Fintechzoom Crypto ETF: Your 2025 Guide to Crypto Gains Without Worry

Investing in crypto scares many. It's the Wild West of finance, with its huge price fluctuations and technical jargon. That's why a Fintechzoom Crypto ETF could be an easy means to gain "crypto gains without worry."

In this 2025 guide, we'll explain why crypto ETFs have become so well-liked, what is unique about the Fintechzoom Crypto ETF, and how you can make better investment choices today. You can expect short paragraphs, bullet points, and plain language. Let's begin!

What is driving the surge in crypto ETFs in 2025?

- Mainstream Adoption: Mainstream financial institutions have finally come around to digital assets by mid‑2025, adding legitimacy.

- Regulatory Clarity: Regulators in the U.S., EU, and Asia have clarified the rules for crypto ETF, which minimizes legal uncertainty.

- Investor Demand: As Bitcoin and Ethereum skyrocketed at the start of 2025, investors turned to regulated vehicles rather than self‑custody.

- Lower Barriers: Crypto ETFs allow you to invest using the brokerage accounts you already have—no need for complex wallets or private keys.

Why FintechZoom's Crypto ETF is Worth Your Attention

- Trustworthy Source: FintechZoom is recognized for its thorough research and clear reporting.

- Niche Focus: This Fintechzoom Crypto ETF provides you with the opportunity to invest in multiple significant digital currencies, rather than one coin.

- Competitive Fees: 0.45% expense ratios (a notch below much of the competition) put more of your profits in your pocket.

- Active Oversight: The management team of the ETF rebalances its holdings monthly to capitalize on emerging opportunities.

1. Learning the Fundamentals

1.1 What is a Crypto ETF?

A crypto ETF or exchange-traded fund is an investment that pools funds to invest in crypto assets. Rather than investing directly in coins, investors invest in shares that replicate the price of these assets.

Key Benefits:

- Trades in the stock markets like any other ETF.

- You don't need to develop sophisticated digital wallets.

- Typically insured or guaranteed by known custodians.

- May be invested in retirement funds (such as IRAs).

1.2 How Crypto ETFs Work: A Simple Explanation

- Creation of Funds: Authorized participants deposit a basket of accepted cryptos into the ETF.

- Share Issuance: The ETF will issue shares that symbolize proportional ownership in the crypto basket.

- Trading: You purchase/sell ETF shares on your broker website during trading hours.

- Net Asset Value (NAV): Calculated daily from the price of the assets.

1.3 The Emergence of FintechZoom in the Crypto ETF Market

- Early Mover Advantage: FintechZoom established its initial crypto research desk in 2023 and established a strong foundation.

- Data-Driven Insights: Their weekly research reports include on-chain data and overall trends.

- Partnerships: With top custodians like Coinbase Custody, assets are safely held.

- Increasing AUM: As of Q1 2025, the Fintechzoom Crypto ETF possessed more than $1.8 billion in assets.

Also Read: Best Gold ETFs in India to Invest in 2025

2. In the FintechZoom Crypto ETF

2.1 Assets Held: Which Cryptocurrencies Are Covered?

The Fintechzoom Crypto ETF offers diversified exposure. Here's a typical breakdown:

| Cryptocurrency | Symbol | Approximate Allocation |

|---|---|---|

| Bitcoin | BTC | ~40% |

| Ethereum | ETH | ~30% |

| Solana | SOL | ~10% |

| Polkadot | DOT | ~5% |

| Cardano | ADA | ~5% |

| Miscellaneous Altcoins (Chainlink, Avalanche, Polygon, etc.) | Various | ~10% |

2.2 Weighting Strategy: Equal, Market Cap, or Smart Beta?

- Market‑Cap Based: Heaviest weights on BTC and ETH—captures overall crypto market structure.

- Dynamic Rebalancing: Rebalancing monthly ensures the portfolio remains within pre-defined risk bands.

- Smart‑Beta Factors: Overweights tokens with high momentum or positive on-chain behavior.

2.3 Active vs. Passive Defined Management Style:

- Semi-Active Strategy: Fintechzoom Crypto ETF follows a broad crypto index but also has an active component.

- Passive Base: It follows a top-10 crypto index.

- Active Tilt: We can tilt up to 15% of the portfolio to smaller but promising tokens based on fundamental research.

Why It Matters: An entirely passive crypto fund will likely forgo short-term profits; this hybrid fund attempts to benefit from both stability (from well-established firms) and growth (from emerging projects).

3. 2025 Performance Overview

3.1 Year-to-Date Returns and Market Behavior

(Data as of May 31, 2025)

| Metric | Value/Observation |

|---|---|

| YTD Return (ETF) | Roughly 35% |

| Bitcoin YTD | Climbed ~50% |

| Ethereum YTD | Climbed ~40% |

| Smaller Altcoins | Lagged behind |

| Volatility (Monthly Std. Dev.) | Roughly 6% (typical for crypto) |

Market Drivers:

- Institutional investment in spot Bitcoin ETFs contributed to the aggregate bullish sentiment.

- DeFi Growth: Additional DeFi projects on Ethereum boosted demand for ETH.

4. Strategic Investment Benefits

4.1 Diversification Without the Complexity

- Single-Ticket Exposure: Rather than managing five separate coins, simply purchase a single ETF share.

- Automatic Rebalancing: Reduces manual buying of laggards and selling of winners.

- Risk Mitigation: Exposure to a basket of cryptos cushions blow if a single token crashes.

4.2 Getting Familiar with New Digital Assets

The Fintechzoom Crypto ETF can focus more on newer, promising blockchains like Solana and Polkadot through its smart-beta slice.

- Early Access: Getting familiar with small-cap tokens prior to them getting extremely popular, yet with the stability of large-cap tokens.

4.3 Benefits of Tax Efficiency and Regulation Design

- ETF Wrapper: May benefit from "in-kind" creation/redemption, reducing taxable events relative to direct crypto buying/selling.

- IRA/401(k) Eligibility: Most brokerages permit you to hold this ETF in retirement accounts for tax-deferred or tax-free growth.

- Regulated Custody: Funds are deposited into insured custodians reducing theft/hack risk common with self‑custody.

5. Risks All Investors Should Know

5.1 Changes in the Crypto Market

- Price Swings: Cryptocurrency markets can move 20% and higher in days—or decline just as quickly.

- ETF’s Buffer: While diversified, a broad crash (like a 2022‑style winter) will still hurt.

5.2 Changes in Rules and Legal Uncertainty

- Potential Crackdowns: Any fresh rules, such as prohibiting particular tokens, can necessitate portfolio readjustments.

- ETF Suspension: In theory, when regulators find an underlying token non‑compliant, it can be delisted or swapped out.

5.3 Individual Holding Liquidity Problems

- Altcoin Liquidity: Smaller-cap tokens might not be actively traded, exposing them to price impact from ETF rebalancings.

- Trading Spreads: On high‑volatility days, the spread (bid/ask difference) of the ETF could increase to 1% or higher.

5.4 Technology and Custody Risks

- Custodian Hacks: While Coinbase Custody is excellent, no solution can be 100% hack-proof.

- Smart Contract Vulnerabilities: A weakness in tokens in possession could result in instant devaluation.

- Custody Fees: Fees can surge in extreme situations (e.g., during network congestion).

6. Who Would Want This ETF?

6.1 Retail Investors Seeking Simplicity

- No-Hassle Exposure: If you prefer to have crypto but don't wish to deal with wallets, private keys, or taking care of it yourself, this ETF is ideal.

- Dollar-Cost Averaging (DCA) Friendly: Periodically buy through your brokerage.

6.2 Institutional Actors Seeking Exposure

- Endowments and pension funds can invest 1% to 3% of their holdings in crypto through a single regulated vehicle.

- Family Offices: Get a combination of crypto investments in one swift report.

6.3 Long-term Investors and Short-term Traders

- Long-Term Holders: Best for a "set and forget" approach; let the research and rebalancing group make the changes.

- Short‑Term Traders: Might prefer single‑coin futures or tokens for quick in‑and‑out, as ETFs have the potential to lag underlying markets by hours.

7. Investment Strategy Recommendations

7.1 How to Invest in Your Portfolio with FintechZoom's Crypto ETF

- Core/Satellite: Core (60%): Less expensive, wide market index or total-stock-market ETF. Satellite (5%‑10%): Fintechzoom Crypto ETF for growth potential.

- Risk Parity: If you are able to bear more risk, increase your investment to 15%, but not exceeding 20% of your net worth.

7.2 Dollar-Cost Averaging: Reducing Risk Over Time

- Every month, buy $500 worth of goods, no matter the price.

- Psychological Advantages: You take away the anxiety of "timing the bottom."

- Long‑Term Outcome: In the long run, your average cost decreases volatility.

7.3 Market Peak and Trough Exit Strategies

- Profit-Taking Level: If your ETF increases by 100% from your basis, sell 25% to take your profit.

- Stop‑Loss Rule: Place a stop‑loss in mind at –40% below cost basis. Reassess market conditions and fundamentals if triggered.

- Rebalance Once a Year: Even if you do not sell, rebalance your overall portfolio to keep desired risk exposure.

8. Future Growth Potential

8.1 Trends Shaping the Crypto ETF Market in 2025

- Spot Bitcoin and Ethereum ETFs are approved. Many invested in these crypto-ETFs, and due to this, the entire space expanded.

- DeFi and Web3 Expansion: With established decentralized finance systems, tokens from these platforms gain increasing attention from institutions.

- Corporate Adoption: Firms placing crypto on their balance sheets (such as Tesla and MicroStrategy) create long-term legitimacy.

8.2 Future Blockchain Technologies Affecting ETF Holdings

- Layer‑2 Scaling (e.g., Optimism, Arbitrum): Anticipate increased allocation to Layer‑2 tokens if they show real‑world adoption.

- Interoperability Protocols: Polkadot (DOT) and Cosmos (ATOM) could be more valuable if cross-chain bridges perform well.

- Decentralized Identity and Data Privacy Chains: Solutions like Polygon ID or Oasis Network could be classified under the small-cap "Smart-Beta" category.

8.3 The Future: Predictions for 2026 and Beyond

- Improved Token Coverage: By 2026, anticipate having 15–20 top tokens in Fintechzoom Crypto ETF, plus extra DeFi and NFT infrastructure coins.

- AI and Blockchain Together: As AI gets more intertwined with blockchain, tokens founded on data marketplaces or AI computer networks can be added.

- International Expansion: European and Asian underwriters may initiate similar services, increasing competition and reducing fees.

9. How to Invest FintechZoom Crypto ETF

9.1 Platforms Facilitating the ETF

Big Brokerages:

- Fidelity

- Charles Schwab

- E*TRADE

- Robinhood

Robo-Advisors: Certain robo-advisors, such as Betterment and Wealthfront, now hold crypto ETFs in their "moderate" or "aggressive" portfolios.

9.2 Step-by-Step Buying Instructions

- Open or log in to your brokerage account.

- Search for Ticker (e.g. "FZCE" – sample ticker)

- Select the order type: market order, limit order, or recurring DCA order.

- Number of Shares: Give the number of shares or a dollar figure.

- Review Fees & Confirm: Review fee ratio and platform-fee commission (usually $0).

- Place Order: You currently possess units of the Fintechzoom Crypto ETF.

9.3 Fees and Expense Ratios to Monitor

- Expense Ratio: 0.45% per annum (covers custodial and management fees).

- Bid-Ask Spread: Typically 0.10%–0.20% in normal market conditions.

- Broker Commissions: All the major platforms have commission‑free ETF trades; check before buying.

10. Real Investor Stories

10.1 Case Study: A First-time Investor's Experience

Background: Sarah is 32 years old, tech-savvy but crypto novice.

Challenge: She didn't want to handle a lot of wallets or lose private keys.

Solution: Invested $5,000 in Fintechzoom Crypto ETF through Fidelity, using DCA ($500/month).

Result (6-Month Update):

- Portfolio Value: $6,750 (35% increase this year).

- Emotional Benefit: Less stress compared to keeping track of coin prices hourly.

- Lessons Learned: Despite altcoins' rally in April, the balanced strategy of the ETF saved her from May's mid-month altcoin crash.

10.2 Case Study: Institutional Strategy Using Crypto ETFs

Apex Capital, a medium-sized hedge fund, wished to start venturing into crypto.

Challenge: Needed a regulator-approved vehicle, risk controls, and an open audit trail.

Solution: Invested 2% of the AUM (total AUM of $100M → $2M in the Fintechzoom Crypto ETF).

Result (Q2 2025):

- AUM Growth: Crypto allocation increased to $2.7M (35% YTD before fees).

- Reporting: Straightforward statements of ETFs facilitate easier audit and risk reporting.

- Next Steps: European city regulators requested Apex to think about the ETF as part of a broader plan for digital assets.

11. Frequently Asked Questions

Yeah. You have controlled custody, a broad selection of cryptocurrencies, and one-click buy or sell in your brokerage account. But remember that cryptocurrency markets can be really volatile—your entire investment can shift 30% in a month.

Yes. All of the large brokerages permit you to invest Fintechzoom Crypto ETF in IRAs, Roth IRAs, and 401(k)s (if your plan administrator permits ETFs). This is tax-advantageous to you:

- Traditional IRA: Tax-deferred growth.

- Roth IRA: Withdrawals tax-free (if invested 5+ years).

Portfolio Impact: Anticipate the ETF to decline approximately in line with the broader crypto index—can be 40%‑60% decline.

Built-in Buffer: Since the ETF includes several leading coins, if one token fails (like in a hack), it won’t ruin the whole portfolio.

Active Tilt: The managers may switch from underperforming altcoins to stable coins during mid-crash, possibly minimizing losses.

Recovery Potential: Cryptocurrencies have tended to recover from severe declines in the past. Ensure that you look long-term (3-5 years) to ride out these bad times.

12. Conclusion

Final Thoughts: Is Fintechzoom's Crypto ETF a Good Investment in 2025?

If you need exposure to crypto without the hassle of self-custody, pick one ETF. With its 0.45% cost ratio, monthly active rebalancing, and transparent holdings, Fintechzoom Crypto ETF is competitive with passive rivals.

The ETF provides large‑cap stability (BTC, ETH) and growth potential (Solana, Polkadot, Cardano, etc.). All that aside, acknowledge inherent crypto volatility and risk only what you can afford to lose (preferably 5%‑10% of your portfolio).

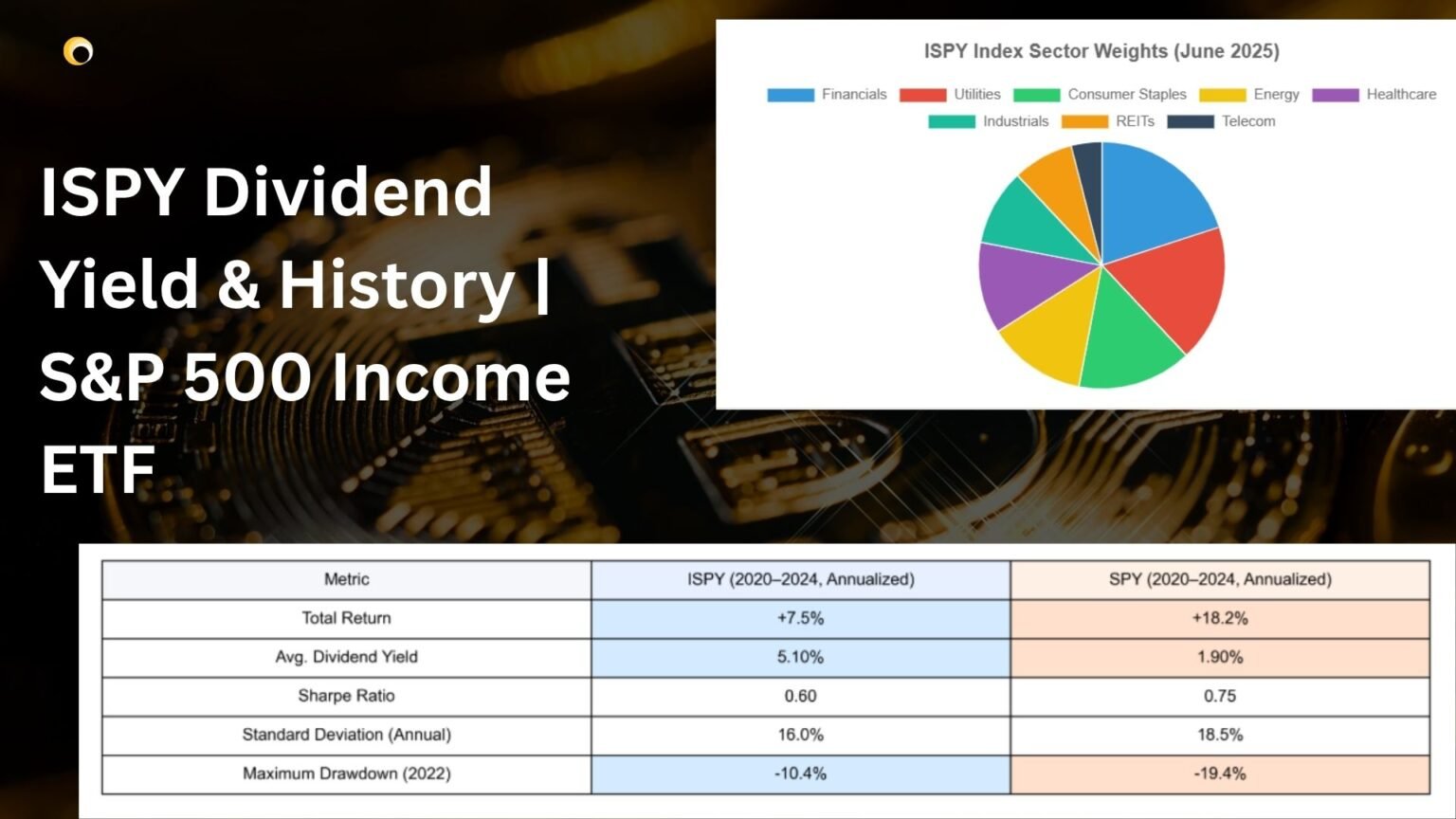

Pingback: ISPY Dividend Yield & History | S&P 500 Income ETF

Pingback: CONY Dividend Yield, Dates & History Details