Jio BlackRock Mutual Fund: A Digital-First Approach

Overview and Background

Launched in 2025, Jio BlackRock Mutual Fund is a 50:50 joint venture between Jio Financial Services and BlackRock, following a SEBI order on May 26.

The fund leverages BlackRock's global expertise and Jio's extensive digital reach to offer cost-effective and easily accessible investment solutions to Indian investors. As of July 12, 2025, it features three open-ended debt plans powered by the advanced analytics platform, Aladdin.

Latest NAV Updates (as of July 11, 2025)

The fund's Net Asset Value (NAV) history confirms steady growth since its launch.

| Scheme | NAV (₹) | Risk Level | Min. Investment |

|---|---|---|---|

| Liquid Fund (Direct Growth) | 1,001.49 | Low to Moderate | ₹500 |

| Money Market Fund (Direct Growth) | 1,001.39 | Low to Moderate | ₹500 |

| Overnight Fund (Direct Growth) | 1,001.45 | Low | ₹500 |

Key Takeaway

A consistently rising NAV above ₹1,001 reflects stability in short-term debt instruments.

Scheme Details & Objectives

Liquid Fund

- Objective: Generate income through investment in money market & debt papers with maturity of 91 days or less.

- Risk: SEBI Class A-I, Low to Moderate.

- Exit Load: 0.007% if redeemed within 1 day; nil after 7 days.

Money Market Fund

- Objective: Pursue income with instruments maturing in up to 1 year.

- Risk: SEBI Class B-I, Low to Moderate.

- Exit Load: Nil.

Overnight Fund

- Objective: Earn income from overnight debt securities.

- Risk: SEBI Class A-1, Low.

- Exit Load: Nil.

All schemes offer flexible investment options like SIP, STP, and SWP.

Performance Comparison & Visuals

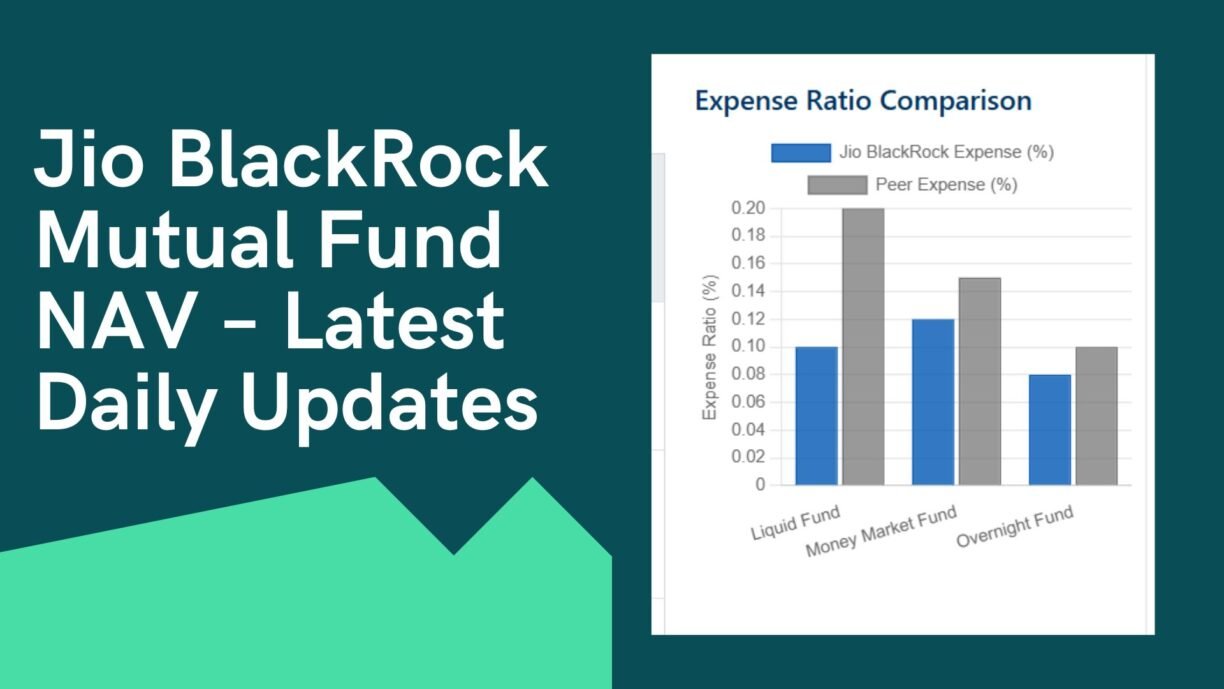

Lower fees directly translate to better net returns, a crucial factor in today's low-yield environment.

Data Comparison

| Scheme | NAV (₹) | Expense Ratio (%) | Peer NAV (₹) | Peer Expense (%) |

|---|---|---|---|---|

| Liquid Fund | 1,001.49 | 0.10% | HDFC Liquid – 1,002.00 | 0.20% |

| Money Market Fund | 1,001.39 | 0.12%* | ICICI MM – 1,001.80 | 0.15% |

| Overnight Fund | 1,001.45 | 0.08%* | SBI Overnight – 1,001.60 | 0.10% |

*Estimated based on industry averages.

Expense Ratio Comparison

Case Study: Investor Returns

Based on a hypothetical initial investment of ₹10,000, the growth since launch is:

- Liquid Fund: ₹10,014.90 (a 0.149% rise)

- Money Market Fund: ₹10,013.90 (a 0.139% upswing)

- Overnight Fund: ₹10,014.50 (a 0.145% profit)

These returns can be enhanced through compounding with a monthly SIP of ₹500.

Opportunities & Financing Plan

- 🛡️ Low Risk: Cautious SEBI risk ratings provide peace of mind for conservative investors.

- 💧 High Liquidity: Redeem funds any business day with minimal or zero exit loads.

- 🚀 Low Entry Barrier: Begin your investment journey with just ₹500.

- 💻 Digital-First Model: A simple, direct delivery model keeps costs and the expense ratio low.

Investment Tips

- Use the Overnight Fund to park surplus cash for very short periods.

- Switch between Liquid and Money Market funds based on your investment horizon.

- Utilize SIPs to average out NAV fluctuations through rupee cost averaging.

Market Context & Future Prospects

By July 12, 2025, Jio BlackRock has impressively raised ₹17,800 crore across its initial three debt schemes. The fund has attracted over 67,000 retail investors and 90 institutional clients.

With eight additional equity and hybrid funds planned for launch by the end of the year, competition in the asset management space is set to intensify, which will ultimately benefit investors with more choice and competitive pricing. Jio’s vast telecom network provides an unmatched distribution channel for its mutual fund offerings.

Conclusion & Recommendations

Jio BlackRock’s initial debt schemes successfully combine low-cost, low-risk income strategies with unparalleled digital convenience. They are an ideal choice for conservative investors, individuals managing short-term cash flows, and newcomers to the world of mutual funds.

Always align your investment choices with your financial goals, monitor the NAV history, and leverage systematic investment plans (SIPs) to maximize the benefits of rupee cost averaging.