Aditya Infotech Ltd. IPO: A Comprehensive Guide

Aditya Infotech Ltd., the flagship company of the widely known CP Plus brand, is going to launch an Initial Public Offering (IPO) on Dalal Street. This offers investors an opportunity to invest in India's leading video security and surveillance firm. This article provides a concise summary of the IPO, with key information for investors seeking easy-to-understand information.

IPO Overview

Aditya Infotech Ltd IPO aims to raise ₹1,300 crore. The fundraising is structured with a new issue of ₹500 crore and an offer for sale (OFS) of ₹800 crore.

Key IPO Facts

| Issue Size | ₹1,300 crore |

|---|---|

| Fresh Issue | ₹500 crore |

| Offer to Sell (OFS) | ₹800 crore |

| Price Band | ₹640 – ₹675 per share |

| Lot Size | 22 shares |

| Face Value | ₹1 per share |

| Post-Issue Market Cap | ₹7,912 crore (approx.) |

| Promoter Holding | Pre: 89.01%, Post: 73.28% |

| Retail Quota | 10% of the net offer |

| Employee Reservation | ₹6 crore limit with ₹60 discount |

IPO Structure

IPO Schedule

| Anchor Investor Bid | July 28, 2025 |

|---|---|

| Issue Open Date | July 29, 2025 |

| Issue Close Date | July 31, 2025 |

| Basis of Allotment | August 1, 2025 |

| Refund Start Date | August 4, 2025 |

| Credit of Shares to Demat | August 4, 2025 |

| Listing Date | August 5, 2025 |

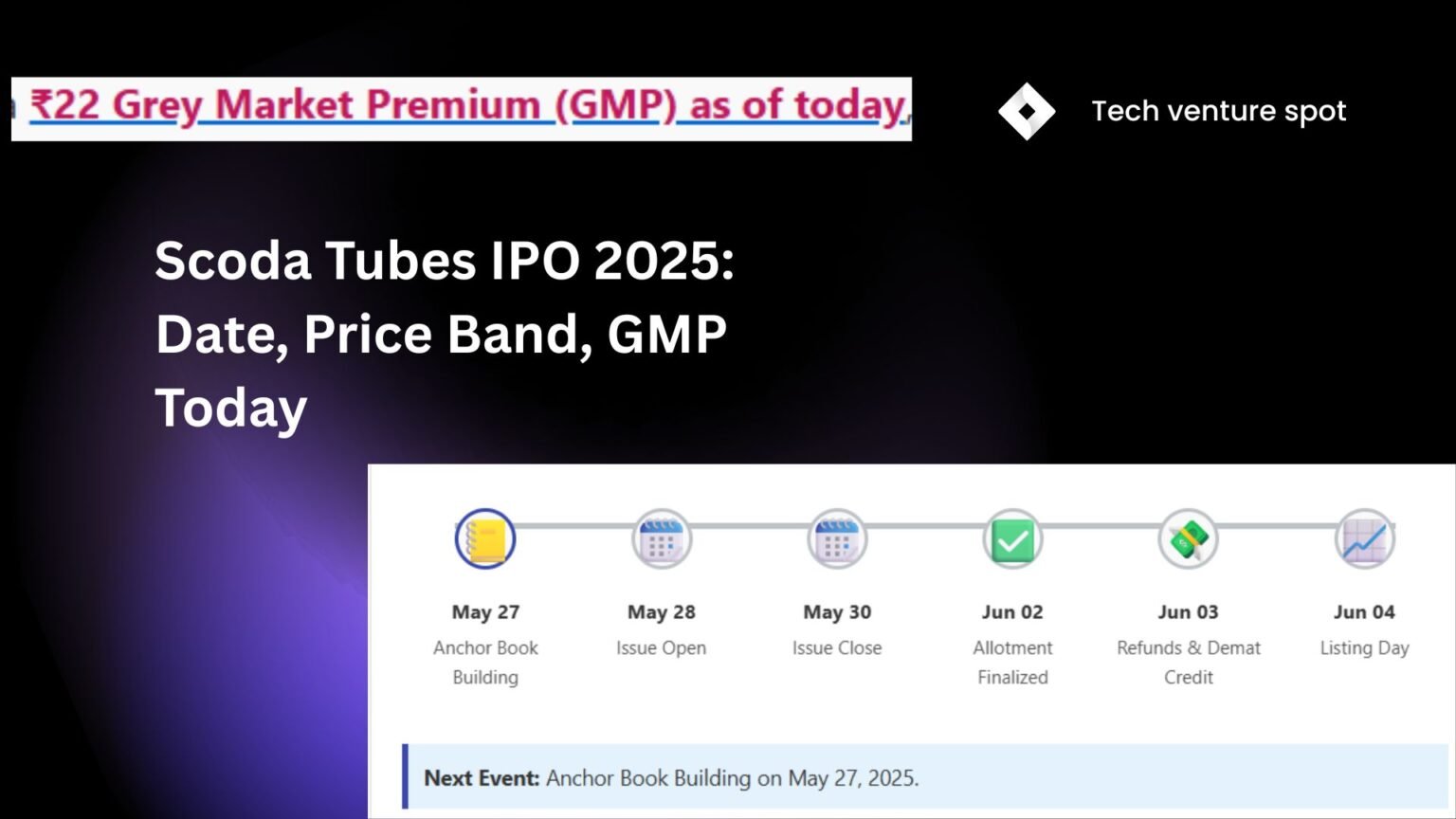

Grey Market Premium (GMP)

As of 24th July 2025, the Grey Market Premium (GMP) for the Aditya Infotech IPO is not yet known as trading has not commenced.

GMP indicates the premium at which shares are traded in the unofficial grey market before listing. Investors should monitor financial websites for GMP updates closer to the IPO opening date.

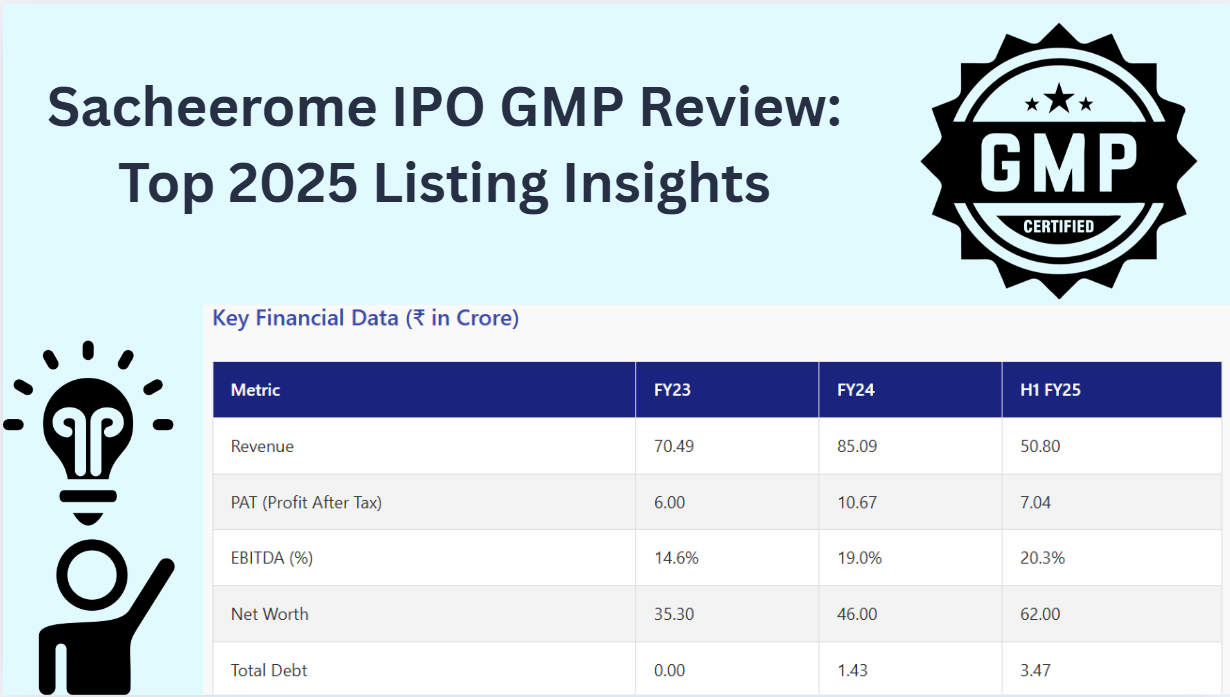

Financial Performance

Aditya Infotech Ltd. has demonstrated consistent financial growth, indicating a robust position in the video surveillance sector. The Price-to-Earnings (PE) Ratio based on FY25 earnings is 22.5x.

| Year | Income (₹ Cr) | Profit After Tax (PAT) (₹ Cr) |

|---|---|---|

| FY23 | 2,296 | 108 |

| FY24 | 2,796 | 115 |

| FY25 (Est.) | 3,123 | 351.4 |

Key Growth Metrics

- Revenue Expansion: Revenue grew by 21.8% from FY23 to FY24 and is projected to increase by 11.7% in FY25.

- Profit Growth: PAT increased by 6.5% from FY23 to FY24 and is expected to surge by an impressive 205.6% in FY25.

Allocation and Investment Details

The IPO is structured to cater to different investor categories with specific quotas and investment minimums.

Investor Quota Allocation

Use of Proceeds

The net proceeds from the fresh issue of ₹500 crore will be utilized for:

- Debt Repayment: ₹375 crore will be used for prepayment or repayment of outstanding borrowings.

- General Corporate Purposes: The balance amount will be used to support business operations and strategic growth initiatives.

About Aditya Infotech Ltd.

Aditya Infotech Ltd is the largest Indian-owned video surveillance and security company, commanding a market share of 20.2% in India as of FY24 (according to Frost & Sullivan). Operating under the renowned brand name CP Plus, the company provides a wide range of advanced video security products, technologies, and solutions.

Its offerings include end-to-end security systems and Security-as-a-Service, catering to diverse sectors such as:

Corporate Presence

The company's registered office is in New Delhi, with its corporate office located in Noida, Uttar Pradesh, strategically positioning it within India's key business hubs.

Promoters and Ownership

The IPO is backed by the Khemka family. The promoter holding will dilute from 89.01% to 73.28% post-IPO to facilitate the OFS.

Promoters:

- Hari Shanker Khemka

- Aditya Khemka

- Ananmay Khemka

- Hari Khemka Business Family Trust

Entities in Offer for Sale (OFS):

The ₹800 crore OFS comprises shares from various promoter and promoter group entities, including Aditya Khemka (up to ₹524.04 cr) and Ananmay Khemka (up to ₹123.16 cr), among others.

Risks and Considerations

Investing in the Aditya Infotech IPO involves certain risks, which are detailed in the Draft Red Herring Prospectus (DRHP). Investors must carefully review these before making a decision.

- No Prior Market: This is the company's first public issue, so there is no existing trading market for its shares.

- Price Volatility: The offer price may not reflect the market price after listing, and there is no guarantee of active or continuous trading.

- Regulatory and Market Risks: The business is subject to risks inherent in the security and surveillance industry.

Frequently Asked Questions (FAQs)

When are the IPO dates for Aditya Infotech Ltd.?

The IPO opens on July 29, 2025, and closes on July 31, 2025. The anchor book opens on July 28, 2025.

What is the price range and lot size for the IPO?

The price band is ₹640 to ₹675 per share, with a minimum lot size of 22 shares.

What is the total issue size?

The total issue size is ₹1,300 crore, comprising a fresh issue of ₹500 crore and an OFS of ₹800 crore.

What is the latest GMP for the IPO?

As of July 24, 2025, the GMP is not available as grey market trading has not yet begun.

When will the shares be listed?

The shares are scheduled to be listed on the BSE and NSE on August 5, 2025.

Who are the lead managers for the IPO?

The book-running lead managers are ICICI Securities Limited and IIFL Securities Limited.

Important Points for Investors

- Application Process: Use only valid payment methods like UPI or ASBA through your bank account. Third-party applications may be rejected.

- Risk Awareness: A thorough reading of the DRHP is crucial to understand all associated risk factors before investing.

- External Links: For more on specific IPOs, you can refer to external resources. Example: Savy Infra IPO GMP Today or Best Corporate Bond Mutual Funds 2025.

Meet Akabari

Hello! I'm Meet Akabari, and I haven't turned back since I entered the finance industry a year and a half ago. I began by researching mutual funds and fixed deposits to see how they compared. I was shocked to see that carefully selected mutual funds can yield returns of 25–30%, outperforming typical FDs. I became passionate about all things investing after experiencing the excitement of seeing my money grow.

I expanded my toolkit to include IPOs six months ago. In order to determine which offerings are worth my time, I have read through every prospectus, asked myself the difficult questions—why this firm, why now, and what is the risk—and developed a straightforward, trustworthy framework.

I'm here to help you whether you're ready to make your first initial public offering (IPO) bid, have questions about mutual funds, or want to compare your FD to something with a greater yield. My objective? to translate technical terms into understandable insights so that, like me, you may invest with assurance and reap genuine rewards. Together, let's develop!