Bajaj Housing Finance P/E Ratio: Complete Valuation Guide

What is the current Bajaj Housing Finance P/E ratio?

Why does the P/E ratio matter?

What was BHFL’s P/E right after IPO?

How does it compare to peers?

What does a high P/E mean for investors?

It may indicate that Bajaj Housing Finance has strong growth expectations, but it also carries a larger risk if those expectations aren’t fulfilled.

Bajaj Housing Finance Limited (BHFL)

📈 Performance Metrics

📊 Key Statistics

| Metric | Value | Details |

|---|---|---|

| Current Price | ₹125.00 | 25 April 2025 Closing |

| Post-IPO Peak | ₹188.50 | PE Ratio 72× |

| IPO Price | ₹66-70 | Initial PE ~27× |

| Previous Close | ₹132.30 | -5.5% Daily Change |

| Market Cap | ₹1.04T | NSE/BSE Listed |

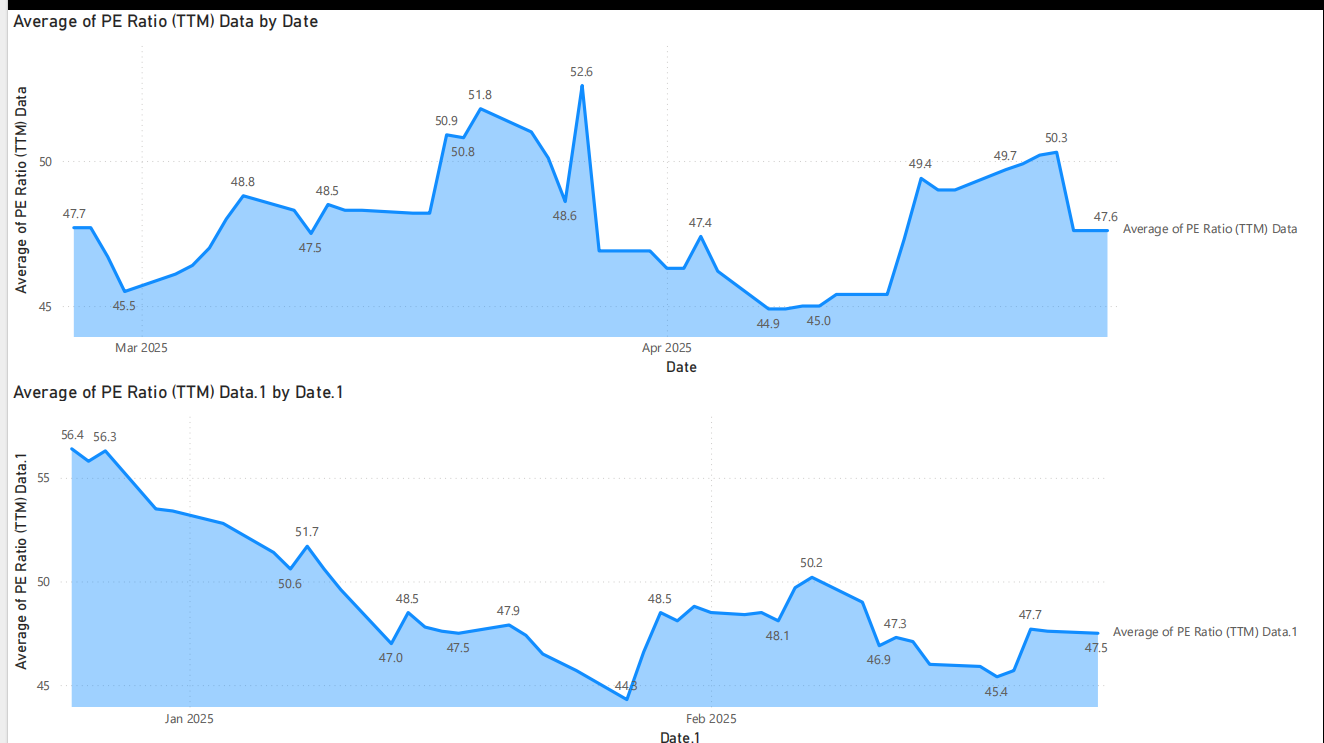

Bajaj Housing Finance PE Ratio

The P/E ratio shows the result of dividing stock price by earnings per share values. Price at ₹125 divided by EPS finding of ₹2.6 results in an estimated 48 ratio. In the market investors allocate Rs. 48 for each rupee BHFL distributes in yearly earnings.

- Formula: P/E = Share Price ÷ EPS.

- BHFL example: ₹125/₹2.6 ≈ 48.

- The market believes in increased growth prospects when businesses have high P/E ratios. The P/E ratio of Bajaj Housing Finance (~48) stands at a high level because analysts anticipate robust earnings growth for the company.

- A ratio of 10 signifies low or slow-growth prices whereas ratios reaching 50 indicate high or rapid-growth expenses. The price-to-earnings ratio at BHFL stands among the higher ranges for housing finance companies.

- Despite delivering excellent growth the market has significantly anticipated future growth because of the stock’s nearly 50 P/E ratio. I evaluate if future profits will provide sufficient value for the high premium price.

- The analysis of Bajaj housing finance pe ratio leads me to important investment questions about whether BHFL’s growth justifies such market valuation because of its Bajaj brand reputation.

After BHFL listed on Sep 16, 2024, the bajaj housing finance pe ratio after listing reached an astounding level due to an extreme rise in share price.

Experts declared IPO listing prices to reach ₹149 while earnings per share hovered around ₹2.6 thus creating a P/E ratio of about 57.

During the September 16, 2024, listing the stock price reached a level of ~₹149 representing 110% increase from its IPO value.

Implied P/E: ~57× (₹149/₹2.6 EPS).

- The post-listing PE ratio exceeded what industry standards typically indicated. After its listing the ratio between Baltic’s share price and its fundamental value was considered excessively high according to experts.

- Insightfully I approached this situation with caution. The market’s behavior toward the financial institution made me wonder whether it showed too much financial greed. The valuation of 60 times P/E demonstrated that investors had formed incredibly high prognostications from the first day.

Bajaj Housing Finance Industry PE Ratio

| Company | P/E Ratio | Premium/Discount |

|---|---|---|

| Bajaj Housing Finance (BHFL) | 48 | +87.5% |

| Industry Average | 25.6 | - |

| LIC Housing Finance | 10 | -60.9% |

| PNB Housing | 14 | -45.3% |

📈 Growth Expectation

87.5% Premium

Investors expect BHFL to grow significantly faster than industry peers

⚠️ Risk Consideration

Less Margin for Error

Any growth slowdown could lead to multiple compression

Comparison of Bajaj Housing Finance's P/E Ratio With Top 10 Housing Finance Peers

| Company | P/E Ratio | vs Sector Avg |

|---|---|---|

| Bajaj Housing Finance | 48.09 | +133% |

| Aavas Financiers | 33.50 | +63% |

| HDFC Ltd. | 31.12 | +51% |

| Home First Finance | 24.90 | +21% |

| Aptus Value Housing | 23.09 | +12% |

| Can Fin Homes | 11.23 | -46% |

| PNB Housing | 13.84 | -33% |

| Indiabulls Housing | 6.98 | -66% |

| LIC Housing | 6.32 | -69% |

| Repco Home | 5.41 | -74% |

Bajaj Housing Finance IPO PE Ratio

| P/E Calculation (Upper Range) | 70 ÷ 2.6 = 26.92 |

| P/E Calculation (Lower Range) | 66 ÷ 2.5 = 26.4 |

| Average Implied P/E | ≈27 |

📈 Valuation Context

• 31% premium to sector average P/E

• Among highest valuations for housing finance IPOs

• Reflects strong investor confidence in Bajaj brand

• Priced for future growth expectations

Bajaj Housing Finance Current PE Ratio

As of right now, we’ve already discussed the current P/E ratio for Bajaj Housing Finance, which is approximately 48. If you search for “Bajaj Housing Finance Current PE Ratio” or just “Bajaj Housing Finance PE Ratio,” you’ll find that the trailing P/E is approximately 48.

- Trailing P/E: ~48 (based on ₹125 price and trailing EPS ~₹2.6).

- Forward P/E: Analysts might project a lower forward P/E if earnings grow. I watch forward estimates (some platforms see EPS rising toward ₹17–18 next year, which would lower P/E).

- Context: BHFL recently went public, so it’s still valued as a high-growth stock; if growth slows, P/E would probably decline.

- Investors note: The high level of the Bajaj Housing Finance PE ratio makes me cautious whenever I look at it.

BHFL Valuation: Final Analysis

✅ Bull Case

- Strong brand parentage

- Growth-focused management

- Sector tailwinds in housing

⚠️ Bear Case

- Premium valuation

- Interest rate sensitivity

- Competitive sector

1 thought on “Bajaj Housing Finance P/E Ratio: Complete Valuation Guide”

Pingback: Chipotle PE Ratio Deep Dive: Unlock CMG Stock Insights