Mutual Fund NAV Cut-off Time: A Guide for Investors

When you invest in or redeem from a mutual fund, the fund house determines the Net Asset Value (NAV) you receive based on specific timing rules. Understanding these cut-off times is crucial whether you're making a lump-sum purchase, running an SIP, or redeeming units. This guide breaks down everything you need to know about NAV allocation.

Understanding Key Terms

- Cut-off Time: This is the deadline by which your transaction request (purchase, switch, or redemption) must reach the fund house to be eligible for the same day's NAV.

- NAV Allocation Time: The point at which the fund house calculates and applies the Net Asset Value (NAV) to your transaction. This depends on when your request and funds are received.

- Business Day: Any day the financial markets are open. This excludes weekends and public holidays.

Why Cut-In Time Matters for Investors

Price Certainty: In volatile markets, even small differences in NAV can significantly impact your investment's value. Meeting the cut-off helps you lock in a predictable price.

Liquidity Planning: NAV allocation time is critical for managing your cash flow, especially when dealing with debt or liquid funds where you might need quick access to your money.

SIP Discipline: For Systematic Investment Plans (SIPs), missing the cut-off time can push your investment to the next business day's NAV, affecting your long-term averaging strategy.

SEBI's Updated Rules on NAV Cut-Off Times

The Securities and Exchange Board of India (SEBI) regularly updates its framework to enhance transparency and protect investors. Recent updates, effective since April 22, 2025, have refined cut-off timings, particularly for overnight funds.

Background of Changes

These changes build upon earlier regulations, such as the February 1, 2021 rule, which linked NAV allocation to the actual realization of funds in the mutual fund's bank account, not just when you make the payment.

Detailed Changes in Cut-off Time

The most significant update pertains to overnight mutual fund plans. The key changes are:

- Standard Cut-off: For redemption applications received by 3:00 PM on a business day (T), the closing NAV of Day T is applicable. For requests after 3:00 PM, the NAV of the next business day (T+1) applies.

- Extended Cut-Off for Online Redemptions: For online redemption requests in overnight funds, the cut-off is extended to 7:00 PM. If you submit an online request by 7:00 PM on day T, you will receive the closing NAV of day T.

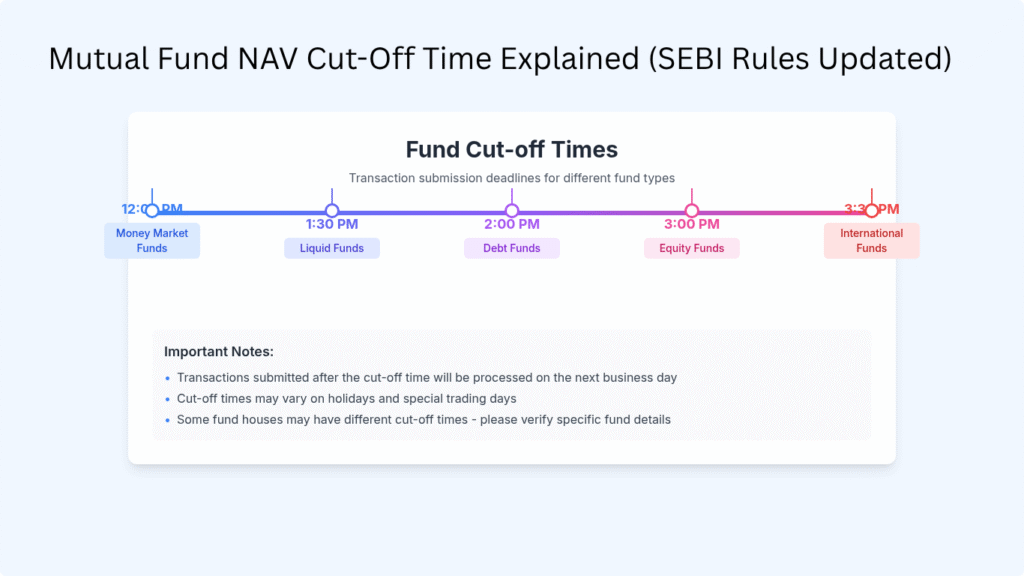

Cut-off Timings for Different Fund Schemes

Here is a summary of the standard cut-off times for various transactions across fund types.

| Scheme Type | Transaction Type | Cut-off Timing |

|---|---|---|

| Liquid Funds & Overnight Funds | Subscription (including Switch-in) | 1:30 PM |

| Liquid Funds & Overnight Funds | Redemption (including Switch-out) | 3:00 PM |

| All Other Schemes (Equity, Hybrid, etc.) | Subscription (including Switch-in) | 3:00 PM |

| All Other Schemes (Equity, Hybrid, etc.) | Redemption (including Switch-out) | 3:00 PM |

Visualizing the Cut-off Times

Step-by-Step Guide to Placing Orders

- Verify the Fund Type: Is it an Overnight/Liquid fund or another type? This determines the specific cut-off window.

- Check Cut-off Windows: Refer to the table to know your deadline.

- Start the Process Early:

- Online: Complete your payment at least one hour before the cut-off to account for any processing delays.

- Offline: Ensure your cheque and request form are submitted and stamped at the AMC office well before the deadline.

- Verify Fund Realization: The crucial step! Your money must be credited to the fund house's account before the cut-off. Check your transaction status on the platform to ensure it's not "Pending Realization."

- Monitor NAV Allocation: Your investment platform will display the NAV date for each transaction, confirming if you met the deadline.

Also Read: Best Low Risk High Return Mutual Funds in India 2025

SBI Mutual Fund NAV Cut Off Time: A Case Study

The rules apply universally, including for SBI Mutual Fund. Here’s how it works in practice:

| Date | Action | Time of Request | Funds Realized by AMC | NAV Date Allocated |

|---|---|---|---|---|

| Jun 10, 2025 | Redemption (Equity Fund) | 2:45 PM | N/A (Request before 3 PM) | Jun 10, 2025 |

| Jun 12, 2025 | Lump-sum Buy (Equity Fund) | 2:50 PM | 2:58 PM | Jun 12, 2025 (Realized before 3 PM) |

| Jun 12, 2025 | Lump-sum Buy (Equity Fund) | 2:55 PM | 3:05 PM | Jun 13, 2025 (Realized after 3 PM) |

Frequently Asked Questions (FAQ)

Q1: Do I lose a day if I don't redeem my mutual fund before the 3:00 PM cutoff time?

A1: Yes. Your redemption request will be processed using the NAV of the next business day. This means your money will be delayed by at least one business day compared to meeting the cut-off.

Q2: If my bank transfer shows "completed" at 2:59 PM, will I get the same-day NAV?

A2: Not necessarily. The timestamp that matters is when the funds are realized in the Asset Management Company's (AMC) bank account. Bank processing time can cause a delay. If the AMC receives the money after 3:00 PM, you will get the next day's NAV.

Q3: Do SIPs have a different mutual fund NAV allocation time?

A3: No. SIP transactions are subject to the same cut-off rules. The funds for your SIP installment must be realized in the AMC's account before the cut-off time (e.g., 3:00 PM for an equity fund SIP) to get that day's NAV.