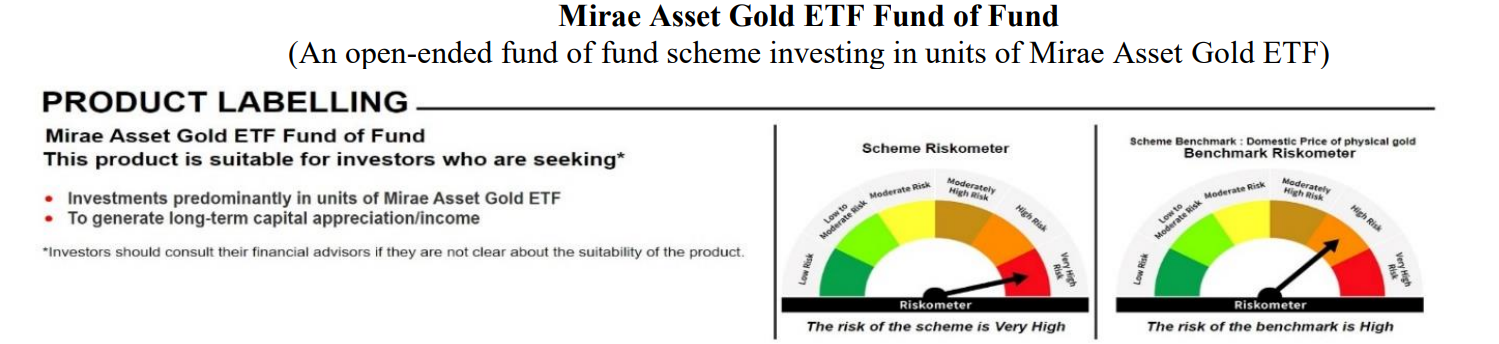

Mirae Asset Gold ETF Fund of Fund

(An open-ended fund of fund scheme investing in units of Mirae Asset Gold ETF)

Fund Overview

The Mirae Asset Gold ETF is a conventional exchange-traded fund (ETF) that aims to replicate the performance of the domestic price of physical gold. It offers a simple, passive investment for individuals seeking exposure to gold in their portfolio without the complexities of storing physical gold.

With a low expense ratio and a clear investment objective, it is positioned for long-term investors who wish to diversify their assets and hedge against inflation and market volatility.

A key decision for an investor is whether to invest directly in this ETF, which requires a Demat account, or through its "Fund of Fund" counterpart, which has a higher fee but is accessible like a traditional mutual fund.

Also Read:

Key Details

| Fund Name | Mirae Asset Gold ETF |

|---|---|

| Ticker Symbols | NSE: GOLDETF, BSE: 543781 |

| Fund Type | An open-ended Exchange Traded Fund (ETF) tracking domestic physical gold prices. |

| Investment Objective | To generate returns in line with the performance of physical gold, subject to tracking errors. |

| Allotment Date | 20th February 2023 |

| Benchmark | Domestic Price of Physical Gold |

Key Financials & Risk Profile (as of April 30, 2025)

The TER of 0.32% is competitive. AUM of over ₹750 Crore indicates strong liquidity and investor confidence. The tracking error is reasonable, showing the fund is closely tracking the price of gold, with minor deviations due to expenses.

Tata Silver ETF: Price, Performance & Investment Guide

Holdings & Asset Allocation (as of April 30, 2025)

| Asset | % of Total Assets |

|---|---|

| Gold | 97.77% |

| Cash & Other Receivables | 2.23% |

| Total | 100.00% |

The asset allocation is exactly as expected for a Gold ETF. The ~98% allocation to physical gold ensures it closely tracks the commodity's price, while the small cash component is for liquidity and expense management.

Performance & Returns Analysis (as of April 30, 2025)

Lump-Sum Investment Performance

The fund has marginally underperformed its benchmark, as expected. The "tracking difference" is mainly due to the Total Expense Ratio (TER).

| Period | Mirae Gold ETF Returns | Benchmark Returns | Tracking Difference |

|---|---|---|---|

| Last 1 Year | 29.98% | 31.30% | -1.32% |

| Since Inception (CAGR) | 25.02% | 26.24% | -1.22% |

SIP Performance (Benchmark)

The underlying asset (gold) has shown excellent performance in SIPs over the last 5 and 10 years, highlighting the long-term wealth-creation potential of systematic gold investing.

| Period | Monthly SIP | Total Invested | Value of Investment | XIRR |

|---|---|---|---|---|

| 5 Years | ₹10,000 | ₹6,00,000 | ₹9,60,777 | 19.5% |

| 10 Years | ₹10,000 | ₹12,00,000 | ₹27,19,575 | 16.1% |

Peer Comparison: ETF vs. Fund of Fund (FoF)

The most direct peer is the Mirae Asset Gold ETF Fund of Fund. The FoF is a mutual fund that invests in the underlying ETF, making it accessible to investors without a Demat account.

| Parameter | Mirae Asset Gold ETF | Mirae Asset Gold ETF FoF |

|---|---|---|

| How to Invest | Demat Account Required | No Demat Required |

| Expense Ratio (TER) | 0.32% | 0.64% (Regular Plan) |

| AUM (in Crore) | ₹768.56 | ₹87.18 |

| Since Inception Return | 25.02% (CAGR) | 44.16% (Simple Annualized) |

Analysis

Cost: The primary difference is cost. The FoF's expense ratio is double that of the ETF (0.64% vs. 0.32%). This is because the FoF adds its own management fee on top of the underlying ETF's fee.

Convenience: The FoF is more convenient for investors who do not have a Demat account. The choice is clear: if you have a Demat account, the ETF is cheaper. If you prefer mutual funds, the FoF is available at a higher long-term cost.

Historical NAV Performance Chart

This chart shows the historical Net Asset Value (NAV) of the Mirae Asset Gold ETF, providing a visual representation of its price movement over time.

Pingback: Tata Gold ETF – NAV, Returns, Risk & Performance