Bajaj Finance Ltd: Introduction

India’s leading non banking financial company (NBFC) Bajaj Finance Ltd. continues to redefining the financial sector with its diversified products and innovative approach. Bajaj Finance, specialized in consumer lending, SME lending, commercial lending and wealth management market has become a leader in this segment. With a market cap of ₹4.50T, the company is one of the main market structures in creating India’s narrative on the financial space. In this, the focus is on Bajaj Finance’s share target in 2030 and how historical performance, a technical analysis, and future projections have framed this stock.

Why Bajaj Finance is a Market Leader

| Feature | Description |

|---|---|

| Diverse Offerings | From consumer loans to wealth management, across broad spectrum. |

| Market Strength | Sector dominance reflected in Market cap ₹4.50T |

| Technological Innovation | Digital customer experience solutions that are cutting edge. |

Historical Performance: Setting the Stage

Bajaj Finance has a proven history of delivering best in class returns, with resilience in market volatility.

Performance Metrics

| Metric | Value |

|---|---|

| Lifetime Returns | 131,131.03% |

| Recent Trends | Withstood bad market fluctuations while keeping investor base. |

| Strong Fundamentals | In each step it consistently outperformed expectations. |

Historical performance of Bajaj Finance points that for long term investor Bajaj finance has the potential to grow sustainably.

Technical Analysis: Future Trajectories Prediction

Technical patterns analysis of Bajaj Finance stock gives very promising trends.

Key Technical Indicators

- Support & Resistance Levels: Strong demand in the form of a stable trading range is indicated.

- Upward Momentum: While it may grow at a modest pace in the short term it is likely to extend its pace in the medium to long term.

- Projection Models: Very likely to see significant price appreciation by 2030.

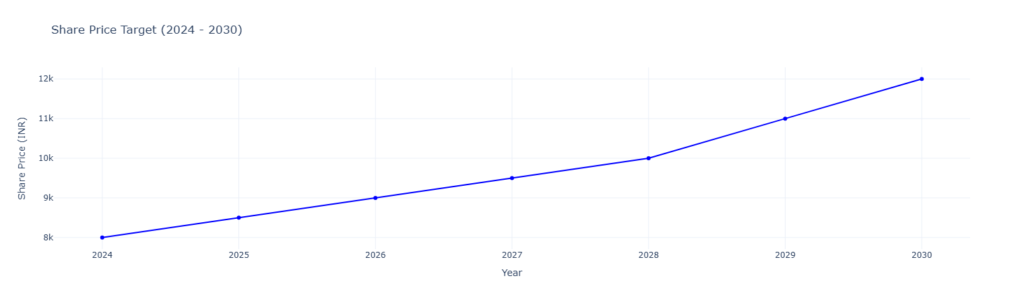

Bajaj Finance Share Price Target 2030

The Bajaj Finance analysts use historical data, technical insights and market dynamics to predict big things will happen to the company in 2030.

Price Projections

| Year | Estimated Price (₹) |

|---|---|

| 2023 | 8,500 |

| 2025 | 10,100 |

| 2030 | 35,763 to 38,147 (Avg: 36,955) |

| 2040 | 45,000 |

And these projections point to how the company can take advantage of new opportunities and generate long term value.

Investment Analysis: Growth Opportunities

With this much annual growth rate predicted, Bajaj Finance is undoubtedly a good choice for long term investment.

Why Invest in Bajaj Finance?

| Factor | Detail |

|---|---|

| Earnings Growth | Expected +5.38% growth rate |

| Share Price Growth | In a year, there is estimated rise to ₹7679.17 from ₹7287. |

| Long-Term Stability | Returning consistently for constant growth |

In case of steady growth and robust returns, Bajaj Finance offers a very strong case.

Future outlook and market trends.

The changing financial landscape offers scope for creative companies such as Bajaj Finance to flourish.

Key Trends

- Digital Transformation: Upscaling in UPI and tech services.

- Government Support: Favorable NBFC policies.

- Economic Dynamics: Growth depends on these things; inflation and monetary shifts.

With these trends constantly ahead, Bajaj Finance is in a position to continue market leadership.

Risks and Challenges

The outlook for Bajaj Finance is pretty positive but investors need to know there are risks too.

Key Risks

- Valuation Concerns: An indicator of overvaluation is high P/E ratio.

- Economic Uncertainty: Growth is affected by global economic changes.

- Regulatory Changes: There are also the challenges with compliance norms.

- Investment diversification will help ease these risk and enable you to have a balanced portfolio.

Conclusion: A Strong Investment Opportunity.

India’s financial sector is dominated by Bajaj Finance Ltd, which is likely to continue to be a leading player in India for long term investors.

Key Takeaways

- Historically robust, with positive technical trends, continued growth is very likely.

- Good future prospects are created by expanding digital services and a welcoming government policy.

- Its potential is projected to highlight its share price target of ₹35,763 to ₹38,147 in the year 2030.

- Investors seeking a balance of stability and growth will find the opportunity to participate in India’s financial evolution in Bajaj Finance. Invest diversely, stay informed, consult with financial experts to make the best out of your investment.

Pingback: Suzlon Share Price Target 2030: Expert Insights & Forecasts