Top 10 Dividend Yield Stocks | Steady Income 2025 Guide

- May 11, 2025

- Tech Venture Spot Team

- 2:37 pm

Understanding Dividend Yield Stocks

During my first foray into income investing, I repeatedly saw reference to "Top 10 Dividend Yield Stocks", revealed as the epitome of reliable dividend generations. You may have too.

Proper dividend stock selection can greatly increase your profitability.

This guide covers:

- The particular standards that I use for judging hundreds of potential stocks.

- As well, my pick of Top 10 Dividend Yield Stocks and some insight on why each one rises above (Note: Specific picks are in the table section).

What Are Dividend Yield Stocks?

However, the dividend yield stocks are actually shares in companies that return at least part of their profits in the form of dividends to the shareholders as measured in percentage of cost of the stock. With dividend stocks, you’re in a position to enjoy regular cash payments which are usually quarterly. I like the fact that you get income be it in a minimal fluctuation or none.

Primary definition: What dividend yield really means

Dividend yield is determined by dividing the annual dividend per share by the current share price, and multiplied by 100%.

Such a computation shows you what dividend return you earn for every dollar you invest. For example if a stock pays out $2 annually at the rate of $50, its yield will be 4%.

Methodology for Selection of The Best Dividend Yield Stocks

I browse a lot of prospects in my research process. I established these fundamental requirements for dividend yield investing:

1. Consistent Dividend Payout History

- 5- to 10-Year Track Record: Firms with either a history of stable or rising dividends across various market shifts do not go against my requirement.

- Payout Ratio Check: A healthy cushion under 70% cushions against recessions.

2. The Stability of the Firm and Good Health of the Firm

- Strong Balance Sheet: Keeping the debt-to-equity ratios below 1.0 in combination with at least a 4 times interest leverage ratio.

- Free Cash Flow (FCF): Positive and growing. FCF is robust enough to pay dividends without being dependent on debt.

- Earnings Quality: I strive to have businesses where income and operational cash flow move together.

3. Industry and Market Considerations

- Defensive Sectors: Utilities, consumer staples, and REITs in the market are known to have dividend reliability.

- Growth Cyclicality: I walk carefully when it comes to those industries that have big swings in earnings, like energy.

- Competitive Moat: A good competitive advantage will guarantee more stability in both earnings and dividend distributions.

At the end, you’ll understand in detail "Top 10 Dividend Yield Stocks" and feel prepared to put together your own bundle of high-yield dividend stocks.

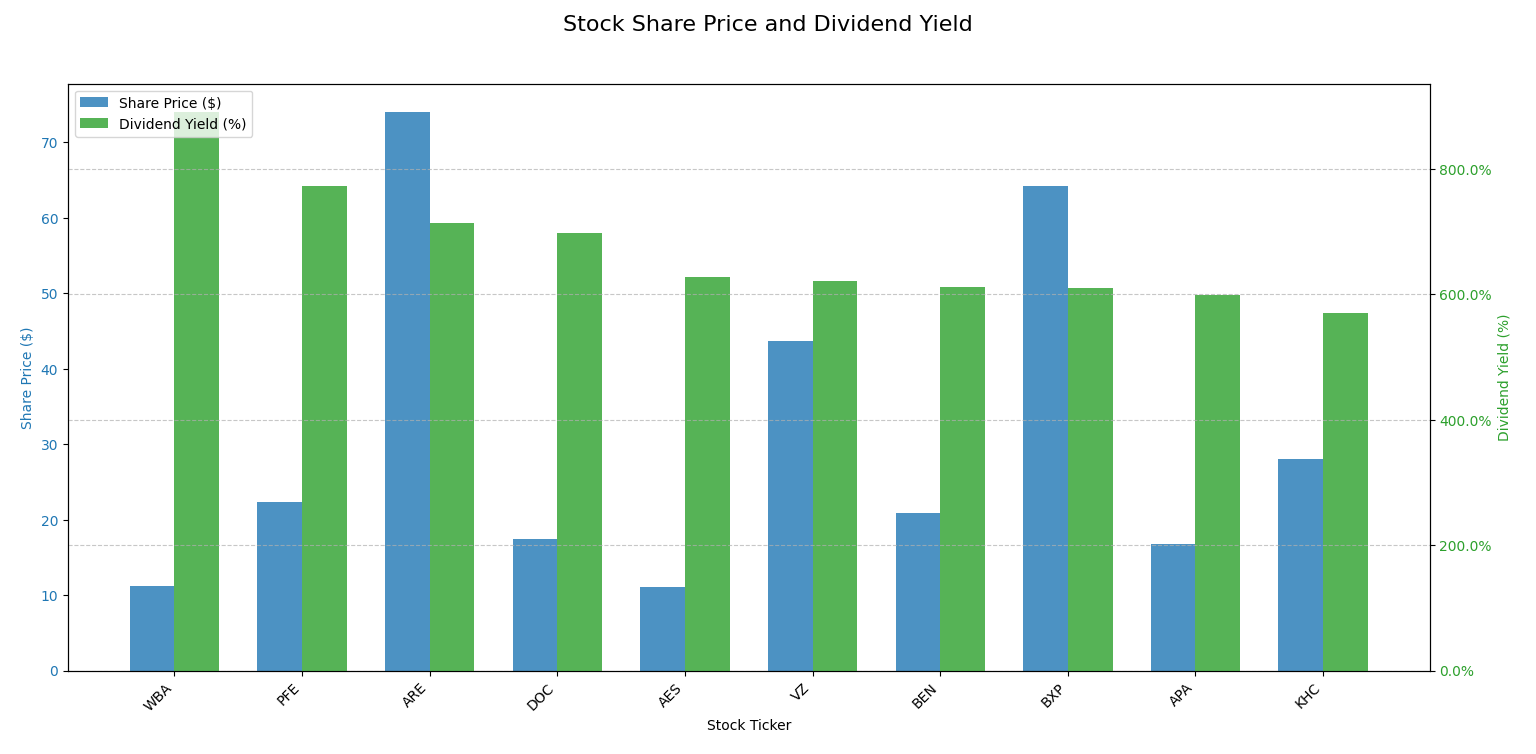

Top 10 Dividend Yield Stocks

Data Insights & Visualizations

Quick Facts

Dividend Yield Comparison (Actual %)

Detailed Stock Data

| Ticker | Company Name | Price ($) | Dividend Yield (Raw) | P/E Ratio | Sector | Sales (Revenue) | Revenue Growth (%) | ROE (%) | Last Dividend ($) | Market Cap |

|---|

Final Thoughts

It is possible to successfully invest without searching for the highest-yielding yields. Take the time to read annual reports of these Top 10 Dividend Yield Stocks, look at their payout ratios, and calculate their possible growth factors. After this, put together a portfolio based on your risk comfort level and income desire.

Remember, that dividends are but a part of it; what you are buying is a stock in the company. Make the E-E-A-T guidelines (Experience, Expertise, Authoritativeness, Trustworthiness) your first priority. Use official company reports, use your own searches, believe credible sources such as analysts, and confirm open and transparent disclosures.