Systematic Withdrawal Plans (SWPs) enable you to withdraw a fixed amount of money every month from your mutual fund, such that your remaining corpus continues to grow.

SWPs are ideal for:

- Retirees who require constant cash generation

- Conservative investors looking for stable returns

- Anyone wishing to earn additional income with less capital loss

Why Choose an SWP?

Guaranteed Monthly Return

Get consistent return every month without having to sell your entire investment.

Sustained Growth

Some of the units are phased out, while others keep growing.

Flexibility

Adjust withdrawal levels and suspend or resume SWP at will.

How We Picked the Top SWP Mutual Funds

- Five-Year Consistent Returns: Funds have to demonstrate consistent growth for 5 years.

- Low Cost Ratio: Retains more of your cash to compound.

- Diversified Portfolio: Combines debt and equity to control volatility.

- High AUM and Manager Qualifications: Large, high-performing funds stand better chances of surviving market volatility.

Top 10 SWP Mutual Funds: Five-Year Absolute Returns

Here we examine their five-year performance, risk profiles, and return potential—so you can select the best SWP plan for yourself. All figures are absolute returns over the last five years (June 2020–June 2025).

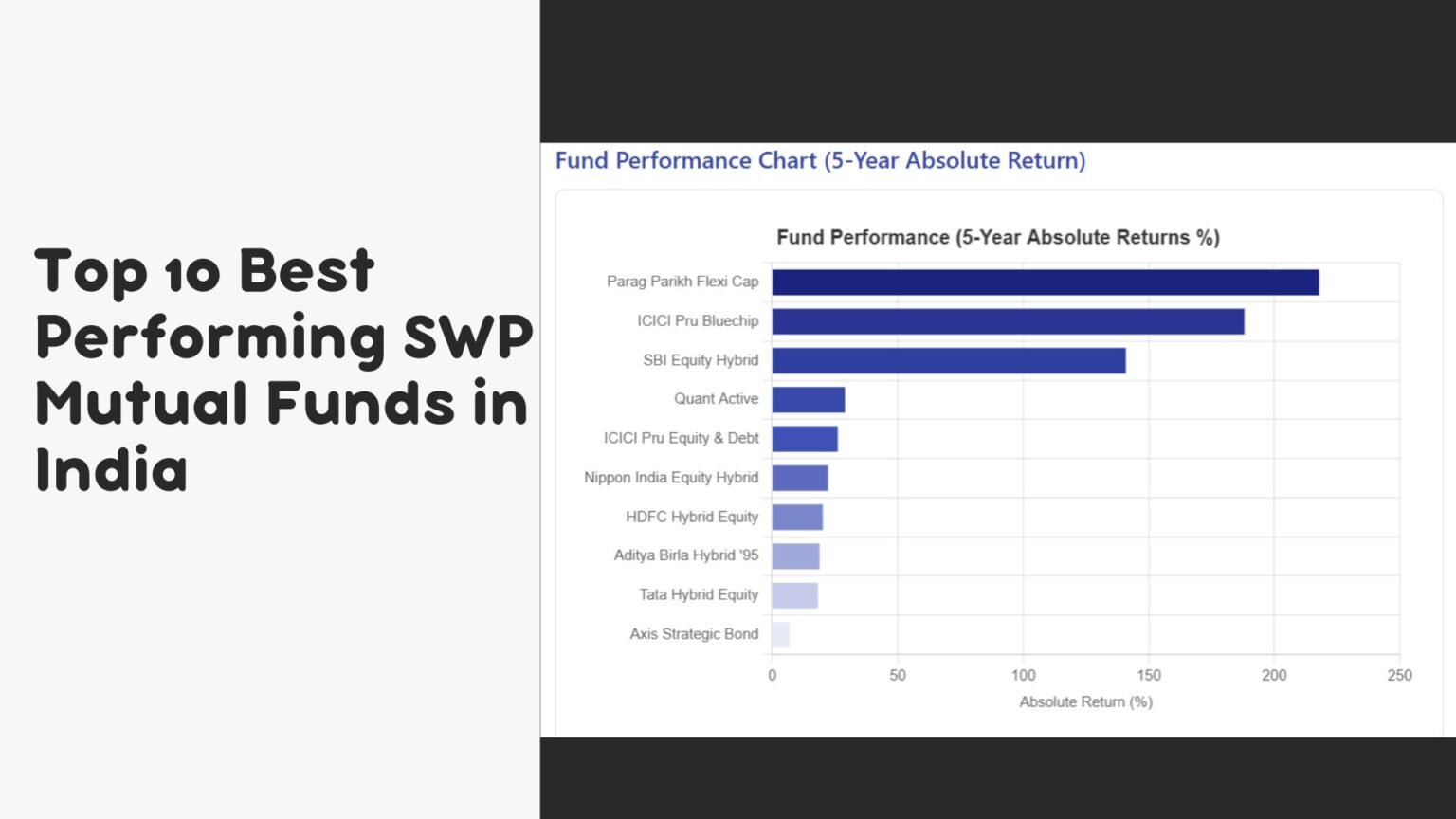

Fund Performance Chart (5-Year Absolute Return)

Fund Performance Data

| Fund Name (Category) | 5-Year Return |

|---|---|

| Parag Parikh Flexi Cap Fund (Equity) | 218.35% |

| ICICI Prudential Bluechip Fund (Large Cap) | 188.52% |

| SBI Equity Hybrid Fund (Hybrid) | 141.30% |

| HDFC Hybrid Equity Fund (Hybrid) | 20.60% |

| Tata Hybrid Equity Fund (Hybrid) | 18.64% |

| ICICI Prudential Equity & Debt Fund | 26.55% |

| Nippon India Equity Hybrid Fund (Hybrid) | 22.69% |

| Aditya Birla Equity Hybrid ’95 (Hybrid) | 19.31% |

| Axis Strategic Bond Fund (Debt) | 7.31% |

| Quant Active Fund (Multi Cap) | 29.43% |

Quick Fund Highlights

- Parag Parikh Flexi Cap Fund: Multi-cap global diversification. Very high upside (218%), but anticipate more volatile swings.

- ICICI Prudential Bluechip Fund: Large-cap tilt for stability. Gave nearly 189%, a strong core SWP option.

- SBI Equity Hybrid Fund: 65% equity and 35% debt balanced portfolio. Consistent 141% growth, capturing income and capital appreciation.

- HDFC & Tata Hybrid Equity Funds: 20.6% and 18.6% returns over time-tested balanced funds—best for moderate-risk SWPs.

- ICICI Prudential Equity & Debt Fund: Dynamic asset allocation fund; 26.6% return provides both growth and defensive stance.

- Multi-cap & Active Picks: Quant Active (29.4%) and Parag Parikh (218%) are suitable for those who are ready to accept higher equity risk.

- Axis Strategic Bond Fund: Five-year bond stability at 7.3%—ideal for ultra-conservative SWP plans.

Case Study: Retiree's Income Plan

Mrs. Sharma, 60 years, has ₹5 lakh to invest for regular income:

- Invest ₹4,000/month (≈9.6% SWP rate) in SBI Equity Hybrid SWP for balancing growth and income.

- Axis Strategic Bond SWP at ₹2,100 per month (≈5% SWP rate) for consistent debt returns.

- ICICI Bluechip SWP for ₹3,500/month (≈8.4% SWP rate) for a little extra upside.

This blend strategy generates an income of ₹9,600/month while keeping a significant portion invested—safeguarding long-term buying power.

How to Start Your SWP

- KYC & Account Opening: Ensure that you get e-KYC done through your AMC or broker.

- Select Your Fund: Select one or combine funds from the table above.

- SWP Instructions: State withdrawal amount, date every month, and minimum balance.

- Monitor & Adjust: Monitor corpus and NAV quarterly; rebalance sizes of SWPs when significant market movements take place.

Also Read: New Mutual Fund Offer in June 2025 – Top NFO Picks

Conclusion Remarks

The optimal SWP plan depends on your income requirements and risk tolerance. Growth-oriented, equity-based plans such as Parag Parikh Flexi Cap and ICICI Bluechip invest with faster growth (and income), hybrid funds provide balance, and debt funds such as Axis Strategic Bond provide security.

Diversification across fund categories ensures you receive a predictable, steady monthly income without fully liquidating your investments. Invest smart, and have your money working for you as you reap a constant flow of money.

FAQs

Q1: What is the best mutual fund for SWP?

There is no one "best" fund that works for everyone. Top picks consist of:

- Equity-heavy SWP: ICICI Prudential Bluechip or Parag Parikh Flexi Cap for increased income and growth.

- Hybrid SWP: HDFC Hybrid Equity or SBI Equity Hybrid for stable and balanced growth.

- Debt SWP: Axis Strategic Bond for stable returns and capital preservation.

Q2: What is the best SWP mutual fund?

The SBI Equity Hybrid Fund is highly recommended if you desire steady monthly dividends with a modest level of risk. It combines debt protection with market upside, yielding about 22–23% returns over five years and allowing withdrawals of ₹3,000–₹4,000 on a corpus of ₹5 lakh.

Q3: What is the ideal mutual fund kind for SWP?

- Higher withdrawal possibilities with equity funds (4–6% SWP rate).

- If you require a midway ground, consider hybrid funds (3–5% SWP rate).

- Debt funds with a 2–3% SWP rate offer the least volatility and capital protection.

Make a decision depending on your financial requirements and risk tolerance.

Q4: Which mutual fund is the best SWP plan name?

Typical SWP plans consist of:

- Parag Parikh's SWP Flexi Cap

- Bluechip ICICI Prudential SWP

- SBI Hybrid SWP Equity

- SWP for Axis Strategic Bond

Every plan accommodates varying risk profiles and allows monthly withdrawals.