When I first began studying tech-heavy indices, one of the most useful measurements that I started to monitor was the Nasdaq 100 PE ratio. It provides me with a snapshot of how pricey or cheap the index is compared to its earnings. But as time went on, I realized there’s more to this figure than we initially suppose.

Here, I’ll take you through it all–from the Nasdaq 100 PE ratio today to its history and how the forward PE ratio might represent market expectations. I’ve also looked at data dating back to the dot-com bubble, namely on the Nasdaq 100 PE ratio in 2000, to put things in a better long-term context.

What is the Nasdaq 100 PE Ratio?

The Nasdaq 100 PE ratio, or price-to-earnings ratio, is a valuation measure based on dividing the current price of the index by the aggregate earnings of the underlying companies. It is the price people will pay now for a dollar of future earnings.

As of April 21, 2025, the Nasdaq 100 PE ratio is 30.93. That’s right in the middle of fair based on history, but it’s headed higher towards the type of levels that tend to bring about corrections.

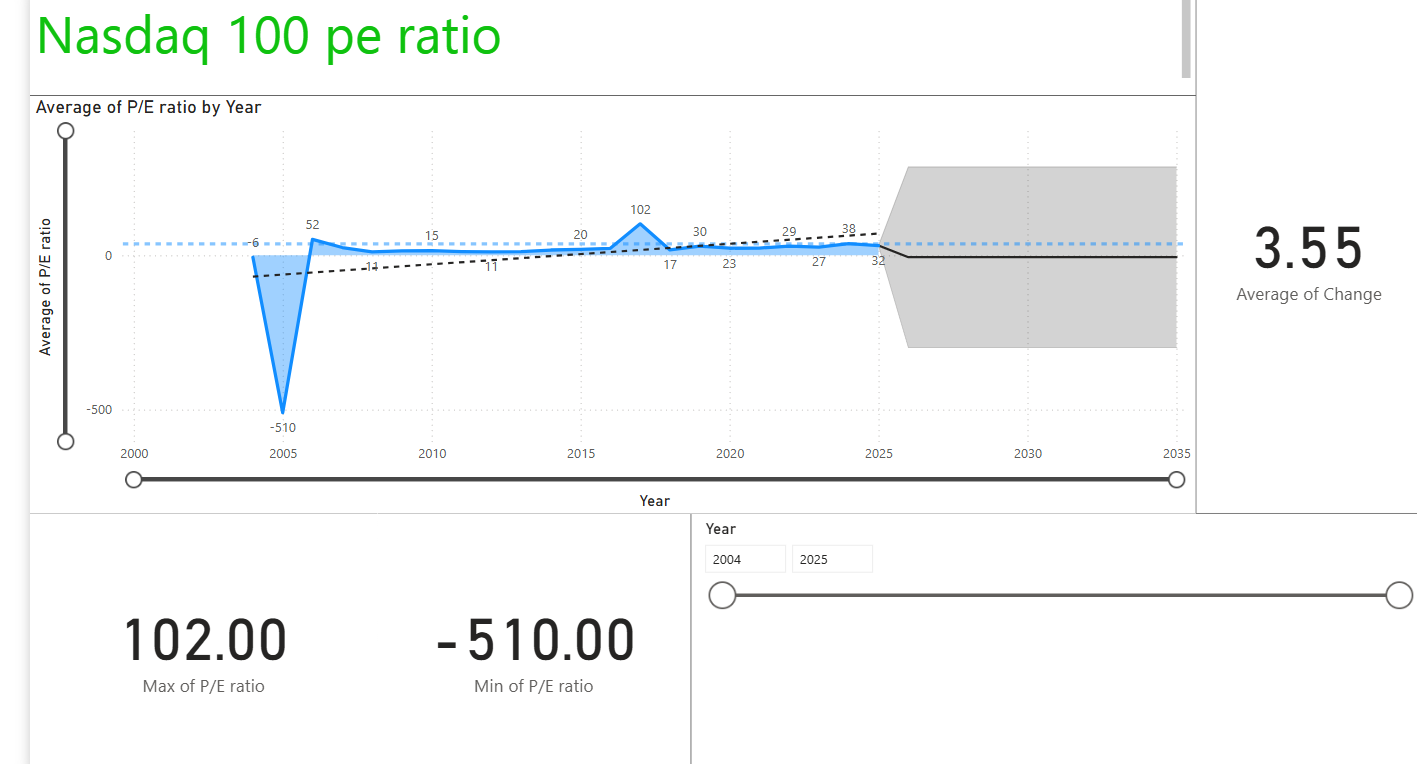

Nasdaq 100 PE Ratio History and Chart

| Year | P/E Ratio | Change |

|---|---|---|

| 2025 | 31.7 | -0.984 |

| 2024 | 37.64 | 0.3900 |

| 2023 | 26.9 | -0.0839 |

| 2022 | 29.4 | 0.2546 |

| 2021 | 23.4 | 0.0230 |

| 2020 | 22.9 | -0.2257 |

| 2019 | 29.6 | 0.6964 |

| 2018 | 17.4 | -0.8287 |

| 2017 | 102.0 | 3.4931 |

| 2016 | 22.6 | 0.1610 |

| 2015 | 19.5 | 0.1316 |

| 2014 | 17.2 | 0.4410 |

| 2013 | 12.0 | 0.0732 |

| 2012 | 11.1 | -0.0845 |

| 2011 | 12.2 | -0.1957 |

| 2010 | 15.1 | 0.0409 |

| 2009 | 14.5 | 0.3099 |

| 2008 | 11.1 | -0.5603 |

| 2007 | 25.2 | -0.5122 |

| 2006 | 51.7 | -1.1014 |

| 2005 | -510.0 | 77.8014 |

| 2004 | -6.47 | -1.2460 |

Following the history of Nasdaq 100 PE ratio is crucial when taking investment decisions. Glancing at 20 years of history, the following are the important milestones:

- 2000 (Dot-com bubble): PE ratios went over 60, which was historically unsustainable.

- 2008 (Financial crisis): The PE fell below 20, indicating panic-driven undervaluation.

- 2020 (Post-pandemic recovery): Historic stimulus pushed PE ratios over 35.

- 2023–2024: A rebalancing year as valuations swung back to the mean.

Historical context is, in my view, the optimal approach to interpretation of whether the current ratio is a red light or a green light.

- AI Monetization: Widespread usage of generative AI across cloud, enterprise, and consumer technology (e.g., Microsoft Copilot, NVIDIA Omniverse).

- Rate Cut Momentum: 3.75-4.00% fed funds rate (down from 5.25% in 2023), which reduces equity risk premiums.

- Earnings Resilience: Nasdaq 100 companies to report $950B of net earnings in 2026 (+20% YoY).

What's Priced In?

Promising Technology Breakthrough:

Artificial intelligence-powered top-line growths (e.g., 30% of SaaS companies currently generate >15% of their top-line revenue from AI-based products).

Semiconductor demand based on quantum computing and AI infrastructure.

Macroeconomic Stability

- 2.3% (CPI) inflation anchored, complementing consistent rate reductions.

- Global GDP growth of 3.1%, avoiding recessionary pressures.

It’s easy to compare the Nasdaq 100 PE ratio in 2000 with the tech valuations of today. But here’s the significant difference: back then, many enterprises had zero earnings. The majority of the Nasdaq 100 behemoths, including Apple, Microsoft, and Nvidia, are now profitable businesses.

In the year 2000, the PE of the index was in excess of 60, predominantly due to growth. Now that we are going close to 30+, it’s on the strength of strong fundamentals. It does not indicate that there is no risk—but it’s a different kind of risk.

Nasdaq 100 Valuation Metrics (2025)

| Ratio | Nasdaq 100 | Investment Bank Avg |

|---|---|---|

| Price/Sales | 5.66x | 2.37x |

| Price/Book | 3.74x | 2.16x |

| EV/EBITDA | 66.38x | 43.56x |

In my opinion, is the Nasdaq 100 PE Ratio excessively high?

Here’s what I think the bottom line is:

Although historically high, today’s PE ratio of 30.93 is not concerning.

The index is cheap in the near run compared to the previous year.

When compared to the 10- and 20-year norms, it is overpriced over the long run.

In order to assess whether present prices are warranted, forward earnings will be crucial.

This might be an excellent opportunity to dollar-cost average into high-quality tech stocks if you’re a long-term investor like me. However, if you are a trader, pay attention to macro signals during earnings season since they have the potential to quickly change mood.

Final Thoughts

I’ve become a more disciplined investor as a result of following the PE ratio and learning about its background, projections, and larger valuation backdrop. I hope that this breakdown will help you make better decisions, whether you’re reevaluating your portfolio or creating a new position.

Today, as additional quarterly earnings are released, I will continue to keep an eye on the Nasdaq 100 PE ratio. This one figure tells much more than most people realize, so pay attention.

Pingback: Top 8 Intraday Stocks Under ₹100 to Watch Today

Pingback: Top 10 Penny Stocks for Long-Term Growth in 2025

Pingback: Nifty Next 50 PE Ratio Secrets: Maximize Your 2025 Returns