A defense sector mutual fund list is becoming more and more popular among investors looking for diversification and focused exposure to India's expanding defense industry. Defense equities have produced strong returns as a result of government reforms under Make in India and the escalation of geopolitical tensions . To assist you in making informed investment decisions, we have included a comprehensive list of top defense sector mutual funds for 2025 in this guide, along with relevant facts, illustrations, and case studies.

Comprehending Mutual Funds in the Defense Sector

What Are Mutual Funds for the Defense Sector?

These are thematic funds that primarily invest in stocks of businesses involved in homeland security, aerospace, defense, and related technology. They provide more focused exposure than more general sectors or diversified equity funds.

Their Distinctions from Other Sectoral Funds

- More centered on the defense supply chain, including electronics, heavy machinery, and aircraft components.

- Greater association with cycles of government defense spending as opposed to consumer patterns.

Why Make Defense Sector Investments?

Rising Defense Budget in India

The FY25 budget saw a significant increase of around 3.5% year over year, reaching ₹6.13 lakh crore, signaling sustained government support.

Geopolitical Tensions

Strategic alliances and ongoing border conflicts fuel the continuous need for military modernization and preparedness.

Reforms and Privatization

Defense PSUs are now accepting private investment through PLI programs , opening up new growth avenues.

Who Should Invest in a List of Mutual Funds for the Defense Sector?

- Investor Profile: Ideal for those with a moderate to high-risk appetite, given the concentration risk.

- Investment Horizon: A horizon of 5+ years is recommended to ride out budget cycles and order book inflows.

- Risk-Reward Ratio: These are sectoral funds with volatility typically around 1.2 times the benchmark (e.g., NIFTY 50).

- Return Potential: Historical performance has shown an average of 12–18% annually over 3-year periods.

Performance Overview: 2024 vs 2025

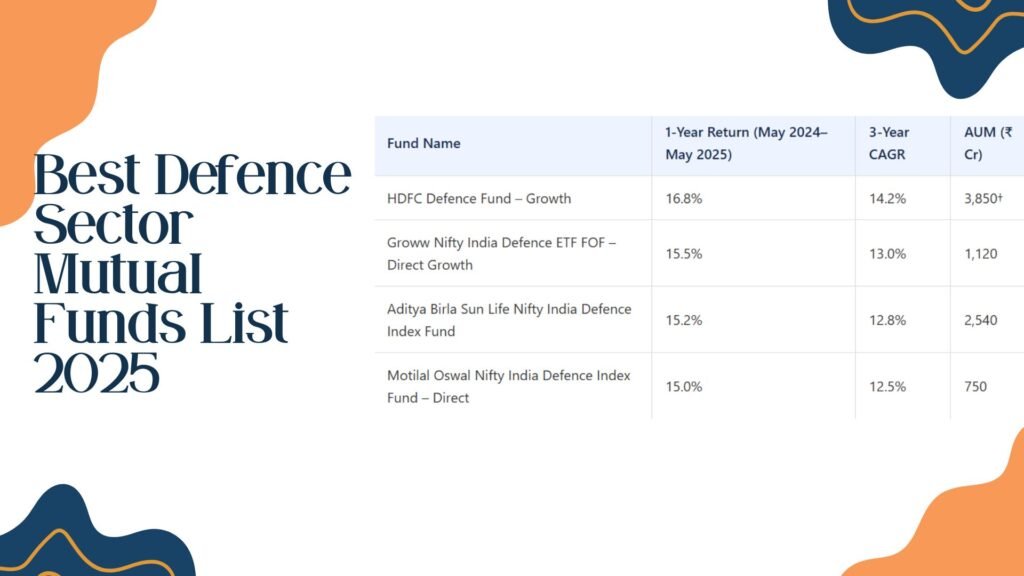

The table below highlights the performance of key defense funds. The data is visualized in the chart that follows.

| Fund Name | 1-Year Return (May 2024–May 2025) | 3-Year CAGR | AUM (₹ Cr) |

|---|---|---|---|

| HDFC Defence Fund – Growth | 16.8% | 14.2% | 3,850† |

| Groww Nifty India Defence ETF FOF – Direct Growth | 15.5% | 13.0% | 1,120 |

| Aditya Birla Sun Life Nifty India Defence Index Fund | 15.2% | 12.8% | 2,540 |

| Motilal Oswal Nifty India Defence Index Fund – Direct | 15.0% | 12.5% | 750 |

Key Metrics to Evaluate a Defence Sector Mutual Fund List

NAV (Net Asset Value)

This is the entry/exit price of a fund unit. For example, the HDFC Defence Fund NAV was ₹25.27 as of June 6, 2025.

AUM (Assets Under Management)

A higher AUM can indicate investor confidence, though a very large AUM might affect agility in managing the portfolio.

Expense Ratio

The annual fee charged by the fund. It's lower in ETFs and index FOFs, typically ranging from 0.40% to 1.68% for this sector.

Holding Concentration

To manage stock-specific risk, the top five holdings shouldn't account for more than 40% of total holdings.

Top Performing Funds in Our Best Defence Sector Mutual Funds List

HDFC Defence Fund

NAV (Growth): ₹25.27 | Expense: 1.42%

Top 3 Holdings: HAL (8.7%), Bharat Electronics (7.2%), L&T Defence (6.8%).

Pros: Active management, strong performance in 2024 (+16.8%).

Cons: Higher expense ratio compared to passive funds.

Groww Nifty India Defence ETF FOF

NAV (Direct Growth): ₹13.19 | Expense: 0.15%

Tracking: Nifty India Defence Index.

Pros: Very low cost, transparent index-based investing.

Cons: Cannot outperform the index; returns are tied to the benchmark.

Aditya Birla Sun Life Nifty India Defence Index Fund

NAV: ₹12.76 | Expense: 0.20%

Tracking: Nifty India Defence Index.

Pros: Balanced approach with options for growth and income.

Cons: Slightly higher expense ratio than a pure ETF.

Comparison Table: Defence Sector Mutual Funds List at a Glance

| Scheme | NAV (₹) | Expense Ratio | 1-Yr Return | 3-Yr CAGR | AUM (₹ Cr) |

|---|---|---|---|---|---|

| HDFC Defence Fund – Growth | 25.27 | 1.42% | 16.8% | 14.2% | 3,850 |

| HDFC Defence Fund – Direct Growth | 25.87 | 0.79% | 17.0% | 14.5% | 1,950 |

| Groww Nifty India Defence ETF FOF – Direct Growth | 13.19 | 0.15% | 15.5% | 13.0% | 1,120 |

| Aditya Birla Sun Life Nifty India Defence Index Fund | 12.76 | 0.20% | 15.2% | 12.8% | 2,540 |

| Motilal Oswal Nifty India Defence Index Fund – Direct | 11.68 | 0.18% | 15.0% | 12.5% | 750 |

How to Begin Investing

- Choose a Platform: Select a reliable platform like Groww, Zerodha, or Kuvera.

- Select Plan: Decide between a Regular plan (via a distributor) or a Direct plan (lower costs). Direct is generally recommended.

- Investment Route:

- Lumpsum: Invest a single, large amount at once.

- SIP (Systematic Investment Plan) : Invest a fixed amount regularly. SIP is highly advised for managing volatility through rupee-cost averaging.

Risks to Consider

- Sector Concentration Risk: Performance is heavily correlated with defence budget cycles and government policies.

- Government Policy Dependency: Any changes to procurement rules or PLI schemes can directly impact returns.

- Global Geopolitics: Unforeseen de-escalations in global conflicts could slow down defense spending and growth.

Professional Views and a Case Study

Case Study: HDFC Defence Fund

An investor who put ₹1 lakh into the HDFC Defence Fund in June 2022 saw their investment grow to ₹1.38 lakh by May 2025. This represents a 12.1% annualized return, significantly outperforming the 10.2% return of the NIFTY 50 during the same period.

Analyst Outlook: Analysts from Motilal Oswal and Ambit Capital predict that budget support will continue, with defense-focused schemes expected to generate 10–12% annual returns through 2026.

Defense Mutual Funds: FAQs & Investment Analysis

Your comprehensive guide to understanding defense sector mutual funds in 2025 - from SIP options to foreign investments and fund structures

Frequently Asked Questions

Yes, Systematic Investment Plans (SIPs) are an excellent strategy for investing in defense mutual funds. SIPs allow you to invest a fixed amount regularly (monthly/quarterly) rather than a lump sum investment.

Why SIPs are effective for defense funds

SIPs help reduce volatility through rupee-cost averaging. As defense funds can experience fluctuations due to government policy changes and geopolitical factors, SIPs provide a disciplined approach that smooths out market timing risks.

For long-term investors (5+ years), SIPs in defense funds can potentially generate substantial wealth as the sector benefits from increasing global defense spending and domestic manufacturing initiatives.

Learn more about SIP strategies: SIP on Wikipedia

Yes, foreign nationals can invest in Indian defense mutual funds through the Portfolio Investment Scheme (PIS) route with designated banks.

Key Requirements: Foreign investors must have a Portfolio Investment Scheme (PIS) account with an authorized bank in India. Investments are subject to Foreign Exchange Management Act (FEMA) regulations and sectoral caps.

The process involves:

- Opening a PIS account with an RBI-approved bank

- Completing KYC documentation

- Adhering to investment limits (currently 10% of a fund's units for NRIs)

For regulations: RBI FEMA Guidelines

All major defense sector mutual funds available today are open-ended, meaning investors can buy or redeem units at any time based on the fund's current Net Asset Value (NAV).

Structure Comparison

Open-Ended Funds

- Continuous buying/selling of units

- No fixed maturity period

- Liquidity at any time

- NAV-based transactions

Closed-Ended Funds

- Fixed number of units

- Fixed maturity period

- Traded on exchanges

- Price determined by market

The open-ended structure provides flexibility for investors to enter or exit according to their financial goals and market conditions.

Conclusion: Are Defense Mutual Funds a Good Choice for 2025?

Defense sector mutual funds present an alluring investment opportunity in 2025 by combining:

Government Spending

Increased defense budgets globally and domestically

Private Sector Reforms

Opening of defense manufacturing to private companies

Strategic Positioning

India's growing role in global defense supply chains

Our analysis suggests that defense funds can provide:

- Portfolio diversification away from traditional sectors

- Growth potential from modernization initiatives

- Long-term stability through government backing

Investment Approaches

Active Management

e.g., HDFC Defence Fund

- Professional fund management

- Flexibility in stock selection

- Potential for outperformance

Passive Indexing

e.g., Groww Nifty India Defence ETF FOF

- Lower expense ratios

- Broad market exposure

- Transparent portfolio

For regulatory information: SEBI Mutual Fund Regulations

Data Sources: AMFI, SEBI, RBI, and fund house disclosures

Note: Past performance is not indicative of future results. Mutual fund investments are subject to market risks.

This information is for educational purposes only and not investment advice.

Pingback: Top 10 Best Performing SWP Mutual Funds in India

Pingback: Morgan Stanley Mutual Funds in Energy Returns

Pingback: HDFC BAF Cross ₹1Lcr AUM—dynamic hybrid fund leader now!

Pingback: Best International Mutual Funds in India 2025