Introduction

The ICICI Prudential Alpha Low Vol 30 ETF FOF is a complex investing strategy. It aims to combine the advantages of low volatility with alpha generation and quality characteristics. This fund-of-fund (FOF) structure offers investors exposure to the Nifty Alpha Quality Low-Volatility 30 Index through a practical mutual fund wrapper. A key benefit is that it removes the need for a demat account, preserving the advantages of smart-beta investment.

Getting to Know the Underlying Index: Nifty Alpha Quality Low-Volatility 30 Index

Construction and Methodology

The multi-factor Nifty Alpha Quality Low-Volatility 30 Index combines three important investment factors:

- Alpha: Calculates excess returns over performance standards.

- Quality: Assesses businesses using indicators of their financial health.

- Low Volatility: Chooses equities with less volatile prices.

Key Index Specifications

| Parameter | Details |

|---|---|

| Launch Date | July 10, 2017 |

| Base Date | April 1, 2005 |

| Base Value | 1,000 |

| Number of Constituents | 30 stocks |

| Rebalancing Frequency | Semi-annual |

| Weight Methodology | Factor-weighted with 5% individual stock cap |

| Universe | Nifty 100 and Nifty Midcap 50 |

Index Performance Metrics (As of May 30, 2025)

| Metric | 1 Year | YTD | QTD | 5 Years (CAGR) | Since Inception (CAGR) |

|---|---|---|---|---|---|

| Price Return | 20.42% | 0.18% | -2.46% | 16.59% | 6.44% |

| Total Return | 22.16% | 1.47% | -1.91% | 18.31% | 6.65% |

Risk Characteristics

| Risk Metric | Value |

|---|---|

| Standard Deviation (Annualized) | 13.56% |

| Beta vs Nifty 50 | 0.72 |

| Correlation with Nifty 50 | 0.82 |

Fund Structure and Features

ICICI Prudential Alpha Low Vol 30 ETF FOF Details

| Feature | Specification |

|---|---|

| Fund Type | Open-ended Fund-of-Fund |

| Underlying Investment | ICICI Prudential Alpha Low Vol 30 ETF |

| Launch Date | 2021 |

| Investment Style | Passive (Index Tracking) |

| Minimum SIP | ₹100 |

| Exit Load | Nil |

Expense Structure (As of April 30, 2025)

| Plan Type | Expense Ratio | Suitable For |

|---|---|---|

| Direct Plan | 0.10% p.a. | Self-directed investors |

| Regular Plan | 0.53% p.a. | Investors preferring advisory support |

Important Note: Investors bear the recurring expenses of the Fund-of-Fund scheme in addition to the expenses of the underlying ETF scheme.

Current Fund Statistics (April 30, 2025)

Sectoral Composition and Holdings

Sector Allocation (Based on Underlying Index)

| Sector | Weight (%) |

|---|---|

| Fast Moving Consumer Goods | 29.97% |

| Healthcare | 17.92% |

| Capital Goods | 15.54% |

| Automobile and Auto Components | 12.45% |

| Information Technology | 11.94% |

| Consumer Durables | 6.07% |

| Chemicals | 3.79% |

| Oil, Gas & Consumable Fuels | 2.30% |

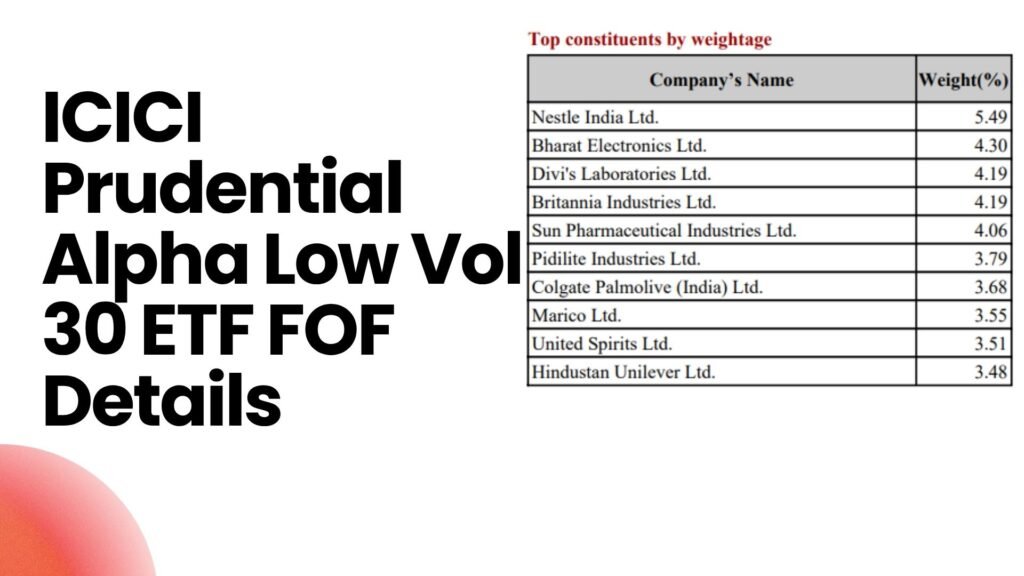

Top 10 Holdings by Weight

| Company | Weight (%) | Sector |

|---|---|---|

| Nestle India Ltd. | 5.49% | FMCG |

| Bharat Electronics Ltd. | 4.30% | Capital Goods |

| Divi's Laboratories Ltd. | 4.19% | Healthcare |

| Britannia Industries Ltd. | 4.19% | FMCG |

| Sun Pharmaceutical Industries Ltd. | 4.06% | Healthcare |

| Pidilite Industries Ltd. | 3.79% | Chemicals |

| Colgate Palmolive (India) Ltd. | 3.68% | FMCG |

| Marico Ltd. | 3.55% | FMCG |

| United Spirits Ltd. | 3.51% | FMCG |

| Hindustan Unilever Ltd. | 3.48% | FMCG |

Full List of Holdings

The fund has 30 carefully chosen stocks across a range of industries:

Quick-moving consumer goods:

Colgate Palmolive (India) Ltd., Dabur India Ltd., Hindustan Unilever Ltd., ITC Ltd., Marico Ltd., Nestle India Ltd., United Spirits Ltd., Asian Paints Ltd., and Britannia Industries Ltd.

Healthcare:

Sun Pharmaceutical Industries Ltd., Torrent Pharmaceuticals Ltd., Divi's Laboratories Ltd., Dr. Reddy's Laboratories Ltd., and Zydus Lifesciences Ltd.

Capital Goods:

Siemens Ltd., Havells India Ltd., Hindustan Aeronautics Ltd., Bharat Electronics Ltd., and Cummins India Ltd.

Information Technology:

Tata Consultancy Services Ltd., Oracle Financial Services Software Ltd., Infosys Ltd., and HCL Technologies Ltd.

Auto vehicles and auto parts:

Hero MotoCorp Ltd., Bajaj Auto Ltd., Bosch Ltd., and Maruti Suzuki India Ltd.

Fund Performance Analysis

Historical Returns (As of April 30, 2025)

Fund Performance - Growth Option

| Period | Fund CAGR (%) | Current Value of ₹10,000 | Benchmark CAGR (%) | Additional Benchmark (Nifty 50) CAGR (%) |

|---|---|---|---|---|

| 1-Year | -1.79% | ₹9,821 | -0.10% | 9.01% |

| 3-Year | 15.87% | ₹15,568 | 17.59% | 13.78% |

| Since Inception | 10.66% | ₹14,418 | 12.56% | 10.96% |

Plan-wise NAV (April 30, 2025)

| Plan Type | NAV (₹) |

|---|---|

| Direct Plan Growth | 14.6610 |

| Regular Plan Growth | 14.4178 |

Important Points to Note:

- Because of market volatility, the fund has underperformed in the short term (one year).

- Excellent three-year results with a 15.87% CAGR.

- Consistent long-term profits are demonstrated by the 10.66% CAGR performance since inception.

- Better returns are provided by the direct plan because of its reduced expenditure ratio.

Performance Adjusted for Risk

When compared to more general market indices, the fund has shown better risk-adjusted returns:

- Reduced Volatility: 13.56% against 16.96% for the overall market.

- Improved Downside Protection: The underlying index dropped 1.4% during the 2022 market slump, while the Nifty plummeted 5.7%.

- Reliable Alpha Generation: Regularly produced excess returns over the benchmark.

The Advantages of a Multi-Factor Approach to Investment Strategy and Philosophy

Fund Management

Asset Management Company

- 5.2 lakh crores in assets under management as of May 2025.

- 6.5+ million investors make to the investor base.

- Performance History: Proven proficiency in passive and smart-beta tactics.

Managers of Funds

- Kayzad Eghlim: Senior fund manager has a wealth of knowledge in passive methods.

- Ashwin Jain: Expert in factor-based and smart-beta investing.

Comparative Analysis

Performance Comparison with Alternatives (Updated Data)

| Fund Name | Type | 3-Year CAGR | 1-Year Return | Risk Level |

|---|---|---|---|---|

| ICICI Pru Alpha Low Vol 30 ETF FOF | Multi-factor FOF | 15.87% | -1.79% | Very High |

| Nifty Alpha Low-Volatility 30 TRI (Benchmark) | Index | 17.59% | -0.10% | Very High |

| Nifty 50 TRI (Additional Benchmark) | Broad Market Index | 13.78% | 9.01% | High |

| Motilal Oswal Nifty Low Volatility 30 ETF FOF | Low Vol FOF | ~15.7% | Variable | Medium-High |

Final Suggestion (Revised Evaluation)

Although recent performance highlights the need of a long-term investing horizon, this product is still appropriate for conservative to moderate investors seeking equities exposure with managed risk. It is a desirable choice for long-term, patient investors due to its straightforward investment structure, expert management, and multi-factor investing.

Verdict on Current Investments:

- Suggested for: Core equity allocation with an investment horizon of at least five years.

- Risk Profile: Fits investors with a moderate to high level of risk tolerance.

- Important Point: Investors with a long-term perspective shouldn't be discouraged by recent short-term underperformance.

- The best strategy is to invest in SIPs to average out market volatility.

Pingback: BITO ETF Dividend 2025: Yield, History & Payouts

Pingback: Top AVGO Leveraged ETFs: AVGX, AVL & AVGG Compared