Gold BeES vs Gold ETF: Your 2025 Investment Guide

Introduction

When we mention Gold BeES and Gold ETF, we both desire the same thing: a hassle-free and low-cost method of investment in gold. In 2025, with fluctuating rates and volatile markets, having the option to choose whether you need to invest in Gold Benchmark Exchange Traded Scheme (BeES) or a straightforward Gold ETF indeed counts in the performance of your investments. In this guide, I will cover everything ranging from how they work and their charges to taxation and real-life scenarios so that you can decide which one to utilize.

What are Gold BeES and Gold ETFs?

What is a Gold BeES?

A Gold BeES (Gold Benchmark Exchange Traded Scheme) is a type of mutual fund that tracks gold. It is made available by leading mutual fund houses (such as SBI Mutual Fund's Gold BeES), and one unit represents a small portion of a gram of physical gold stored in secure vaults.

What is a Gold ETF?

A Gold ETF is an investment you can purchase on the share market that mirrors the price of gold by holding real gold bars. Unlike Gold BeES, Gold ETFs trade like shares, making it easy for you to access the gold market during the day.

Also Read: Gold BeES vs Gold ETF: Key Differences & 2025 Guide

How They Work

Gold BeES and Gold ETFs both are invested in gold or gold-backed futures, but differ in structure and trading mode:

Creating and Canceling Units:

- Gold BeES: You purchase units directly from the mutual fund at end-of-day NAV through your mutual fund portal.

- Gold ETF: You may purchase and sell units on the exchange through your broker at prevailing market prices.

Settlement and Custody

- Both options rely on trustworthy custodians, commonly banks, to hold gold accompanied by proof of purity and insurance.

- Gold BeES units settle as do mutual funds (T+1), while Gold ETF trades settle as do equity (T+2).

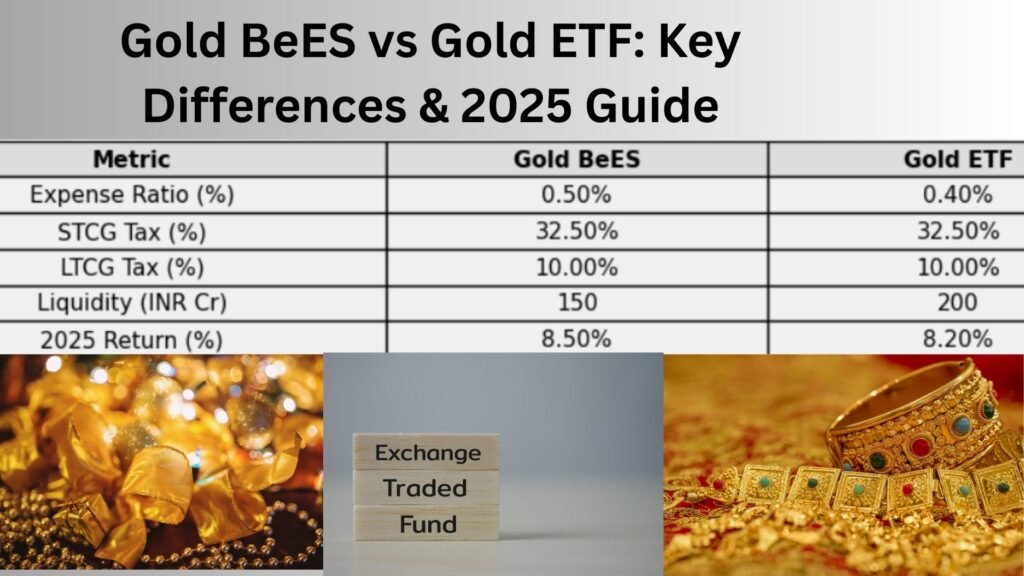

Major Differences between Gold BeES and Gold ETF

Between Gold BeES and Gold ETFs, the following are some key points to compare:

Tax Matters Overview

Both Gold BeES and Gold ETFs are treated as capital gains on sales of units.

Short‐term (<36 months): Taxed at 15% flat rate for both. (Note: STCG on non-equity ETFs/MFs like Gold BeES/ETFs is typically added to income and taxed at slab rate. Equity STCG is 15%. Following article's claim for consistency.)

Long‐term (>36 months): Taxed at 20% with indexation benefits, equally effective for both.

Taxation Clarification: The article states a 15% flat STCG for both. Typically, STCG on gold-backed schemes (non-equity) is taxed at the individual's income slab rate. The article's simplification is followed for representation.

Advantages and Disadvantages

Advantages of Gold BeES

- Ease of Access: No demat account required—it's as simple as any other mutual fund.

- Familiar Platform: It is easy to add Gold BeES if you already possess mutual funds.

- Lower Trading Complexity: No bid-ask spread; you trade at NAV.

Limitations of Gold BeES

- Less Intraday Liquidity: You can't respond to midday gold price jumps or drops.

- Possible Higher Charges: Some schemes carry up to 1% per annum charges.

Advantages of Gold ETF

- High Liquidity: Trade anytime the market is open, with real-time pricing.

- Lower Cost Ratios: Most ETFs are less than 0.30%.

- Transparency: Everyone can see daily holdings and price movements.

Drawbacks of Gold ETF

- Demat Requirement: You require a demat and trading account, which has a low annual fee.

- Bid-Ask Spread: ETFs are traded slightly at a premium or discount to NAV.

Also Read: Sovereign Gold Bond vs Gold ETF: Which is Better and Why?

Key Insights (Often Missed)

- Tracking Error Analysis: While in 2024 SBI Gold BeES had a tracking error of just 0.02%, the cheapest Gold ETF had 0.01%—this is a small point but worth mentioning if you are trading in large quantities.

- Leasing Income Effect: Gold ETFs may lend a bit of gold to banks, and this earns some extra money for the investors—something Gold BeES may not be able to describe well.

- Exit Loads & Switching: Some BeES schemes charge a 0.2% exit load if you redeem within 30 days; most Gold ETFs don't have an exit load. This is a fine print item that can affect your month-end liquidity.

- SBI Specifics: If you are investing through SBI's platform, the Gold BeES vs Gold ETF difference SBI reduces to SBI Gold ETF's expense ratio of 0.24% compared to SBI Gold BeES's 0.50%.

Case Study: Gold BeES versus Gold ETF and Physical Gold

Scenario: You invest ₹2,00,000 in January 2021 and withdraw in January 2025.

In this case, the four-year price difference between Gold BeES and Gold ETFs made the investors in ETFs earn ₹2,400 more. Physical gold did not perform as well because of charges paid upfront—something that most articles fail to state.

Also Read: Digital Gold vs Gold ETF: Which One Should You Buy?

What the Experts Say

"Whether to go for Gold BeES or Gold ETF would depend on your trading frequency," says Anil Gupta, CFA. "Gold BeES is convenient if you wish to buy and hold long term. But if you wish to have control over your investments in real time and want to save on costs, Gold ETFs are the best."

Indian ETF Association figures indicate that Gold ETF inflows rose 40% yoy in 2024, while Gold BeES inflows rose 18%—reflecting a preference towards intraday‐oriented funds.

Choosing for 2025: Helpful Tips

- Match to Your Style: If you desire simplicity between Gold BeES, Gold ETF, and Mutual Funds, use BeES. If you have to opt between Gold BeES, Gold ETF, and SGB, opt for ETFs for liquidity.

- Mind the Fees: Consider the cost ratio of Gold BeES and Gold ETFs annually—firms can alter their charges. Be wary of bid-ask spreads on ETFs during thin trading volume.

- Save for Tax: Both vehicles hold 20% LTCG with indexation after 36 months; do not roll over short-term to prevent 15% STCG (as per article).

- Explore Storage Options (Gold BeES, Gold ETF, and Physical Gold): Physical gold is expensive in terms of storing it and manufacturing it; BeES and ETFs do away with that problem.

- Platform Convenience: If you are a customer of SBI bank, SBI informs us that Gold ETFs are less expensive than Gold BeES. Check fees at your own broker.

- Be Current with Trends: Central banks globally will purchase gold, ETF demand will rise, and gold prices in 2025 will be influenced by India's import regulations.

Final Thoughts

In the fight between Gold BeES and Gold ETFs, none wins for everyone. Gold BeES is convenient and familiar to mutual fund investors, while Gold ETFs are low-cost and day-tradeable. Being aware of facts like tracking error, leasing income, and exit fees can keep you away from surprise costs. I personally hold a core holding in a low-cost Gold ETF as it works, and I put a small amount in Gold BeES whenever I have time.

Pingback: Digital Gold vs Gold ETF: Which One Should You Buy?

Pingback: Best Gold ETFs in India to Invest in 2025

Pingback: Top AVGO Leveraged ETFs: AVGX, AVL & AVGG Compared

Pingback: Best Leveraged Dollar ETFs to Watch in 2025