Introduction: Why HDFC Bank is the Market Leader

The biggest private sector bank in India, HDFC Bank is renowned for its strong financial results, innovative digital banking, and substantial market penetration. With a $145 billion market valuation as of April 2024, HDFC Bank is the third-biggest firm listed on Indian stock exchanges. It remains the industry leader with a 15% market share in banking sector advances and a 37% market share in private sector bank advances.

We will examine the ramifications of the HDFC Bank PE Ratio for investors, which is a crucial component in comprehending the bank’s valuation. Its market position, financial growth, strengths, shortcomings, peer comparison, and outlook for the future will also be examined.

HDFC Bank Market Performance

Valuation Multiples

Growth Metrics

Profitability

| Date | Stock Price (₹) | PE Ratio | 5Y Growth |

|---|---|---|---|

| March 2020 | 1,350 | 17.3 | +39% |

| March 2024 | 1,707 | 18.8 | +26% |

| March 2025 | 1,880 | 20.5 | +10% |

Stock Price Trajectory

Although it has changed throughout time, the HDFC Bank PE Ratio is still a crucial gauge of the bank’s worth. The present PE ratio indicates a reasonable value with good growth potential when compared to its past patterns.

2. Strengths & Competitive Edge of HDFC Bank

Why Do Investors Have Faith in HDFC Bank?

- Market Leadership: One of the top three banks that collect taxes from the government.

- Strong financials: ROCE (7.67%) and ROE (17.1%) are high.

- Digital Innovations: Pioneer in UPI, mobile banking, and net banking.

- Diverse Loan Portfolio: Well-established in both retail and corporate lending.

- Consistent Profitability: Supported by its various revenue streams and excellent loan book, HDFC Bank has consistently increased its earnings.

- Brand Trust: Its significant market share in lending and deposits is a result of both a strong brand presence and consumer trust.

HDFC Bank - Market Leadership

Tax Collection Leader

Among top 3 banks in government tax collections

Strong Fundamentals

Digital First

Leader in:

Net Banking • UPI • Mobile Solutions

Diverse Portfolio

Balanced exposure:

Corporate + Retail Lending

Consistent Profits

23% CAGR Profit Growth

(5-Year Average)

Brand Trust

Market Leader in:

Deposits • Lending • Investments

3. Key Challenges & Weaknesses

- Risk profile is impacted by high contingent liabilities of ₹24,09,821 Cr.

- P/E ratio (18.8) is marginally higher than the sector median (13.7), raising concerns about stock valuation.

- High Cost of Borrowing: Impacting corporate margins.

- Growing Competition: HDFC Bank is under more and more pressure to hold onto its market share as fintech companies and digital-only banks upend established banking structures.

- Regulatory Risks: Shifts in government policies and RBI regulations may have an effect on interest rates, non-performing assets, and loan disbursement.

HDFC Bank SWOT Analysis

Strengths

- Market leadership in tax collection

- Digital banking innovation leader

- Strong ROE (17.1%) and brand trust

- Diverse loan portfolio

Weaknesses

- ₹24.1T High contingent liabilities

- P/E 18.8 Premium valuation vs sector (13.7)

- Elevated borrowing costs

Opportunities

- Digital banking expansion

- Untapped rural markets

- Wealth management growth

- Fintech partnerships

Threats

- Fintech competition

- Regulatory changes

- Margin compression

- Economic slowdown risks

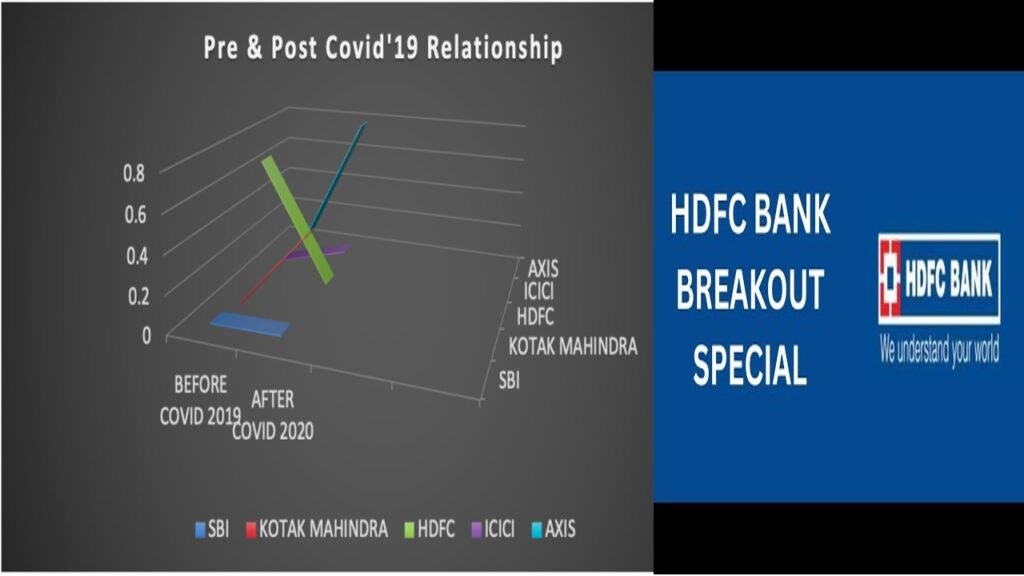

4. Peer Comparison: How HDFC Stands Against Competitors

Indian Banking Sector Benchmark Analysis (₹ Crore)

| Bank | Market Cap | P/E Ratio | Div Yield | Net Profit | ROE | NPA |

|---|---|---|---|---|---|---|

| Leader HDFC Bank | 13,05,782 | 18.8 |

1.14%

|

18,340 | ||

| ICICI Bank | 8,83,061 | 17.95 |

0.80%

|

13,846 | ||

| Kotak Mahindra | 3,94,682 | 20.07 |

0.10%

|

4,701 | ||

| Axis Bank | 3,12,802 | 11.10 |

0.10%

|

6,779 | ||

| IndusInd Bank | 52,379 | 7.25 |

2.45%

|

1,401 | ||

| Yes Bank | 50,761 | 23.40 |

0.00%

|

619 |

Key Insights

🏆 HDFC maintains leadership through:

- Highest profitability (Net Profit ₹18,340 Cr)

- Superior ROE at 17.1%

- Lowest NPA ratio (1.2%)

⚠️ Challenges include:

- Premium valuation (P/E 18.8 vs sector median 15.2)

- Digital competition requiring tech investments

- Regulatory pressures on lending practices

Important Takeaways:

- The HDFC Bank PE Ratio shows a balanced valuation in relation to earnings; it is marginally higher than ICICI Bank but lower than Kotak Mahindra Bank.

- With the exception of IndusInd Bank, which gives 2.45%, the dividend yield is higher than that of the majority of rivals.

- With a 17.1% return on equity (ROE), it is among the strongest in the sector and demonstrates effective capital use.

- With one of the lowest Non-Performing Asset (NPA) percentages (1.2%), HDFC Bank demonstrates excellent risk management.

- HDFC Bank dominates the private banking industry in terms of net profit, greatly surpassing rivals.

5. Future Growth Opportunities for HDFC Bank

- Fintech Innovation: Enhanced online banking and finance services powered by AI.

- International Banking: Establishing presence in Bahrain, Hong Kong, Dubai.

- Government Policies: RBI policies and tax reforms’ impact on banking.

- Credit Card & Retail Lending Expansion: Credit card, housing loan, and SME loan expansion.

- Green Financing: Green banking and green finance schemes.

6.Investment Point of View: HDFC Bank Share: Worth Buying?

Major Investment Statistics

- EPS (Earnings Per Share): ₹90.9

- Dividend Yield: 1.14%

- Stock Price Growth Rate: 12% 10-Year, 5% 3-Year

- Analyst Consensus: 73% Buy, 15% Hold, 0% Sell

- Valuation Outlook: Analysts believe that the HDFC Bank PE Ratio indicates that it’s undervalued compared to other international banking stocks.

7. Conclusion: The Future for HDFC Bank

- The top pick is HDFC Bank, with solid earnings, growth prospects, and healthy balance sheets.

- The PE Ratio of 18.8 reflects a fair value with growth potential.

- Investors need to track interest rate changes, off-balance sheet items, and fintech rivalry.

- Long-term investors can take advantage of building positions at these levels.