Introduction

Individuals searching for reliable investment income usually choose dividends mutual funds to fulfill their needs. These investment funds allocate their assets into dividend-paying companies which generate two-fold benefits of regular payouts combined with potential market gains. The year 2025 approaches so investors must receive immediate updates on mutual funds dividends to take well-informed investment decisions.

This article examines the current mutual fund dividend releases alongside their record timings and describes the advantages of dividend investments and condenses guidance for strategic portfolio usage of dividend mutual funds.

What are Dividends Mutual Funds?

The investment vehicles of dividend mutual funds focus mainly on stocks and bonds which disburse dividend payments. They generate returns through:

Benefits of Investing in Dividends Mutual Funds

- The regular dividend payments enable investors to receive dependable supplemental income or they can use these funds for reinvestment.

- These investment funds demonstrate lower market fluctuations than those that pursue growth potential.

- Dividend funds distribute investments across various sectors which helps decrease risk.

- Wealth accumulation occurs when reinvested dividends generate successive increases in your financial value throughout time.

Upcoming Dividend Announcements

March 2025 Dividend Declarations Analysis

| Scheme Name | Category | Dividend Date | Dividend (%) |

|---|

2025 Ultra High Dividend Stocks Analysis

Strategic Investment Opportunities with Dividend Yields up to 6600%

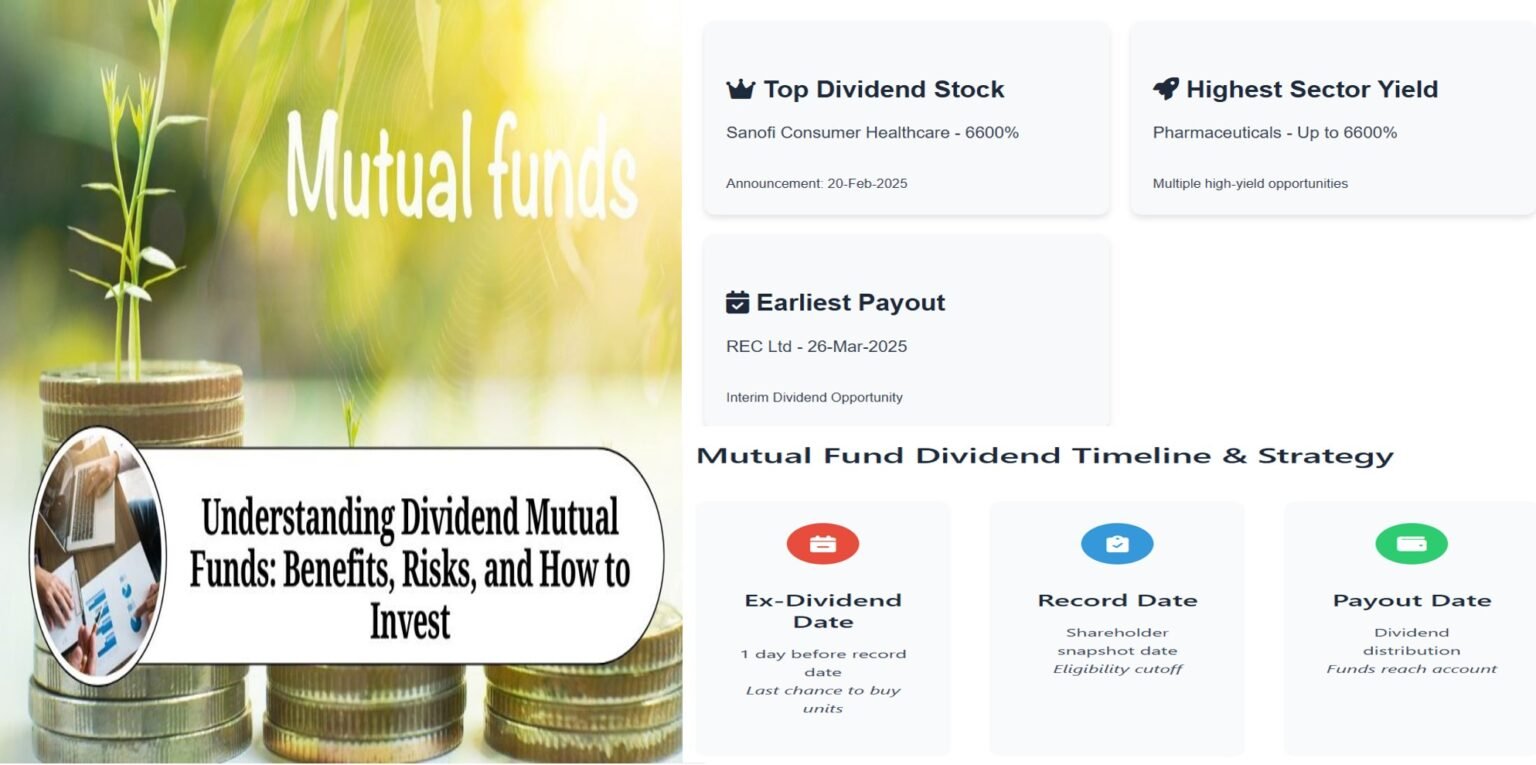

Top Dividend Stock

Sanofi Consumer Healthcare - 6600%

Announcement: 20-Feb-2025Highest Sector Yield

Pharmaceuticals - Up to 6600%

Multiple high-yield opportunitiesEarliest Payout

REC Ltd - 26-Mar-2025

Interim Dividend OpportunityHigh-Dividend Stock Details

| Company | Type | Dividend (%) | Announcement Date | Record Date |

|---|

How to Identifying Dividend Opportunities in Mutual Funds

Dividend History

5+ years consistent payouts

Fund Category

Equity vs Hybrid vs Debt

Yield & Payout

Optimal 3-5% yield

Market Trends

Economic cycle analysis

| Fund Name | Category | Dividend Yield | Payout Ratio | 5-Yr Consistency |

|---|---|---|---|---|

| BlueChip Growth | Equity | 4.2% | 75% | ⭐️⭐️⭐️⭐️ |

| SafeReturn Hybrid | Hybrid | 3.8% | 65% | ⭐️⭐️⭐️⭐️⭐ |

| Govt Bond Plus | Debt | 2.9% | 85% | ⭐️⭐️⭐️ |

Dividend Performance vs Market Conditions

🚀 Quick Checklist

- ✅ Minimum 3-year dividend history

- ✅ Yield between 3-5%

- ✅ Payout ratio < 90%

- ✅ Match category to risk profile

Mutual Fund Dividend Timeline & Strategy

Ex-Dividend Date

1 day before record date

Last chance to buy units

Record Date

Shareholder snapshot date

Eligibility cutoff

Payout Date

Dividend distribution

Funds reach account

| Fund Type | Typical Record Date | Payout Period | Yield Range | Ideal Investor |

|---|---|---|---|---|

| Equity Dividend | Quarterly | 7-10 days | 4-6% | Growth Investors |

| Hybrid Fund | Bi-Annual | 10-15 days | 3-4% | Balanced Investors |

| Debt Fund | Monthly | 3-5 days | 2-3% | Conservative Investors |

Strategic Advantages

- �︎ Dual benefit of income + growth

- ⏳ Compound growth potential

- 🛡️ Risk mitigation through diversification

Ideal For

- 👴 Retirement income seekers

- 📉 Risk-averse investors

- 📈 Long-term wealth builders

Conclusion

People who put their faith in financial security through wealth generation must monitor dividend mutual fund disclosure schedules. High-dividend fund investments will help you gain maximum return rates alongside reliable income flows.

Stay Updated!

Users can bookmark this page to stay updated on mutual fund dividends which are expected to arrive in 2025. Obtain customized financial investment recommendations from professionals in your financial field.

Disclaimer: This content is for educational purposes only. Please consult with a financial advisor before making any investment decisions.

Pingback: Amazon P/E Ratio Explained: Is It Overvalued or a Buy?

Pingback: Highest Dividend Paying Stocks in Nifty 50

Pingback: Top 20 Highest EPS Stocks in India to Watch in 2025