Belrise IPO Details

Belrise is an Automotive component manufacturing company which offers a range of safety critical systems and other engineering solutions for two wheelers, three wheelers, four wheelers, commercial vehicles and agri-vehicles.

Financial Highlights

| Fiscal Year | Revenue (₹ Cr) | PAT (₹ Cr) | PAT Margin (%) |

|---|

Revenue & PAT Trend (₹ Cr)

IPO Overview

Issue Size: 2,150

Issue Type: Full Fresh Issue

Face Value (FV): 5

Retail Quota: 35%

Lot Size & Price Band

Smallest Lot Size: 166 shares

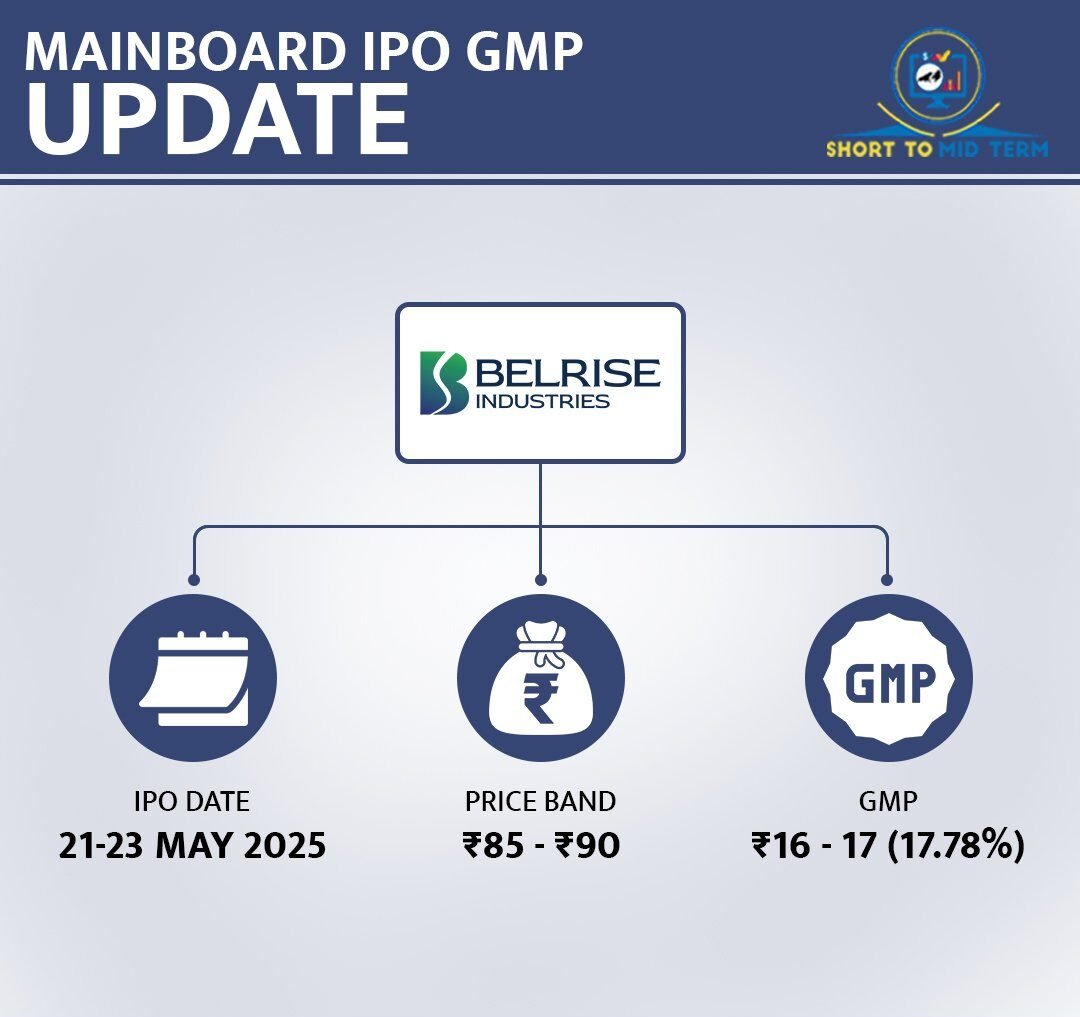

IPO Price Band: 85 – 90 per share

Minimum Investment Outlay

At 85: 166 × 85 = 14,110

At 90: 166 × 90 = 14,940

Indicative Listing Profit (Dynamic)

If shares list around (i.e. approx. 4.25 Grey Market Premium over 90), you’d make about 705.50 per lot.

Lead Managers

BI Belrise Industries Limited IPO Overview

Key Offer Details

Anchor Book: 20-May-2025

Issue Open: 21-May-2025

Issue Close: 23-May-2025

Issue Breakdown & Structure

238,888,889 Fresh Equity Shares

Aggregating up to ₹2150 Cr.

Offer for Sale (OFS): None

100% Book Built Issue

Fresh Issue under SEBI ICDR Rules (Rule 6(1))

Investor Category Allotment

| Category | Size In (%) | Min Bid Lot Shares | Min Bid Lot Amount (₹ at Upper Band) | Applications Reserved (Approx.) |

|---|---|---|---|---|

| Retail | 35% | 166 Shares | ₹14,940 | 503,681 |

| Small HNI (sHNI / NII < ₹10 Lakhs) | 5% | 2324 Shares | ₹209,160 | 5,140 |

| Big HNI (bHNI / NII ≥ ₹10 Lakhs) | 10% | 11122 Shares | ₹1,000,980 | 10,279 |

Net Offer Reservation Details

| Category | Percentage of Net Offer | Approx. Shares | Approx. Amount (₹ Cr at Upper Band) |

|---|---|---|---|

| QIB (Anchor Included) | 50% | 119,444,444 | 1075 Cr |

| HNI (Total Non-Institutional Investors) | 15% | 35,833,333 | 322.5 Cr |

| ↳ HNI Small (2-10 Lakh) | (5%) | (Apx 11,944,444) | (107.5 Cr) |

| ↳ HNI Large (10 Lakh+) | (10%) | (Apx 23,888,889) | (215 Cr) |

| Retail | 35% | 83,611,111 | 752.5 Cr |

Note: Share numbers are approximate. "Reservation Quota: ---No Reservation---" likely indicates no specific employee/shareholder or other reserved quotas beyond QIB, NII, and Retail categories.

Reservation Split (Net Offer)

Bid Calculator (Illustrative)

Calculate Your Potential Bid

This is an illustrative calculator. Ensure you meet minimum application criteria for your chosen category (e.g., sHNI, bHNI).

Pre & Post Issue Highlights

| Parameter | Pre-Issue | Post-Issue (at Upper Price Band) |

|---|---|---|

| Market Cap | ₹5858.91 Cr. | ₹8008.91 Cr. |

| Promoter Holding | 99.81% | 73.01% |

Key Participants & Listing

Indicative IPO Timeline

- 26-May-2025: Finalization of Basis of Allotment

- 27-May-2025: Initiation of refunds/unblocking of funds

- 27-May-2025: Credit of Equity Shares to Demat accounts

- 28-May-2025: Commencement of trading on exchanges

Company Information

Plot No D-39 MIDC Area Waluj, Aurangabad 431133, Maharashtra, India

Office No. 501 and 502, Fifth Floor, Cello Platina, Shivaji Nagar, Fergusson College Road, Pune 411106, Maharashtra, India

Manish Kumar (Company Secretary and Compliance Officer)

📧 E-mail: complianceofficer@belriseindustries.com

📞 Telephone: +91 (0240) 2551206

🌐 Website: www.belriseindustries.com

Important Disclosures & Risks

Key Dangers in This Initial Offering (Summary from RHP)

- No Previous Trading Record: This is an initial public offering; there is no prior market price for equity shares.

- Price Discovery: Price determination via book building involves floor, cap, and final issue prices determined with BRLMs based on investor demand. (Refer to "Basis for Issue Price" p. 173 in RHP).

- No Active Trading Guarantee: Post-listing prices and trading volumes may vary; an active or stable market cannot be guaranteed.

- General Investment Risks: Investing in stocks is inherently risky. Invest only if you can accept the risk of losing your entire investment.

Our Unwavering Duty (Belrise Industries Limited)

We have posed all the right questions to ensure that this Red Herring Prospectus is accurate and complete. Everything that is relevant to our company and the issue is covered. The intentions and presentations expressed here are genuine and not false. We take full responsibility for the contents of this document in all material respects.

Important Notes for Applicants:

- Applications made using third-party UPI or ASBA Bank A/c are liable to be rejected.

- UPI Mandate expires at 5 PM on 23-May-2025.

- Do not subscribe to the IPO based on rumors or Grey Market Premiums (GMPs).

- This information is for representation purposes only and does not constitute a recommendation.

- Always read the Red Herring Prospectus (RHP) and conduct your due diligence before investing in any IPO.

Disclaimer: This is a summary presentation. For complete details, including all risk factors (refer to "Risk Factors" p. 41), eligibility (p. 505), and issue structure (p. 528), please refer to the Red Herring Prospectus dated May 15, 2025. SEBI does not approve or sanction this prospectus and does not guarantee its accuracy.

Belrise Industries IPO - Frequently Asked Questions

What is the minimum investment?

| Lot Size | Price Range | Investment Range |

|---|---|---|

| 166 shares | ₹85–₹90 | ₹14,110 – ₹14,940 |

When does the IPO begin and end?

How do I apply for the IPO?

Two application methods available:

- ➞ Online through your bank's net banking portal

- ➞ Via broker's IPO application form

Required details: Lot size and preferred price band

What kind of profit can I expect?

| Metric | Value |

|---|---|

| Current GMP | ₹4.25 |

| Projected Listing Price | ₹94.25 |

| Potential Per-lot Gain | ≈₹705 |

* Grey market premiums (GMP) fluctuate daily

What are the biggest threats?

- ⚠️ No historical trading data available

- ⚠️ Listing price uncertainty

- ⚠️ Market volatility risks

- ⚠️ Potential capital loss

Who is eligible to invest?

Permitted investor categories:

- • Individual Indian residents

- • Hindu Undivided Families (HUFs)

- • Registered Companies

- • Trusts & Institutions

Allocation categories per SEBI:

- 1. QIB (Qualified Institutional Buyers)

- 2. NII (Non-Institutional Investors)

- 3. RII (Retail Individual Investors)

How do I know my allotment status?

Check status through these steps:

- 1. Visit registrar's website post-allotment date

- 2. Use either:

- - Application number

- - PAN number

- 3. Search for your allotment status

Pingback: Aegis Vopak Terminals IPO GMP Today, Price, Date, Allotment

Pingback: Schloss Bangalore IPO GMP, Price, Status & Review