How Startup Funding Works

Splitting the Pie: An Interactive View of Company Equity

Select a funding stage to see how equity distribution changes over time as new investors join and the company grows.

The Key Players

Understanding the roles of different individuals and groups in the funding journey of a startup.

You (Founder)

Starts the company with an idea. Initially owns 100% of nothing, which is a lot less than 17% of a big company.

Co-Founder

Joins the founder early on to help build the company. Typically does half the work and receives a significant equity stake.

Friends and Family

Invests before anyone else, often at the lowest price and highest risk. This early support is crucial for getting the idea off the ground.

Angel Investors

Wealthy individuals who invest their own money. Usually an accredited investor with significant business experience.

Venture Capitalists (VCs)

Firms that invest other people's money into promising startups. They typically invest large sums in exchange for significant equity and a board seat.

Early Employees

Join the company post-seed funding. Gamble on the company's success by accepting lower salaries in exchange for stock from the option pool.

Investment Bankers

Manage the Initial Public Offering (IPO) process, handling paperwork and selling the company's stock to the public market, taking a fee for their services.

Anyone (The Public)

After a company goes public (IPO), anyone can buy its shares on the stock market, becoming an investor and partial owner.

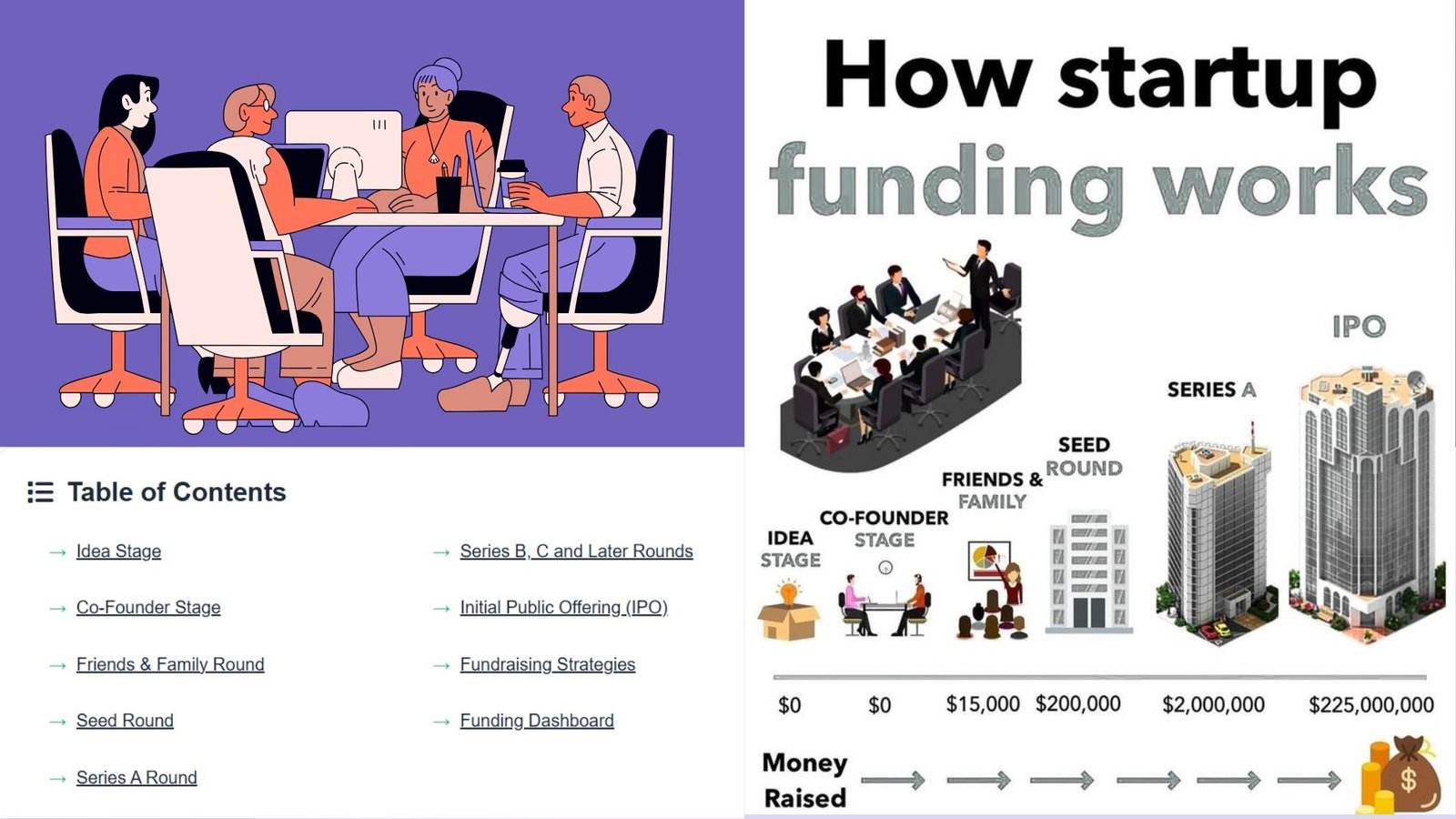

Startup Funding Stages

Table of Contents

Startup funding progresses through several distinct stages, each with specific goals, activities, and funding ranges. This guide explains each stage in detail with key activities, typical funding amounts, and strategies for success.

Idea Stage

Validate your concept with minimal investment

This initial phase focuses on validating your business concept before seeking external funding. The goal is to test whether your idea solves a real problem in the market.

Key Activities:

- Draw or diagram your product/service

- Research market conditions and competitors

- Define your target customer profile

- Test core assumptions with minimal budget

- Create initial business model canvas

Key Terms:

Success Tip: Focus on problem-solution fit before building anything. Talk to potential customers to validate pain points.

Co-Founder Stage

Build your founding team and initial prototype

This stage focuses on assembling your core team and developing an initial prototype. You'll define roles, equity distribution, and create your first product iteration.

Key Activities:

- Recruit co-founders with complementary skills

- Define roles, responsibilities, and equity split

- Develop a working prototype

- Establish company vision and values

- Create founder agreements

Key Terms:

Success Tip: Clearly document all agreements between founders. Ambiguity in early-stage agreements causes problems later.

Friends & Family Round

First external funding from personal network

The first formal funding round typically comes from personal connections who believe in you and your vision. This capital helps build your MVP.

Key Activities:

- Formally pitch to close connections

- Explain product, market size, and early traction

- Use SAFE or convertible notes

- Set clear expectations about risk

- Establish basic financial reporting

Key Terms:

Success Tip: Treat friends and family investors professionally with clear documentation. This establishes good habits for future rounds.

Seed Round

Develop and launch your MVP

Seed funding helps you build your Minimum Viable Product (MVP), acquire early customers, and validate product-market fit.

Key Activities:

- Develop and launch MVP

- Acquire first 100-1,000 customers

- Create investor pitch deck

- Prove product-market fit

- Build founding team

Key Terms:

Success Tip: Focus on demonstrating early traction. Investors want to see growing user numbers and engagement metrics.

Series A Round

Optimize and scale your business model

Series A funding helps you optimize your business model and accelerate growth. Investors expect clear metrics showing product-market fit.

Key Activities:

- Demonstrate consistent user/revenue growth

- Refine business model and unit economics

- Establish key performance metrics

- Formalize company structure

- Build specialized teams

Key Terms:

Success Tip: Focus on unit economics. Investors want to see a clear path to profitability at scale.

Series B, C and Later Rounds

Scale operations and expand markets

Later-stage funding focuses on scaling operations, entering new markets, and expanding product offerings.

Key Activities:

- Build specialized teams (sales, marketing, engineering)

- Expand to new markets (geographic or vertical)

- Develop thorough due diligence materials

- Create detailed financial models

- Acquire complementary businesses

Key Terms:

Success Tip: Develop rigorous financial models and operational metrics. Later-stage investors expect professional-grade reporting.

Initial Public Offering (IPO)

Access public capital markets

An IPO represents the transition from private to public company, providing access to public capital markets.

Key Activities:

- File S-1 registration statement

- Prepare investor roadshow materials

- Establish strong corporate governance

- Implement financial reporting systems

- Build investor relations function

Key Terms:

Success Tip: Establish robust financial controls and governance structures well before beginning the IPO process.

Fundraising Strategies

Preparation

- Develop a functional prototype before fundraising

- Create clear financial projections

- Prepare due diligence materials in advance

- Build a compelling pitch deck

Communication

- Simplify your vision for broader understanding

- Use customer stories instead of generic statistics

- Focus on persuasion over impressive jargon

- Maintain transparent communication

Networking

- Leverage warm introductions from current investors

- Focus on investors who understand your space

- Prioritize quality relationships over quantity

- Attend industry-specific events

Control

- Use SAFE agreements for simpler negotiations

- Maintain founder decision-making authority

- Be strategic about board composition

- Protect founder equity through vesting schedules

Funding Dashboard

Funding Progression

Startups typically progress through 7 distinct funding stages from concept to IPO.

The journey from Idea to IPO takes 7-10 years on average, though timing varies significantly by industry.

Investor Types

Different investor types participate at different stages:

- Friends & Family: Idea to Seed stages

- Angel Investors: Seed to Series A

- VC Firms: Series A through Growth

- Private Equity: Growth to Pre-IPO

- Public Markets: IPO and beyond

Equity Dilution

Founders typically retain 10-20% equity at IPO:

- Pre-Seed: Founders 100%

- Seed: 10-25% dilution

- Series A: 15-25% dilution

- Series B: 10-20% dilution

- Later Rounds: 10-15% per round

- IPO: 15-25% dilution

Key Funding Metrics

| Stage | Avg. Funding | Valuation Range | Success Rate | Timeline |

|---|---|---|---|---|

| Idea | $0 | $0-500k | N/A | 3-6 months |

| Co-Founder | $0-15k | $500k-1M | 60% | 3-9 months |

| Friends & Family | $15k-200k | $1M-3M | 40% | 6-12 months |

| Seed | $200k-2M | $3M-10M | 30% | 12-18 months |

| Series A | $2M-15M | $10M-30M | 20% | 18-24 months |

| Series B | $10M-30M | $30M-100M | 15% | 24-36 months |

| IPO | $100M+ | $1B+ | 1% | 7-10 years |