Ganga Bath Fittings IPO:

1. Introduction +

The company Ganga Bath Fittings Limited (formerly Ganga Plast Industries Limited) is all set to launch an IPO on the Emerge platform of the National Stock Exchange of India soon.

The business focused on making bathroom fittings and accessories is a good prospect due to the growth in the home improvement and sanitary ware industry.

This detailed guide discusses all the information investors require about the Ganga Bath Fittings IPO, for example, main dates, pricing information, rumored premiums in the grey market and expert opinions for confident decision-making.

Ganga Bath Fittings IPO Key Details +

| Detail | Information |

|---|---|

| Issue Size: | ₹32.65 Crores |

| Face Value: | ₹10 per share |

| Lot Size: | 3,000 equity shares |

| Price Band: | ₹46 – ₹49 per share |

| Total Shares Offered: | 66,63,000 equity shares |

| Issue Type: | Fresh Issue (Book Built Issue) |

| Market Cap at Upper Price: | Approximately ₹32.65 Crores |

The company is offering 66.63 lakh equity shares aggregating to ₹32.65 crores at the upper price band. This is a fresh issue with no offer for sale component, meaning all proceeds will go directly to the company for its growth and expansion plans.

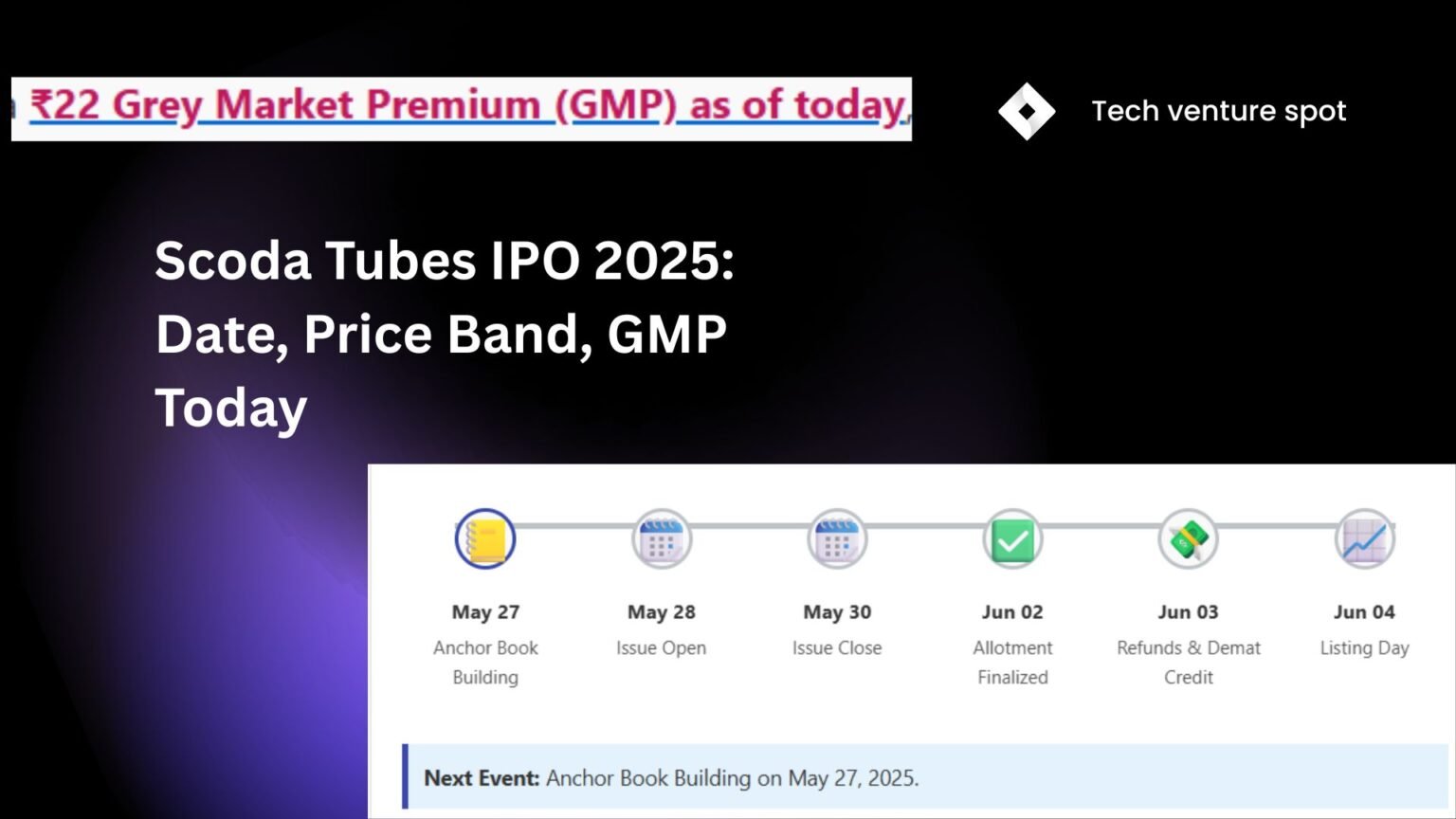

3. IPO Timeline +

- IPO Opening Date: Wednesday, June 4, 2025

- IPO Closing Date: Friday, June 6, 2025

- Bid/Issue Period: 3 days

- Expected Allotment Date: June 9, 2025 (tentative)

- Expected Listing Date: June 11, 2025 (tentative)

- Stock Exchange: NSE Emerge Platform

- Registrar: Kfin Technologies Limited

The IPO will remain open for subscription for three working days, providing investors with sufficient time to analyze and make their investment decisions.

4. Company Background +

Ganga Bath Fittings Limited acts in the bathroom fittings and accessories manufacturing industry. The company is promoting itself as a company that supplies quality bathing products by highlighting “Redefining Bathing Experience” in their tagline.

Corporate Details:

- Registered Office: Survey No. 121, Nr. Vraj Industrial Estate, SIDC Road, at the back of Shantidham Residency, in Veraval (Shapar), Kotda Sangani, Rajkot, Gujarat 360024.

- Contact Person: Ms. Priyanka Sharma (Company Secretary & Compliance Officer)

- Website: www.gangabathfittings.com

- Email: cs@gangabathfittings.com

People promoting the company include:

- Mr. Tusharkumar Vithaldas Tilva

- Mr. Jimmy Tusharkumar Tilva

- Mr. Sajan Tusharbhai Tilva

5. Gray Market Premium (GMP) +

As of [June 4, 2025], the Grey Market Premium (GMP) for Ganga Bath Fittings IPO is ₹1 (2.04%).

GMP indicates the premium at which the IPO shares are trading in the unofficial grey market before listing. It's an indicator of market sentiment but is not an official price and can be highly volatile.

Live Subscription / Bid Details

The following data reflects the graphical display of bids received (indicates bids position and not necessarily the subscription to the issue) as per available information:

Key Subscription Figures:

- Total Issue Size (Shares): 66,63,000

- Total Bids Received (Shares): 28,05,000

- Total Bids Received at Cut-off price (Shares): 9,42,000

- Subscription (No. of times): 0.42 times

Bids Received at Different Price Points:

| Price >= (₹) | No. of Shares Bid |

|---|---|

| 46.00 | 2,805,000 |

| 47.00 | 2,751,000 |

| 48.00 | 2,742,000 |

| 49.00 | 2,739,000 |

| Cut-Off | 9,42,000 |

Note: The bid data indicates cumulative shares bid at or above the specified price. "Cut-Off" bids are those where investors agree to subscribe at the price determined through the book-building process within the price band. Subscription figures are subject to change until the issue closes.

6. IPO Objectives +

Because this is a fresh issue, the organization is using the gathered money for:

- Business strategies to increase growth and expansion

- The amount of working capital the company requires

- What a corporation is meant to achieve in the general sense

- Making the company more visible and competitive in the bathroom fittings area

You can find out exactly how the offerings will be spent in the company’s Red Herring Prospectus.

7. Allotment Status +

Methods to Confirm Your Allotment:

- Go to the registrar’s website (Kfin Technologies Limited).

- Enter the application number or your Personal Account Number (PAN).

- Use your broker’s website to monitor the trading process.

- Get notifications by email or SMS from the registrar.

Allotment Process:

- Split the contribution evenly, when people give more than the goal.

- Capitalize the rest of the funds if there is less money than needed.

- All refund requests processed in accordance with the set deadlines.

- Shares that are credited digitally to your demat account even before listing.

8. Review and analyze the company’s IPO +

Strengths:

- A boom in the home improvement industry for bathroom products.

- An agency formed by people with experience in the industry.

- Money used to fuel growth plans.

- Access to NSE Emerge helps SMEs reach new investors.

Risk Factors:

- First time a company offers its bonds to the public without any previous trading.

- Not much financial information about business is easily available.

- Existing players creating tough competition.

- General risks that affect the markets and economy.

- SME platform tends to be more unpredictable.

Investment Considerations:

- The bathroom fittings industry has kept growing steadily.

- Extra income is encouraging people to spend on home remodeling.

- Building policies that encourage the sector.

- Having better quality and a strong brand identity will make a company different from others in the industry.

9. Competitor Comparison +

A number of known companies are part of the bathroom fittings and sanitary ware sector.

Businesses in the same sector include:

- Cera Sanitaryware Limited

- Somany Ceramics

- Orient Bell Limited

- Many regional and community institutions

Sector growth drivers (Things that fuel sector development):

- The growth of urban areas and more divided properties.

- People are living better lives.

- Programs to build government housing.

- Demand for changing or improving existing buildings exists.

- An increase in understanding hygiene and beauty.

10. Should You Consider Investing? +

Investment Thesis:

People should only invest if the investment matches their risk level and aims. Remember to look at these factors:

Positive Factors:

- A chance to address more customers.

- Money to support growth.

- Established group of tour promoters.

- Growth in the housing sector has helped the sector.

Risk Considerations:

- Issues first published to the public.

- Not enough time for the company to show a long history of operations.

- Market competition.

- Small and midsize business platform variability.

Suitable for:

- Investors who can deal with higher risk.

- Those who want to experience SME development.

- Those who stay invested in the market for years based on sector potential.

- Investors who accept that their investments can change rapidly.

11. The Process +

Application Methods:

- Using broker: Register your account through the platform provided by your broker.

- ASBA (Application Supported by Blocked Amount): Applies to individuals using net banking.

- UPI: Retail investors can open an account with UPI for ease (recommended).

Application Process:

- Comply with the Know Your Customer requirements provided by the exchange.

- Keep enough money in the account.

- Complete and send the application with your right information.

- Bid prices inside the provided price band.

- Dedicate a specific number of lots (3,000 shares in each lot).

Important Points:

Minimum Investment Required (1 Lot at Upper Price Band):

₹1,47,000(3,000 shares × ₹49 per share)

- You can put up to ₹2 lakhs into this category for retail investors.

- Ensure you can use the demat account and it is linked to the company you want to invest in.

Updates

- Ganga Bath Fittings IPO 🚿

12. FAQs +

How much money must you invest to become an investor? +

The required starting investment is ₹1,47,000 (1 lot of 3,000 shares at the upper price of ₹49).

When is the company going to start trading its shares? +

Expected listing date is June 11, 2025, on the NSE Emerge platform.

Who has been appointed to manage this IPO as registrar? +

The registrar is Kfin Technologies Limited.

What is the actual lot size involved in this transaction? +

The number of equity shares in each transaction is 3,000.

Is applying through UPI also possible? +

Yes, retail investors using UPI-supported apps are able to apply.

What happens if the demand for IPO shares exceeds what is available? +

Proportional allotment will take place for every applicant accounted for in each group, as per SEBI guidelines for oversubscription.

How can I find out my allotment status? +

You can see your allotment status by going to the registrar's website (Kfin Technologies Limited at www.kfintech.com) or finding it on your broker’s platform once the allotment is finalized.

Disclaimer:

The article does not offer financial advice or a prompt to invest; it is meant to inform only. People should do their own research and see a financial advisor certified by the SEBI before deciding to invest. All information shared such as IPO details, GMP and expert analysis, comes from public sources and might change at any time. We take no responsibility for any errors in the information or for it being up-to-date. Spending your money on IPOs brings risks and just because something did well before does not mean the same will happen in the future.

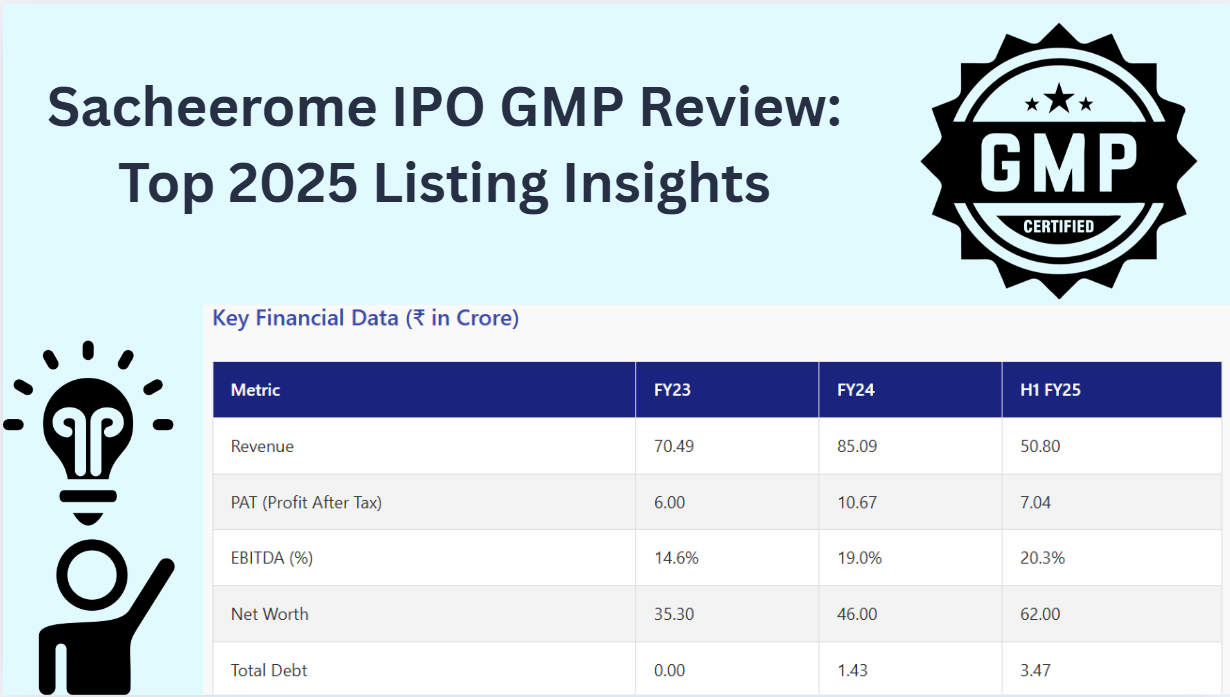

Pingback: Sacheerome IPO GMP Review: Top 2025 Listing Insights