Hey there, fellow investor 👋 — if you’ve ever found yourself questioning, “Is Tesla genuinely overvalued or is it the future we’re underestimating?”, you’re not alone. To be honest, you’re asking the appropriate question if you want to understand the Tesla PE ratio. Together, let’s decipher the stock market like friends at a café rather than using dry textbook jargon.

First Things First: What Even Is a PE Ratio?

So, the PE ratio — or Price-to-Earnings ratio — is effectively the sticker price for $1 of a company’s profit. It’s computed like this:

- Share Price / Earnings Per Share (EPS) is the PE Ratio.

The catch is that Tesla’s PE ratio is outside of the “normal” range that most businesses fall into. People are confused since it frequently appears to be extremely high. However, a high PE may not always indicate overvaluation. Low PE, too? does not always imply a good deal. It’s all about context.

So, What’s the Current Tesla PE Ratio?

Compared to established automakers like Ford or GM, Tesla’s PE ratio is now much higher, around 118.32. The worst part is that Tesla is more than just a car manufacturer.

Tesla is a hybrid of an automaker, a tech innovator, and an energy company. It would be like comparing Apple to a walkie-talkie firm to compare it to Ford. The playing field isn’t level. In addition to today’s profits, investors are paying more for the potential of tomorrow: energy storage, robots, autonomous driving, and so on.

Tesla PE Ratio Analysis

Understanding the Valuation Behind the Innovation

Growth Expectations

50% annual growth projections in EV and energy sectors

Tech Potential

AI, Robotics, and Autonomous Driving pipelines

Brand Power

Elon Musk influence and market leadership

Do you think Tesla's PE ratio is justified?

Tesla Inc (TSLA)

NASDAQ: TSLA · Updated April 17, 2025

Tesla (TSLA)

General Motors (GM)

Ford (F)

Toyota (TM)

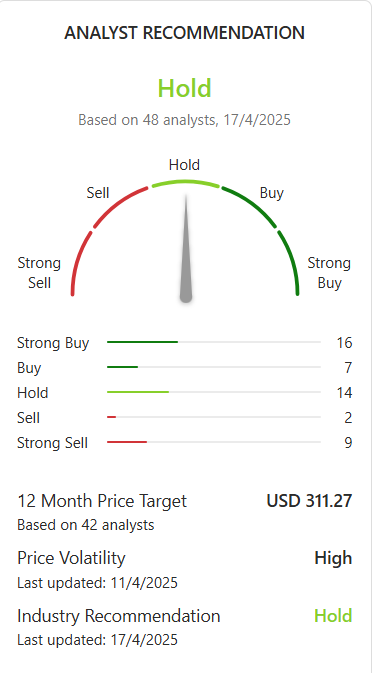

Analyst Rating

Navigating Tesla Stock as a New Investor

Here’s my opinion if you’re new to all of this and asking, “Should I buy Tesla?”

- Don’t buy based just on buzz.

- Recognize that strong expectations are reflected in the Tesla PE ratio.

- Diversify. You could use Tesla as a growth play, but be sure you balance it with value stocks.

- Furthermore, it’s acceptable to feel enthusiastic about a business. So am I. However, knowledge with enthusiasm equals wise investment.

Valuation Metrics

| Metric | Current | 3-Yr Avg | Industry Avg |

|---|---|---|---|

| Revenue Growth | 2.15% | 25.24% | 0.06% |

| EPS Growth | -71.04% | 66.19% | -18,375% |

| Operating Margin | 6.16% | 11.03% | -18.33% |

Efficiency Metrics

My Honest Opinion on Tesla PE Ratio

I believe that the tale of Tesla is still being written. The Tesla PE ratio tells a story in addition to numbers. The present PE is perhaps justifiable if you think that Tesla’s innovation pipeline, which includes humanoid robots and robotaxis, is sound.

However, Tesla might not be for you at this time if you’re conservative or seeking stability.

📚 Final Thoughts: Should You Even Care About Tesla PE Ratio?

Absolutely, but don’t focus solely on it. One lens is the Tesla PE ratio. Combine it with additional techniques such as revenue growth, cash flow analysis, total addressable market, and your personal risk tolerance.

The truth is that no article, no metric, and no ratio—not even this one 😉—can forecast the future. However, remaining informed? Your superpower is that.

Pingback: Metropolitan Stock Exchange Share Price Target 2025

Pingback: Nasdaq 100 PE Ratio Today: Charts, History & is High?

Pingback: Tesla Stock High Before Split: Price History & Analysis