Introduction

As a key company in India’s energy infrastructure sector Adani Energy Solutions Limited has added renewable energy and sustainability focus to its growing portfolio. Our research uses both financial analysis and technical market aspects to predict Adani Energy Solutions share price target 2025.

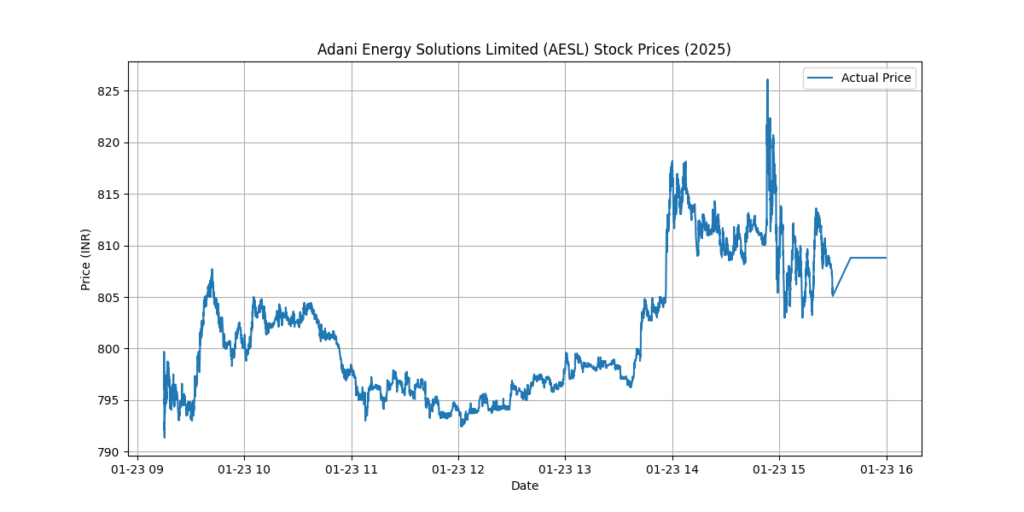

Technical Analysis of Adani Energy Solutions Share Price

1.Historical Price Patterns

During its most recent year Adani Energy Solutions stock varied between ₹1,348 at its peak and ₹588 at its lowest point.

Over time the security declined because market conditions and sector difficulties influenced company performance.

2.Key Technical Indicators

Simple Moving Averages (SMA):

- 50-day SMA: ₹795.26

- 100-day SMA: ₹897.40

- 200-day SMA: ₹971.64

- Resistance Levels: ₹827, ₹845, ₹862

- Support Levels: ₹774, ₹792, ₹756

- Volume Trends: Traders are buying more shares as recent transaction numbers demonstrate this interest.

3.Short- and Long-Term Trends

- Short-term trend: Buyers have entered the market because trading volume kept rising after recent gains.

- Long-term trend: Investors should approach with optimistic caution due to the bearish market outlook.

- Our view combines both market performance examination with specific business drivers.

Fundamental Analysis and Market Factors

1.Business Growth and Revenue Drivers

- Renewable Energy Projects: Through the Bhadla-Fatehpur HVDC project worth ₹25000 crore Adani Energy Solutions is creating new opportunities by moving 6 GW of renewable power to the grid.

- Government Policies: By investing in transmission infrastructure Adani Energy Solutions will benefit from India’s goal to reach 900 GW power generation capacity by FY34.

- Smart Metering and Distribution: Our venture into city power networks plus smart meter technology helps us earn more money.

2.Regulatory and Policy Impacts

- Environmental Regulations: Stronger environmental rules will create higher operating expenses now but support better future sustainability results.

- Tariff-Based Competitive Bidding (TBCB): Adani Energy Solutions netted major projects because government strategies boosted its market power.

3.Debt and Financial Health

- Debt-to-Equity Ratio: 0.02, indicating manageable leverage

Profit Margins: Despite industry pressures the company kept its net profit margin at 6.85% during FY24.

Price Target Predictions: Scenarios for 2025

1.Bull Case:

- A successful infrastructure field combined with beneficial policies plus good project progress.

- Target Price: ₹1,400

2.Base Case:

- The market shows steady growth patterns alongside reliable project completion patterns.

- Target Price: ₹1,200

3.Bear Case:

- Slow government approvals together with increased market competition and escalated expenses form challenges in this industry.

- Target Price: ₹1,000

Key Risks and Challenges

1.Regulatory Risks:

Project development faces problems because of slow approval times and environmental legislation changes.

2.Debt Management:

When interest rates go up it becomes more expensive to get loans.

3.Market Competition:

The business faces competition from both national and international market sellers.

4.Execution Risks:

Large infrastructure projects face problems when they must complete on schedule.

Industry and Competitor Analysis

Peer Comparison

- Adani Green Energy: Although Adani Green dominates renewable energy Adani Energy Solutions offers multiple market opportunities for stable development.

- Tata Power: Tata Power competes favorably in both its conventional and renewable businesses yet Adani Energy Solutions moves ahead with stronger infrastructure growth plans.

- NHPC and JSW Energy: Adani Energy Solutions has better project plans and less debt than its competitors which puts it ahead in the market.

Global Market Trends

- Renewable Energy Demand: The world’s transition to clean energy creates new demand for transmission projects that need high capacity.

- Copper Prices: Low copper price stability increases business spending needs while calling for better expense control.

- Forex Volatility: Changes in foreign exchange market value impact raw material import spending for businesses and shrink their profits.

Investment Strategy

Portfolio Allocation:

Distribute 10-15% of your investments across Adani Energy Solutions to support both safety and profitability.

Entry and Exit Points:

- Recommended Entry: ₹790 – ₹810.

- Target Exit: Budget between Rs.1200 and Rs.1400 based on several possible market scenarios.

Long-Term Horizon:

- Our 3-5 year investment period matches both the project development schedule and market expansion of Adani Energy Solutions.

Conclusion

The company stands ready to take full advantage of India’s plans to build renewable energy and develop new infrastructure. Despite market risks the company’s solid performance track record and industry outlook creates an excellent investment opportunity for long-term gains. Adani Energy Solutions targets 2025 share price rises because its sustainable operations and leadership position can generate strong market performance.

Pingback: Cyient DLM Share Price: Analysis and Trading Insights