Hi there! Today, I want to delve deeply into the realm of value and concentrate on one metric—the chipotle pe ratio—that you have undoubtedly seen mentioned on investor forums and financial news programs. Why is it important? How can it help you make better choices? What can we learn about Chipotle Mexican Grill’s stock from its current PE ratio? I’ll cover everything in this Tech Venture Spot piece, from definitions to a comparison of case studies, so you can decide with confidence if the chipotle pe ratio makes CMG a good purchase or a sell. Ready? Let’s begin!

Chipotle's P/E Ratio

High P/E

Growth expectations

Higher volatility risk

Low P/E

Undervaluation potential

Stagnation concerns

| Company | P/E Ratio | Market Perception |

|---|---|---|

| Chipotle | 44.7 | High growth expectations |

| Dunkin' | 24.1 | Moderate growth |

| Starbucks | 28.7 | Established player |

Compare with industry peers for relative valuation

High P/E suggests growth expectations

Low P/E may indicate undervaluation or stagnation

Chipotle's Stock Performance & PE History

Rebound & Expansion

• 450+ new locations

• Digital sales infrastructure buildout

• 12% CAGR revenue growth

Pandemic Adaptation

• Digital sales grew 176%

• Drive-thru "Chipotlanes" expansion

• 7% comparable sales growth

Mature Growth Phase

• 5-7% annual comps

• Loyalty program (35M+ members)

• International expansion

25

>50

110

43

| Period | PE Range | Market Context |

|---|---|---|

| 2010 (Pre-Crisis) | 22-28 | Traditional valuation |

| 2015-2019 | 45-65 | Digital transformation premium |

| 2020 Peak | 110 | Pandemic digital surge |

| Current (2024) | 40-60 | Mature growth pricing |

Maintained elevated PE (40-60) despite market volatility

Digital sales now 37% of total revenue (vs 12% in 2018)

Current PE of 43 positions between growth and value metrics

Factors Shaping Chipotle's PE Ratio

| Factor Details | Visual |

|---|---|

|

Growth and Performance of Earnings

Digital sales and new locations are the main drivers of Chipotle's revenue growth. Growth in same-store sales usually raises profits projections every quarter, which raises the chipotle pe ratio. |

📈 |

|

Market Sentiment and Investor Expectations

Even if there is only a slight short-term increase in EPS, colleagues and I frequently point out that the excitement surrounding menu innovations, such as Lifestyle Bowls, can send the multiple skyrocketing. |

✨ |

|

Financial Situation

Growth stocks like CMG frequently experience PE shrinkage in rising-rate environments because future earnings are more heavily discounted. |

📉 |

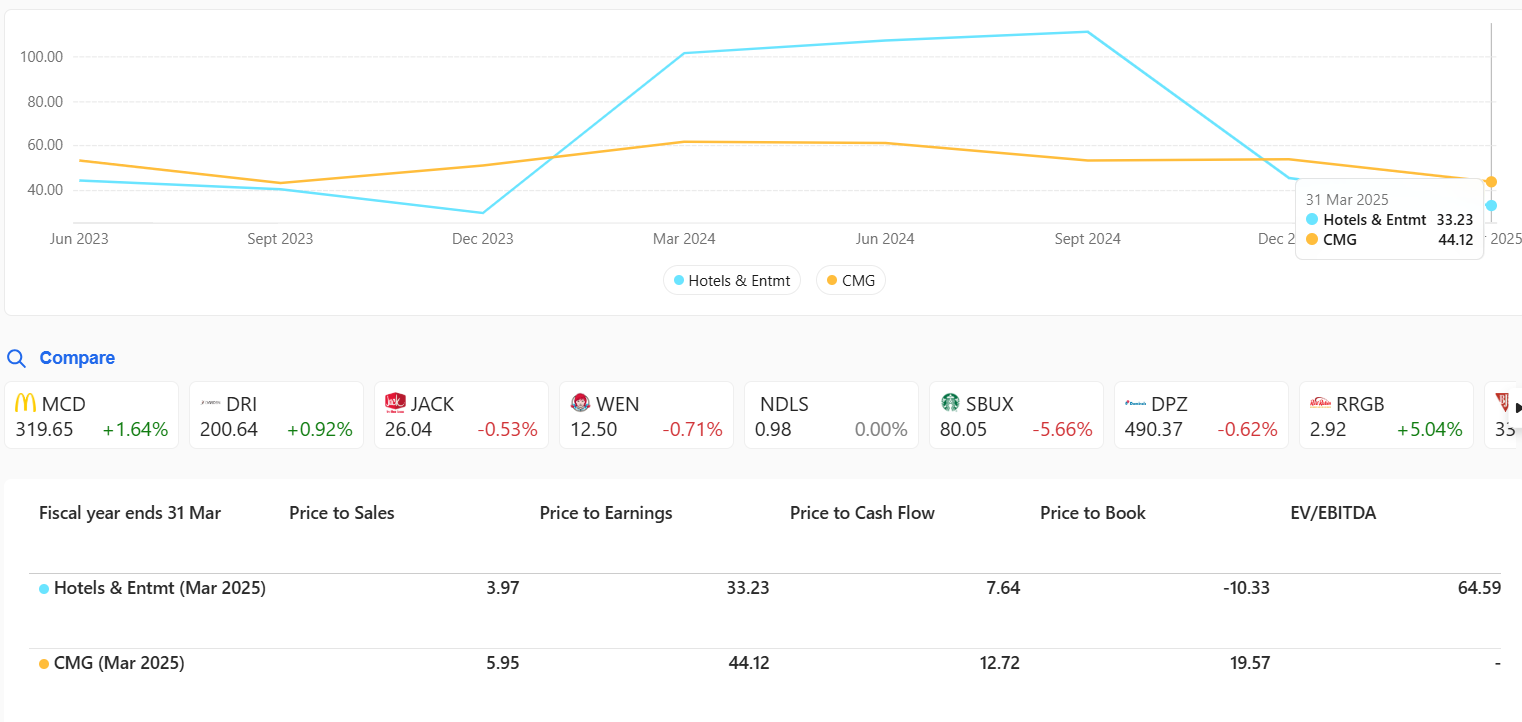

Restaurant Industry PE Comparison

| Company | Ticker | PE Ratio | Valuation |

|---|---|---|---|

| Chipotle Mexican Grill | CMG | 43.00 | Growth Premium |

| Starbucks | SBUX | 28.00 | Mature Valuation |

| Domino's Pizza | DPZ | 35.00 | Tech Premium |

| Yum! Brands | YUM | 22.00 | Value Range |

| McDonald's | MCD | 28.06 | Stable Giant |

| Restaurant Brands International | QSR | 20.25 | Franchise Model |

| The Wendy's Co | WEN | 13.16 | Deep Value |

| Papa John's International | PZZA | 13.54 | Turnaround |

| Shake Shack | SHAK | 381.48 | Speculative Growth |

Chipotle trades at 53% premium to quick-service restaurant average PE of 28

Shake Shack's extreme PE reflects transition to profitability phase

QSR companies with digital capabilities command higher multiples

Analyzing Chipotle’s Valuation

The valuation of Chipotle through its 43 PE ratio seems both excessive and affordable simultaneously. Let’s break it down:

⚖️Assessing Overvaluation vs. Undervaluation

🌧️Impact of Economic Conditions on the PE Ratio

In a recession, discretionary spending dips and multiples compress. Chipotle's robust financial position enables the company to sustain through economic downturns in a better way than what casual-dining peers experience. 🛡️

🔭Future Outlook for Chipotle’s PE Ratio

The chipotle pe ratio will be driven by two main factors in the future period.

📊Predictions for Earnings Growth

The prediction from analysts indicates Chipotle earnings will expand by 10–12% over the following 2–3 years. A solid performance reaching this target will validate the current multiple rate.

⚙️Potential Market Changes Affecting the PE Ratio

Conclusion

My conclusion after analyzing the chipotle pe ratio is as follows:

Important Points:

- The price paid per dollar of earnings is measured by the PE ratio.

- High growth aspirations are reflected in Chipotle's current chipotle pe ratio of approximately 43.

- Multiples in the past have varied greatly, ranging from the mid-20s to more than 100.

- Competitive actions and economic cycles will affect its future multiple.

Final Thoughts on Investment Potential:

The current Chipotle PE ratio makes sense if you think the company will maintain double-digit growth through menu excellence and digital innovation. However, CMG may experience multiple constriction if broader economic challenges reduce discretionary expenditure; hence, adjust your risk appropriately.

I hope this in-depth analysis clarifies the significance of the chipotle pe ratio and explains how to utilize it to evaluate CMG's valuation.

Pingback: Top 10 Highest PE Ratio Stocks S&P 500: Must Watch

Pingback: Adani PE Ratio 2025 Chart, History & Forecast