Digital Gold vs Gold ETF: Which is Better for Your Portfolio?

Introduction

When it comes to Digital Gold and Gold ETFs, everyone asks me which is better to have in your investment portfolio. You might have seen ads with a promise of delivery of digital gold or showing ETFs that are tradable like shares. In this article, I shall bring out the contrasts between Digital Gold and Gold ETFs, based on my personal experiences, real-life examples, and the facts left out in most top 10 articles. By the end of this, you will be aware of which is the best for your goals—and why I use one over the other.

Also Read:

Digital Gold vs Gold ETF – What is Digital Gold?

In Digital Gold vs. Gold ETF, digital gold is a service wherein you can purchase tiny fractions of actual gold. Someone else holds it on your behalf. You can see how much you have in grams in an app, and some sites even allow you to order bars or coins.

Pros:

- Fractional Ownership: You can start with as low as ₹1, so you don't need to be wealthy.

- Storage & Purity Assured: The provider handles vaulting, insurance, and purity checks.

- Instant Transactions: You can sell or purchase in seconds, much quicker than physical gold documents.

Potential Disadvantages:

- Buyback Margins: Some websites make you pay 1–2% when you sell back, so you are losing a little bit every time you leave.

- Regulatory Clarity: Digital gold is not treated as stocks; you depend on how trustworthy the provider is.

Also Read:

Digital Gold vs Gold ETF – What is a Gold ETF?

A gold ETF is an investment fund that tracks the price of actual gold. You have ownership of a part of a holding of gold that is being kept by a custodian when you purchase units, and you can sell the units on the stock exchange like shares.

Major Advantages:

- Regulated Structure: As a security, gold ETFs are governed by strict SEBI guidelines, providing that added sense of security.

- Minimize Recurring Costs: Cost ratios are about 0.2–0.4%, often lower than normal digital gold margins.

- Tax Benefit: Held for three years or more, gains are qualified for long-term capital gains tax at 20% with indexation—usually less than short-term.

Disadvantages:

- You must possess and maintain a demat account and a trading account.

- Market Hours Only: You can't trade outside exchange hours, as opposed to 24/7 digital gold apps.

Also Read:

Digital Gold and Gold ETF – Digital Gold vs. Gold ETFs: Key Differences

When Digital Gold and Gold ETFs are compared, note the following distinctions:

Visual Cost Comparison

This chart illustrates the typical cost structures. Digital Gold often involves buy/sell margins, while Gold ETFs have annual expense ratios and per-trade brokerage fees (brokerage not depicted in chart but is an additional factor for ETFs).

Also Read:

Digital Gold or Gold ETF – Which One Should You Choose?

Selecting between the two relies on what matters most to you:

Goal & Horizon:

If you're investing small sums weekly, digital gold's low entry is for you.

Cost Sensitivity:

As a fee-sensitive and demat-comfortable investor, ETFs win on expense ratios and tax advantages.

Trading Style:

Need 24/7 flexibility? Digital gold. Need regulated markets? ETFs.

Also Read:

Case Studies

Case Study 1 – Newbie Digital Gold

Priya started with ₹500 monthly in digital gold. In two years, she loved the app’s ease but lost 1.5% each sell transaction, eating into her gains.

Case Study 2 – ETF Fan

Raj opened a demat account to purchase a gold ETF. He paid ₹50 every time (brokerage), but his long-term gains got indexation benefits, boosting his net returns.

Conclusion: Gold vs Gold ETF

Lastly, Digital Gold vs Gold ETF is not "better" or worse—it is a question of "fit." I prefer gold ETFs for sums greater than ₹5,000 a month due to lower periodic expenses and more favorable tax treatment. But if you're starting from zero with ₹100 or need round-the-clock liquidity, digital gold is where you need to be.

Now you are aware of Digital Gold and Gold ETF—so I would prefer you to take into account your budget, tax slab, and how much you can comfortably trade. Select the one which is optimal for your use, and begin your golden journey!

Pingback: Sovereign Gold Bond vs Gold ETF: Which is Better and Why?

Pingback: Gold ETF vs Gold Mutual Fund: Key Differences in 2025

Pingback: Fintechzoom.com Crypto ETF Guide: Smart Investing 2025

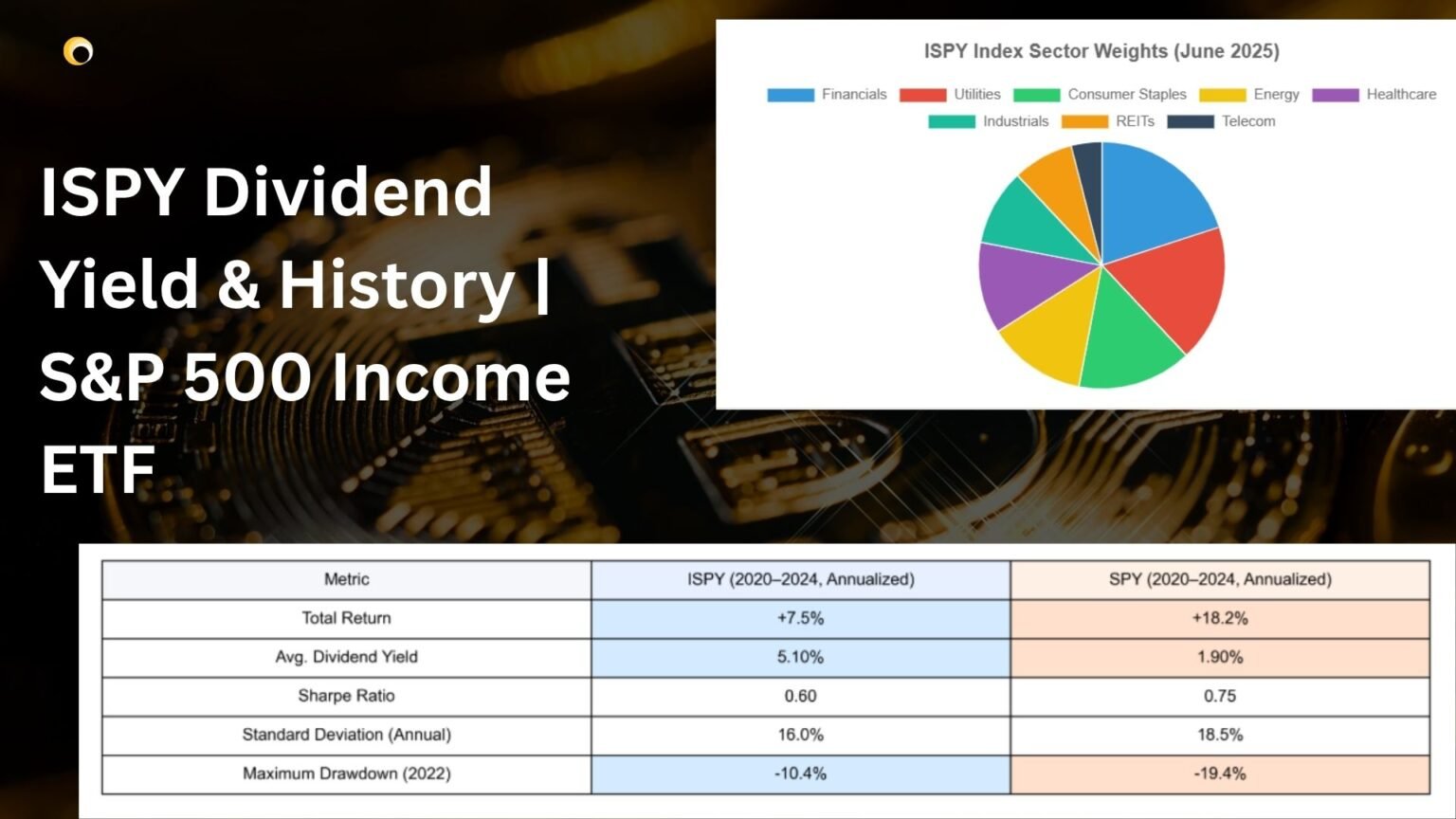

Pingback: ISPY Dividend Yield & History | S&P 500 Income ETF

Pingback: Best Leveraged Dollar ETFs to Watch in 2025

Pingback: Best Copper ETFs to Invest in India (2025 Guide)

Pingback: Direxion Daily TSLA Bull 2X Shares (TSLL) Overview