Introduction

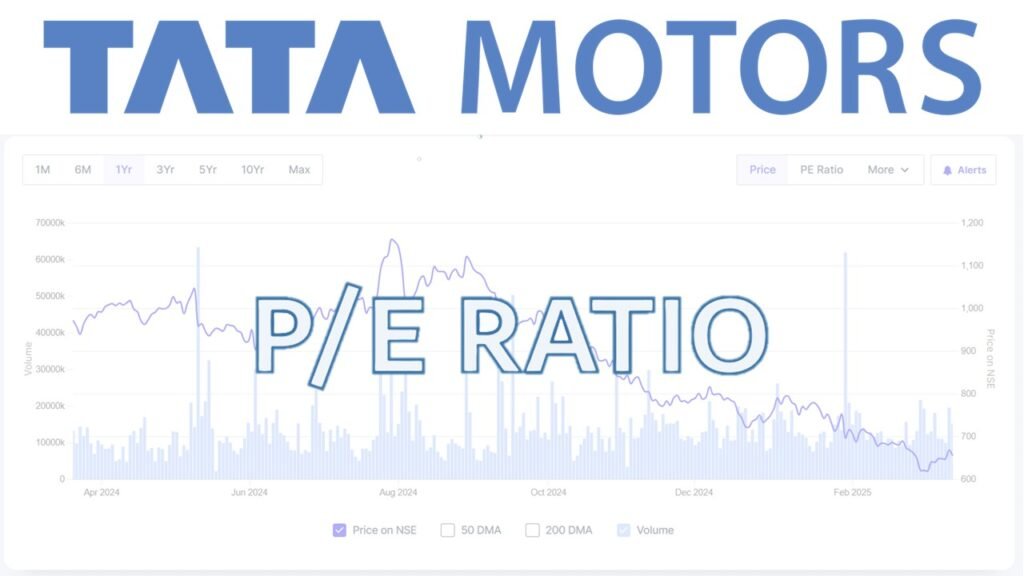

Investor interest in Tata Motors stock has been growing, and it’s critical to comprehend the company’s Price-to-Earnings (PE) ratio if you’re thinking about investing in this massive automaker. This potent indicator shows whether a stock is fairly valued and provides information about whether the price of Tata Motors shares is a warning sign or a great opportunity.

We’ll examine the Tata Motors PE ratio in detail in this guide, as well as its importance, historical trends, comparison to competitors, and implications for your investment path. We’ll also look at how market trends, value dynamics, and the Tata stock rate all significantly influence how this legendary brand develops in the future.

Why It Is Important

- Strong growth expectations are frequently indicated by a high PE ratio, but it can also be a sign of overvaluation.

- Although a low PE ratio can indicate fundamental flaws, it can also indicate that the company is inexpensive.

- Relative valuation can be ascertained by comparing the PE ratios of competitors.

- To make wise investment choices, the PE ratio should be used with other financial indicators.

Long-term investors must comprehend the market price of Tata Motors shares and how it affects the PE ratio.

Understanding EPS (Earnings Per Share)

EPS is crucial in calculating the Tata Motors PE ratio.

- Increased profitability is indicated by a rising EPS, and this can propel stock price increase.

- Net income, share buybacks, and dilution from the issue of new stock can all affect EPS.

- To have a better grasp of financial health, investors should keep an eye on quarterly and annual EPS patterns.

Low vs. High PE Ratio

- High PE Ratio: Although the stock may be pricey, investors are prepared to pay more for growth.

- Low PE Ratio: Could point to possible hazards or an opportunity that is undervalued.

- Industry Context Is Important: It’s important to constantly compare the PE ratio to industry and historical averages.

Tata Motors Current PE Ratio

PE Ratio

Share Price

| Metric | Value |

|---|---|

| Current Share Price | ₹655.40 |

| Earnings-TTM | ₹31,829 Cr |

| Market Cap | ₹2,41,265 Cr |

Source: Tata Motors Financial Report 2025

📢 Monitor daily share market price for latest trends

Historical PE Ratio Trends

PE Ratio Evolution (2020-2025)

| Year | PE Ratio | Trend |

|---|---|---|

| 2020 | 0.00 | - |

| 2021 | 0.00 | - |

| 2022 | 0.00 | - |

| 2023 | 66.72 | 📈 Peak |

| 2024 | 12.12 | 📉 Drop |

| 2025 | 7.58 | 📉 Stabilization |

2023 Valuation Spike

PE ratio reached 66.72 due to speculative EV growth expectations and market optimism

2025 Stabilization

PE ratio normalized to 7.58 through improved earnings and operational efficiency

Auto Sector PE Ratio Comparison

Key Observation

Tata Motors' PE ratio of 7.58 is significantly lower than industry average of 24.82, suggesting potential undervaluation. Monitor Tata Motors share price and Tata auto share price trends for market sentiment signals.

Factors Affecting the PE Ratio of Tata Motors

1.Performance of the Company

- Revenue increased dramatically to ₹437,928 Cr in FY24.

- In FY24, net profit jumped to ₹31,807 Cr.

- It became a more appealing investment when operating profit margins increased to 14%.

2.Market Attitude

- Trends in the domestic and international automotive industries affect investor confidence.

- The performance of Jaguar Land Rover has a significant impact on Tata Motors’ valuation.

3.Economic Factors

- Inflation, interest rates, and GDP growth affect vehicle demand and profitability.

- Electric vehicle (EV) proliferation and government incentives could drive future growth.

Making Investment Decisions with the PE Ratio

- Combine with other financial statistics, such as cash flow analysis, debt-to-equity, and the P/B ratio.

- Examine market conditions while taking corporate fundamentals and larger economic developments into account.

- Examine management effectiveness, creativity, and brand strength in addition to numbers.

- A long-term outlook that emphasizes sustainable business practices is crucial.

Actionable Takeaways

- Make sure Tata Motors’ valuation is in line with rivals by conducting in-depth research and not relying solely on the PE ratio.

- ✅ Track trends by examining economic circumstances, revenue, and profit growth.

- ✅ Diversify your investments: Avoid investing all of your money in a single stock.

Conclusion

With a PE ratio of 7.58, Tata Motors’ stock might be cheap in comparison to its rivals. Before making a choice, investors must evaluate variables like growth potential, earnings stability, and macroeconomic trends. For well-informed investing, a comprehensive strategy utilizing a variety of financial indicators is essential.

Frequently Asked Questions (FAQs)

1. What does a low Tata Motors PE ratio indicate?

2. Is Tata Motors a strong long-term investment?

3. How does Tata Motors' PE ratio compare to industry competitors?

Disclaimer

This document is for general information purposes only. Always consult a financial planner before investing.

Pingback: Bank Nifty PE Ratio Guide – Smart Trading Insights

Pingback: HDFC Bank PE Ratio 2025: Is It the Right Time to Invest?