Nifty Midcap 50 Index

As of May 30, 2025

I find the Nifty Midcap 50 Index to be a particularly interesting segment of the market. Its main goal is to capture the performance of the most liquid and actively traded mid-cap stocks. It's a curated list, selecting the top 50 companies from the broader Nifty Midcap 150 index based on their average free-float market capitalization.

A key detail for me is that preference is given to companies available for trading in the Futures & Options (F&O) segment. This acts as a filter for liquidity and investor interest. For this analysis, I'm focusing on the Total Returns Index variant because it includes dividends, giving a more accurate representation of investor returns.

Also Read:

Key Performance & Fundamental Metrics

Here's my breakdown of the index's vital statistics. The strong 5-year CAGR stands out, pointing to robust growth in this space, though the P/E ratio suggests a premium valuation compared to the broader market.

Total Return (1 Year)

Total Return (5 Yr CAGR)

P/E Ratio

P/B Ratio

Dividend Yield

Beta (vs NIFTY 50)

Visualizing the Index Composition and Performance

To get a better feel for the index, I've visualized its historical performance and composition. The long-term chart showcases the significant growth potential inherent in the mid-cap segment. The sector allocation is heavily tilted towards Financial Services, which is a key driver of its performance.

Historical Performance (Since 2004)

Sector Representation (%)

Top 10 Constituents by Weightage (%)

Also Read:

Nifty Midcap 50 Stocks List

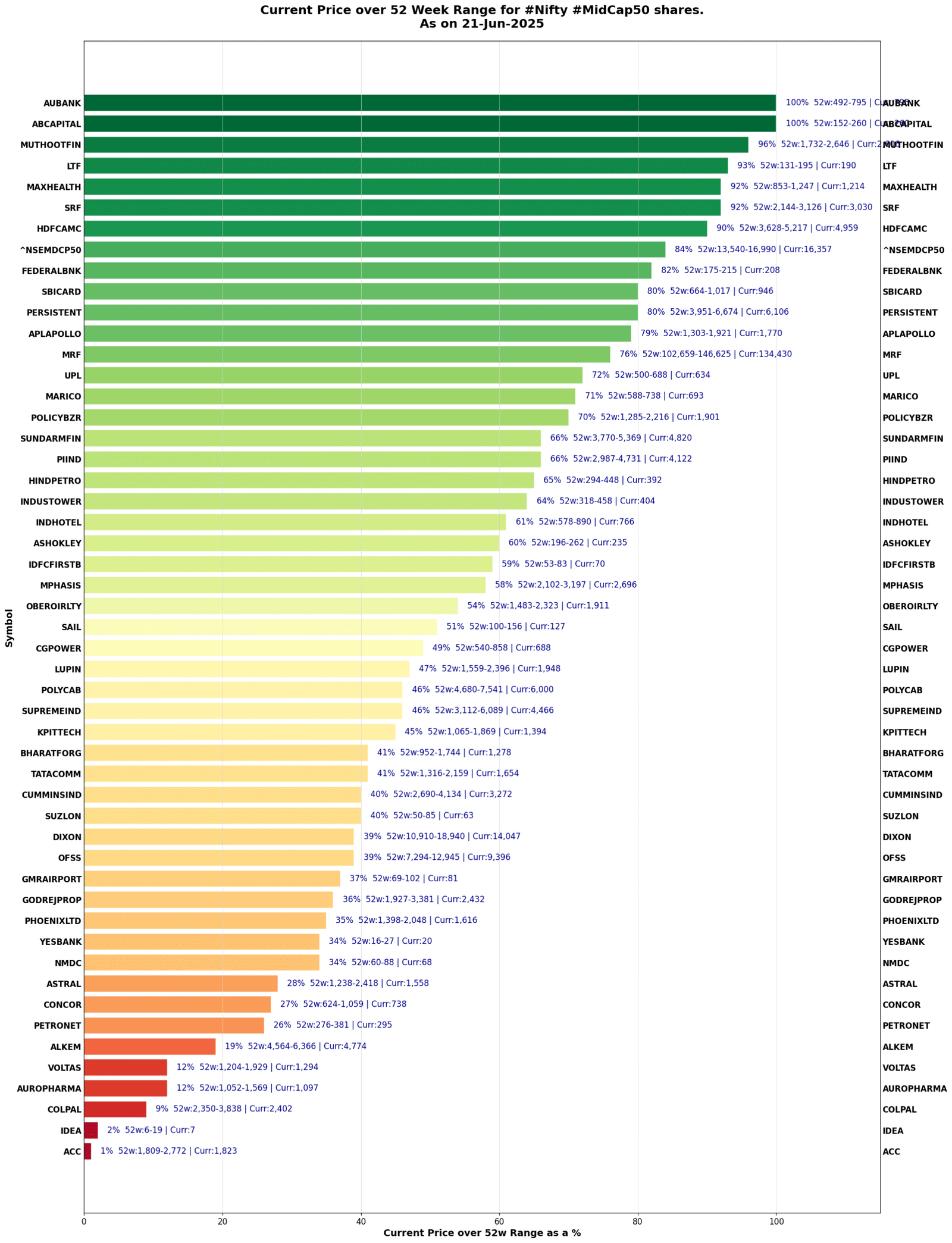

For a more detailed examination, I've compiled the full list of the 50 companies in the Nifty Midcap 50 Index, updated with the latest available stock prices. This table is interactive—you can search for a specific company or sort the columns by clicking on the headers. (price source: fetch from the yfinance)

| Company Name | Symbol | Price (INR) As of 21 June, 2025 |

|---|

My Notes on the Index Methodology

The rules for inclusion and exclusion are quite specific, which I appreciate as it maintains the index's integrity and focus on high-quality mid-caps.

- Universe: Companies must first be part of the Nifty Midcap 150 index.

- Selection Pool: The top 100 companies from the universe are selected based on average daily market cap and turnover. From this pool, the final 50 are chosen.

- Inclusion Criteria: Securities are included based on their 6-month average free-float market capitalization, with a preference for F&O stocks.

- Exclusion Criteria: A stock is removed if its rank falls below 70 in the eligible universe or if it's dropped from the parent Nifty Midcap 150 index.

- Rebalancing: The index is rebalanced semi-annually (based on data ending Jan and Jul) to ensure it stays current, with changes implemented at the end of March and September.

Pingback: Nifty Bank Stocks List 2025 - with Weightage & Prices

Pingback: Nifty Chemical Stocks List NSE – with Price & P/E Ratio