Introduction: Why Focus on Intraday Stocks Under ₹100?

Let’s get real — searching for the best intraday stocks to buy under ₹100 is like looking for hidden gems in the market. These low-cost, high-potential stocks offer great possibilities for traders who like fast action and fast turnaround. At Tech Venture Spot, we like digging up the best stock ideas — especially when they pack oomph without breaking the bank.

Although the majority of traders ignore stocks within this range, they move very fast and yield enormous short-term gains. However, remember, the same volatility that makes them exciting can be hazardous. Therefore, tread carefully, do your own homework, and always have a good plan to exit.

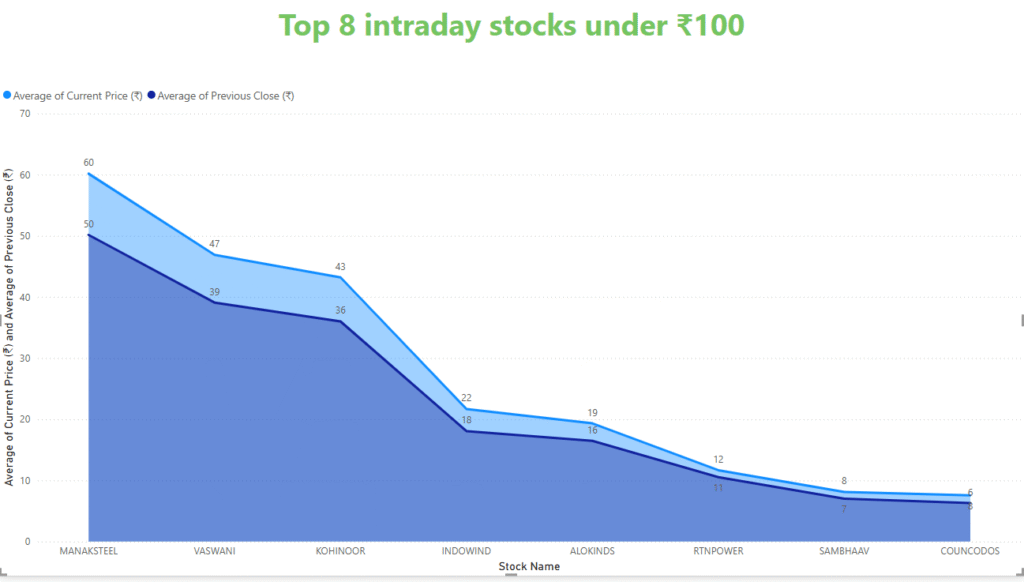

Best Intraday Stocks Under ₹100

Here are today's top potential movers in budget-friendly range (always do your own analysis):

1. MANAKSTEEL

2. COUNCODOS

3. KOHINOOR

4. INDOWIND

5. VASWANI

6. ALOKINDS

7. SAMBHAAV

8. RTNPOWER

Best Intraday Stocks Under ₹100 — Categorized by Term

Long-term Decisions Down the Road (Maintaining momentum or creating cornerstones)

Long-term Decisions Down the Road (Maintaining momentum or creating cornerstones)

These are stocks you can hold for weeks to months or longer, depending on consistent performance, improving fundamentals, or sector trends.

1. MANAKSTEEL (₹60.18)

- Why Long-Term? Steady upward movement, reasonable P/E ratio (41.23), and a part of the steel group — which enjoys healthy infrastructure tailwinds.

2. VASWANI (₹46.90)

- Why Long-Term? Reasonable P/E ratio (14.53), sound technical setup, and less volatile than others in the list.

3. INDOWIND (₹21.68)

- Why Long-Term? Renewable energy plays with increasing interest. P/E of 41.41 suggests some confidence in earnings.

4. RTNPOWER (₹11.68)

- Why Long-term? Power sector is important, and huge size (456L+) reflects institutional interest. P/E is low (0.58), suggesting undervaluation if fundamentals are improving.

Most suitable for Short-Term or Intraday Trading (Very high risk, quick profit)

These are volatility stocks, ideal for intraday or short-term swing trading. Not ideal for long-term holding because of erratic fundamentals or negative P/E.

1. COUNCODOS (₹7.56)

- Why Short-Term? Penny stock with an astronomical P/E (99.16). Primarily speculative trades.

2. KOHINOOR (₹43.21)

- Why Short-Term? Negative P/E (-12.37) means it’s still in the red. Strong momentum today but risky long-term.

3. ALOKINDS (₹19.34)

- Why Short-Term? Negative P/E (-8.36), massive volume spike — more trader favorite than investor stock.

4. SAMBHAAV (₹8.12)

- Why Short-Term? Low cost, high volatility. P/E of 59.28 is stretched. Good for momentum trades, not long-term portfolios.

Final Recommendations by Tech Venture Spot

- Short-Term Picks = Quick Profits + High Risk

- Long-Term Decisions = Gradual Growth + Less Volatility

If you’re creating a portfolio, focus on MANAKSTEEL, VASWANI, and RTNPOWER. If you want action right away, COUNCODOS, ALOKINDS, and KOHINOOR can give you the fire — just remember your stop-loss! Want help designing a tracker or daily watchlist template for these stocks? I can help with that too.

Pingback: Top 10 Penny Stocks for Long-Term Growth in 2025

Pingback: April 2025: Forthcoming Mutual Fund Dividends Revealed!