Profiling India's Top AI Stocks for 2025

Introduction

India's artificial intelligence (AI) industry is at a major inflection point in 2025. Fueled by new ventures in machine learning, strong government initiatives, and explosive enterprise adoption, the sector is poised for unprecedented growth and innovation.

This analysis profiles prominent AI-related technology stocks based on valuation, growth trends, trading volume, and market capitalization. (Last published July 8, 2025 - 11:15 AM IST)

Market Situation and Key Serials

The landscape for AI in India is defined by rapid market expansion and robust government backing.

Sectoral Adoption is Broad-Based:

- Healthcare: AI is transforming diagnostics, telemedicine, and drug discovery pipelines.

- Finance: Algorithmic trading, personalized advisory, and fraud detection are boosting efficiency.

- Automotive: Key focus areas include autonomous driving, predictive maintenance, and supply chain optimization.

Best 5 AI Stocks to Buy in India

Based on analyst ratings and market performance, these five companies stand out in the AI space.

Current Stock Prices and Metrics (as of July 8, 2025)

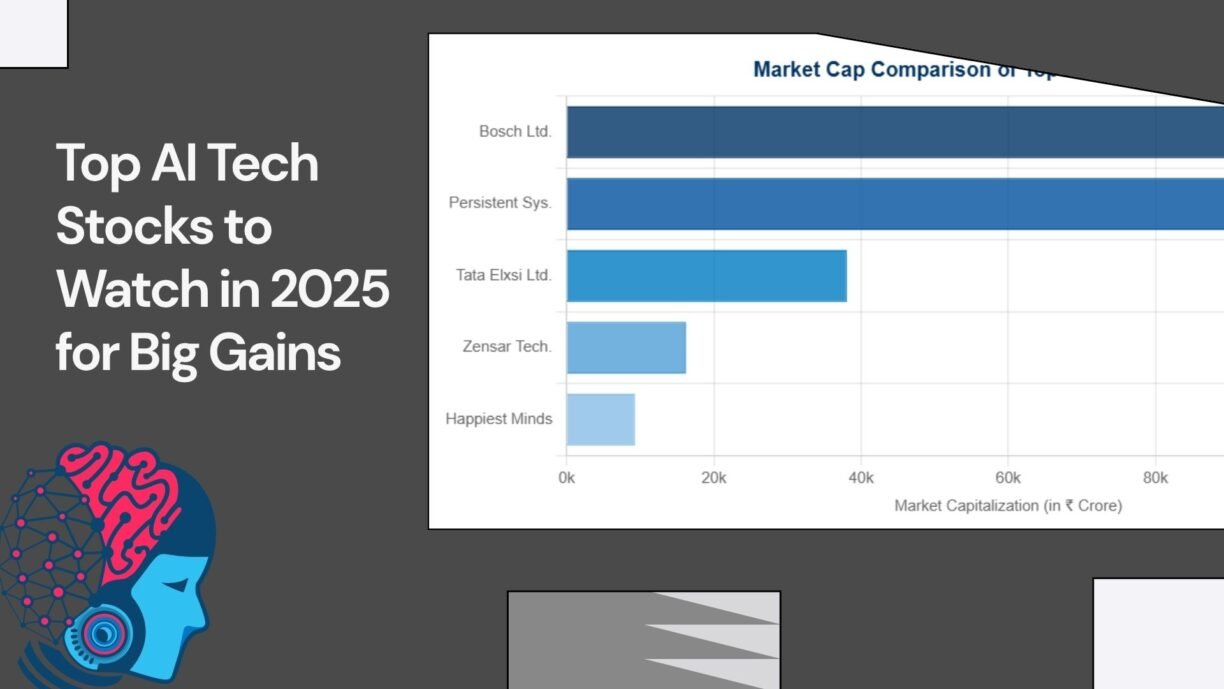

| Company Name | Current Price (₹) | Market Cap (₹ Cr) | P/E Ratio | ROE (%) | ROCE (%) | Debt to Equity | Sector |

|---|---|---|---|---|---|---|---|

| Tata Elxsi Ltd. | 6,110.20 | 38,050 | 186.48 | 34.62 | 46.60 | 0.00 | Tech Services |

| Bosch Ltd. | 35,631.10 | 105,076 | 52.42 | 21.60 | 28.02 | 0.00 | Auto Ancillaries |

| Persistent Systems Ltd. | 5,818.00 | 91,345 | 65.18 | 24.1 | 30.4 | 0.04 | Tech Services |

| Happiest Minds Tech. Ltd.* | 606.75 | 9,239 | 41.50 | 21.46 | 23.35 | 0.30 | Tech Services |

| Zensar Technologies Ltd.* | 713.90 | 16,213 | 25.07 | 20.52 | 27.43 | 0.00 | Tech Services |

*Note: Prices for Happiest Minds and Zensar are from April 2, 2025, data and may have changed. Investors should always check real-time data before making decisions.

AI Penny Stocks in India

True AI-focused penny stocks are rare in India, as most established AI players are mid to large-cap companies. The term is sometimes used more broadly for lower-priced tech stocks.

- Remarkable Contenders: Based on price point (under ₹1000), some consider stocks like Happiest Minds Technologies (₹606.75) and Zensar Technologies (₹713.90) in this context, although they are established mid-cap firms.

- Beware Interpretation: Lower-priced stocks can be highly volatile. Thin liquidity and limited analyst coverage can amplify both gains and losses, so extreme caution is advised.

Growth Potential & Key Drivers

Strong Historical Performance:

- Bosch India: 123% return over 3 years.

- Persistent Systems: 51% return over 3 years.

- Tata Elxsi: 27% return over 1 year.

Government Support:

- The Union Budget 2025-26 has allocated a significant budget for AI education centers, fostering a skilled workforce.

- National AI policies are designed to drive adoption in critical sectors like healthcare, finance, and manufacturing.

Picking Your AI Stocks

- Investment Horizon: AI is a long-term growth story. Investors should be prepared for short-term volatility and consider a 3- to 5-year investment horizon.

- Platform Monitoring: Use real-time trackers like Moneycontrol or Screener to monitor price action and company fundamentals.

- Due Diligence: Beyond price, analyze the company's core business, client base, and role in the AI ecosystem.

Frequently Asked Questions: Investing in AI Tech Stocks

What are the best picks of AI stocks in 2025?

Top contenders include Tata Elxsi, Persistent Systems, Happiest Minds, Cyient, and Zensar Technologies.

What is the base of their growth?

Their growth is driven by a strong emphasis on R&D, strategic international partnerships, and recurring revenue from software-as-a-service models.

What is the best strategy to measure AI stocks?

Focus on key metrics like revenue growth rates, profit margins, expenditure on R&D, and the rate of new client acquisitions.

What are the main risks involved?

Key risks include high valuation rates, the rapid pace of technological change, potential regulatory amendments, and general market fluctuations.

What is an ideal investment horizon for these stocks?

An investment horizon of at least 3 to 5 years is recommended to weather short-term volatility and realize the full value of long-term AI adoption.

Where can I view their performance?

Real-time data, including dashboards and charts, is available on financial websites like Moneycontrol and on the official NSE and BSE websites.

What role does government support play for these stocks?

Government initiatives like the IndiaAI Mission and funding for AI infrastructure create a supportive ecosystem, boosting demand and growth for the entire sector.

Are AI penny stocks worth investing in?

They should be considered only for small-scale, high-risk portfolios. The vast majority of high-potential, fundamentally strong AI companies are established mid-cap or large-cap stocks.