Introduction

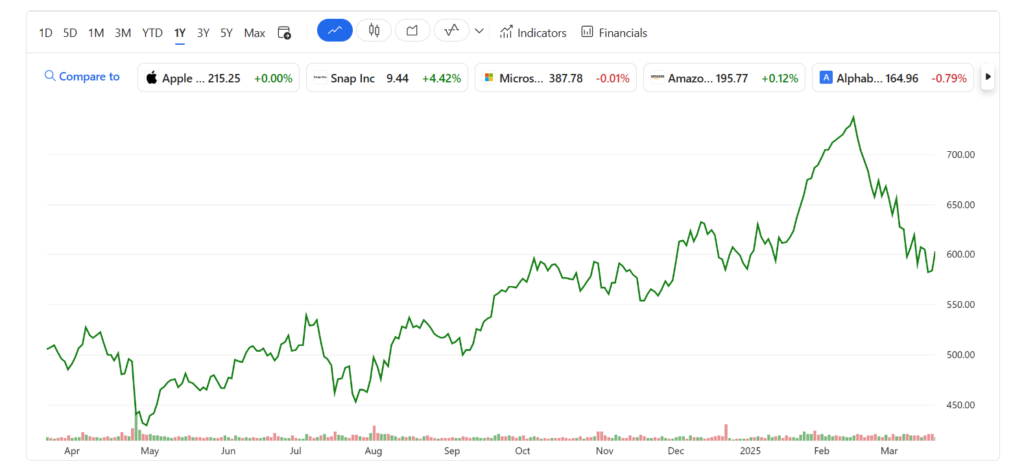

Meta stock price has visible dramatic swings, taking pictures the eye of both pro traders and rookies eager to seize the following huge possibility. The burning question stays — is Meta a clever buy right now, or need to you hold off? One essential tool to discover the solution is the Meta P/E ratio. This powerful financial metric offers a window into how the market values Meta’s income capability and usual status in the tech global.

But numbers alone don’t inform the whole story. Behind the figures lies a story of innovation, ambition, and calculated risks. From its dominance in social media to its groundbreaking investments in artificial intelligence and the metaverse, Meta maintains to shape the digital landscape.

In this text, we’ll decode the significance of Meta P/E ratio, see the way it stacks up in opposition to enterprise titans like Alphabet and Apple, and discover the underlying elements using its valuation. We’ll additionally examine marketplace sentiment, sales increase, and investor views that will help you determine if Meta is the proper addition for your portfolio.

What is the P/E Ratio?

Types of P/E Ratios

- Trailing P/E: Based at the past three hundred and sixty-five days of real earnings.

- Forward P/E: Based on projected earnings for the subsequent 365 days.

Interpreting P/E Values

- High P/E: Indicates sturdy investor expectations for destiny growth.

- Low P/E: Could advise undervaluation or underlying dangers.

Meta Financial Overview

| Company | P/E Ratio | Market Cap | Revenue |

|---|---|---|---|

| Meta | 24.48 | $1.48T | $164.5B |

| Alphabet | 20.36 | $1.74T | $324.0B |

| Apple | 29.28 | $2.83T | $394.3B |

| Microsoft | 32.15 | $3.05T | $260.2B |

Key Factors Affecting Meta P/E Ratio

Revenue & Earnings Growth (+20.6% YoY)

Meta's consistent revenue growth demonstrates strong market position and advertising dominance, supporting its P/E valuation.

Profitability Leadership

Cost Management Strategy

Despite significant investments in future technologies, Meta maintains disciplined cost controls in its core advertising business.

3. Market Sentiment and Search Trends

- “Meta P/E ratio” has visible steady seek interest, indicating endured investor interest.

- “Facebook share price” and “Meta systems stock” searches stay high, reflecting sturdy public hobby in Meta’s inventory overall performance.

- “Market cap” and “fee earnings ratio” are regularly searched financial terms, reinforcing their significance in funding choices.

4. Investments in AI and the Metaverse

Meta has aggressively invested in AI and its Reality Labs division, focusing on AR/VR generation. While these tasks gift long-term increase potential, they also contain high costs and uncertainty.

5. Competition and Regulatory Risks

Meta faces severe competition from Instagram, YouTube, and other digital marketing players. Additionally, regulatory scrutiny over statistics privacy and monopolistic practices could effect its boom trajectory.

Expert Opinions on Meta Valuation

"Meta center advert business stays robust, and its AI investments may want to drive future growth. However, the metaverse remains an excessive-hazard guess that traders have to reveal carefully."

Compared to its historical valuation, Meta is reasonably priced, making it an attractive purchase for long-term investors." – Market StrategistTech Venture Spot Team

Should You Invest in Meta?

Meta Investment Decision Matrix

Compelling Advantages

Financial Strength

20.6% YoY revenue growth with industry-leading margins

Innovation Power

Dominance in AI research and digital advertising technology

Attractive Valuation

24.48 P/E ratio vs 10-year average of 33.63

Key Risks

Metaverse Uncertainty

$10B+ annual investment in unproven virtual reality projects

Regulatory Pressure

Antitrust lawsuits and privacy law changes could impact profits

Fierce Competition

TikTok, Google, and emerging platforms challenging dominance

Strategic Investment Advice

Meta presents a compelling value proposition for long-term investors comfortable with moderate risk. Key considerations:

- Allocate 3-5% of portfolio for balanced exposure

- Monitor quarterly Reality Labs burn rate

- Diversify with complementary tech stocks

Conclusion

Meta present day P/E ratio shows a fair valuation in comparison to its historical common and industry friends. While its AI and metaverse investments may want to pressure long-term boom, buyers should weigh regulatory risks and competitive pressures earlier than investing.

By staying informed on marketplace trends, financial overall performance, and seek information, traders could make greater assured decisions concerning Meta’s inventory.

Stay up to date, examine market developments, and make investments wisely.

Pingback: Ford PE Ratio Deep Dive: Undervalued Gem or Value Trap?

Pingback: S&P 500 PE Ratio: Trends, History & Future Insights