Indian stock investors seeking maximal earnings per share for investment purposes can find their options in this article. You’re in the right place. Investors focusing on fundamental evaluation prefer to assess profitability via EPS (Earnings Per Share) measurement. The following article presents the top 20 Indian stocks based on their EPS data to help investors make strategic decisions backed by financial evidence.

📌 What Are the Highest Earnings Per Share Stocks?

Companies which distribute maximum profits to shareholders through each stock unit maintain the top position in earnings per share statistics. Holding high EPS demonstrates the company remains financially sound with strong profitability and potentially presents an opportunity to buy at a lower value relative to its earnings potential. Stock screening together with value investing utilizes this metric as its fundamental evaluation measurement.

Top 20 High EPS Stocks Analysis

| Company | Price | EPS | PE Ratio | ROE | RSI | 1Y Return |

|---|

Expert Tips to Invest in Highest EPS Stocks

1.Combine EPS with Growth Rates

- High EPS demonstrates excellent results, yet investors must also search for annual growth development.

2.Watch for Market Corrections

- The stock market has the potential to adjust share prices even among excellent investment opportunities. You should use market declines as entry points to purchase high-quality businesses.

3.Diversify

- Invest entire monetary assets in just one sector type. These stocks cover pharmaceuticals together with automobiles as well as media companies.

4.Stay Updated

- Business earnings in the quarterly periods strongly influence earnings per share. Follow the financial statements together with management commentary output.

Top 5 High EPS Growth Stocks

Fundamental Analysis & Technical Insights

MMRF (₹4,866.72 EPS)

Diversified conglomerate with stable fundamentals

Bosch (₹646.75 EPS)

Auto components leader with strong margins

Bajaj Holdings (₹670.52 EPS)

Financial powerhouse with massive long-term growth

Page Industries (₹516.64 EPS)

Innerwear market leader with strong pricing power

Force Motors (₹330.24 EPS)

Dark horse with explosive fundamental growth

PE Ratio Valuation Analysis

| Stock | PE Ratio | Industry PE | Difference | ROE | RSI | Valuation Status |

|---|---|---|---|---|---|---|

| MMRF | 27.78 | 39.08 | -11.30 | 12.46% | 63.52 | Undervalued |

| Bajaj Holdings | 17.06 | 29.01 | -11.95 | 11.70% | 42.99 | Undervalued |

| Bosch | 40.76 | 37.75 | +3.01 | 20.65% | 53.37 | Overvalued |

| Honeywell Automation | 57.16 | 60.33 | -3.17 | 13.90% | 49.59 | Neutral |

| Abbott | 47.68 | 54.86 | -7.18 | 32.48% | 48.49 | Undervalued |

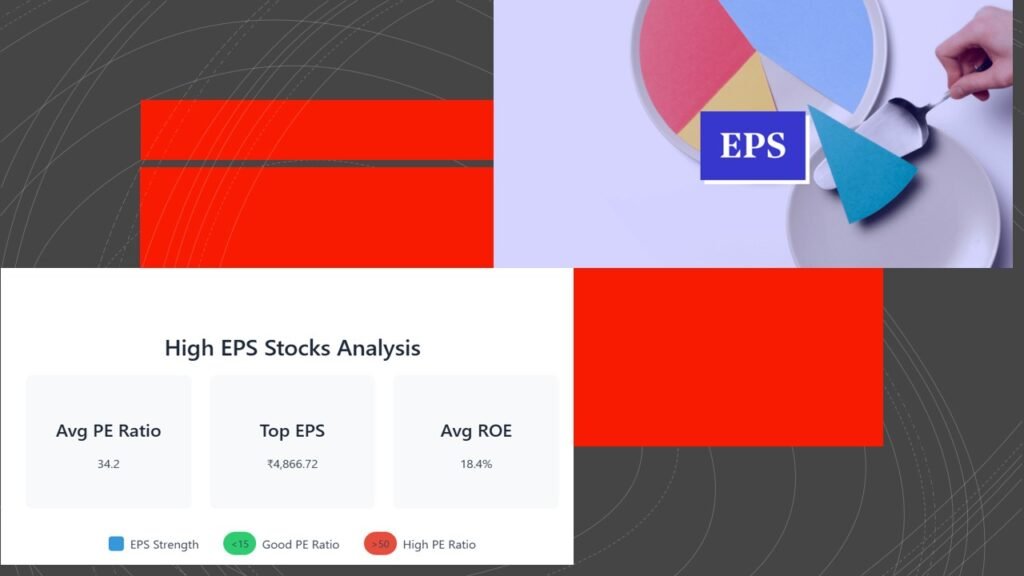

High EPS Stocks Analysis

Avg PE Ratio

34.2

Top EPS

₹4,866.72

Avg ROE

18.4%

🧠 How to Analyze the Highest Earnings Per Share Stocks?

Take note that looking at EPS figures alone is not enough to evaluate highest earnings per share stocks properly. Consider:

- When earnings per share figures combine with a lower than average price-to-earnings ratio the stock may be deemed undervalued.

- Return on Equity and Capital Employed demonstrate the effectiveness with which investor funds are utilized by the company.

- Higher EPS values permit companies to distribute consistent or rising dividends through dividend yield payments.

- RSI and moving averages help investors identify their position entries or exits through stock price analysis.

Want Mult bagger Returns? Start with EPS Screening

According to those who aim to create long-term wealth they should begin searching for stocks that demonstrate the highest earnings per share metrics. Screening for financial ratios requires tools from Screener.in and Tickertape and Trendline to identify low-priced undervalued stocks.

Final Thoughts: Should You Only Rely on EPS?

EPS serves as a significant parameter, yet it functions better when combined with multiple other factors. Financial analysis and cash flow calculations when combined with debt examinations and competitive market research and management quality evaluation will provide you with the full picture. Having the highest earnings per share stocks creates a solid investment fundamental.

Companies with strong financial positions are characterized by excellent investor trust in addition to solid historical returns and excellent financial health.

Pingback: Top Intraday Stocks Today – High Volume Gainers

Pingback: Top 10 Best Stocks Under $10 to Buy Now in 2025