PSU Mutual Funds: An In-Depth Look

PSU (Public Sector Undertaking) funds invest in government-owned companies across key sectors like banking, energy, utilities, and defense. They offer the potential for thrilling growth but come with higher volatility compared to conventional large-cap investments. Let's take a clear-eyed look at the top PSU-themed equity funds to see if they align with your investment goals.

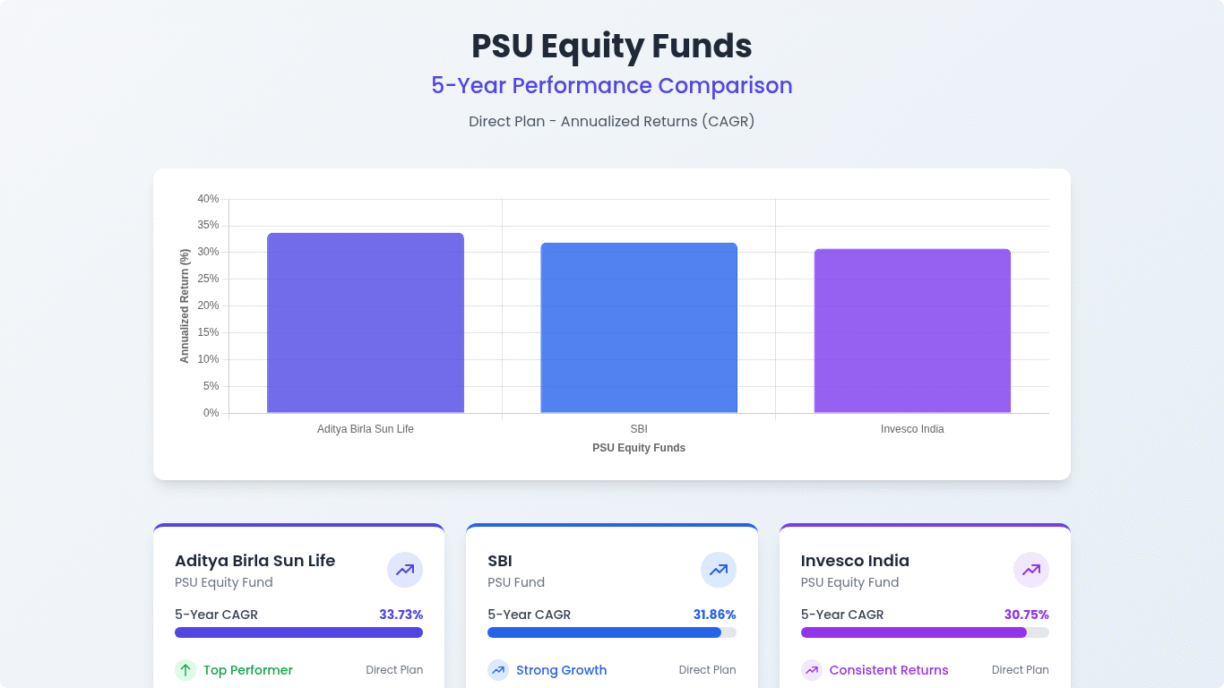

Top 5 PSU Mutual Funds in India

| Fund Name | 1Y Return | 3Y CAGR | Sharpe (3Y) | AUM (₹Cr) | Exp. Ratio (%) |

|---|---|---|---|---|---|

| SBI PSU Fund (Direct, Growth) | –0.6% | 38.3% | 1.21 | 5,259 | 1.86 |

| Invesco India PSU Equity Fund (Growth) | –4.3% | 38.7% | 1.24 | 1,394 | 2.14 |

| Aditya Birla SL PSU Equity Fund (Growth) | –4.6% | 36.0% | 1.14 | 5,582 | 1.79 |

| ICICI Pru PSU Equity Fund (Direct, Growth) | –1.2% | 36.3%* | 1.23 | 2,059 | 2.07 |

| Quant PSU Fund (Direct, Growth) | –8.6% | 35.8% | N/A | 722 | 2.34 |

* Data based on available information, may vary. 3Y CAGR for Quant PSU taken as 35.8% for consistency.

Performance Snapshot (1Y vs 3Y)

Key Fund Characteristics

Performance Snapshot

- Recent downturns are visible with negative 1-year returns.

- Long-term 3-year CAGRs (36-39%) are exceptionally strong.

- Good risk-adjusted returns, as shown by Sharpe Ratios around 1.2.

Risk & Volatility Profile

- Higher volatility than broad-market large-cap funds.

- Funds tend to amplify market movements (Beta > 1.0).

- Historically have seen larger drawdowns (20-25%) in falling markets.

Cost Considerations

- Expense ratios for direct plans are relatively high (1.8%-2.3%).

- Short-term exit loads (0.5-1%) are common.

- Moderate portfolio turnover helps manage hidden trading costs.

Fund Management & House Strength

- Managed by top-tier AMCs like SBI, ICICI, and Aditya Birla.

- Led by experienced fund managers with strong research backing.

- Strong compliance and risk management frameworks.

Portfolio Highlights

- Heavy concentration in Banking, Energy, Power, and Defense sectors.

- Top 5 holdings often make up 50-70% of the portfolio.

- These are pure thematic plays, sticking strictly to their PSU mandate.

Benchmark & Peer Comparison

- Best compared against the BSE PSU or Nifty PSE Total Return Index.

- SBI PSU fund is often a category leader, with others grouped closely.

- Typically receive high 4 or 5-star ratings, with a high-risk qualifier.

Who Should Invest?

These funds are suitable for:

- Aggressive investors seeking high, sector-focused growth.

- Those with a long-term investment horizon (5+ years) to navigate market cycles.

- Investors who are comfortable with significant volatility and are not easily shaken by market swings.

A Word of Caution for Conservative Investors

If high volatility is a concern, consider a lower-risk alternative like a Banking & PSU Debt Fund. These funds (e.g., UTI Banking & PSU Debt, SBI Banking & PSU Debt) primarily invest in bonds and offer moderate risk with stable yields, typically around 7-8% per annum.