Best Leveraged ETFs to Look Out For in 2025

In the high gain-low gain market in place today, leveraged ETFs have the capability of ludicrously boosting profits and losses by utilizing derivatives to provide multiples of an index value.

Although they fit more with advanced traders who have a precise short-term opinion, the proper names in your spotlight could allow you to understand the movement across sectors and their momentum in the market.

The following is a pick’n mix of handy, understandable listings of the top 3x and 2x leveraged ETFs relative to several broad categories along with their most recent performance, expenses and funds under management.

Technology ETFs

These funds aim to amplify the returns (and risks) of the tech sector and its semiconductor subset.

Key ETFs

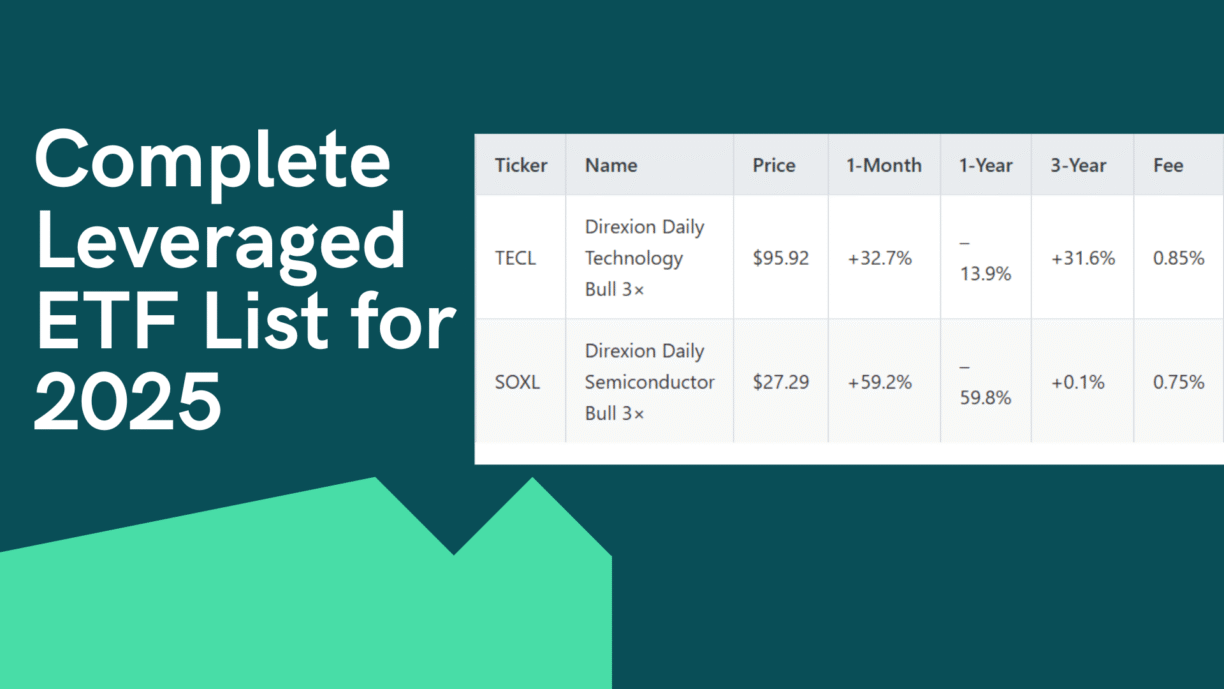

| Ticker | Name | Price | 1‑Month | 1‑Year | 3‑Year | Fee |

|---|---|---|---|---|---|---|

| TECL | Direxion Daily Technology Bull 3× | $95.92 | +32.7% | –13.9% | +31.6% | 0.85% |

| SOXL | Direxion Daily Semiconductor Bull 3× | $27.29 | +59.2% | –59.8% | +0.1% | 0.75% |

Why TECL?

Broader tech exposure—from software to hardware. Its strong three-year track record (31.6% annualized) signals resilience beyond just the latest rally.

Why SOXL?

Pure play on chipmakers. Exceptional one-month pop (59%) makes it a high-beta play when semis are hot—but watch the steeper downside on corrections.

S&P 500 ETFs

For bulls targeting broad-market surges, these 3× and 2× S&P funds are go-to vehicles.

Key ETFs

| Ticker | Name | Price | 1‑Month | 1‑Year | 3‑Year | Fee |

|---|---|---|---|---|---|---|

| SPXL | Direxion Daily S&P 500 Bull 3× Shares | $177.54 | +17.1% | +12.4% | +26.9% | 0.87% |

| UPRO | ProShares UltraPro S&P 500 | $93.55 | +17.2% | +16.5% | +26.5% | 0.91% |

| SSO | ProShares Ultra S&P 500 | $99.29 | +11.4% | +14.2% | +22.6% | 0.89% |

SPXL vs. UPRO

Both deliver 3×, but SPXL’s slightly lower fee may edge out UPRO if you’re trading the same S&P swings.

SSO

A 2× alternative with a lower volatility profile and fee, ideal for more moderate moves in large caps.

Nasdaq ETFs

Capture the innovation-heavy Nasdaq Composite with a leveraged tilt.

Key ETFs

| Ticker | Name | Price | 1‑Month | 1‑Year | 3‑Year | Fee |

|---|---|---|---|---|---|---|

| TQQQ | ProShares UltraPro QQQ | $83.72 | +19.3% | –0.2% | +37.3% | 0.84% |

| QLD | ProShares Ultra QQQ | $118.50 | +12.9% | +8.2% | +32.2% | 0.95% |

TQQQ

The go-to for aggressive Nasdaq bulls; strong three-year returns underscore how mega-caps have dominated.

QLD

Delivers 2× leverage, smoothing out some of TQQQ’s whipsaw while still offering twice the upside.

Financials ETFs

A concentrated play on banks, insurers, and financial services.

Key ETFs

| Ticker | Name | Price | 1‑Month | 1‑Year | 3‑Year | Fee |

|---|---|---|---|---|---|---|

| FAS | Direxion Daily Financial Bull 3× Shares | $165.94 | +7.2% | +57.4% | +28.0% | 0.89% |

FAS

One of the oldest financials triple-levers, FAS has rewarded patience in the past year (57%) and over a three-year span (28%) as rising rates and SOFR linked products powered bank profits.

Energy ETFs

Energy swings can be dramatic—these funds capture oil, gas and equipment movers.

Key ETFs

| Ticker | Name | Price | 1‑Month | 1‑Year | 3‑Year | Fee |

|---|---|---|---|---|---|---|

| GUSH | Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2× | $25.33 | +20.2% | –24.2% | +26.8% | 0.99% |

| ERX | Direxion Daily Energy Bull 2× Shares | $56.57 | +18.1% | –6.9% | +10.3% | 0.90% |

GUSH

Your 2× oil & gas play—excellent for capturing cyclical rebounds, though downside can be steep in bear markets.

ERX

Broader energy basket; smoother rides during volatile crude and nat-gas moves.

Commodities ETFs

Ideal for traders seeking leveraged exposure to raw materials.

Key ETFs

| Ticker | Name | Price | 1‑Month | 1‑Year | 3‑Year | Fee |

|---|---|---|---|---|---|---|

| UCO | ProShares Ultra Bloomberg Crude Oil | $24.57 | +20.0% | –27.4% | +25.4% | 1.43% |

| BOIL | ProShares Ultra Bloomberg Natural Gas | $43.60 | –13.6% | –30.3% | +83.5% | 0.95% |

UCO

Heavy on crude-oil performance—expect volatile swings with OPEC moves and demand shocks.

BOIL

Natural gas lovers’ dream; extreme volatility has rewarded those who timed supply disruptions correctly (83% over three years).

Broad-Market ETFs

Key ETFs

| Ticker | Name | Price | 1-Month | 1-Year | 3-Year | Fee | AUM |

|---|---|---|---|---|---|---|---|

| TNA | Direxion Daily Small Cap Bull 3X Shares | $36.10 | 22.74% | -0.76% | 10.23% | 1.02% | $1.83B |

| UDOW | ProShares UltraPro Dow30 | $95.88 | 14.65% | 18.52% | 29.40% | 0.95% | $679.21M |

| URTY | ProShares UltraPro Russell2000 | $42.39 | 22.53% | -1.11% | 8.92% | 0.95% | $297.33M |

Thematic ETFs

Sectoral: Biotech

Also Read: Direxion Daily TSLA Bull 2X Shares (TSLL) Overview

| Ticker | Name | Price | 1-Month | 1-Year | 3-Year | Fee | AUM |

|---|---|---|---|---|---|---|---|

| LABU | Direxion Daily S&P Biotech Bull 3X Shares | $65.04 | 22.87% | -46.85% | -44.80% | 1.02% | $556.71M |

Crypto & AI

Also Read: Global X Copper Miners ETF (COPX) – Price, Chart & Forecast

| Ticker | Name | Price | 1-Month | 1-Year | 3-Year | Fee | AUM |

|---|---|---|---|---|---|---|---|

| BITU | Proshares Ultra Bitcoin ETF | $61.65 | 21.58% | 170.42% | N/A | 0.95% | $1.20B |

| CONL | GraniteShares 2x Long COIN Daily ETF | $55.37 | 121.48% | 25.81% | N/A | 1.15% | $709.31M |

| NVDL | GraniteShares 2x Long NVDA Daily ETF | $76.33 | 37.14% | -7.24% | N/A | 1.15% | $3.72B |

The Usage of This List

- Establish doubts of sequential settlement: Leveraged ETFs reset every day, so are ideal for holding positions of less than a week.

- Watch volatility: Fees and leverage are doubled: it increases drawdowns, so apply stop-loss limits.

- Diversify: Do not work all in a single business, instead, think about matching funds (e.g., TECL + FAS).

- Remain credible: The driving sectors are economic data, earnings and geopolitical roundups.

Frequently Asked Questions (FAQs)

1. What is a leveraged ETF?

A leveraged ETF employs both derivatives and debt to multiply the day-to-day performance of an underlying index by a factor of 2 times or 3 times. For example, a 3x fund is expected to produce three times the daily performance of its benchmark.

2. What role do daily resets play on performance?

Leveraged ETFs are rebalanced every trading day to keep their target multiple. Compounding and market fluctuations over time may result in returns that are substantially different than the expected multiple of index cumulative returns over periods that take longer than one day. This effect is known as volatility drag or path dependency.

3. Would leveraged ETFs be appropriate for long-term investors?

Generally no. Due to daily rebalancing and path-dependency, leveraged ETFs should not be held long-term (in other words, buy-and-hold). They are designed to be used for short-term trading (typically days, sometimes weeks, but rarely months).

4. What are the primary risks in trading leveraged ETFs?

Volatility drag: High values of volatility can significantly reduce returns in the long run.

Increased fees: The expense ratios of leveraged ETFs are higher than traditional ones.

Compounding Risk: Over periods longer than a day, the performance can diverge significantly from the target multiple of the underlying index's return.