Tata Gold ETF Fund of Fund: An In-Depth Analysis

The Tata Gold ETF fund of fund (FoF) offers a straightforward gateway for retail investors to gain exposure to gold. This analysis breaks down the product's mechanics, costs, and inherent risks to provide a clear picture beyond marketing claims.

The Core Structure: A Fund of a Fund

This fund doesn't directly purchase physical gold. Instead, it invests in another fund, the Tata Gold Exchange Traded Fund (TGETF), which in turn holds physical gold. The structure is:

Investor → Tata Gold ETF FoF → Tata Gold ETF → Physical Gold (99.5% purity)

The Convenience (Pro)

The main advantage is convenience. You don't need a DEMAT account to invest. It allows for systematic investments through a SIP (Systematic Investment Plan), which is difficult with ETFs bought directly on the stock exchange.

The Layered Cost (Con)

This convenience comes at a cost due to its two-layer structure. You incur two sets of expenses:

- The Expense Ratio of the Fund of Fund itself.

- The Expense Ratio of the underlying Tata Gold ETF.

The Scheme Information Document (KIM) notes the total expense ratio (TER) of the FoF, including the underlying scheme's costs, will not exceed 1.00%.

Cracking the Investment Rationale

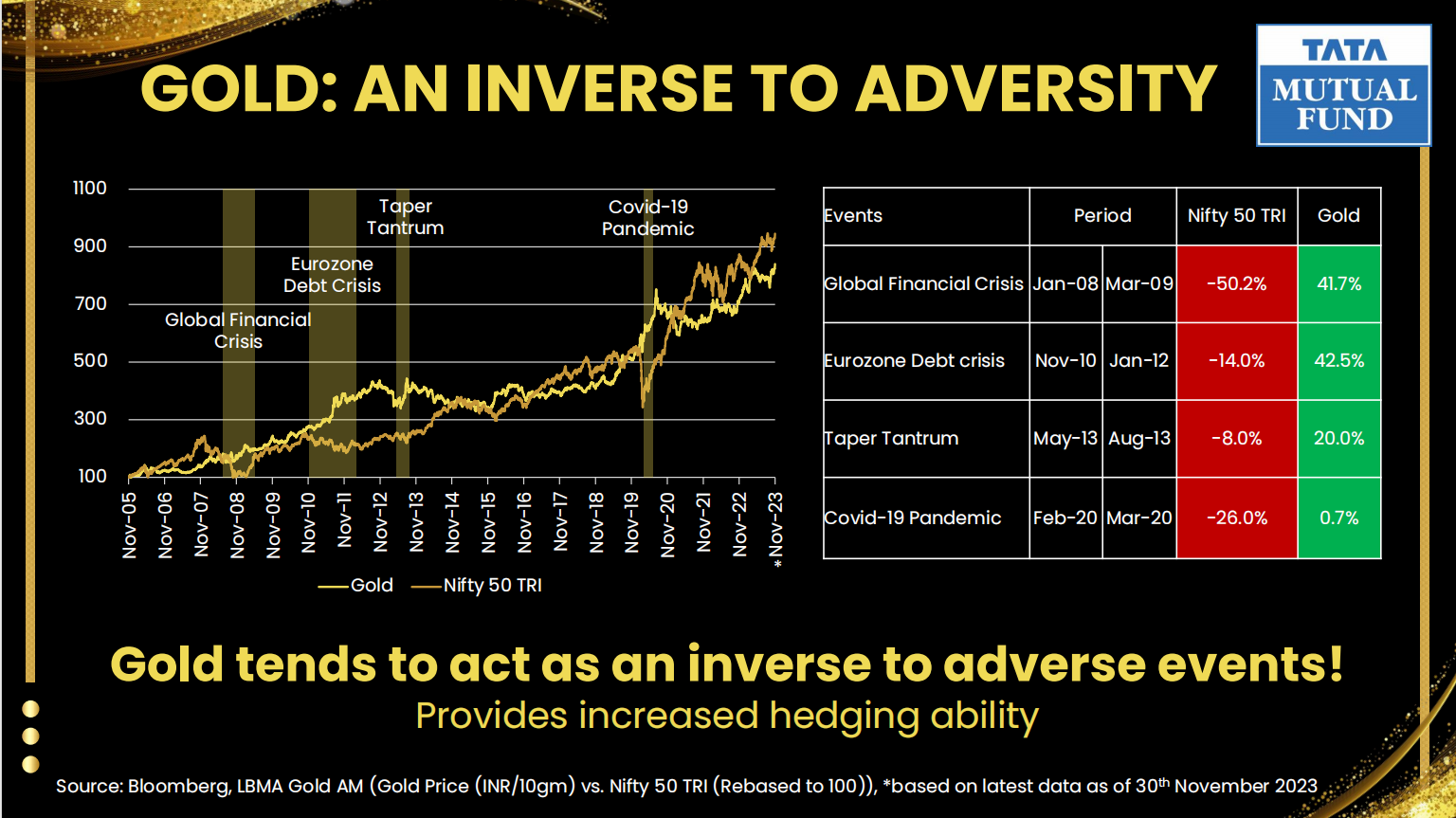

The case for gold is built on its historical performance during crises and its role as a diversifier.

Haven in Adversity

Gold often performs well when other assets struggle. For example:

- Global Financial Crisis (2008): Gold +41.7% vs. Nifty -50.2%

- Eurozone Debt Crisis (2010-12): Gold +42.5% vs. Nifty -14.0%

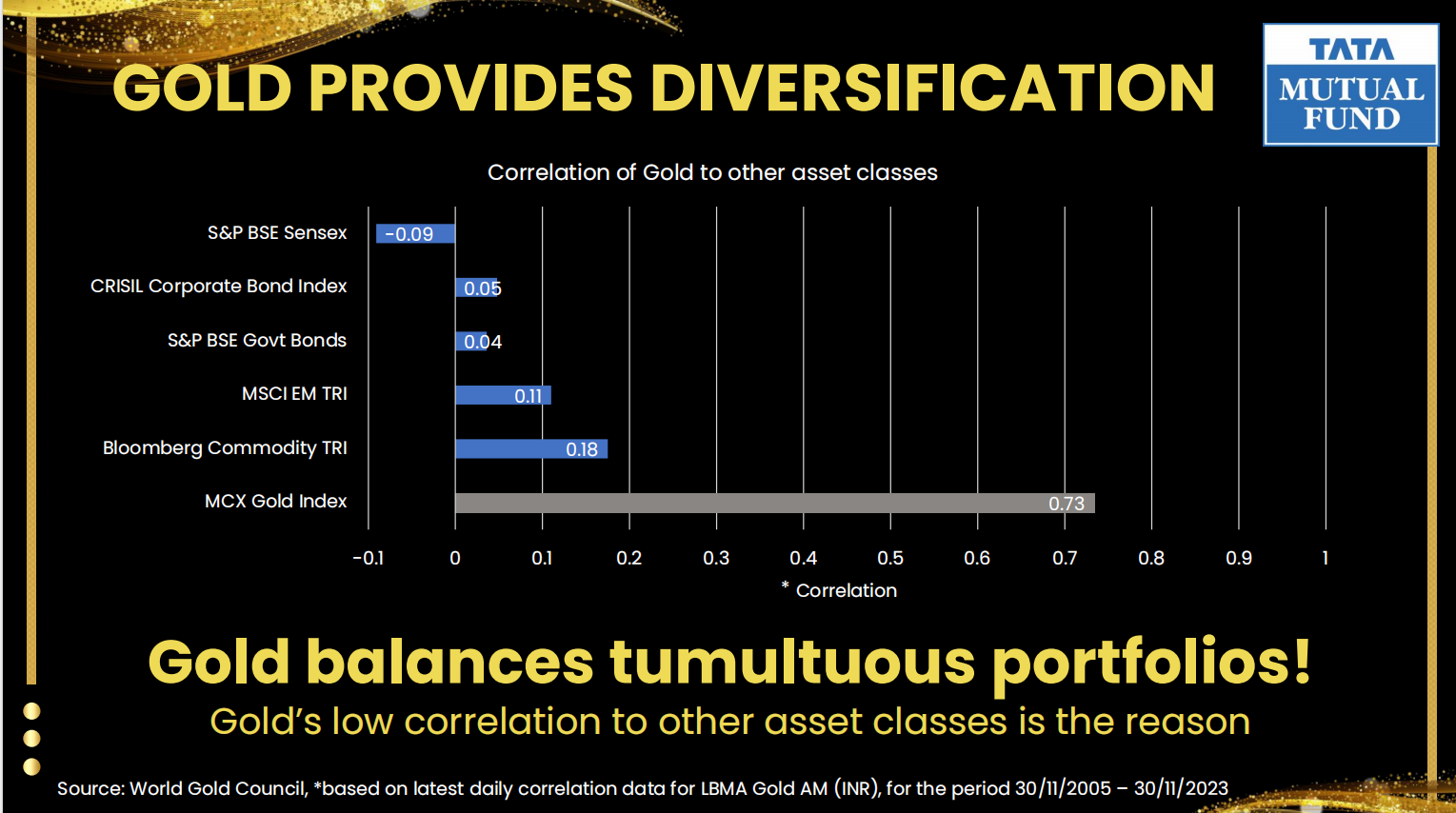

Portfolio Diversification & Hedging

Gold has a low or negative correlation with equities (e.g., -0.09 correlation with S&P BSE Sensex). This means it can balance your portfolio when stocks fall. It also serves as a hedge against currency depreciation and rising inflation.

Also Read: Mirae Asset Gold ETF NAV, Returns & Review

Diverse Global Demand for Gold (2010-2022)

Gold's value is supported by consistent and varied demand from jewellery, investment, and central banks. While jewellery remains a significant component, investment and central bank purchases have been key drivers of growth, especially in recent years.

Scheme Overview and Key Data

- Fund Manager: Tapan Patel

- Benchmark: Domestic Price of Gold

- Minimum Application: ₹ 5,000

- Exit Load: 1% if redeemed within 365 days for withdrawals over 12% of the invested amount. NIL otherwise.

- Direct Plan TER (FY 24-25): 0.13%

- Regular Plan TER (FY 24-25): 0.67%

Calculated Returns (as of 18 Jun 2025)

Based on the provided NAV data, here are the calculated returns:

- 1-Week Return: ~2.65% (vs. 11 Jun 2025 NAV of ₹9.4397)

- 1-Month Return: ~5.57% (vs. 19 May 2025 NAV of ₹9.1785)

- 1-Year Return: ~38.16% (vs. 18 Jun 2024 NAV of ₹7.0131)

Who Should Consider This Fund?

This fund might be a good fit if:

- You are a long-term investor seeking 5-10% gold allocation for diversification.

- You do not have a DEMAT account and prefer not to open one.

- You wish to invest in gold systematically via SIPs.

Consider other options if:

- You have a DEMAT account. Buying a Gold ETF directly is likely cheaper.

- You are highly cost-sensitive and want the lowest possible expense ratio.

- You prefer physical gold or Sovereign Gold Bonds (SGBs), which offer interest and tax benefits.

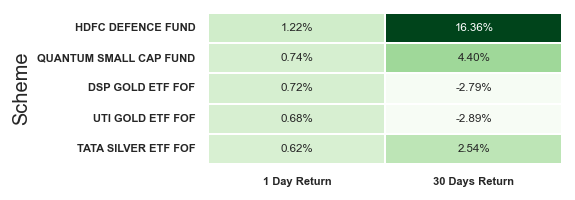

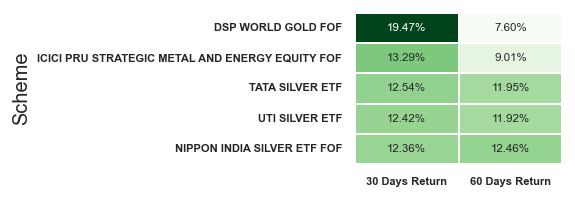

Peer Performance Context

While analyzing a specific fund, it's useful to see how other similar or alternative schemes are performing in the market. The following images provide a snapshot of returns for various funds over different periods.

Historical NAV Performance of Tata Gold ETF

This chart illustrates the historical performance of the Tata Gold Exchange Traded Fund's Net Asset Value (NAV) from January 2024 to June 2025, based on the provided data.

Pingback: Nifty 200 Quality 30 ETF 2025: Performance, Returns & Review - Tech Venture Spot

Pingback: 7 Best Covered Call ETFs for Monthly Income - Tech Venture Spot