Glen Industries IPO: Overview

Company Overview

Glen Industries Limited specializes in manufacturing a diversified range of packaging and serving food items. Its main products include Thin Wall Food Containers, Polylactic Acid (PLA) Straws, and Paper Straws.

The firm's products are primarily supplied to the HoReCa industry and the broader food and beverage packaging market.

Objects of the Issue

The net proceeds of the IPO will be utilized for:

- Establishing a new manufacturing unit in Purba Bardhaman, West Bengal.

- General business applications and corporate purposes.

IPO Quick Look

| Glen Industries IPO Date and GMP | |

|---|---|

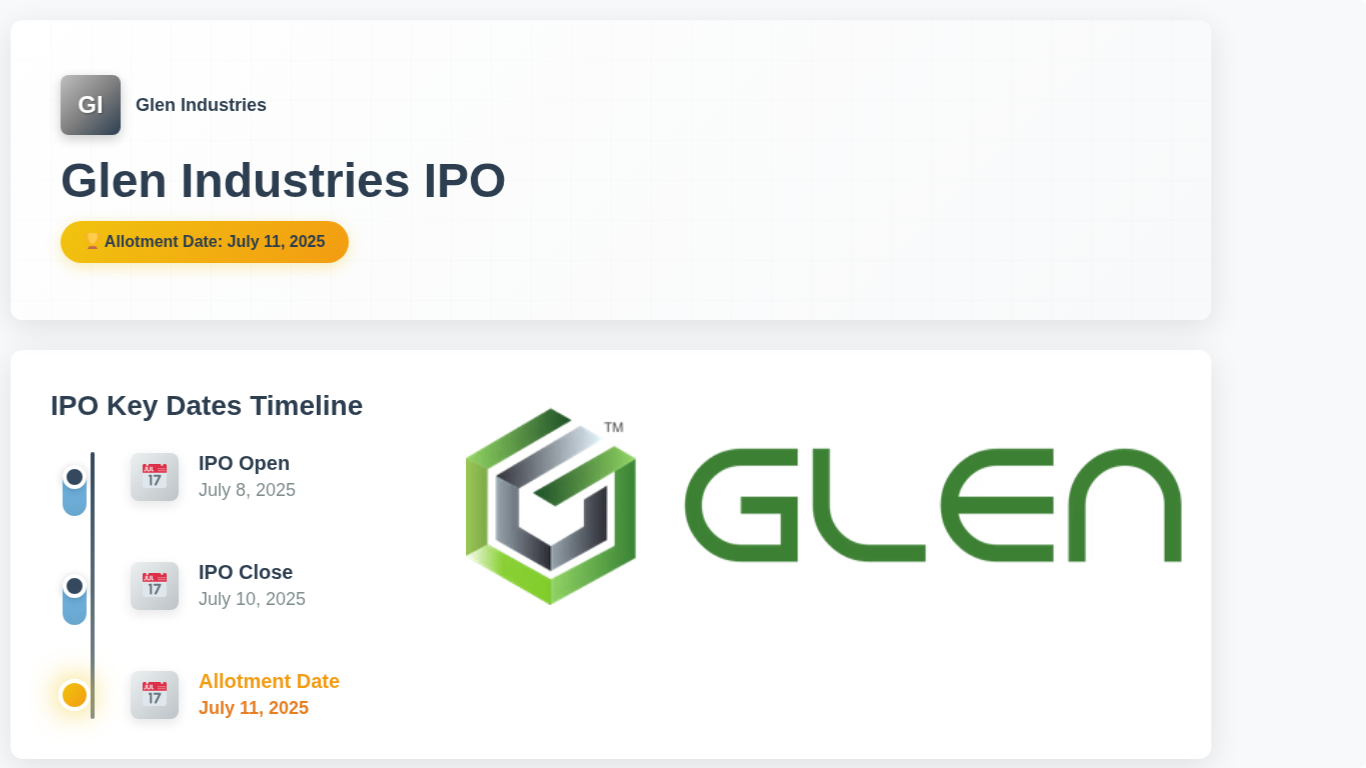

| IPO Open Date: | July 8, 2025 |

| IPO Close Date: | July 10, 2025 |

| Allotment Date: | July 11, 2025 |

| Listing Date: | July 15, 2025 |

| Price Band: | ₹92–₹97 per share |

| GMP (as of July 7, 2025): | ₹25 |

| Exchange & Board: | BSE SME (Not a mainboard IPO) |

Also Read: Vandan Foods IPO GMP

Link: https://techventurespot.com/vandan-foods-ipo-gmp

Glen Industries IPO Financials

Here is a summary of the company's restated consolidated financial performance (in ₹ lakhs):

| Particulars | For Period Ended June 30, 2024 | For Year Ended March 31, 2024 | For Year Ended March 31, 2023 | For Year Ended March 31, 2022 |

|---|---|---|---|---|

| Revenue from Operations | 4,323.34 | 14,450.02 | 11,885.07 | 9,385.37 |

| EBITDA | 1,056.03 | 2,486.88 | 1,389.06 | 1,329.99 |

| Profit After Tax (PAT) | 523.71 | 857.89 | 148.55 | 367.83 |

| Total Borrowings | 9,328.18 | 8,882.75 | 8,165.32 | 7,217.60 |

| Net Worth | 2,718.03 | 2,194.32 | 1,336.43 | 1,187.88 |

| EPS (Post-Bonus, ₹) | 2.98 | 4.88 | 0.85 | 2.09 |

Financial Performance Trend (₹ in Lakhs)

Glen Industries IPO Risk (Fundamental Risk Factors)

Key risk factors as disclosed in the DRHP:

- Supplier Reliance: Heavy dependence on outside suppliers for equipment and raw materials. Supply chain disruptions pose a significant risk.

- Price Fluctuation: Exposure to price variations of major raw materials, which are global commodities.

- Reliance on Promoters: The firm heavily relies on the experience of its promoters, especially Mr. Lalit Agrawal.

- Export Revenue: Significant revenue from exports exposes the company to international business risks, geopolitical issues, and currency fluctuations.

- Legal Proceedings: Ongoing tax cases amounting to ₹206.64 lakhs could negatively impact financial health if the outcome is adverse.

- Manufacturing Concentration: All manufacturing is in Howrah, West Bengal, exposing the company to local risks like political instability or natural disasters.

- SME Listing Risks: Listing on the BSE SME exchange involves lower liquidity, higher volatility, and stricter regulations compared to the main board.

Glen Industries IPO Subscription (Reservation Quota)

The allocation for different investor categories in the Net Offer will be as follows:

- Qualified Institutional Buyers (QIB): Not more than 50%

- Non-Institutional Investors (NII/HNI): Not less than 15%

- Retail Individual Investors (RII): Not less than 35%

A portion is also reserved for the Market Maker and potentially for eligible employees. Anchor investors can be allocated up to 60% of the QIB portion.

Investor Reservation Quota

Glen Industries IPO Allotment Procedure

This is a Book Built issue, and allotment is on a proportionate basis. Key steps include:

- Bidding: Investors place bids within the declared price band.

- Price Discovery: A cut-off price is set based on demand.

- Allotment: Shares are allotted. In case of oversubscription in the retail category, allotment is done via a random lottery.

- Share Credit: Allotted shares are credited to investors' Demat accounts.

- Refund: Unsuccessful applicants receive a refund to their ASBA accounts.

IPO Minimum Investment

For this SME IPO, the minimum application size is confirmed to be over ₹100,000. The specific number of shares per lot will be determined based on the final issue price.

Glen Industries IPO FAQs

Q1: What is Glen Industries?

Glen Industries produces food packaging materials such as thin-wall packaging and biodegradable straws (PLA and paper) for food, beverages, and HoReCa sectors.

Q2: Why is the firm issuing an IPO?

The money will primarily be used by the company to set up a new factory to increase its manufacturing capacity and for general corporate expenses.

Q3: Is it a mainboard or SME IPO?

This is an SME IPO, and the shares will be listed on the BSE SME platform.

Q4: Can I apply for a single share?

No, applications must be for a minimum lot of shares, with the total value exceeding ₹100,000.

Q5: Through which channel can I apply for the Glen Industries IPO?

You can apply through any ASBA (Application Supported by Blocked Amount)-facilitated bank account or through a UPI-linked trading account with your broker.

Q6: Who are the promoters of the company?

The key promoters are Mr. Lalit Agrawal, Mrs. Lata Agrawal, Mr. Nikhil Agrawal, and Mrs. Niyati Seksaria.