Record AUM Rs 72.2 lakh crore: May 2025 AUM Milestone

The Indian mutual fund industry achieved a historic milestone in May 2025. The total Assets Under Management (AUM) surged to a record ₹72.2 lakh crore. This growth was fueled by strong equity inflows, altering investor preferences, and a significant shift of money from debt to equity instruments.

What Changed and Why It Matters

This succinct, data-driven guide helps understand the key changes, their significance, and how you might position yourself for the next wave of growth.

Market Sentiment Shift

Rising GDP growth projections (7.5% in FY26) encouraged equities investments.

Bank Deposit Saturation

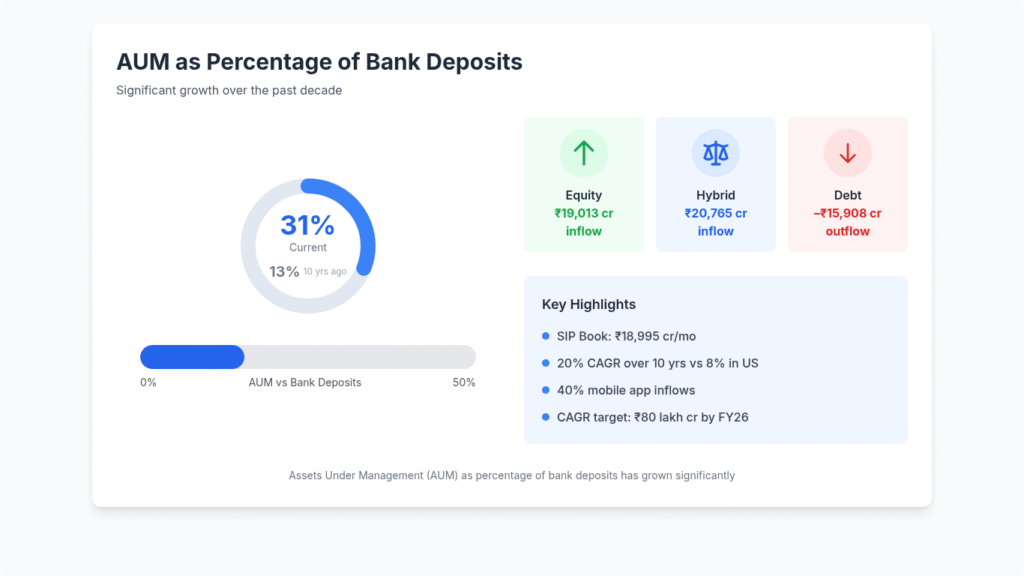

Mutual fund AUM now accounts for 31% of bank deposits, up from 13% a decade ago.

Digital Adoption

40% of inflows come through smartphone apps, lowering entrance barriers.

Top Drivers Behind the ₹72.2 Lakh Crore Surge

- The Sensex and Nifty gained 12% year-to-date, with multi-cap and flexi-cap net inflows of ₹9,840 cr.

- Balanced advantage funds saw a net inflow of ₹1,136 crore due to increased volatility.

- Investors shifted ₹40,000 crore from liquid funds to short-duration funds.

- The SIP book reached a monthly record high of ₹18,995 crore.

AUM Breakdown by Fund Category (%)

Top Fund Houses: Net Equity Inflow (₹ cr)

Breakdown by Fund Category

| Category | Net Inflow (May ’25, ₹ cr) | AUM Share (%) |

|---|---|---|

| Debt | –15,908.48 | 24.3 |

| Equity | 19,013.12 | 44.5 |

| Hybrid | 20,765.05 | 13.2 |

| Solution Oriented | 177.33 | 0.8 |

| Other (ETFs/Index) | 5,525.98 | 17.2 |

Also Read:

HDFC BAF Cross ₹1Lcr AUM—dynamic hybrid fund leader now! Read more...

Top 15 Funds by AUM

| Rank | Fund Name | AUM (₹ Crore) |

|---|---|---|

| 1 | Parag Parikh Flexi Cap Fund Direct - Growth | 1,03,868.00 |

| 2 | HDFC Balanced Advantage Fund Direct - Growth | 1,00,299.00 |

| 3 | SBI Liquid Fund Direct - Growth | 81,785.50 |

| 4 | HDFC Mid-Cap Opportunities Fund Direct - Growth | 79,717.70 |

| 5 | HDFC Flexi Cap Fund Direct - Growth | 75,784.50 |

| 6 | SBI Equity Hybrid Fund Direct - Growth | 75,639.20 |

| 7 | HDFC Liquid Fund Direct - Growth | 73,208.70 |

| 8 | ICICI Prudential Large Cap Fund Direct - Growth | 69,762.50 |

| 9 | Kotak Equity Arbitrage Fund Direct - Growth | 67,362.10 |

| 10 | ICICI Prudential Balanced Advantage Fund Direct - Growth | 63,786.80 |

| 11 | Nippon India Small Cap Fund Direct Plan Growth Plan - Bonus Option Bonus | 63,006.70 |

| 12 | Nippon India Small Cap Fund Direct - Growth | 63,006.70 |

| 13 | ICICI Prudential Multi Asset Fund Direct - Growth | 59,452.30 |

| 14 | ICICI Prudential Liquid Fund Direct - Growth | 55,812.20 |

| 15 | Kotak Emerging Equity Fund Direct - Growth | 53,463.90 |

Which Fund Houses Saw the Biggest Jumps?

- HDFC Mutual Fund saw a net equity inflow of ₹6,500 crore, with strong tech and financials calls.

- ICICI Prudential made ₹5,200 crore in hybrid and debt to equity swaps.

- Kotak MF saw a net inflow of ₹3,600 crore from sectoral themes (PSUs and infrastructure).

- Reliance MF's 20% AUM growth is fueled by systematic flows.

Risks to Watch Despite Record Inflows

- Stretched Valuations: Nifty PE ratio at 22x versus the 10-year average of 18x.

- Rate Volatility: Bond yields may be impacted by the RBI's position.

- Global Headwinds: A tightening of Fed policy may lead to outflows.

- Liquidity Mismatches: Inverse arbitrage in the debt ETF market.

Expert Predictions on Mutual Fund AUM's Future

- "Look for 15–18% AUM CAGR in FY26 as fiscal stimulus winds down and corporate earnings normalize," advises an AMFI strategist.

- If SIP pace continues, the next milestone is ₹80 lakh cr by Q1 FY26.

- Emerging categories: FOFs and ETFs will increase by 25% year over year.

- AI-powered advice to onboard new investors is part of the digital revolution.

Pingback: Handpicked List of Mutual Funds 2025 (PlumbLine)