Table of Contents

Suzlon Energy is a leader as select renewable energy sector continues to gain momentum globally. All investors and market analysts are looking forward to the direction of the company and its share price target for 2030. In this article, we look deep into Suzlon’s Market position, financial outlook & key factors driving its stock, giving well researched mines that can help guided decision making.

Company Overview

Shree Tulsi Tanti, as well known as The Wind Man of India, is the Founder of the suzlon Energy, which was often considered as a leader in India’s renewable energy sector. Over the years, the company has:

- Entered wind energy solutions and established itself as a leader.

- Rolling out operations in over 20 + countries, supported by Europe, Asia, Australia, Africa, and the Americas.

- It had contributed considerably in rural development of India, uplifting the livelihood of over 183,000 families in India predominantly in Maharashtra.

Being India’s largest wind turbine generator (WTG) and operations and maintenance (O&M) service company, Suzlon has been a key player in providing solutions in the renewable energy market.

Historical Performance

Analyzing Suzlon Energy’s historical stock performance reveals a mix of challenges and growth:

- 52-Week Range: However, share price has ranged from Rs 86 to Rs 33.8.

- Recent Rally: The past six months saw the stock rise 39.7%, and it has yielded a 41% return year to date.

- Key Drivers: Investor confidence has been massively boosted with the introduction of the S144 wind turbine model and a healthy order book of 4.7 GW.

Factors Influencing Suzlon’s Share Price Target 2030

1. Internal Factors

- Product Innovation: With its strong order book, Suzlon’s S144 wind turbine model is also a symbol of the company’s quest for innovation.

- Revenue Streams: WTGs and O&M services support the company’s earnings with stable cash flow.

- Debt Levels: There is concern about high debt, which may harm long term profitability.

2. External Factors

- Government Policies: Suzlon is the beneficiary of favorable policies as India’s commitment to renewable energy includes targets for increased wind power capacity.

- Market Trends: Demand for Suzlon’s offerings is expected to be driven by the jump in the global interest in sustainability and renewable energy investments.

- Competition: The wind energy sector faces intense competition, which will pressure margins, and market share.

3. Global Economic Conditions

As an integrated products manufacturer engaged in the USD 46 billion wind markets, Suzlon is acutely aware of global economic trends, policy movements and the fluctuating energy markets.

Market Sentiments and Expert Predictions

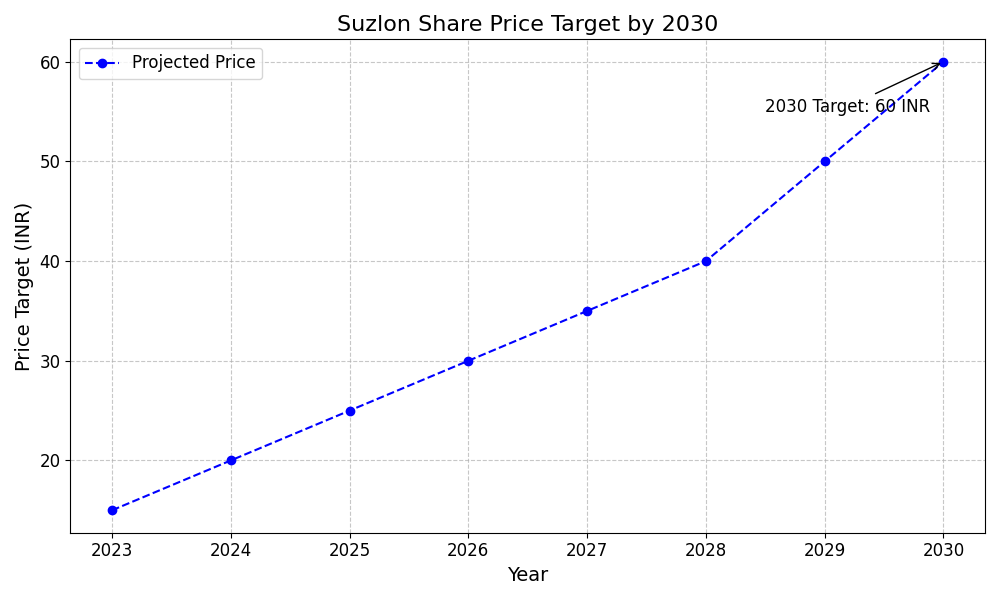

The latest reports from major brokerage houses predict that the share price target of Suzlon for 2030 will be between Rs 200 and Rs 250. This is a positive outlook because of India’s strong goals for renewable energy and the worldwide need for clean energy.

The launch of new wind turbines and deals for offshore wind projects also strengthen investor trust in Suzlon’s ability to stay a leader in the industry.

- Morgan Stanley: Repeats that it has an “overweight” view, expecting a long-term target price of Rs 230, assuming steady revenue growth and less debt.

- JM Financial: Notes Suzlon’s efforts to reduce debt as a key factor, aiming for a target of Rs 220 by 2030.

- Geojit Financial Services: Mentions the company’s strong position in local and global markets, predicting a share price of Rs 240 by 2030.

Despite obstacles, the mood is upbeat, with strategic innovations and government support for renewable energy initiatives serving as positive triggers.

What is the Suzlon Share Price Target 2030?

Suzlon Share Price Details

| Detail | Value |

|---|---|

| Current Share Price (NSE) | ₹57.26 |

| 52-Week High | ₹86.04 |

| 52-Week Low | ₹35.50 |

| Market Capitalization | ₹77,609 Crore |

| P/E Ratio | 78.7 |

| Book Value | ₹3.32 |

For investors looking to stay updated on Suzlon’s performance and forecasts, the following platforms are highly recommended:

- Financial Websites: Updates, analysis, and real time are provided by Moneycontrol, NSE, BSE, Bloomberg and other such platforms.

- Stock Tracking Tools: To get data, historical data, and predictions, use apps or tools.

- Company Reports: Look at Suzlon’s financial reports and press releases periodically for clues on how it is doing and how it plans to do so.

Investment Prospects

Suzlon Energy presents a compelling case for investors, especially those interested in the renewable energy sector:

- Short-Term Gains: Short term appreciation potential is implied by analysts’ target prices.

- Long-Term Growth: And like with many companies, global sustainability goals align with their focus on innovation and expanding renewable energy capacity.

- Risks: There are some things to watch out for — high debt levels, changes in regulation, competitive pressures — and what most managers fail to do is manage down this debt.

Conclusion

Suzlon Energy’s rise in the renewable energy sector is a testament to its resilience, as well as its innovation. The company has its problems but the strategic initiatives and the position in the market give good conditions for future growth. Risks versus opportunities: With share price target promising for Suzlon, investors need to reconcile the two.

Continue to monitor Suzlon performance on reliable financial platforms and company updates to take advantage of when Suzlon flowers in the evolving renewable energy gardening.

Pingback: IRB Infra Share Price Target 2030: Growth Insights & Trends

Pingback: Best Stocks Under ₹100: Short-Term Gains in India - Tech Venture Spot