| Field | Information |

|---|---|

| Company Name | Denta Water and Infra Solutions Limited (Mainboard) |

| IPO Dates | Open: 22 January 2025 - Close: 24 January 2025 |

| Price Range | ₹279 - ₹294 |

| Lot Size | 50 Shares |

| Premium (Last Updated) | 21 January 2025, 01:49 PM |

| Estimated Profit (Retail) | ₹8,250.00 |

| Estimated Profit (HNI) | ₹1,15,500.00 |

| Allotment Date | 27 January 2025 |

| Listing Date | 29 January 2025 |

| Field | Information |

|---|---|

| Total Issue Size | 7,500,000 Equity Shares aggregating up to ₹220.50 Crore |

| Fresh Issue Size | 7,500,000 Equity Shares aggregating up to ₹220.50 Crore |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE, BSE |

| Pre-Issue Shareholding | 19,200,000 Shares |

| Post-Issue Shareholding | 26,700,000 Shares |

| Field | Information |

|---|---|

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Net Offer |

Subscription Details (No. of Shares)

| Category | Offered | Applied | Times |

|---|---|---|---|

| QIBs | 1,500,000 | 2,321,050 | 1.55 |

| HNIs | 1,125,000 | 10,202,100 | 9.07 |

| HNIs 10+ | 750,000 | 5,721,750 | 7.63 |

| HNIs 2+ | 375,000 | 4,480,350 | 11.95 |

| Retail | 2,625,000 | 17,072,900 | 6.5 |

| Total | 5,250,000 | 29,596,050 | 5.64 |

Application-Wise Breakup (Approx. No. of Apps)

| Category | Reserved | Applied | Times |

|---|---|---|---|

| HNIs (10L+) | 1,071 | 1,570 | 1.47 |

| HNIs (2-10L) | 536 | 5,800 | 10.82 |

| Retail | 52,500 | 252,616 | 4.81 |

Subscription Demand (in ₹ Crore)

| Category | Offered | Applied | Times |

|---|---|---|---|

| QIBs | 44.1 | 68.24 | 1.55 |

| FIIs | - | - | - |

| DIIs | - | - | - |

| Mutual Funds | - | - | - |

| Others | - | 68.24 | - |

| HNIs | 33.08 | 299.94 | 9.07 |

| HNIs 10+ | 22.05 | 168.22 | 7.63 |

| HNIs 2+ | 11.03 | 131.72 | 11.95 |

| Retail | 77.18 | 501.94 | 6.5 |

| Total | 154.35 | 870.12 | 5.64 |

9:00 AM: A Promising Start

A lot of eager investors visited Denta Water and Infra’s IPO the first day it was open for applications. The shares for sale run from ₹279 to ₹294 in this IPO, and the company wants to raise ₹220.50 million through it. Investors can choose to buy or sell 50 shares when making offers. The morning’s data points to lots of interest in the IPO, with investors currently offering ₹165 minimum per share. This implies investors could gain around 56% on the first day the IPO trades publicly.

9:15 AM: Subscriptions Rolling In

During the IPO’s first 15 minutes of subscription, 52% of shares were purchased. Most retail buyers filled up 68% of their allowed quotas in a short amount of time. The extra money investors are willing to pay for Denta Water shares in the grey market, at ₹165, tells us investors are very optimistic about its performance.

9:30 AM: Market Snapshot

As investors watched the Nifty gain 45 points and Sensex climb 120 during this morning, most attention stayed focused on the upcoming Denta Water and Infra IPO. Good government policies concerning infrastructure and water management make this offering more attractive to investors.

9:45 AM: Retail Investors Lead the Charge

Most retail investors are driving demand for this IPO, which has grown to 3.18 times its original ask. Other large investors bought 3.54 times the offered shares. Even though some big investment firms have shown interest, other banks and financial outfits have yet to engage.

10:00 AM: Strong Grey Market Sentiment

Right now, people who follow the IPO’s price movement say Denta Water investors are paying the same amount for their orders as yesterday, which is usually around ₹165. According to experts, day traders will ramp up their investments during the course of the day.

10:15 AM: Key Analyst Insights

Investors look at the fact that Denta Water uses few resources but makes high profits with EBITDA of 33%-43% as factors giving them an advantage over other companies. Denta Water has orders worth 784.2 crores (rupees), and has built its business around water management, giving them good chances to grow.

10:30 AM: Peer Comparison

Compared to recent IPOs in the infrastructure sector:

When its IPO A launched, the company’s stock prices grew by 45%.

Half the shares in IPO B were already subscribed on Day 1 of the offering.

All investors bidding for IPO C were 60% more than what the auction called for.

Denta Water and Infra is setting itself apart with new groundwater recharge projects, which are driving its IPO to reach higher benchmarks.

10:45 AM: Increased Participation Across Categories

Subscription figures reveal:

- Retail: 3.18x

- NII: 3.54x

- QIB: 0x

Shareholders are highly interested when looking at the total subscription ratio of 2.35x.

11:00 AM: Strategic Strengths Boost Demand

People want to invest in Denta Water because they know the company focuses on water infrastructure and participates in the Jal Jeevan Mission. The unofficial market shows Denta Water IPO Gaming Margin Premium is growing right now, signaling that prices could rise even more.

11:15 AM: Market Trends Supportive

The general stock market rise creates better conditions for successful IPOs to launch. Since the Nifty index grew by 60 points, it helped create a favorable startup environment for projects focused on building infrastructure like the Denta Water IPO.

11:30 AM: Record Retail Oversubscription

Investors pouring in more money than predicted have bought 354% of the available stock. Institutional investors who had been slow to sign up are now showing interest as well, showing that many types of buyers want this IPO.

11:45 AM: Expert Endorsements

Leading brokerage analysts from SBI Securities and Ventura Capital advise buying the IPO because their analysis shows market-leading position and good value for money.

12:00 PM: Subscription Update

The number of investors applying for stocks increased by 2.78 times. Both small retail and large non-institutional buyers tripled their previous interest in buying. Today’s Good Morning Peace (GMP) indicator for Denta Water’s IPO shows ₹165, and it points to growing interest from investors.

12:15 PM: Comparing Financial Metrics

Denta Water’s bottom line performance stands much higher than competitors, with an EBITDA margin of 33% and a return on equity (ROE) at 36.3%. The reliable financial data shows Denta Water can develop steadily and strongly in infrastructure business.

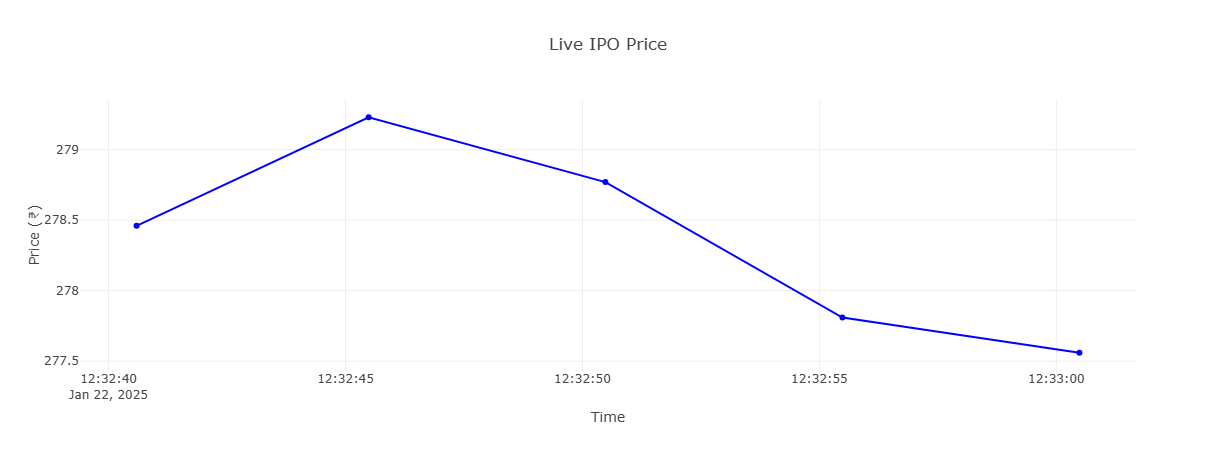

12:30 PM: Momentum Builds in Institutional Categories

Investors wanting to buy seasoned shares have put five times more cash into the NII status than there are shares available. A few big investors appear to be getting involved. Buyers from retail stores still show strong interest, making the incoming IPO even stronger.

12:45 PM: A Look at Future Prospects

As the company plans to enter more markets and invest more in recycling water projects, it shows it will stay ahead in this water management field. Expert analysts believe the company will have many chances for growing in the growing market for water solutions.

1:00 PM: Grey Market Premium Update

Investors right now are showing strong interest in the IPO, as shown by today’s GMP staying at ₹165. Right now, investors are willing to pay a 56% higher price compared to the IPO’s upper limit, which sets the IPO’s potential listing price at ₹459.

1:15 PM: Subscription Peaks

The IPO attracts extra attention because total applications increased threefold. People from all investment types are rushing to get holdings in this interesting new offering.

1:30 PM: Closing Day Expectations

People in retail and NII categories are talking about how much more money they could spend on this IPO before it closes its registration.

1:45 PM: Analyst Commentary

An analyst who’s well-respected points out that Denta Water’s growth prospects look very good, thanks to its growing customer order book and bright market possibilities.

2:00 PM: Retail Demand Soars

Individual investors are asking for four times more shares than the IPO allows, proving how much they want to buy. The company’s good name and focused advertising strategies are helping them get more buyers.

2:15 PM: Institutional Investors Ramp Up

Investors from major financial institutions join the offering, showing they want to be part of Denta Water’s success story. Denta Water received more orders and showed investors they’ll continue growing in the future.

2:30 PM: Sustained Grey Market Premium

People buying shares before listing continue to pay the same price today, showing they trust the worth of this company’s public trading.

2:45 PM: Midday Analysis: Denta Water's Business Approach Shines in Significance

Because Denta Water has strengths in both groundwater recharge and selling infrastructure while running a lean business, it stands out amongst its industry peers.

3:00 PM: Final Hour Surge

Right before the end of the first day, IPO backers increased their bids by 4.5 times overall, thanks to late requests from people in every category.

3:15 PM: Day 1 Recap

People subscribed to Day 1’s offer 4.8 times over, with regular investors buying a lot more, while other businesses started to take notice. The market’s limited information today about the company’s upcoming listing suggests strong hope for its debut performance.

3:30 PM: Market Close

The IPO’s first day finishes strong, with analysts optimistic about how Denta Water and Infra will do on their listing. Stay tuned to the allotment process because many more people will apply for this IPO than it can accommodate.

Pingback: Adani Energy Solutions Share Price Target 2025 - Tech Venture Spot