Top Gold ETFs in India to Buy in 2025

Gold has always been a popular choice for investors looking to diversify their holdings and protect themselves from inflation. ETFs, or exchange-traded funds, offer a contemporary, economical, and technological way to invest in gold. An overview of the well-known gold exchange-traded funds (ETFs) in India for 2025 is provided below.

This information is for guidance and investors should conduct their own research or consult a financial advisor before making investment decisions. All figures are indicative and subject to change. Past performance is not indicative of future results.

Gold ETF Comparison Table

| ETF Name | Ticker | Fund House | NAV (₹) | 1Y Return (%) | 3Y Return (%) | 5Y Return (%) | Expense Ratio (%) | AUM (₹ Cr) | Tracking Error (%) | Liquidity | Min. Investment (₹) | Launch Date | Risk Level |

|---|

Taxation Note: For all listed Gold ETFs, Long Term Capital Gains (LTCG) from units held for more than 3 years are taxed at 20% with indexation benefits. Short Term Capital Gains (STCG) are added to your income and taxed as per your applicable income tax slab.

Further Reading & Comparison

Also Read: Sovereign Gold Bond vs Gold ETF: Which is Better and Why?

ETF Visualizations

Return Comparison (1Y, 3Y, 5Y)

This chart compares the 1-year, 3-year, and 5-year annualized returns for each Gold ETF. Higher bars indicate better past performance over the respective period.

AUM (Assets Under Management) Distribution

This chart illustrates the market share of each Gold ETF based on their Assets Under Management (AUM). Longer bars signify a larger AUM, indicating greater investor interest or fund size.

Tracking Error (%) vs. 1Y Return (%)

This scatter plot shows the relationship between Tracking Error and 1-Year Return. Ideally, an ETF should have low tracking error (closer to the Y-axis, meaning it closely follows the price of gold) and high returns (higher on the Y-axis). Hover over dots for specific ETF details.

Questions and Answers (FAQs) - Gold ETFs

How do gold exchange-traded funds (ETFs) operate?

Exchange-traded funds that mimic the price of real gold are known as gold ETFs. Investors can purchase or sell gold exposure without actually owning the metal because they hold gold bullion (physical gold of specified purity) and issue units that trade on stock markets, similar to shares.

Are Gold ETFs preferable to purchasing actual gold?

Compared to physical gold, gold exchange-traded funds (ETFs) offer several benefits such as easier liquidity, lower storage expenses (as these are part of the fund's expense ratio), and transparent pricing based on live market rates. However, they lack the tactile ownership and the possibility of use as jewelry that physical gold offers.

Comparison: Gold ETFs vs. Physical Gold

| Feature | Gold ETFs | Physical Gold |

|---|---|---|

| Liquidity | High; easily bought/sold on stock exchanges during market hours. | Lower; selling might require finding a buyer/jeweler, potential for varied buy-back rates. |

| Storage & Security | No direct storage costs or security concerns for the investor; managed by the fund. | Requires secure storage (e.g., bank locker, home safe), incurring costs and risks. |

| Pricing Transparency | High; prices are live and reflect international gold prices. | Can vary; includes making charges, GST (in India), and potential for price negotiation. |

| Purity | Guaranteed; ETFs typically hold gold of 99.5% purity or higher. | Needs verification (hallmarking); risk of impurities if not properly checked. |

| Minimum Investment | Low; can invest in as little as 1 unit (often representing 1 gram or a fraction of a gram of gold). | Typically higher (e.g., minimum 1 gram for coins/bars, higher for jewelry). |

| Ease of Transaction | Simple; through a Demat and trading account, like stocks. | More complex; involves physical verification, paperwork. |

| Tactile Ownership | No; investment is in paper/dematerialized form. | Yes; physical possession of the metal. |

| Utility as Jewelry | No. | Yes; can be worn and used. |

How is a Gold ETF's net asset value (NAV) determined?

The Net Asset Value (NAV) of a Gold ETF represents the market value of gold held by the fund per unit. It is calculated as follows:

NAV Formula:

NAV = [(Total Value of Gold Holdings at current market price) - (Liabilities and Expenses of the Fund)] / (Total Number of Outstanding Units)

This NAV is usually calculated by the fund house at the end of each trading day and published.

When selecting a Gold ETF, what factors should I take into account?

Several factors are important when choosing a Gold ETF to ensure it aligns with your investment goals and offers good value:

Key Factors for Selecting a Gold ETF:

| Factor | Description | Why it's Important |

|---|---|---|

| Expense Ratio | The annual fee charged by the fund to manage the ETF, expressed as a percentage of assets. | A lower expense ratio means more of the returns from gold price movements are passed on to the investor. Directly impacts net returns. |

| Tracking Error | The difference between the ETF's returns and the returns of the benchmark (physical gold price). | A lower tracking error indicates the ETF is doing a better job of replicating gold's price performance. |

| AUM (Assets Under Management) | The total market value of assets currently managed by the ETF. | Higher AUM generally suggests greater investor confidence and often leads to better liquidity and tighter bid-ask spreads. |

| Liquidity / Trading Volume | The ease with which units can be bought or sold on the exchange without significantly impacting the price. | Higher trading volumes typically mean better liquidity, making it easier to enter or exit positions at prevailing market prices. |

| Fund House Repute | The reputation, track record, and reliability of the Asset Management Company (AMC) offering the ETF. | A reputable fund house is more likely to manage the ETF efficiently and ethically. |

| Underlying Gold Purity | The purity of the physical gold held by the ETF (e.g., 99.5% or 99.99%). | Ensures the quality of the underlying asset. Most standard ETFs hold high-purity gold. |

With lower costs (expense ratio) and minimal tracking inaccuracy, the ETF's performance will more closely align with actual gold prices.

How are Indian gold exchange-traded funds taxed?

Taxation of Gold ETFs in India is treated similarly to non-equity mutual funds or physical gold for capital gains purposes (rules are subject to change, always verify with current tax laws):

- Short-Term Capital Gains (STCG): If Gold ETFs are sold within three years (36 months) of purchase, the gains are considered STCG. These gains are added to your total income and taxed at your applicable income tax slab rate.

- Long-Term Capital Gains (LTCG): If Gold ETFs are held for more than three years, the gains are considered LTCG. These gains are taxed at 20% after providing indexation benefits. Indexation adjusts the purchase price for inflation, which can reduce the taxable capital gain.

Disclaimer: Tax laws are complex and subject to change. It is highly recommended to consult with a qualified tax advisor or chartered accountant for personalized advice based on the latest regulations and your individual financial situation.

Can I use my standard brokerage account to buy Gold ETFs?

Yes, absolutely. Gold ETFs are listed and traded on major stock exchanges, such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) in India, just like company stocks.

You can buy or sell units of Gold ETFs through your existing Demat and trading account with any registered stockbroker. Transactions occur during regular stock market trading hours at the prevailing market price.

What is tracking error and why does it matter?

Tracking error measures the difference between the performance of an ETF and the performance of its underlying benchmark index or asset (in this case, the price of physical gold). It's essentially a gauge of how well the ETF is "tracking" or mimicking the price changes of gold.

Why it matters:

- Performance Alignment: Investors choose Gold ETFs to get exposure to gold prices. A lower tracking error signifies that the ETF's returns are closely aligned with actual gold price movements. This means the investor is getting the performance they expect.

- Efficiency Indicator: A consistently low tracking error can indicate efficient fund management. Factors that can contribute to tracking error include:

- The ETF's expense ratio (fees).

- Cash holdings by the fund (not all assets might be invested in gold at all times).

- The cost of buying/selling gold by the fund.

- Differences in valuation timing of the ETF units and the gold prices.

- Predictability: A lower tracking error makes the ETF's performance more predictable relative to gold prices.

Ideally, an investor would look for a Gold ETF with the smallest possible tracking error, as this suggests the fund is doing an excellent job of delivering returns that mirror the spot price of gold, minus the fund's expenses.

Pingback: Sovereign Gold Bond vs Gold ETF: Which is Better and Why?

Pingback: Fintechzoom.com Crypto ETF Guide: Smart Investing 2025

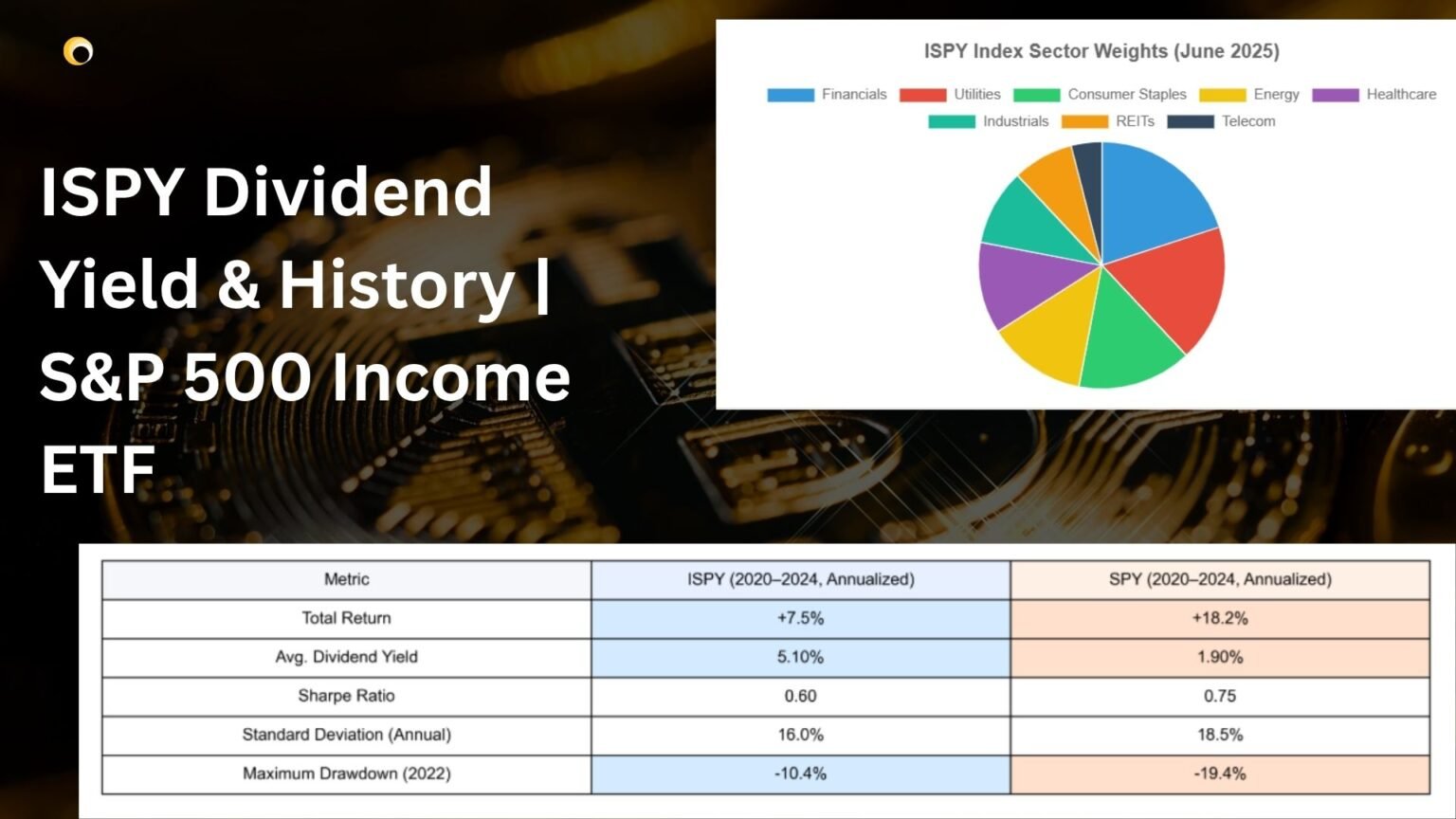

Pingback: ISPY Dividend Yield & History | S&P 500 Income ETF