Introduction

Asian Paints is one of India’s largest and most significant paint firms. It dominates both decorative and industrial paint markets. Investors closely monitor Asian Paints Q3 results because they provide significant information regarding the financial health of the company, market trends, and future prospects. Being aware of these results is extremely crucial for shareholders and potential investors so they can make intelligent decisions.

This article provides a comprehensive overview of Asian Paints Q3 results, how they influence the stock price, and investment advice for the company.

Asian Paints Q3 Results: Key Financial Indicators

The recent Asian Paints Q3 results revealed a combination of good and bad news:

Though these figures indicate a slowdown, Asian Paints Q3 results indicate that they remain robust despite market pressures.

- Net Profit: Declined by 23.5% y-o-y to ₹1,128 crore, slightly lower than what analysts had expected at ₹1,150 crore.

- Revenue: Registered at ₹8,549 crore, down 6% y-o-y.

- EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortization): Declined 20% y-o-y to ₹1,637 crore.

- Margins: Declined by 310 basis points to 19.5%, primarily due to increased expenses, poor product mix, and adverse operating leverage.

- Decorative Business Volume Growth: Registered a growth of 1.6%, better than market expectations.

- International Business: Registered a growth of 5% y-o-y, driven by strong performance in the Middle East and better economic conditions in key Asian markets.

Analysis of Trends: What Do the Numbers Indicate?

- Revenue Decline Due to Weak Demand: The revenue decline was due to weak consumer demand, customers opting for lower-priced products, and poor festive season sales.

- EBITDA and Margins Beat Estimates: Despite a year-over-year decline, Asian Paints was able to maintain margins higher than analysts had estimated, reflecting good cost-control measures and good operations.

- Decorative Paint Business Remains Resilient: The 1.6% sales growth indicates that the firm’s robust brand and prices assisted in managing low demand.

- International Expansion Compensates for Domestic Weakness: International sales rose 5%, driven by strong performance in the Middle East and stable economic conditions in Sri Lanka, Bangladesh, and Nepal.

Impact of Asian Paints Q3 Results on Stock Price

When Asian Paints released its Q3 results, the stock price of the company initially declined but then rose by 3%, closing at ₹2,355.85. Various factors influenced the stock movements:

- Short-Term Volatility: Investors reacted to lower profit figures and declining revenue.

- Long-Term Confidence: Strong EBITDA and margin performance instilled confidence in investors that the company is capable of managing cost pressures.

- Market Sentiment: The overall market trend and sentiments in the industry played a significant role in stabilizing the stock price post-results.

Expert Opinions on Asian Paints' Outlook

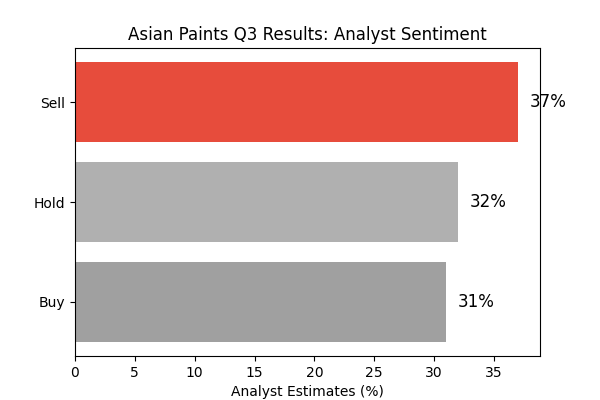

- Market Analysts: Most analysts continue to rate the stock as ‘Hold’ with a price range of ₹2,080 to ₹3,650.

- CEO’s Statement: Amit Syngle, MD & CEO of Asian Paints, emphasized the company’s continued investment in brand building, innovation, and customer focus, expressing cautious optimism about the recovery of demand in the future.

Strategies for Investing in Asian Paints

For investors to benefit from Asian Paints Q3 results, the following strategies are useful:

1. Long-Term Investment Perspective

Despite short-term fluctuations, Asian Paints has a solid history of long-term growth. The company’s leadership in the market, brand power, and expansion into related segments (home decor, waterproofing) make it a sound long-term investment.

2. Buying on Dips

With the recent decline in stock price, investors may consider buying shares during market dips to enhance returns over the long run.

3. Tracking Global and Domestic Trends

Asian Paints’ performance is influenced by raw material prices, demand fluctuations, and global economic conditions. Tracking these aspects will enable investors to make timely investment decisions.

4. Dividend Yield Consideration

Asian Paints has a history of paying consistent dividends, making it an attractive choice for investors seeking stable returns in addition to capital appreciation.

Risk Factors to Consider

- The rapid price swings of crude oil products lead to rising input costs for the organization.

- Market share may decline due to intensifying competitive pressures between Berger Paints and Kansai Nerolac along with Indigo Paints.

- Paint sector demand would decline during economic slowdowns which result in a reduced requirement for real estate and construction activities.

Conclusion

Key Takeaways:

- The company recorded a 23.5% yearly decline in net profit yet EBITDA and marginal performance exceeded market forecasts.

- The stock price displayed durable performance by recovering following its first reduction.

- Analysis firms have established a holding recommendation with forecasted price ranges between ₹2,080 and ₹3,650.

- Strategic long-term investors should buy the stock during market declines because Asian Paints demonstrates sturdy fundamental characteristics.

- Three main risk factors influence the company’s operations which include increasing expenses and market competitors and economic dynamism.

- Investors who track the Q3 results for Asian Paints and market developments across all sectors will develop better insight for making profitable long-term decisions.

Pingback: MTNL Share Price Jumps 20%: What’s Fueling the Rally?

Pingback: Servotech Share Price Target 2025: Growth & Analysis

Pingback: HBL Power Share Price Target 2025: My Expert Analysis