Dr Agarwal Healthcare IPO Review, Details, Price, News

- January 25, 2025

- MEET AKABARI

- 3:39 am

- Read Time: 6 mins

| Particulars | Details |

|---|---|

| IPO Open Date | January 29, 2025 |

| IPO Close Date | January 31, 2025 |

| Price Band | ₹382 - ₹402 |

| Lot Size | 35 shares |

| Total Issue Size | ₹3,027.26 crores |

| Fresh Issue | ₹300 crores |

| Offer for Sale | 6.96 crore shares |

| Listing Date | February 5, 2025 |

| Registrar | KFin Technologies Limited |

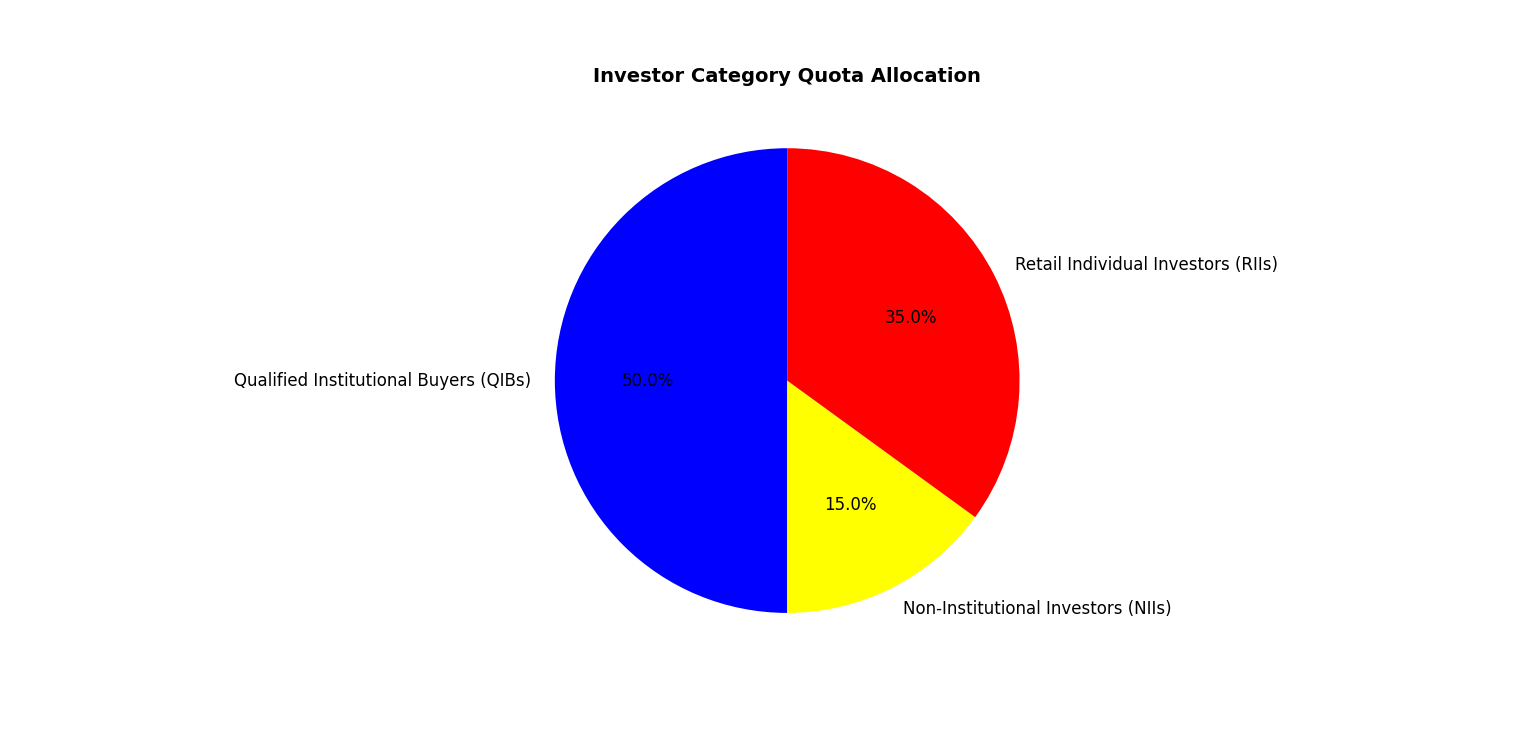

| Retail Allocation | 35% |

| Qualified Institutional Buyers | 50% |

| Non-Institutional Investors | 15% |

| Event | Date |

|---|---|

| IPO Open Date | January 29, 2025 |

| IPO Close Date | January 31, 2025 |

| Basis of Allotment Finalization | February 3, 2025 |

| Refund Initiation | February 4, 2025 |

| Shares Credited to Demat | February 4, 2025 |

| Listing Date | February 5, 2025 |

| Company | Revenue (₹ Cr) | EPS (₹) | RoNW (%) | P/E Ratio | NAV (₹) |

|---|---|---|---|---|---|

| Dr Agarwal Healthcare | 1,376.45 | 3.08 | 6.21 | 130.44 | 50.53 |

| Apollo Hospitals | 19,059.20 | 62.50 | 12.97 | 107.11 | 481.93 |

| Max Healthcare | 6,849.00 | 10.89 | 12.58 | 95.88 | 86.54 |

The upcoming Dr Agarwal Healthcare IPO has caught market attention as the start date approaches January 29, 2025. Investors especially value the Dr Agarwal Healthcare IPO because of its renowned position in providing structured eye care services to customers. The 3,027.26 crores total issue includes 6.96 crore OFS shares combined with a fresh issue of ₹300 crores.

India Opulent Retail’s stock prices will range between ₹382 and ₹402 before its planned listing date on February 5, 2025 on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

The company’s projections of substantial IPO demand stem from its ongoing attractive business expansion coupled with its hub-and-spoke operational infrastructure. Positioned due to its 25% market presence in India’s organized eye care sector the company advances toward major growth as India’s eye care market shows anticipated growth of 12–14% throughout the next four years.

The Dr Agarwal Healthcare IPO will initiate subscriptions from January 29, 2025 to January 31, 2025 while trading between ₹382 to ₹402 per share form until the issue period. The ₹3,027.26 crore IPO amounts to a combination of new share issuance worth ₹300 crores and existing share disposal through an offer for sale of 6.96 crore shares. Investors wait with anticipation for the Dr Agarwal Healthcare IPO to list on BSE and NSE on Feb 5, 2025.

Table of Contents

Company Overview

Indian ophthalmic service provider Dr Agarwal Healthcare operates as a prominent eye care services market participant throughout India and internationally. The company employs a hub-and-spoke business model through its 193 Indian facilities as well as 16 locations abroad in Africa. Dr Agarwal Healthcare delivers cataract surgeries and diagnostic services and professional consultations while capturing 25% of India’s organized eye care service market.

Strengths and Opportunities

- Market Leader: Dr Agarwal Healthcare stands as the prime force in India’s organized eye care sector by treating more than 21 lakh patients throughout the year.

- International Expansion: The company maintains operations throughout nine African nations which creates long-term potential for business expansion.

- Efficient Model: By implementing the ‘hub-and-spoke’ model the company achieves business growth through optimized resource use.

- Revenue Streams: Through a combination of surgeries which comprise 64% of their revenue and optical sales and pharmaceuticals revenue streams the company achieves more resilient operations.

Risks and Challenges

- Competition: Established players like Apollo Hospitals and Max Healthcare present tough competition.

- Dependence on Key Markets: Three states—Tamil Nadu, Maharashtra and Karnataka produce nearly 42 percent of the company’s total revenue.

- Regulatory Risks: The high degree of industry regulation creates potential difficulties for business compliance operations.

- Economic Volatility: External circumstances such as economic inflation together with reduced disposable income may both impact customer numbers at NexGens healthcare facilities alongside decreasing revenue sources.

IPO Objectives

- Debt Repayment: The company will use ₹195 crores to pay off debts which will enhance its financial stability.

- Corporate Purposes: The raised funds will enable expansion alongside investment in IT infrastructure and funding of working capital requirements.

Final Review: Should You Apply?

This IPO provides investors with the rare chance to acquire high growth potential assets in the small but thriving eye care industry. The eye care company’s market leadership position together with an international footprint provide investors with compelling reasons to consider long-term investment. The Dr Agarwal Healthcare IPO makes an appealing healthcare investment opportunity for those who want portfolio diversity.

Call to Action: Secure a portion of Dr Agarwal Healthcare through the IPO subscription period from January 29 to January 31, 2025.

3 thoughts on “Dr Agarwal Healthcare IPO Review, Details, Price, News”

Pingback: Arisinfra soulutions ltd IPO: Comprehensive Analysis for Investors

Pingback: Jana Small Finance Bank Shares: Expert Tips & Forecasts!

Pingback: BigBasket IPO: The Future of Grocery Shopping & Quick Commerce