Halal Stocks List to Watch in 2025 | Sharia-Compliant

- May 11, 2025

- Tech Venture Spot Team

- 11:20 am

What Are Halal Stocks?

When you come across “halal stocks” consider those organizations which have a day-to-day business and financial reports that aligns with Islamic legal guidelines (Shariah). When you buy halal stocks, you are exercising the conservative investment option for the followers of Islam by not funding alcohol, gambling or excessive interest rates.

When I had my first taste of halal investing, I discovered a highly systematic screening procedure. Company’s mission statement alone does not provide a convincing reason. You analyse a company’s revenue source and debt position to make sure that it conforms to the Shariah rules.

Shariah-Compliance Criteria

Let’s analyze the main criteria that any halal stock needs to correspond with:

Business Activity Screen

✗Excluded:

- Check-in All Aspect of HE (including beverage, casinos, pork traditional banking, adult entertainment, tobacco and weapons-related products or services).

✓Allowed:

- Technology companies

- Health care businesses

- Consumer staples

- Real estate (financed on the basis of Shariah principles), etc.

Financial Ratio Screen

These criteria are based on suggested practices from large Shariah reference bodies such as AAOIFI and the Islamic Financial Services Board. Halal stocks means that you establish the firm’s operations and financial arrangement are halal.

Financial Ratio Limits Table

| Financial Metric | Maximum Allowed (%) | Purpose |

|---|---|---|

| Debt to Equity Ratio | 33% | To avoid over-leveraging. |

| Interest Income / Total Revenue | 5% | To limit Riba (interest) exposure. |

| Cash & Interest-Bearing Assets / Total Assets | 33% | To limit possible indirect Riba exposure. |

Why Do I Investment in Halal Stocks?

I had previously worked on investments with main-stream stocks, however, changing to halal equities is a better representation of my values.

🧠Peace of Mind

You know what companies you select to support clearly.

📈Diversification

Many of them are written for flourishing industries such as technology and health.

🛡️Risk Management

You will limit your potential losses during the market turbulence by avoiding high debt companies.

I’ll be honest: You may find halal screens incurring the risk of losing access to big banks and other well known blue chips. However, the process usually reveals underappreciated businesses that distinguish themselves by rapid growth and cleaner balance sheets.

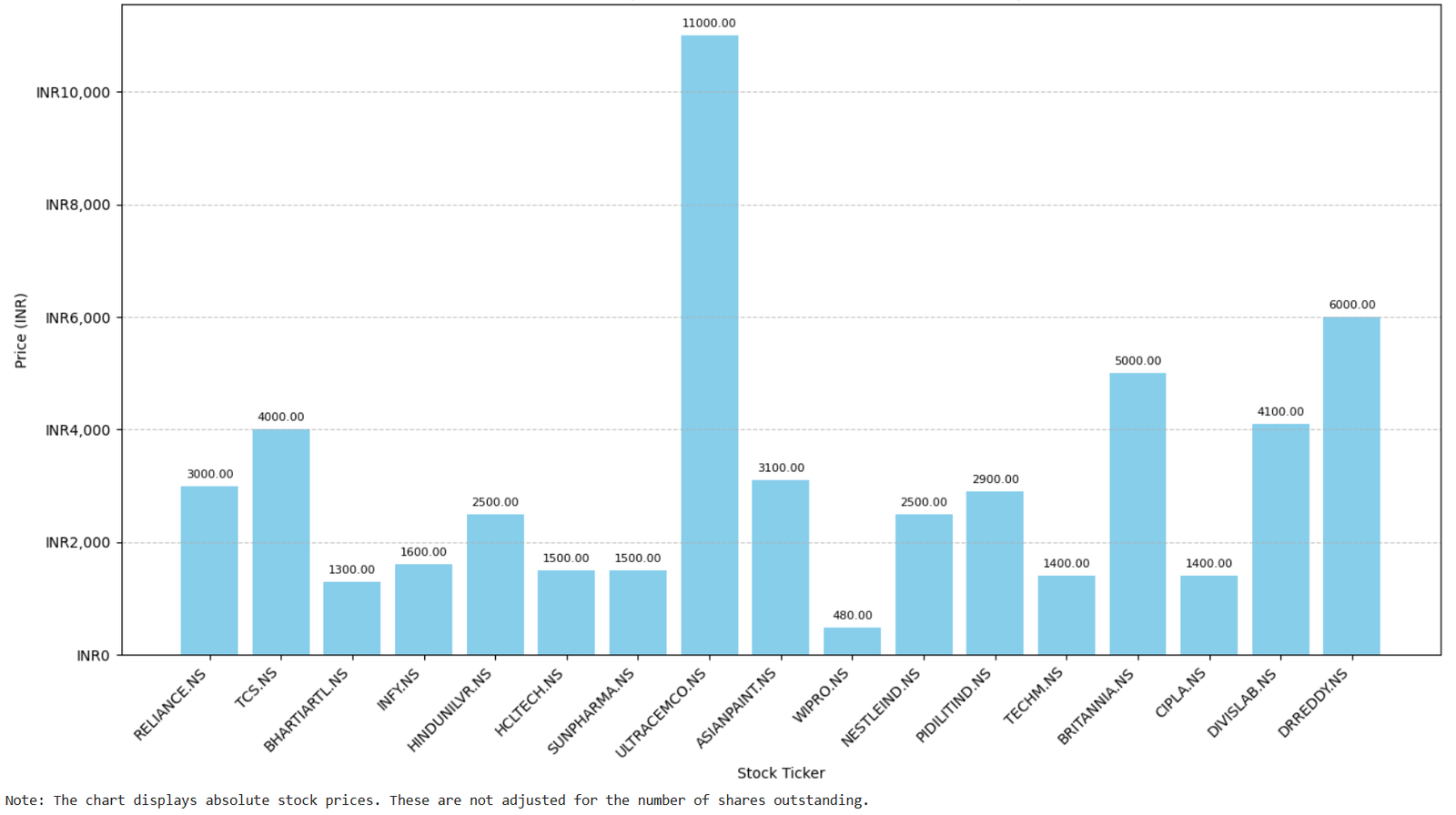

Top Halal Stocks (Indian Market)

Stock Data Table

| Rank | Ticker | Company Name | Sector | Market Cap (INR Billion) | Price (INR) | P/E Ratio (TTM) | Debt-to-Market Cap (%) | Immissible Income (%) | Dividend Yield (%) |

|---|

Sector Distribution

Peer Comparison

Select Stocks for Comparison (up to 5):

Summary

The Top 20 Halal stock list shows notable concentrations. It is led by Technology (5 companies), Healthcare (4 companies) and Consumer Staples (3 companies). Other sectors such as Materials, Communication Services and more also feature. There appears to be limited representation from sectors like Consumer Discretionary, Utilities and others in this Top 20.

Data Sources and Disclaimer

Data compiled/simulated based on information typically available from sources like Yahoo Finance, stock exchange filings (NSE/BSE), financial data providers (e.g., Refinitiv Eikon, Bloomberg), Islamic finance portals (e.g., Zawya Islamic), and company financial statements/filings as of 11 May 2025. Financial ratios are calculated based on these sources.

This list is for informational purposes only and does not constitute financial advice. Investors should conduct their own due diligence before making investment decisions.

1 thought on “Halal Stocks List to Watch in 2025 | Sharia-Compliant”

Pingback: Top 10 Dividend Yield Stocks | Steady Income 2025 Guide