Scoda Tubes Limited IPO Overview

One of the fastest-growing stainless-steel pipe manufacturers in India, Scoda Tubes Limited, is already commanding a ₹22 Grey Market Premium (GMP) as of today, and its initial public offering (IPO) is scheduled to launch on May 28, 2025. Compared to the upper price range of ₹140, that suggests possible listing gains of more than 15%.

In this handbook:

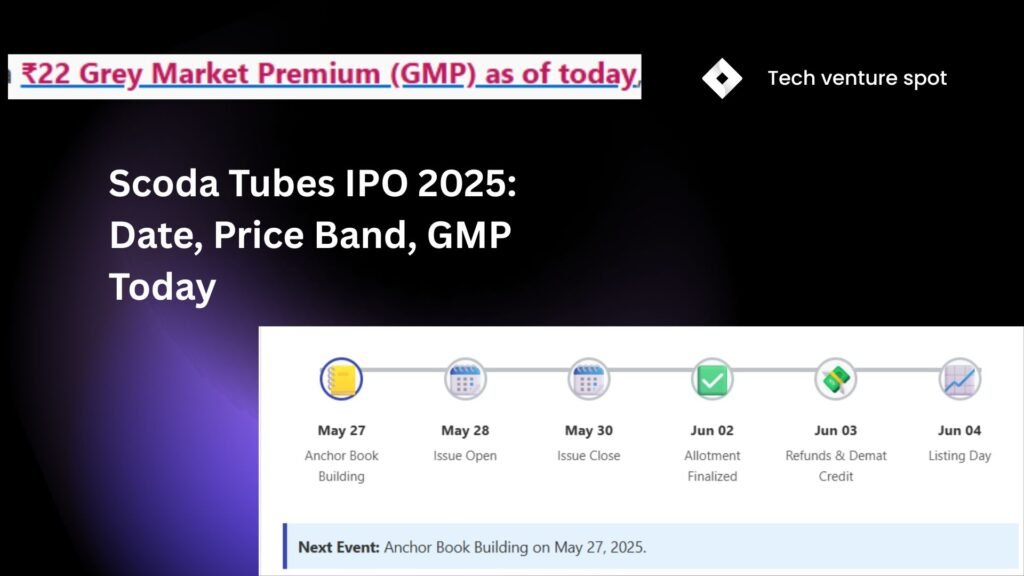

IPO Timeline & Key Dates

1. IPO Snapshot

| Parameter | Detail |

|---|---|

| Anchor Book Building | May 27, 2025 |

| Issue Open | May 28, 2025 |

| Issue Close | May 30, 2025 |

| Price Band | ₹130 – ₹140 per share |

| Lot Size | 100 shares (₹14,000 at ₹140) |

| Issue Size | ₹220 Cr (15,714,286 fresh shares) |

| Face Value | ₹10 per share |

| Pre-Issue Market Cap | ₹618.7 Cr |

| Post-Issue Market Cap (at ₹140) | ₹838.7 Cr |

| Listing On | BSE & NSE |

2. Grey Market Premium (GMP) Trends

| Date | GMP (₹) | Trend | Subject-to-Sauda (₹) |

|---|---|---|---|

| May 27 | 22 | ↑ Up | 1,800 |

| May 26 | 18 | ↑ Up | 1,200 |

| May 24 | 18 | ↑ Up | 1,200 |

| May 23 | 10 | ↑ Up | 600 |

GMP Visualization

Takeaway: GMP jumping from ₹10 to ₹22 in four trading days shows strong demand—but grey-market rates can swing sharply before listing.

3. Company at a Glance

Scoda Tubes Limited (est. 2008) is a leading manufacturer of stainless-steel pipes and U-tubes, supplying to oil & gas, power, petrochemical and engineering sectors. Key products:

- Seamless Pipes: Hot-pierce rolling process → mother hollows → finished tubes

- Instrumentation Tubes for high-pressure applications

- U-Tubes for heat exchangers in power plants

FY24 Financials (per RHP)

| Metric | Amount |

|---|---|

| Revenue | ₹402.49 Crores |

| Profit After Tax | ₹18.30 Crores |

Financials Visualization (FY24)

Also Read: Prostarm Info Systems IPO GMP, Price & Key Details

4. Issue Mechanics & Reservation Quotas

| Category | Quota | Min. Bid Shares | Min. Amount | Apps Reserved / Shares |

|---|---|---|---|---|

| Retail | 35% | 100 | ₹14,000 | 55,000 (Applications) |

| Small HNI | 5% | 1,500 | ₹210,000 | 524 (Applications) |

| Big HNI | 10% | 7,200 | ₹1,008,000 | 1,048 (Applications) |

| QIB¹ | 50% | – | – | 7,857,143 shares |

| Total | 100% | – | – | 15,714,286 shares |

¹Includes anchor allotments.

HNI Sub-Breakup:

- Small HNI (₹2–10 Lakh): 5% → 785,714 shares (₹11 Cr)

- Large HNI (>₹10 Lakh): 10% → 1,571,429 shares (₹22 Cr)

Retail Total:

35% → 5,500,000 shares (₹77 Cr)

5. Anchor Investor Allocation

On May 27, Monarch Networth Capital allocated 4,714,200 shares at ₹140 to six anchor funds:

| Anchor Investor | Shares | % of Anchor Book | Value (₹) |

|---|---|---|---|

| Malabar India Fund Limited | 2,142,800 | 45.45% | 299,992,000 |

| MNCL Capital Compounder Fund 2 | 1,142,600 | 24.24% | 159,964,000 |

| Aarth AIF Growth Fund | 357,200 | 7.58% | 50,008,000 |

| IMAP India Capital – Catalyst New India Fund | 357,200 | 7.58% | 50,008,000 |

| Chhattisgarh Investments Limited | 357,200 | 7.58% | 50,008,000 |

| Swyom India Alpha Fund | 357,200 | 7.58% | 50,008,000 |

| Total | 4,714,200 | 100% | 659,988,000 |

Also Read: Schloss Bangalore IPO GMP, Price, Status & Review

Timeline & Next Steps (Detailed Table)

| Event | Date |

|---|---|

| Basis of Allotment Finalized | June 2, 2025 |

| Refunds Initiated & Demat Unblocking | June 3, 2025 |

| Shares Credit to Demat | June 3, 2025 |

| Listing & Trading Commences | June 4, 2025 |

6. Contacts

Company Secretary & Compliance Officer

Nishita Sanghvi

📧 cs@scodatubes.com | 📞 +91 2764 278 278

Book Running Lead Manager

Monarch Networth Capital Limited

Saahil Kinkhabwala & Aayushi Poddar

📧 ecm@mnclgroup.com | 📞 +91 22 6647 6400

Registrar

MUFG Intime India Private Limited

Also Read: Borana Weaves IPO: Key Details, Pros & Listing Outlook

7. FAQs & Investor Takeaways

Frequently Asked Questions

- GMP: What is it?

- An unofficial grey market measure of demand for listings. Although it includes execution risk, a high GMP can indicate significant listing benefits.

- Kostak Rate: What is it?

- To move your IPO application off-market, you must pay a premium. For Scoda Tubes, Kostak is currently zero.

- Subject-to-Sauda: What is it?

- The pre-listing settlement cost in the event that your application is rejected. It is currently ₹1,800.

Who ought to submit an application?

- Retail: Compare GMP to the ₹130–₹140 area for small gains.

- HNIs/QIBs: Keep an eye on fluctuations in the gray market for allocation and more exposure.

Key Risks

- Variable premiums in the grey market.

- Inflation of raw material costs.

- Dilution of promoter (90% → 66% post-issue).

Disclaimer: This information is for informational purposes only and does not constitute financial advice. Investing in IPOs involves risks. The "Also Read" link at the very beginning was Aegis Vopak Terminals IPO: https://techventurespot.com/aegis-vopak-terminals-ipo