Forecast: Anthem Biosciences IPO Analysis

Key Developments & Market Sentiment

Lukewarm Initial Subscription

The initial public offering (IPO) saw a lukewarm response on its opening day, recording a total subscription of 73%.

According to reports from Moneycontrol and Business Standard, the subscription was led by Non-Institutional Investors (NIIs) at 1.55 times their quota, while Retail Investors showed modest interest with a 58% subscription.

Strong Financial Footing

Moneycontrol's live blog highlighted the company's robust financial health. Anthem Biosciences reported a strong 30% revenue growth and a 23% increase in Profit After Tax (PAT) between fiscal years FY24 and FY25.

The company is a recognized market leader in the Contract Research, Development, and Manufacturing Organization (CRDMO) segment, serving over 550 customers across 44 countries.

Investor Expectations & GMP

Early social media buzz on X (formerly Twitter) from sources like @CNBCTV18Live and @megharaj_g_k suggested potential listing gains between 18% to 20%. As of July 14, 2025, the Grey Market Premium (GMP) stabilized at ₹100, indicating an estimated listing gain of around 17.5% over the upper price band of ₹570.

Subscription Status (Day 1)

The chart displays the subscription rate by investor category. A value over 100% indicates oversubscription for that category's quota.

Financial Performance (FY24 to FY25 Growth)

This chart illustrates the company's year-over-year growth in key financial metrics, showcasing strong business expansion.

Grey Market Premium (GMP)

The GMP is an unofficial indicator of investor sentiment and potential listing gains. It reflects the price at which IPO shares are traded before they are officially listed on the stock exchange.

| Date | GMP (Rs) | Est. Listing Gain (at ₹570) | Notes |

|---|---|---|---|

| July 14, 2025 | ₹100 | ~17.5% | Based on data from IPO Watch & Business Standard. |

| July 10, 2025 | ₹102-₹114 | ~18%-20% | Early estimates based on social media reports. |

Sources & Further Reading

- To know more, please check the following link: Moneycontrol IPO Live Updates

- For GMP details, refer to: IPO Watch GMP Details

Anthem Biosciences IPO: Date, Price, GMP & Review

Anthem Biosciences is gearing up for its highly anticipated ₹3,395 crore book-built IPO, and investors are buzzing with questions: “Is this IPO good or bad?”, “What’s the GMP today?”, and “When exactly does it open?”

Let’s dive into everything you need to know—broken into bite-sized sections, bullet points, and tables to keep it clear and actionable.

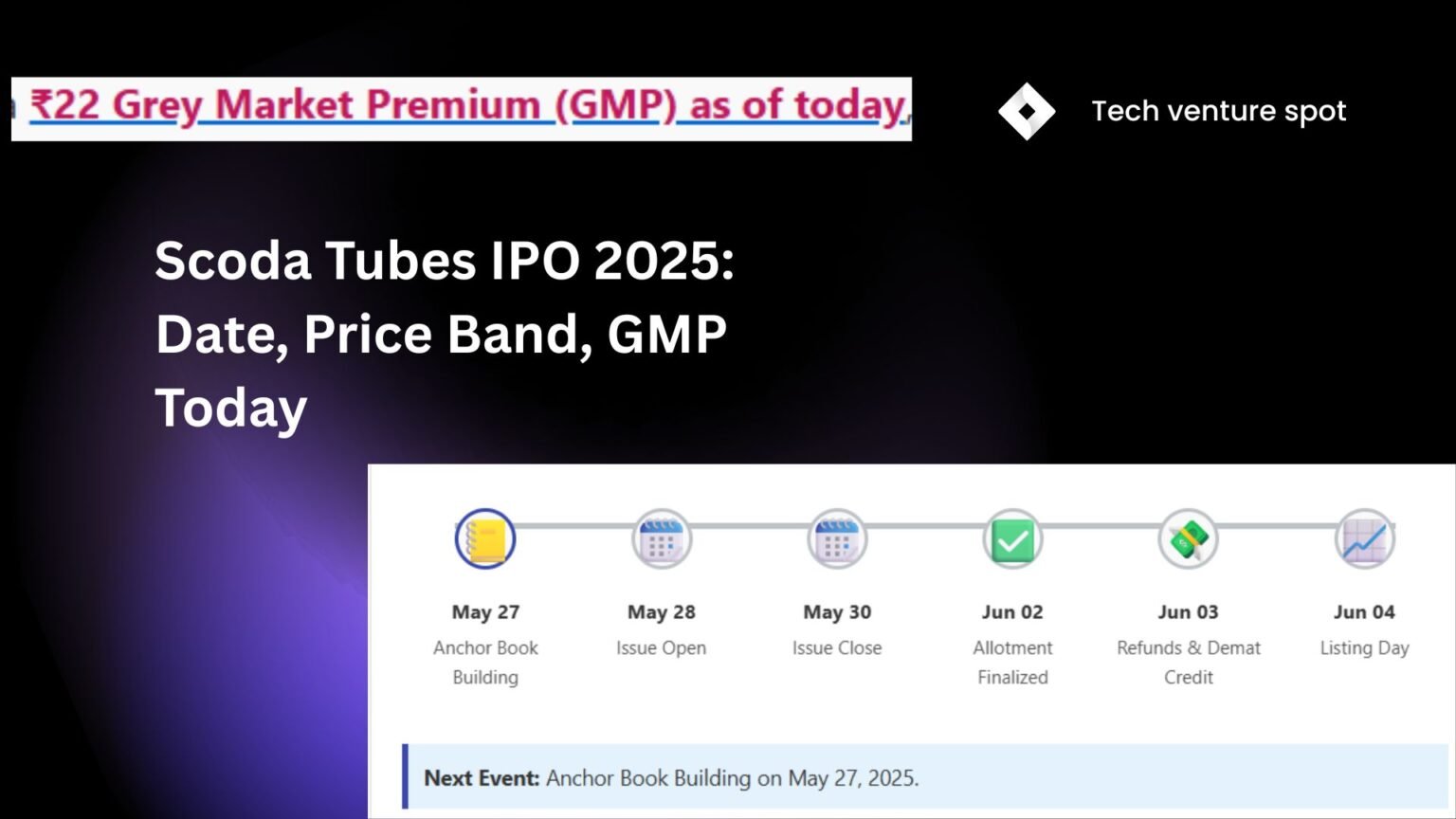

anthem biosciences ipo date

| Event | Date |

|---|---|

| Open for subscription | July 14, 2025 |

| Close for subscription | July 16, 2025 |

| Allotment finalized by | July 17, 2025 |

| Credit to Demat/Refunds | July 18, 2025 |

| Listing on BSE & NSE | July 21, 2025 |

anthem biosciences ipo price today

- Price band: ₹540–₹570 per share

- Face value: ₹2 per share

- Lot size: 26 shares (₹14,820 minimum investment)

- Employee discount: ₹50 per share

| Investor Category | Min Lots | Shares | Investment (₹) |

|---|---|---|---|

| Retail (Min) | 1 | 26 | 14,820 |

| Retail (Max) | 13 | 338 | 193,260 |

| S-HNI (Min) | 14 | 364 | 207,480 |

| S-HNI (Max) | 67 | 1,742 | 9,93,000 |

| B-HNI (Min) | 68 | 1,768 | 10,07,760 |

anthem biosciences ipo gmp

The grey market premium (GMP) indicates investor sentiment before official listing. As of July 9, 2025:

A positive GMP suggests strong demand—good if you’re thinking of short-term gains, but remember GMP can swing quickly.

Also Read: Over 50 SEBI-Approved IPOs in 2025: Full Pipeline List

IPO DRHP & Review of Anthem Biosciences IPO

The RHP as well as the DRHP has brought to light the most important strengths and risks:

Strengths

- The services of CFPO (discovery to manufacturing) (end-to-end CRDMO services)

- The largest expanding capacity in specialized fermentation and synthesis in India

- Various sources of revenue: APIs, peptides, enzymes, biosimilars

- 196 ongoing initiatives; 600 strong professionals on the team

- International presence: 550+ customers in 44 countries

Risks

- Delays in approval of regulations

- Capacity underutilization

- Competition in the API markets

- Seasonal Revenue swings

- Data security & IP security trouble

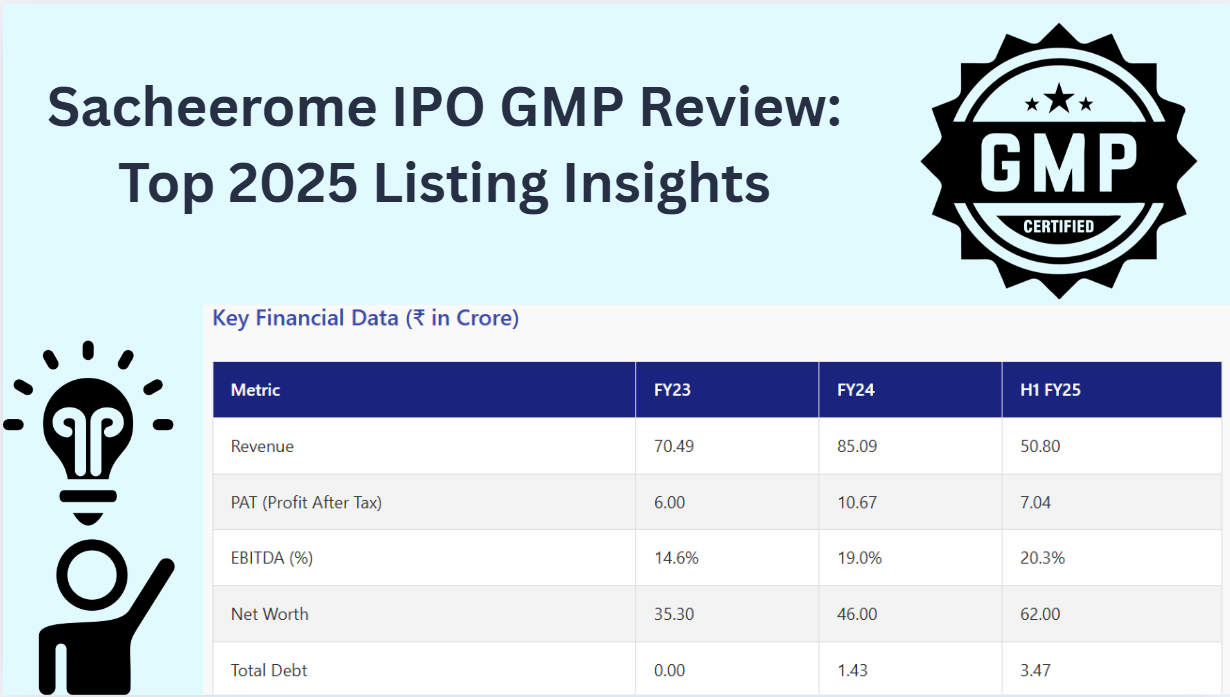

anthem biosciences stock price & revenue

While Anthem isn’t yet listed, here’s what historical financials tell us:

| Metric | Value | Period |

|---|---|---|

| Revenue Growth (YoY) | 30% | FY 24 → 25 |

| PAT Growth (YoY) | 23% | FY 24 → 25 |

| EBITDA Margin | ~36.8% | FY 25 |

| ROE | 20.8% | - |

| ROCE | 26.9% | - |

| Debt/Equity | 0.05 | - |

Outlook

Healthy top-line acceleration and strong margins underscore operational excellence.

An excerpt of a biopharmaceutical firm that is listed like Anthem Biosciences IPO: good or bad?

Good when you want long-term exposure to the India CRDMO market, which shows high growth with diversified services.

Unfortunately, risk-averse investors should note: this is an offer for sale (OFS), so cash does not come to the company as cap-ex.

Key Takeaways

- Subscription Dates: July 14-16; Listing on July 21.

- Price & GMP: Price band is ₹540-₹570. The GMP of ₹67 indicates positive sentiment.

- Financials: Strong growth with 30% revenue and 23% profit increase, complemented by healthy margins.

- Action: Analyze based on your risk profile. The IPO presents fair fundamentals but faces potential market and regulatory headwinds.