Polymatech Financial Analysis

Key Metrics

Price Analysis

Introduction: The Importance of Polymatech Share Price

If you’re anything like me, you’re always tuned to the market all the time, trying to find the next big player before it goes off. I was led to review Polymatech share price—which is one of the more interesting stocks in the semiconductor sector right now.

From hitting record highs to price plunges that would make poor Kria (the double pointer boars feral pigs here on the coast) cry like a baby from being completely gutted at the sight before him! Polymatech share price has seen more action than a Netflix thriller series and there are no prizes for guessing that every swing has a story to tell and if you know what you’re looking for you can use those stories to help guide your next investment.

Section 1: Company Overview - Who is Polymatech and Why Should You Care?

History and Business Model

Polymatech Electronics Pvt. Ltd. started operating in 2007, but really exploded after the company was acquired in 2018 by Eswara Rao Nandam and Uma Nandam. The company is based in Tamil Nadu, and it is the first commercial semiconductor manufacturer in India and specializes in LED chip fabrication.

This company has taken off—revenues soared ₹45 Cr in FY21 to ₹1,220 Cr in FY24. That is not just growth, that is an acceleration.

Revenue Streams and Market Strategy

There core offering is Semiconductor chips, especially for 5G and 6G technologies, but are careful to not have all their eggs in one basket. With five verticals, including ingot fabrication to final packaging their diverse offerings keep them in good standing with their customer base.

And did I mention they are global?! They have manufacturing facilities in Singapore, US, France, and Bahrain which showcases a long-term plan for global domination.

Section 2: Review of the Recent Polymatech Share Price Trend Recent Behaviour

History and Business Model

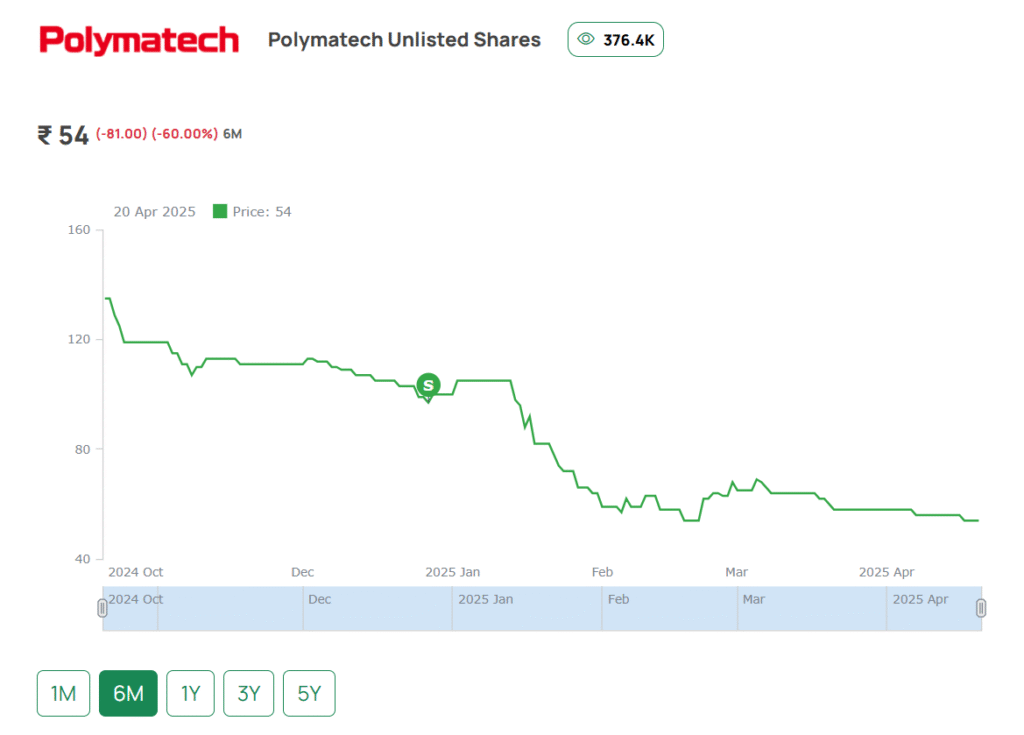

Over the past month, the Polymatech share price.

has fallen even further from its recent 52-week high of ₹195, to where it is at around ₹54 today. That is a 70% fall, which for some investors, is certainly unsettling. However, if you are someone who is looking for a value opportunity, this could be the best opportunity of the year.

Let’s not forget that despite this decline, Polymatech has reported a net profit of ₹240 Cr in FY24, a 64% increase over the prior year. So considering that the fundamentals are still sound.

Major Catalysts

- April: Launch of new 5G/6G product line.

- June: Quarter 1 results greatly exceeded expectations.

- December: Signed MoU for New 1,143 Cr facility in Chhattisgarh.

- FY25: $300 Million budgeted for global acquisitions.

Despite the volatility, many retail investors are continuing to hold. This is simply because they understand that the Polymatech share price is more relative to today, and in some ways, less relevant to where it is going.

Polymatech Electronics

Semiconductor Solutions Provider

Financial Highlights (FY23)

Investment Parameters

* Unlisted share prices are indicative and subject to market conditions

Section 3: What Moves the Polymatech Share Price?

Internal Drivers

Over the past month, the Polymatech share price.

has fallen even further from its recent 52-week high of ₹195, to where it is at around ₹54 today. That is a 70% fall, which for some investors, is certainly unsettling. However, if you are someone who is looking for a value opportunity, this could be the best opportunity of the year.

Let’s not forget that despite this decline, Polymatech has reported a net profit of ₹240 Cr in FY24, a 64% increase over the prior year. So considering that the fundamentals are still sound.

Major Catalysts

- April: Launch of new 5G/6G product line.

- June: Quarter 1 results greatly exceeded expectations.

- December: Signed MoU for New 1,143 Cr facility in Chhattisgarh.

- FY25: $300 Million budgeted for global acquisitions.

Despite the volatility, many retail investors are continuing to hold. This is simply because they understand that the Polymatech share price is more relative to today, and in some ways, less relevant to where it is going.

Section 4: Analysts' Expectations for the Future of the Polymatech Share Price

What Analysts Expect

Given that the IPO is finally imminent and that plans for international development are in motion, many analysts predict that the price of Polymatech’s shares will return to between ₹100 and ₹150 by the end of 2025.

By FY26, target revenue is ₹20,000 Cr.

If growth continues, the long-term price prediction is ₹300+ by FY28.

Roadmap for the Company

- international R&D centers in the US, France, and Japan.

- strategic purchases to enhance the production and packaging of chips.

- market entry in the Middle East and Europe.

- Keep an eye out for earnings reports and IPO announcements if you’re holding or considering entering. In the future, those will be the major triggers.

In summary, is it better to buy, hold, or pass?

What Analysts Expect

Look, I’m not here to give you financial advice. Here’s what I’m doing, though: I’m keeping a close eye on Polymatech’s stock price. The foundations are strong. The leadership has a lot of experience. And the plan? Ambitious in every manner.

Yes, there is sound. Rumor has it. However, there is also a compelling vision. And this stock might be one of the major tales of India’s semiconductor boom if Polymatech follows even 70% of its strategy.

Expert Advice for You:

- Keep tabs on their quarterly profits.

- Await confirmation of the IPO (perhaps in FY26).

- Consider more than just short-term volatility.

- Always diversify. Don’t ignore this one, though.