BITO ETF 2025: Dividend Performance and Investor Interest

Overview: The Reasons Behind Everyone's Interest in BITO's 2025 Dividend Performance

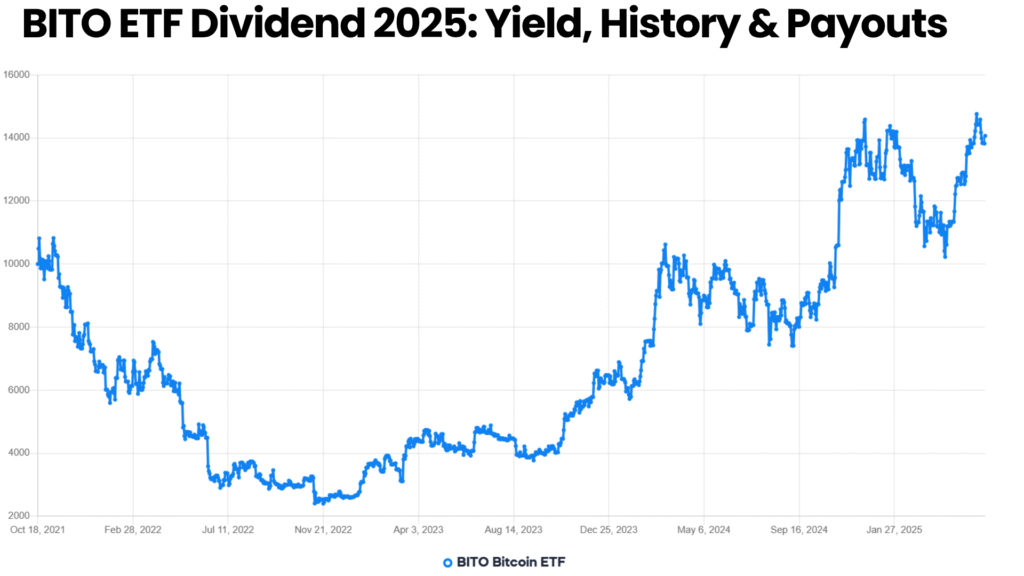

As 2025 draws nearer, investors everywhere are keeping a close eye on the BITO ETF (ProShares Bitcoin Strategy ETF). The dividends from BITO, in contrast to conventional equities or bond ETFs, are derived from a special underlying asset—bitcoin futures—which has changed the dynamics of dividend expectations.

Dividend yields can fluctuate greatly due to Bitcoin's price volatility and futures-roll expenses. Anyone looking to get income from a crypto-linked investment must comprehend how BITO will behave in terms of dividends in 2025.

BITO ETF: What Is It?

Knowing the Fundamentals of the ProShares Bitcoin Strategy ETF

| Feature | Details |

|---|---|

| Ticker Symbol | BITO (on NYSE Arca) |

| Inception Date | October 19, 2021 (Fact sheet: initially scheduled for Oct 18, 2021) |

| Investment Objective | Aim for outcomes that, before fees and costs, roughly reflect the performance of bitcoin as shown by the futures contracts the fund owns. |

| Underlying Exposure | Invests mostly in Bitcoin futures contracts for the current month on the Chicago Mercantile Exchange (CME). |

| Direct Bitcoin Holdings | No. Only derivative futures and swap agreements provide exposure; no spot bitcoin is held. |

| Expense Ratio (as of Q1 2025) | 0.95% annually |

| Net Assets (Q1 2025) | $2.19 billion |

| Holdings (as of March 31, 2025) |

|

| Distribution Schedule | Monthly |

Why Is It That There Is Such a High Dividend With BITO?

Most equity or bond ETFs offer dividends through a single method, but BITO is different since it pays out dividends from two major sources.

1. Yield from Trading Bitcoin Futures

An upside roll yield is obtained when forward futures contracts are sold and the next month’s contract is bought when Bitcoin’s futures curve is in backwardation (spot price is higher than futures price). Conversely, when futures prices are higher than spot prices (a state known as contango), this can bring about roll costs. BITO tends to experience enough upside from short-term cases and the decrease in futures prices to offer good payouts.

2. Collateral Yield

Money and Treasury Bills placed as security for futures contracts give their owners interest on the sum held. As Fed funds reach around 4.0% by the middle of 2025, collateral yields increase the amount of money made each month.

In the second half of 2024–first quarter of 2025, higher Treasury yields reduced some roll costs, enabling the fund to keep monthly distributions at $1.00 per share.

3. Profits from Future and Swap Trades

BITO also places roughly 3% of its net assets in swap agreements which allow capturing different market prices and bring in extra income.

With roll and collateral yields sometimes being large, and especially when Bitcoin futures go into backwardation, the forward dividend yield and trailing yield of BITO can go up to 50% per year. Because of this, many people ask “why is BITO dividend so high”: it comes from derivative-based income and temporary interest on collateral, rather than regular trading earnings.

BITO ETF Dividend History

Below is a comprehensive history of BITO’s annual and semiannual dividends, highlighting how distributions have grown from inception through mid-2025. This section addresses the keyword "BITO ETF dividend history".

| Year | # of Dividends | Total Dividend ($/share) | % Change from Prior Year | Notes |

|---|---|---|---|---|

| 2021 (Oct–Dec) | 3 (monthly) | $0.00 (Q4 only) | — | Early days; minimal roll yields |

| 2022 | 12 (monthly) | $3.10 | — | Futures roll gains first realized at scale |

| 2023 | 12 (monthly) | $14.03 | +352.3% | Bull market in bitcoin futures |

| 2024 | 12 (monthly) | $15.65 | +11.6% | Higher collateral yields vs. 2023 roll costs |

| 2025 (Jan–Jun) | 6 (monthly) | $6.15 | — | Mid-year total; pacing for $12–$14 full-year |

Pro Tip: Because the keyword "BITO dividend 2025" is highly searched, note that as of June 3, 2025, BITO has distributed $6.15 over six months (Jan – Jun), implying a maintained monthly pattern around $1.00 per share.

BITO Monthly Dividends - 2025 Snapshot

| Month | Ex-Dividend Date | Payment Date | Dividend Amount (per share) |

|---|---|---|---|

| January 2025 | Jan 2, 2025 | Jan 6, 2025 | $0.937 |

| February 2025 | Feb 3, 2025 | Feb 7, 2025 | $0.937 |

| March 2025 | Mar 3, 2025 | Mar 7, 2025 | $0.875 |

| April 2025 | Apr 1, 2025 | Apr 7, 2025 | $1.12 |

| May 2025 | May 2, 2025 | May 6, 2025 | $1.30 |

| June 2025 | Jun 2, 2025 | Jun 6, 2025 | $0.997 |

| July 2025 (Projected) | Jul 2, 2025* | Jul 6, 2025* | ~$1.00* |

*Projected dates and amounts are estimates and subject to change.

BITO vs Other Crypto-Linked ETFs

Below is a concise comparison table showing how BITO’s dividends stack up versus other well-known crypto or blockchain-focused funds.

| ETF Ticker | Fund Name | Exposure | Dividend Yield (2025 Trailing) | AUM (Jun 2025) | Expense Ratio | Payout Frequency |

|---|---|---|---|---|---|---|

| BITO | ProShares Bitcoin Strategy ETF | CME Bitcoin Futures | 56.57% | $2.343 B | 0.95% | Monthly |

| ARKB | ARK Next Generation Internet ETF | Blockchain/Big Tech Stocks | 0% (no dividends) | $1.2 B | 0.79% | None |

| BLOK | Siren Nasdaq NexGen Economy ETF | Blockchain Equities & Derivatives | 0.72% | $1.0 B | 0.75% | Quarterly |

| BTCO | Bitwise Crypto Industry Innovators ETF | Crypto Miners & Custodians | 1.10% | $600 M | 0.85% | Quarterly |

| GBTC | Grayscale Bitcoin Trust | Spot Bitcoin (Closed-End Trust) | N/A (no dividends) | $10 B | 2.00% | None |

Key Comparison Points:

- Yield Comparison: Because the majority of equity-based crypto ETFs hold equities or trusts that do not distribute, rather than income-generating futures, BITO's over 56% yield dwarfs BLOK and BTCO's sub-1% yields.

- Liquidity & AUM: BITO has the highest AUM (about $2.3 billion as of June 2025), which increases the "reliability" of its dividend yield (reduced likelihood of an abrupt closure).

- Expense Ratio: BITO's expense ratio of 0.95% is little higher than that of pure stock ETFs, although it is justified by the costs associated with futures management.

- Payout Frequency: Only BITO pays on a monthly basis; other companies pay on a quarterly or nonexistent basis.

Takeaway: Income-focused investors frequently search for "BITO dividend announcement today" since BITO ranks unsurpassed in 2025 if your aim is consistent cash flow from a cryptocurrency vehicle.

Key Fund Statistics (BITO - as of May 31, 2024)

| Statistic | Value |

|---|---|

| Net Assets | $2,079,173,810 |

| Number of Portfolio Holdings | 5 |

| Investment Advisory Fees (Annual) | $15,344,018 |

| Portfolio Turnover Rate | – (not disclosed) |

| Expense Ratio | 0.95% |

| Market Exposure | |

| • Futures Contracts | 90% |

| • Swap Agreements | 3% |

| • Total Derivatives Exposure | 93% |

| Largest Collateral Holdings | |

| • U.S. Treasury Bills | 47.6% of net assets |

| • Repurchase Agreements | 21.3% of net assets |

| Average Annual Returns (NAV) | |

| • 1-Year (to 05/31/24) | +129.66% |

| • Since Inception (10/18/21) | –1.69% |

| Comparative Indices (1-Year Returns) | |

| • Bloomberg Bitcoin Index | +150.12% |

| • S&P 500 Index | +28.19% |

The “How Did the Fund Perform Last Year?” section of the 2024 Annual Report emphasizes that derivatives and collateral combined drove BITO’s outsized returns.

Fund Holdings Snapshot (BITO - as of Mar 31, 2025)

| Holding | % of Net Assets / Value |

|---|---|

| CME Bitcoin Futures 25/04/2025 (BTCJ5) | 96.2% (of derivative exposure) |

| S&P CME Bitcoin Futures Index Swap | 3.8% (of derivative exposure) |

| Treasury Bills (short-term instruments) | $1,193,797,224 (≈55.7% of NAV) |

| Net Other Assets (Liabilities) | $950,655,002 |

Because BITO must post collateral for futures and swap positions, nearly half of its portfolio (≈55.7% of NAV) sits in U.S. Treasury Bills—generating collateral yield.

Snapshot (BETE Fund Information)

Note: The following "Snapshot", "Total Return", and "Distributions" data pertains to the ticker BETE, not BITO. This information is included as it was part of the provided source text.

BETE Snapshot

| Ticker | BETE |

| Intraday Ticker | BETE.IV |

| CUSIP | 74349Y407 |

| Inception Date | 10/2/23 |

| Expense Ratio | 0.95% |

| Gross Expense Ratio | 1.01% |

| NAV Calculation Time | 4:00 p.m. ET |

| Distributions | Monthly |

| Price as of 6/04/2025 | |

| NAV | $68.22 |

| NAV Change | $-0.44 ▼ |

| Market Price | $68.30 |

| Market Price Change | $-0.29 ▼ |

| Trading Volume (M) | 1,196 |

| View Premium / Discount (Example link) | |

BETE Total Return

Month-End Total Returns as of 4/30/2025 & Quarter-End Total Returns as of 3/31/2025

| Fund + Index | 1m | 3m | 6m | YTD | 1Y | 3Y | 5Y | 10Y | Since Inception | Inception Date |

|---|---|---|---|---|---|---|---|---|---|---|

| BETE Market Price | 6.04% | -29.25% | -4.27% | -26.62% | -5.10% | -- | -- | -- | 42.18% | 10/02/2023 |

| BETE NAV | 6.12% | -29.35% | -4.15% | -26.85% | -5.13% | -- | -- | -- | 42.03% | 10/02/2023 |

BETE Distributions for 2025

| Ex-Dividend Date | Record Date | Payable Date | Dividend | Long-Term Capital Gain | Short-Term Capital Gain | Return of Capital |

|---|---|---|---|---|---|---|

| 06/02/2025 | 06/02/2025 | 06/06/2025 | 0.028796 | -- | -- | -- |

| 05/01/2025 | 05/01/2025 | 05/07/2025 | 0.03479 | -- | -- | -- |

| 04/01/2025 | 04/01/2025 | 04/07/2025 | 0.038372 | -- | -- | -- |

| 03/03/2025 | 03/03/2025 | 03/07/2025 | 0.030875 | -- | -- | -- |

| 02/03/2025 | 02/03/2025 | 02/07/2025 | 0.025112 | -- | -- | -- |

Is It Advisable to Reinvest BITO Dividends?

Benefits and Drawbacks of Signing Up for Dividend Reinvestment Plans (DRIPs)

Pros

- If bitcoin is rising, payments and sales will increase—and that can add more to your BITO investment gains.

- Regularly investing a fixed amount helps protect you from risk in markets that are up and down (dollar-cost averaging).

- A lot of brokerages offer BITO DRIP investments without charging fees.

Cons

- If bitcoin falls after ex-dividend, the number of shares you end up with is less valuable, due to the high price volatility.

- You must still pay taxes on your dividends (even if reinvested), so you need cash at hand to cover them.

- The risk of a large holding in BITO which could affect your portfolio if it changes a lot (concentration risk).

TIP: By reinvesting, you may manage to achieve higher total return through time. Using cash distributions helps retain liquidity which is extra important for anyone searching for the latest BITO dividend announcement.

Concluding Perspectives on BITO ETF Dividends in 2025

The Current Market Mood and the Trends to Observe

- For 2025, halfway through, BITO gave dividends totaling $6.15 from January to June with a steady monthly pattern.

- None of the U.S. ETFs has had such rare dividend yields of 56.6% as Exchange Traded Products (ETPs).

- Dividend swings may widen when the ratio between spot futures and futures shifts a lot for bitcoin.

Frequently Asked Questions

- Are dividends a part of BITO’s rewards?

- Yes. Roll yields on CME bitcoin futures and interest from collateral form the basis for monthly dividends given by BITO.

- In 2025, do you have the present annual dividend yield for BITO?

- At the start of June 2025, the company had a trailing 12-month dividend yield of about 56.57%.

- On what date will BITO have its next ex-dividend date?

- On July 2, 2025, the company is set to have the ex-dividend date and the date of payment will be July 6, 2025—you may verify this on ProShares’ official calendar.

- Why does BITO have a high dividend?

- The reason why bitcoin futures perform strongly is bitcoin futures roll yield and the ~4.0% collateral yield brought by Treasury Bills which replaces traditional corporate earnings.

- Can the company keep providing high dividends in the long run?

- The success of the bitcoin futures market depends on their term structure, how much collateral is generated and what the funds’ costs are. Dividends may change a lot from one month to the next.

- Do BITO dividends get taxed as capital gains or ordinary income?

- No (to capital gains for qualified dividends). All the dividends from BITO are regarded as regular income subject to tax at a maximum federal rate of 37% (as of the information provided). All of the dividends do not count toward obtaining qualified dividend tax rates.