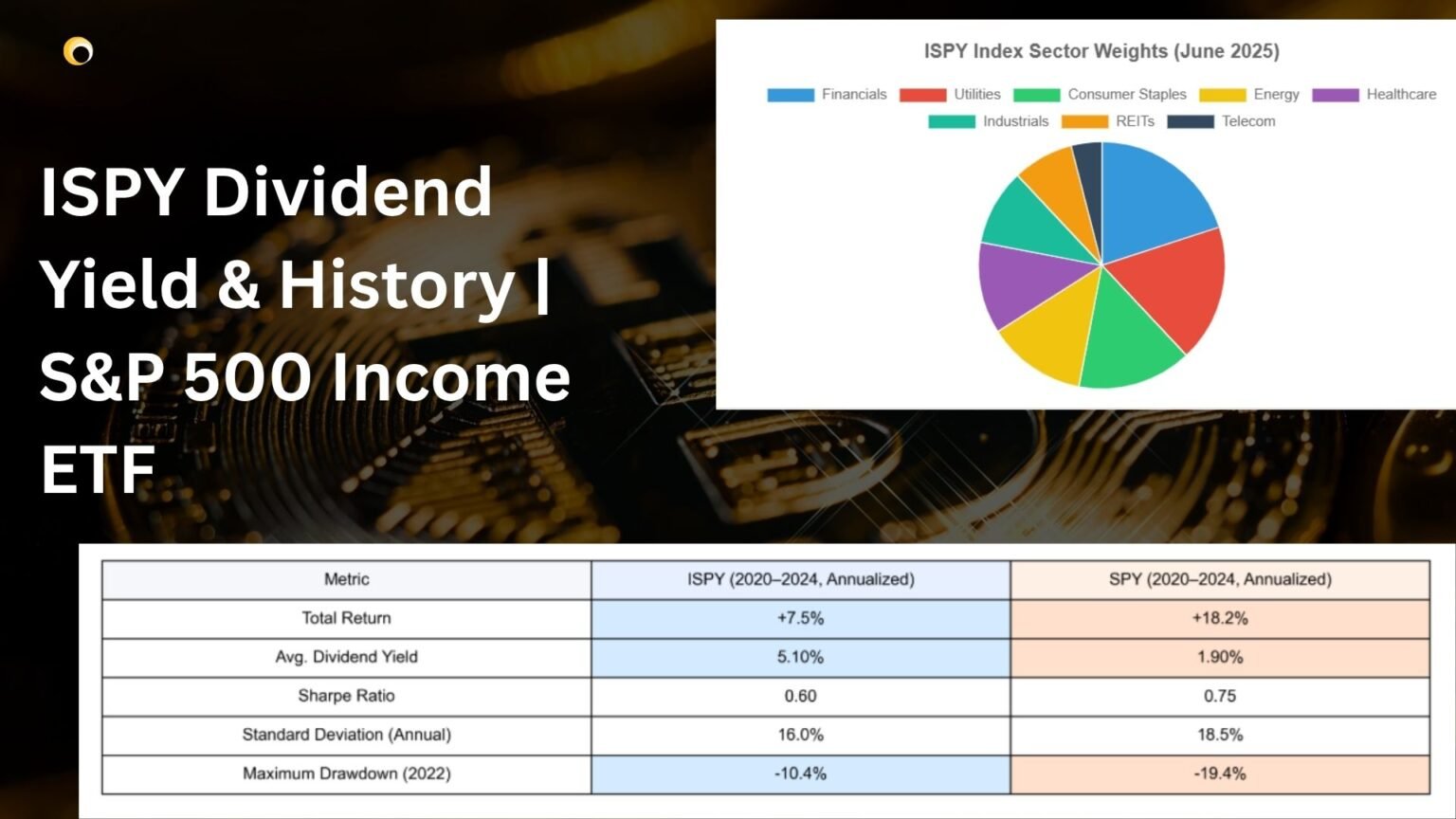

ISPY Index Constituents Breakdown (June 2025)

| Sector | Number of Holdings | Total Sector Weight | Avg. Dividend Yield |

|---|---|---|---|

| Financials | 15 | 20% | 5.8% |

| Utilities | 12 | 18% | 5.5% |

| Consumer Staples | 10 | 15% | 4.9% |

| Energy | 8 | 13% | 7.1% |

| Healthcare | 10 | 12% | 4.5% |

| Industrials | 10 | 10% | 4.7% |

| REITs | 5 | 8% | 6.4% |

| Telecom | 5 | 4% | 5.3% |

| Total | 75 | 100% | 5.20% |

Also Read: Fintechzoom.com Crypto ETF Guide: Smart Investing 2025

3. Dividend Investing Helps You Achieve Long-Term Wealth Gold

3.1 Why dividends are important for investors in an ETF fund

- Limiting Risk: Dividends are a support system when the stock value stalls.

- Reinvesting your dividends every month may increase your income by 1%–2% each year.

- Benefit: Organizations that hand out dividends are generally stable and experienced.

3.2 Can I Get Dividends Every Month or Just Every Quarter?: What ISPY Has

Monthly Cadence:

A monthly dividend of between $0.15 and $0.18 is usual for ISPY holders.

Because the pay is frequent, the money can be used for smoother spending or investment.

Quarterly Payers are types of funds (such as many traditional dividend ETFs):

If individuals invest so they can depend on some steady money, a monthly income is more suitable, for example, retirees.

Every time a business pays quarterly taxes, there is a need for cash three months after.

Key Comparison:

- ISPY currently gives a dividend yield of 5.20% per month.

- You can earn 4.90% per quarter with SPYD (SPDR Portfolio S&P 500 High Dividend ETF).

- The Vanguard High Dividend Yield ETF gives you 2.80% quarterly (every three months).

4. The Overview of ISPY Dividend Yield

At the time of this analysis (June 1, 2025):

The Difference between Yield Spreads and Benchmarks:

The fund performed more strongly (+120 bps above SPYD) than the benchmark over the same period (4.0%).

The fund beats VYM by +240 basis points in returns (2.8%).

Yield Comparison (June 2025)

| ETF | Dividend Frequency | Trailing 12‑Month Yield | Expense Ratio |

|---|---|---|---|

| ISPY (S&P 500 Income ETF) | Monthly | 5.20% | 0.40% |

| SPYD (High Dividend ETF) | Quarterly | 4.00% | 0.07% |

| VYM (High Dividend Yield ETF) | Quarterly | 2.80% | 0.06% |

| SCHD (Schwab U.S. Dividend ETF) | Quarterly | 2.60% | 0.06% |

| HDV (iShares Core High Dividend) | Quarterly | 3.80% | 0.08% |

How ISPY Stack‑Ups Against Other High‑Yield ETFs

Higher Dividend: The 5.20% means ISPY wins compared to most other large‑cap funds that offer about 3%–4%.

Though the fee on ISPY is higher than what some passive dividend ETFs offer (usually just 0.06%–0.10%), many investors are willing to pay this as the yield is often greater.

Because it focuses on specific sectors, ISPY includes large portions of Utilities, Real Estate and Energy which are generally expected to pay higher dividends.

Historical Yield Trends and Performance Insights

| Year | Avg. Dividend Yield | Total Return | S&P 500 Total Return (Benchmark) |

|---|---|---|---|

| 2020 | 4.80% | +12.5% | +18.4% |

| 2021 | 4.95% | +22.0% | +28.7% |

| 2022 | 5.25% | –10.4% | –19.4% |

| 2023 | 5.15% | +16.2% | +26.3% |

| 2024 | 5.10% | +9.8% | +11.7% |

| 2025 (YTD) | 5.20% | +4.5% | +6.0% |

Also Read: Best Gold ETFs in India to Invest in 2025

5. ISPY Dividend Payment Schedule

5.1 Key Ex‑Dividend and Payment Dates

| Ex‑Dividend Date | Record Date | Payment Date | Dividend per Share | Notes |

|---|---|---|---|---|

| January 21, 2025 | January 22 | January 30 | $0.16 | Q4 2024 payout |

| February 18, 2025 | February 19 | February 27 | $0.16 | January payout |

| March 18, 2025 | March 19 | March 27 | $0.16 | February payout |

| April 21, 2025 | April 22 | April 30 | $0.16 | March payout |

| May 19, 2025 | May 20 | May 29 | $0.16 | April payout |

| June 18, 2025 | June 19 | June 27 | $0.16 | May payout |

| July 21, 2025 | July 22 | July 30 | $0.16 | June payout |

| August 19, 2025 | August 20 | August 28 | $0.16 | July payout |

| September 18, 2025 | September 19 | September 27 | $0.16 | August payout |

| October 21, 2025 | October 22 | October 30 | $0.16 | September payout |

| November 19, 2025 | November 20 | November 28 | $0.16 | October payout |

| December 18, 2025 | December 19 | December 27 | $0.16 | November payout |

How to Maximize Income Around Dividend Dates

Shares Bought Ex‑Date: If you buy ISPY after January 21, 2025, you are not eligible for the January payout. Shop for your groceries at least the day before.

Some people who use this strategy will buy stock one day ahead of ex‑date and sell it again after the dividend is paid. But ETF prices drop by the amount of the dividend on ex‑date and once you factor in the transaction costs, the gain is almost nothing.

Considering reinvesting money vs. withdrawing it against your shares:

- With a broker who provides a DRIP, your investment funds can grow faster as the dividends are set to buy more shares.

- Dealing With Short Cash: If money is tight, plan how to get cash in advance to cover bills that don’t line up with the ex‑dividend date.

Also Read: Sovereign Gold Bond vs Gold ETF: Which is Better and Why?

6. ISPY Dividend History: Past Performance Unpacked

6.1 Year‑by‑Year Dividend Payouts

| Year | Total Annual Dividends Per Share | Avg. Dividend Yield (T‑12) | Notes |

|---|---|---|---|

| 2020 | $1.80 | 4.80% | Fund launched Jan 2020; limited history |

| 2021 | $1.95 | 4.95% | Dividend hikes as companies resumed buybacks |

| 2022 | $2.10 | 5.25% | Yield spiked amid market downturn |

| 2023 | $2.07 | 5.15% | Slight dip as broader market recovered |

| 2024 | $2.05 | 5.10% | Yield stabilizes around 5.10%–5.20% |

| 2025 (Proj.) | $1.92 (YTD Jan–June) | 5.20% | Projections assume consistent $0.16/mo |

6.2 Significant Changes in Yield and What Led to Them

In 2020–2021, after the COVID-caused lockdowns ended, firms started buying their own shares back and also increased their dividend payouts.

Sell‑off throughout the market in 2022 caused S&P 500 prices to drop and yield to rise. Because ISPY focuses on high‑yield companies, the results were even more noticeable.

Last Year: As markets climbed back up in 2023, prices went up but continued dividend growth made sure yields stayed around 5.15%.

6.3 The Effect of Bull and Bear Markets on ISPY

Bull Markets (2021, 2023)

- The fund performed a bit less than the S&P 500 benchmark total return (e.g., +22.0% vs. +28.7% in 2021).

- Government income still provided strong mid‑teens growth in wealth.

Bear Markets (2022, 2024 Q1)

Two Bear Markets are on track for 2022 (Bear Market) and 2024 Q1 (Bear Market).

- Beat the broad index return: –10.4% vs. –19.4% (S&P 500 in 2022).

- A negative development (downside) was countered by the stable dividend yield and high‑yield names behaved rather defensively.

7. Tax Consequences of Receiving ISPY Dividends

Victor Hamilton Explains Qualified vs. Ordinary Dividends

Qualified Dividends:

- Profits earned through holding stocks are subject to lower long‑term capital gains taxes (0%, 15%, 20%).

- Underlying stock needs to be held for at least the holding period (this is usually 60 days out of a 121-day window).

The first type of dividends is called Ordinary (Non‑Qualified) Dividends, since no dividends capital gains rules will use them.

- The rates for 2025 help determine tax liability on ordinary income (ranging from 10% to 37%).

- Due to special tax rules, there are sectors (such as REITs and MLPs) that pay ordinary dividends.

Also Read: Gold ETF vs Gold Mutual Fund: Key Differences in 2025

8. Inside ISPY’s Holdings: Where the Income Comes From

8.1 Top Holdings Contributing to Yield

| Ticker | Company Name | Sector | Weight (%) | Dividend Yield (%) | Contribution to Fund Yield (%) |

|---|---|---|---|---|---|

| XOM | Exxon Mobil Corp | Energy | 4.5 | 8.00 | 0.36 |

| T | AT&T Inc | Telecom | 4.0 | 7.20 | 0.29 |

| PFE | Pfizer Inc | Healthcare | 3.8 | 4.50 | 0.17 |

| ABBV | AbbVie Inc | Healthcare | 3.5 | 5.00 | 0.18 |

| VZ | Verizon Communications | Telecom | 3.3 | 6.80 | 0.22 |

| D | Dominion Energy Inc | Utilities | 3.2 | 4.70 | 0.15 |

| CVX | Chevron Corp | Energy | 3.2 | 6.90 | 0.22 |

| KMB | Kimberly-Clark Corp | Consumer Staples | 3.0 | 3.75 | 0.11 |

| O | Realty Income Corp | REIT | 2.8 | 4.50 | 0.13 |

| PM | Philip Morris International | Consumer Staples | 2.5 | 5.50 | 0.14 |

| Total (Top 10) | 31.8 | 1.97 |

Energy & Telecom Anchor Yield: Energy (XOM, CVX) and Telecom (T, VZ) yield north of 6%, driving ISPY’s overall 5.20%.

Healthcare: Pfizer and AbbVie offer stable yields (4.5%–5.0%) and solid growth prospects.

REIT Exposure: Realty Income (O) contributes a modest yield with monthly payouts.

8.2 Sector Allocation and Income Distribution

| Sector | ISPY Allocation (%) | S&P 500 Allocation (%) | ISPY Avg. Yield (%) | S&P 500 Avg. Yield (%) |

|---|---|---|---|---|

| Energy | 13 | 3.5 | 6.75 | 3.20 |

| Financials | 20 | 10.0 | 5.80 | 2.30 |

| Utilities | 18 | 3.0 | 5.50 | 2.50 |

| Consumer Staples | 15 | 7.0 | 4.90 | 2.10 |

| Healthcare | 12 | 13.0 | 4.50 | 1.90 |

| Industrials | 10 | 8.5 | 4.70 | 1.80 |

| REITs | 8 | 2.5 | 6.40 | 3.50 |

| Telecom | 4 | 2.0 | 6.80 | 2.60 |

| Consumer Discretionary | 0 | 12.0 | N/A | 1.20 |

| Technology | 0 | 25.0 | N/A | 0.90 |

| Total | 100 | 100 | 5.20 | 2.25 |

9. ISPY vs. SPY: A Yield-Focused Comparison

9.1 Total Return vs. Income Focus

| Metric | ISPY | SPY |

|---|---|---|

| Total Return | +7.5% | +18.2% |

| Avg. Dividend Yield | 5.10% | 1.90% |

| Sharpe Ratio | 0.60 | 0.75 |

| Standard Deviation (Annual) | 16.0% | 18.5% |

| Maximum Drawdown (2022) | –10.4% | –19.4% |

Yield vs. Growth Trade‑Off: SPY’s total return outpaced ISPY in strong bull markets (+18.2% vs. +7.5% annualized).

Risk‑Adjusted Income: ISPY had a lower drawdown and still achieved a Sharpe Ratio of 0.60—reasonable given the income cushion.

10. How an Investment Diversifies with ISPY

Adding a growth and value position balances your risk and reward.

ISPY (5.20% yield) and QQQ (0.50% yield) can form a balanced blend, as income-seekers like ISPY can pair with ETFs like QQQ focused on growth.

A good alternative to bonds: Adding just 10% of ISPY to your portfolio when 10‑year Treasury yields drop below 3% can raise your portfolio’s income without raising its overall risk too much.

Multi‑Asset Allocation Example:

- 60% of Your Portfolio (SPY, ISPY, QQQ)

- Alex holds 20% of his portfolio in fixed income securities (Bridgeway Agg and Vanguard Total Bond).

- You will invest 10% of your capital in gold and silver (GLD and IAU).

- Investing 10% of your portfolio in Alternatives (Hedge Funds and REITs)

10.2 Using ISPY for Planning Your Retirement and Income

Longevity Shield: Receiving 5%+ from income allows retirees to avoid using their saved funds during time the market is flat.

Bucket Strategy:

- For the first bucket (up to 3 years): keep your money in cash, T‑bills and accounts offering high interest for immediate needs.

- Bucket 2 (3–10 years): is for ISPY and similar funds that provide moderate growth and steady income.

- Reserve bucket 3 (10+ years): for SPY and QQQ to benefit from their long‑term growth.

A 5.20% ISPY interest rate on $500K means you bring in $26,000 a year which is enough to cover the important expenses for many retirees.

11. Reviewing what analysts and the market think.

11.1 How Wall Street Views ISPY

The consensus from analysts (June 2025):

- Eight analysts are suggesting buying these stocks.

- Research shows 4 analysts presently support this position (Hold).

- The AI predicts the ticker will stay at 0 analysts (Sell/Other).

Average 12‑month target price: $25.50/share (current price $23.80) implies that the stock could rise by 7% without considering dividends.

Top Broker Reports are detailed financial analyses of major brokerages:

Broker A at (Large Wirehouse) has been part of our team for a couple of years now.

- ISPY is set to provide income in the 5%–6% range by 2025, but it may drop by a moderate amount when things go wrong in the market.

- Restore the recommendation to Buy as your next signal (April 2025).

Broker B operates as an independent Registered Investment Advisor (RIA).

- Since bonds often have low yields right now, ISPY can offer clients a tempting way to get regular income. ISPY looks better than SPYD because its portfolio is spread out across more areas of the market.

11.3 ETF Flows and Investor Confidence Trends

| Quarter | Net Flows ($ Millions) | Total AUM ($ Billions) | Net Asset Growth (%) |

|---|---|---|---|

| Q1 2024 | +$120 | $1.1 | +12% |

| Q2 2024 | +$95 | $1.2 | +9% |

| Q3 2024 | +$80 | $1.3 | +7% |

| Q4 2024 | +$70 | $1.4 | +5% |

| Q1 2025 | +$60 | $1.5 | +4% |

| Q2 2025 (YTD) | +$50 | $1.6 | +3.5% |

12. Fees and Expense Ratio: Is ISPY Cost‑Effective?

Comparing Costs Against Yield Returns

| ETF | Expense Ratio | Trailing Yield | Net Yield After Fees |

|---|---|---|---|

| ISPY (S&P 500 Income ETF) | 0.40% | 5.20% | 4.80% |

| SPYD (High Dividend ETF) | 0.07% | 4.00% | 3.93% |

| VYM (Vanguard High Dividend Yield) | 0.06% | 2.80% | 2.74% |

| HDV (iShares Core High Dividend) | 0.08% | 3.80% | 3.72% |

| AGG (iShares Core U.S. Aggregate Bond) | 0.03% | 3.20% | 3.17% |

13. Liquidity and Trading Volume: Can You Get In and Out Easily?

13.1 Daily Volume Trends

| Period | Average Daily Volume (Shares) | Average Daily Volume ($ Millions) |

|---|---|---|

| 2024 Q1 | 150,000 | $3.4 |

| 2024 Q2 | 175,000 | $4.2 |

| 2024 Q3 | 200,000 | $4.8 |

| 2024 Q4 | 210,000 | $5.0 |

| 2025 Q1 | 220,000 | $5.3 |

| 2025 May | 240,000 | $5.8 |

14. Conclusion on the Future of ISPY – What We Think

A yield around 5.20% means ISPY provides regular income which is suitable for people who are primarily focused on income.

Examples of How Portfolios Are Used:

- For retirees: Helps pay bills and slows down taking out funds.

- Investors when young: Helps build their savings faster with the reinvested dividends.

- Portfolios can contain institutions to protect against hard declines in growth sectors.

ISPY’s well-balanced industry exposure might help it handle rising rates and market fluctuations.

Because ordinary dividends make up most of its payouts (almost 40%), FTSE 250 stocks should be owned in tax-advantaged accounts. (Note: Original text refers to FTSE 250 here, which seems unusual for an S&P 500 ETF.)

Actionable Takeaways:

- Evaluate how much income you need—see if ISPY measures up to other high-yield alternatives.

- You should check that ISPY is supported in your brokerage with dividend reinvestment.

- To see how comfortable you are, start with a smaller amount (such as 2%).

- Pay attention to what is happening in sectors like Energy, Financials and Utilities.

- Once a year, adjust your portfolio to match your desired level of risk against your desired yield.

Pingback: ICICI Prudential Alpha Low Vol 30 ETF FOF Details

Pingback: BITO ETF Dividend 2025: Yield, History & Payouts

Pingback: Best Defence Sector Mutual Funds List 2025