Top 5 Copper ETFs for Indian Investors: 2025 Outlook

Copper demand is at an all-time high, driven by fundamental shifts in the global economy. Key growth areas include electric vehicles, large-scale renewable energy projects, and essential power grid expansions. With supply struggling to keep pace, a structural deficit is becoming more apparent.

For an Indian investor seeking exposure to this critical commodity without engaging in direct futures or physical holdings on the MCX, selecting a top-tier copper exchange-traded fund (ETF) is an effective strategy. This approach can help protect against shortages and capitalize on long-term trends.

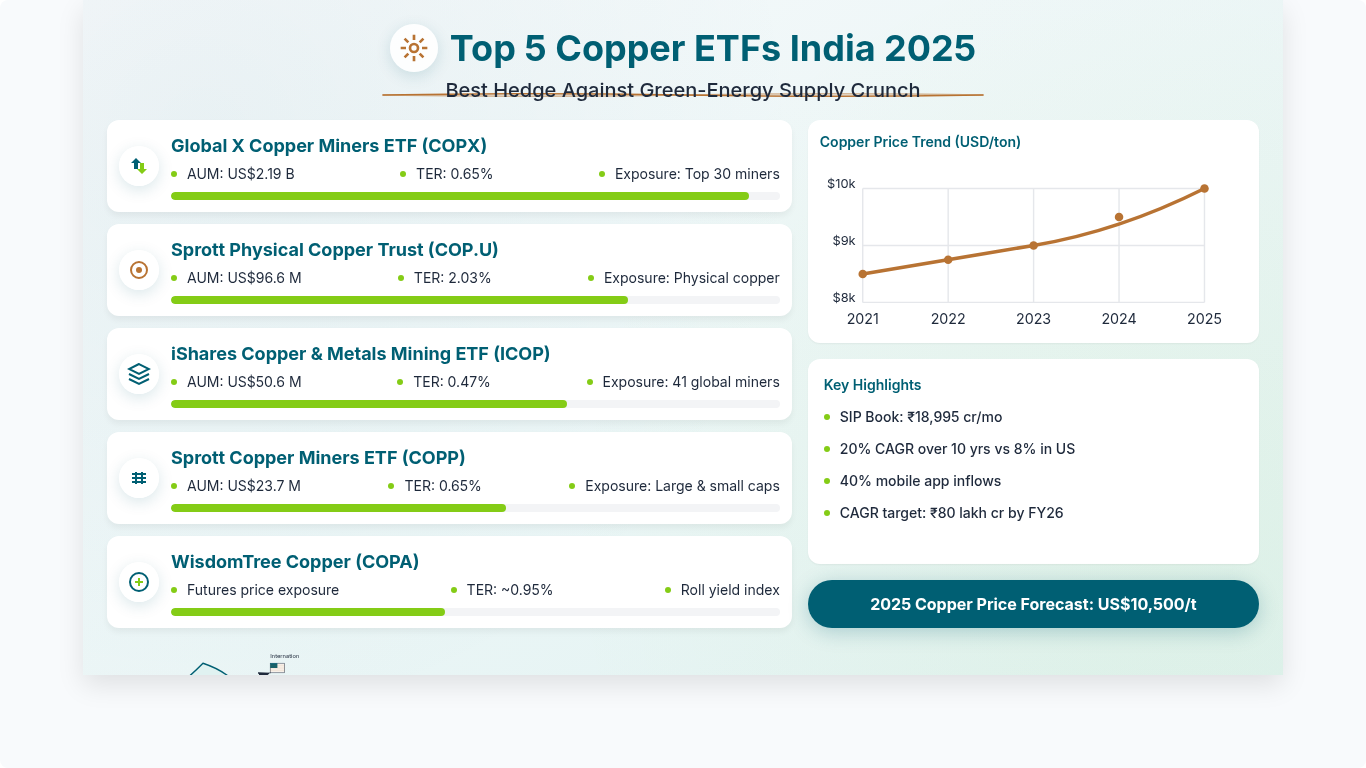

Based on a combination of variables such as assets under management (AUM), total expense ratio (TER), liquidity, and pure-play copper exposure, here is an examination of the top 5 copper ETFs worldwide for 2025.

| ETF Name | Ticker(s) | AUM (USD Mn) | TER | Exposure Type |

|---|---|---|---|---|

| Global X Copper Miners ETF | COPX | 2,190 | 0.65% | Copper mining companies |

| Sprott Physical Copper Trust | COP.U / SPHCF | 96.6 | 2.03% | Physical copper |

| iShares Copper and Metals Mining ETF | ICOP | 50.6 | 0.47% | Copper & base-metals miners |

| Sprott Copper Miners ETF | COPP | 23.7 | 0.65% | Pure-play copper mining firms |

| WisdomTree Copper | COPA | 43.4 | – | Total return on copper prices. |

How to Make Investments from India

- Create an account with an international brokerage (such as Interactive Brokers or a domestic platform with US investing features like Zerodha).

- Fund your account using the USD/INR route, taking forex expenses into account.

- Choose your preferred copper ETF ticker or tickers and place buy orders, just as you would for any US, Canadian, or London-listed ETF.

- Keep an eye on copper price forecasts and rebalance your portfolio annually or as needed.

Top 5 Copper ETFs India 2025

- 1. COPX

- 2. Sprott Physical

- 3. ICOP

- 4. COPP

- 5. COPA

1. Global X Copper Miners ETF (COPX)

This is the largest and most liquid ETF in the space, focusing on a global basket of companies involved in copper mining. It offers diversified exposure to the producers who benefit from higher copper prices.

Key Information (As of Jun 25, 2025)

Top 10 Holdings (As of Jun 25, 2025)

| Net Assets (%) | Name | Market Price ($) |

|---|---|---|

| 5.46 | FIRST QUANTUM (FM CN) | 16.36 |

| 5.27 | LUNDIN MINING CORP (LUN CN) | 10.14 |

| 5.02 | FREEPORT-MCMORAN INC (FCX) | 41.61 |

| 4.67 | SUMITOMO MET MIN (5713 JP) | 22.89 |

| 4.61 | HUDBAY MINERALS INC (HBM CN) | 9.80 |

| 4.59 | ANTOFAGASTA PLC (ANTO LN) | 23.51 |

| 4.58 | TECK RESOURCES LTD-CLS B (TECK/B CN) | 38.21 |

| 4.56 | SOUTHERN COPPER CORP (SCCO) | 97.08 |

| 4.50 | ZIJIN MINING-H (2899 HK) | 2.48 |

| 4.48 | KGHM POLSKA MIEDZ SA (KGH PW) | 33.87 |

Performance History (As of Mar 31, 2025)

2. Sprott Physical Copper Trust (COP.U / SPHCF)

This trust aims to provide a secure and convenient way to own physical copper. It holds London Metal Exchange-grade copper bullion in secure, third-party vaults. It's a pure-play on the copper price itself.

Important Metrics

Why Think About It?

It provides direct exposure to copper bullion as a green energy metals ETF. This is ideal if you believe returns will be driven by the fundamentals of copper prices rather than the equity values of mining companies.

Risks

This trust has a significantly higher expense ratio compared to miner ETFs and may suffer from lower liquidity. The current, large discount to NAV also presents a risk and a potential opportunity.

3. iShares Copper and Metals Mining ETF (ICOP)

A relatively new entrant, ICOP offers exposure to a global basket of companies that derive significant revenue from copper and other base metals mining. Its lower expense ratio is a key selling point.

Key Facts (As of Jun 25, 2025)

Performance (as of Mar 31, 2025)

Note: As a newer fund, ICOP lacks a long-term track record (3, 5, 10 years).

4. Sprott Copper Miners ETF (COPP)

COPP is designed to track an index of companies that are significantly involved in copper mining. It differentiates itself by focusing on companies with a strong correlation to the price of copper, offering a purer-play equity exposure.

ETF Fund Details (June 25, 2025)

Month-End Performance (As of 5/31/2025)

Note: Like ICOP, COPP is a newer fund and does not have a long-term performance history.

5. WisdomTree Copper (COPA)

COPA is an Exchange-Traded Commodity (ETC) listed on the London Stock Exchange. It's designed to track the Bloomberg Copper Subindex, offering investors total return exposure to copper prices through futures contracts.

Product Overview (As of 24 Jun 2025)

Performance Comparison

The chart below shows the performance of the product versus its benchmark index over various periods.

Note: There is a significant divergence in the Year-To-Date (YTD) performance between the product and its benchmark in the provided data, which could be due to tracking errors, costs, or data reporting discrepancies.

Why Invest in Copper Miners Now?

- Growing Demand: Surging energy consumption from developing countries, artificial intelligence, data centers, and the green energy transition are expected to deepen the structural supply deficit in the copper market.

- Supply Challenges: The global copper supply faces significant hurdles, including decreasing ore quality, prolonged lead times for opening new mines, and a long period of underinvestment. These factors highlight the critical role of copper mining companies.

- Price Dynamics: Rising copper prices may be the catalyst needed to motivate the development of new projects, aiming to satisfy the growing appetite for copper.

- Miner Opportunities: The widening gap between supply and demand could benefit both copper prices and mining companies. Additionally, an uptick in mergers and acquisitions (M&A) within the industry could further strengthen the position of copper miners.

Forecast and Justification for Copper Prices in 2025

Analysts predict a persistent copper supply deficit this year due to limited mine output and rising demand from EVs, renewable energy sources, and grid expansions.

- UBS Forecast: LME copper is predicted to average US$10,500 per tonne in 2025.

- Goldman Sachs Forecast: LME copper is predicted to be US$9,600 (3 months), US$10,000 (6 months), and US$10,700 (12 months).

Given these forecasts, Indian investors may consider a copper ETF strategy centered on mining stocks or physical-copper trusts to protect against rising raw-material costs in the green-energy value chain.

Sources

For the most current data, please refer to the official issuer websites:

- COPX: Global X ETFs Official Website

- COP.U / COPP: Sprott Official Website

- ICOP: iShares by BlackRock Official Website

- COPA: WisdomTree Europe Official Website

Disclaimer: This content is for informational purposes only and does not constitute financial advice. All data is sourced from the provided text and is dated for mid-2025. Always conduct your own research before investing.