Table of Contents

Vintron Info. (NSE: VINTRON)

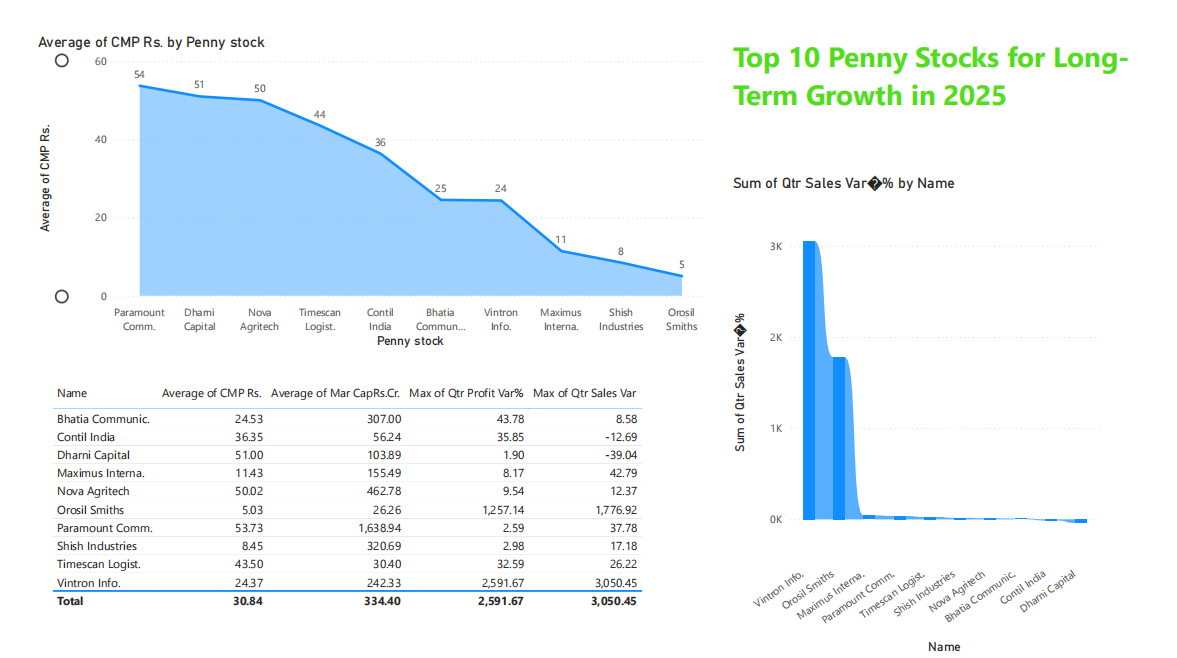

Key Metrics

Performance Highlights

⚠️ Key Risks

ROE Sustainability

Current 2,328% ROE may not be sustainable long-term. Next quarter results crucial for validation.

💡 Maximizing Returns Strategy

Entry Timing

Buy in dips below ₹23 with strict stop-loss at ₹21.50

Position Sizing

Limit to 5-7% of portfolio due to high volatility

Exit Strategy

Take partial profits at ₹28 (15% gain), full exit if ROE drops below 500%

Orosil Smiths (NSE: OROSIL)

Growth Metrics

Valuation

Risk Analysis ⚠️

- Sustained negative ROCE (-10.95%)

- High valuation despite operational challenges

Investment Strategy

Monitoring Period

Watch next 2 quarters for ROCE improvement above -5%

Entry Point

Consider buying only if sustains above ₹5.5 with volume

Maximus International (NSE: MAXIMUS)

Growth Metrics

Valuation

Risk Analysis ⚠️

- Low dividend yield (0%)

- Strong ROCE (18.21%) indicates efficient operations

Investment Strategy

Entry Strategy

Accumulate at current levels (₹11.43) for steady growth

Growth Potential

Monitor quarterly sales growth sustainability above 35%

Timescan Logistics (NSE: TIMESCAN)

Growth Metrics

Valuation

Risk Analysis ⚠️

- Low market cap (₹30.4 Cr) may cause price volatility

- Strong ROE (20.24%) indicates efficient management

Investment Strategy

Entry Strategy

Staggered buying around ₹43.5 for medium-term gains

Growth Monitor

Track quarterly sales sustainability above ₹120 Cr

Bhatia Communications (NSE: BHATIA)

Growth Metrics

Valuation

Risk Analysis ⚠️

- Slow sales growth (8.58%) needs monitoring

- Healthy ROCE (21.14%) supports business model

Investment Strategy

Sector Watch

Hold position and monitor sector-specific catalysts

Growth Trigger

Wait for sales growth acceleration above 15%

Shish Industries (NSE: SHISH)

Growth Metrics

Valuation

Risk Analysis ⚠️

- Low liquidity may affect trading flexibility

- Debt-free status reduces financial risk

Investment Strategy

Entry Strategy

Accumulate gradually at ₹8.45 with SIP approach

Position Sizing

Small position size due to micro-cap nature

Contil India (NSE: CONTIL)

Growth Metrics

Valuation

Risk Analysis ⚠️

- Significant sales decline (-12.69%) requires monitoring

- Strong ROCE (23.76%) indicates operational efficiency

Investment Strategy

Entry Points

Consider averaging down below ₹30 with strict ₹32 stop-loss

Exit Strategy

Exit if sales decline persists for 2 consecutive quarters

Sector Watch

Monitor industry cycles and policy catalysts

Nova Agritech (NSE: NOVAAGRI)

Growth Metrics

Valuation

Risk Analysis ⚠️

- Strong ROE (22.03%) indicates efficient management

- Healthy quarterly revenue (₹88.19 Cr)

Investment Strategy

Sector Play

Agricultural sector exposure with growth potential

Entry Strategy

Accumulate at CMP with 5% portfolio allocation

Growth Catalyst

Monitor monsoon patterns and agri-policy changes

Dharni Capital (NSE: DHARNI)

Growth Metrics

Valuation

Risk Analysis ⚠️

- Severe revenue decline (-39.04%) raises concerns

- High P/E (35.1) despite growth challenges

Exit Strategy

Q4 Checkpoint

Exit if Q4 sales growth remains negative

Price Target

Set stop-loss at ₹48 to limit downside risk

Re-entry Conditions

Consider re-entry only after two quarters of positive growth

Paramount Communications (NSE: PARACABLES)

Growth Metrics

Valuation

Risk Analysis ⚠️

- Strong revenue base (₹391.64 Cr quarterly)

- Valuation premium needs earnings support

Investment Strategy

Mid-Cap Transition

Hold position through market cap expansion phase

ROCE Watch

Monitor ROCE improvement above 15% threshold

Accumulation Zone

Add on dips below ₹50 with strong volume

Pingback: April 2025: Forthcoming Mutual Fund Dividends Revealed!

Pingback: Nifty Next 50 PE Ratio Secrets: Maximize Your 2025 Returns