Introduction: the Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF

Imagine yourself sitting in your neighborhood coffee shop, discussing with your buddy who is excited but also cautious of investing in small businesses. That's me. I'm here to guide you through how this ETF works—no technical jargon with no substance, no secret annotations—and to express my sense of excitement and caution as we proceed. By the end, you will be aware that:

- What the ETF is attempting to do

- How it selects its 100 stocks

- Why momentum and quality can be a potent combination

- The pragmatic advantages and disadvantages

- Simple ways to begin getting involved

Let’s get started.

What Is This ETF All About?

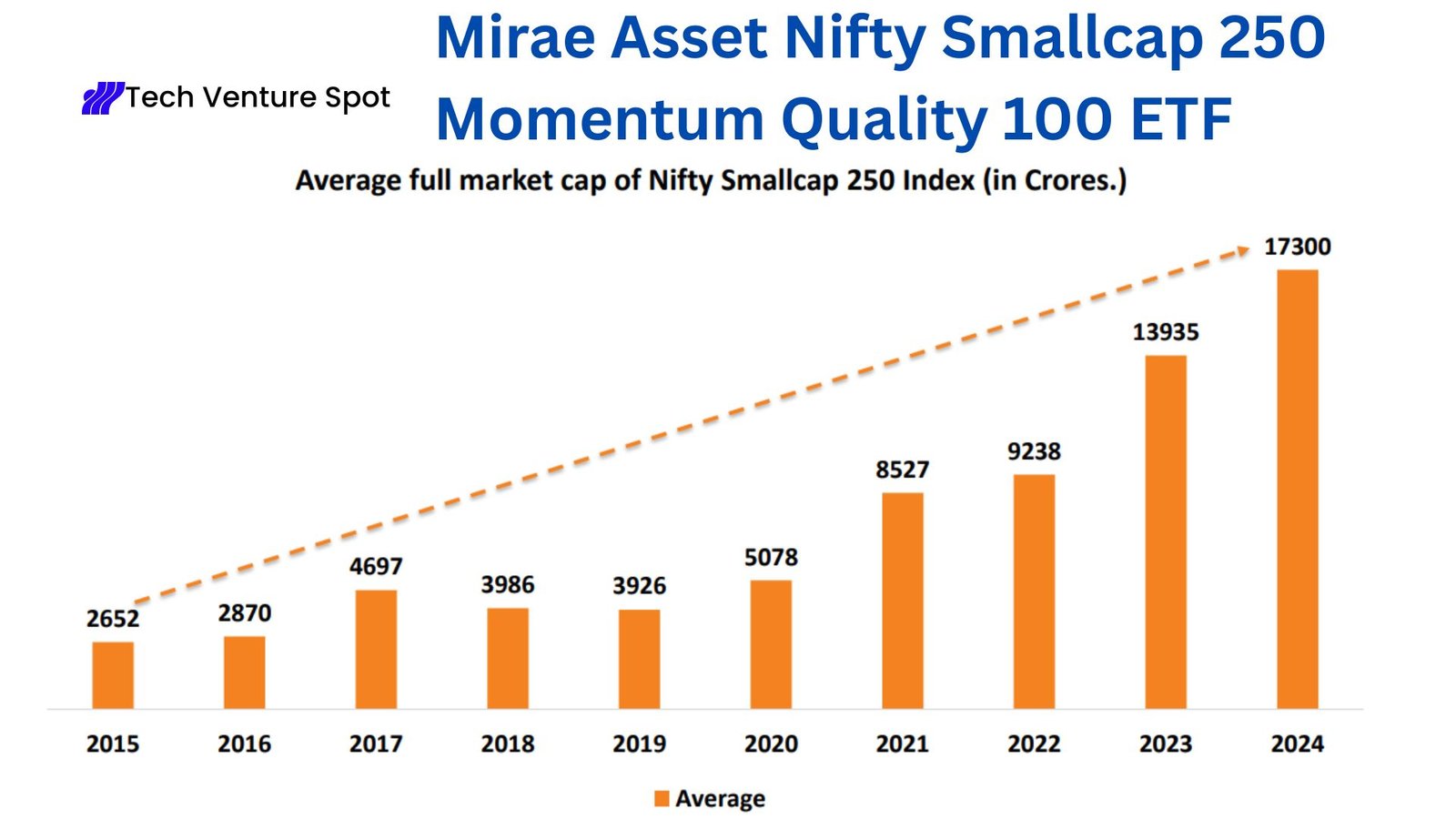

In essence, Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF is an open-ended fund that mimics a custom-made index of 100 Indian small-cap stocks. Instead of merely investing in the highest 250 small‑caps by market capitalization, it screens, ranks, and selects the best 100 quality stocks, combining price action ("momentum") and health of the business ("quality"). The charm? Greater upside when markets rise, and a gentler fall when they decline.

Key Information at a Glance

| Release Date | February 23, 2024 |

| AUM (Apr 2025) | ~₹576 crore |

| Expense Ratio | 0.39% p.a. |

| Minimum Investment | ₹5,000 (best for first-time investors) |

| Trading | Listed on NSE & BSE; intraday liquidity similar to a stock |

How the Magic Happens: Construction Process

+I prefer rule-based approaches because they eliminate human emotion from the process—yet somehow attempt to impart the same emotion that markets accomplish. Here is a straightforward six-step plan:

- Begin with 250 Small-Caps: The world encompasses all the stocks in the Nifty Smallcap 250.

- Clean Up the List: Remove illiquid names, heavily promoter-pledged stocks, or stocks habitually hitting circuit limits. It's akin to taking rattly roller-coaster cars out of the ride.

- Score for Momentum: Stocks that stick around receive momentum points for 6- and 12-month returns but lose points for wild oscillations. Consistent risers are the beneficiaries.

- Score for Quality: Rewards are given for satisfactory return on equity, minimal debt, and stable profits. This is the "safety harness."

- Combine & Select: The highest 100 stocks by combined score get in—thus "Momentum Quality 100."

- Weight by Score + Size: Instead of equal weight, larger and more powerful stocks hold a little extra weight, so your ETF does not get too heavy on a small microcap champion with a hint of air.

This index is updated every six months (June and December), thus keeping pace with developments in the market.

Why This Smart-Beta Hybrid Matters

+1. Growth with Guardrails

Small companies can rise a lot—or fall a lot. By following recent successful stocks, this ETF takes advantage of momentum, but the quality check keeps the risk low. You experience excitement without too many stressful moments.

2. A Smoother Ride

Clean momentum-only methods can fall off sharply when trends reverse direction; clean quality can lag behind in breakouts. Both together give more stable ascents and less dramatic falls. It's like constructing a sports car with anti-lock brakes.

3. Broad Yet Focused

With 100 stocks in sectors—finance, auto parts, consumer goods, technology, pharma—you're diversified enough to steer clear of single-stock shocks, but concentrated enough to grab meaningful small-cap growth.

4. Affordable and Clear

At 0.39% annually, it's less expensive than most actively managed small-cap funds. And since you purchase it like a stock, you get real-time pricing and can buy/sell whenever you want (depending on market liquidity).

Peeking Under the Hood: Industry Structure

+Whereas actual distributions differ with each rebalance, anticipate approximately:

Note: Weights are approximate and can change with rebalancing. Bars represent mid-points of ranges for illustrative purposes.

This diversification implies that you are not depending solely on banks or solely on pharma firms—your portfolio can absorb issues in particular industries.

Trading & Cost Factors

+- Expense Ratio (0.39%): A minimal additional fee over normal small-cap ETFs (typically 0.20%) gets you the smart-beta structure.

- Liquidity: Traded on NSE using the ticker SMALLCAP, with the help of specialist market‑makers. Narrower bid‑ask spreads than some small‑cap mutual funds, but broader than mega‑cap ETFs.

- No Exit/Entry Loads: You can come in or go out without charges, yet stamp duty and brokerage apply.

Remember: tracking error is normal—your returns will vary from a basic small-cap index because of different investments.

How's it going so far?

It's relatively recent—just a year's history to learn about. Here's the overview (Feb 2024–May 2025):

| Fund / Index | 1-Year Return | Cost | AUM (₹ Cr) |

|---|---|---|---|

| This Smart-Beta ETF | -3.7% | 0.39% | 576 |

| Plain Nifty Smallcap 250 Index (i.e., HDFC ETF) | +5.7% | 0.20% | 1,036 |

A rough year for small caps left our smart‑beta fund in the dust behind the aggregate index. Short‑term setbacks are not fate, though; multi‑year studies demonstrate momentum‑quality outperforms vanilla small caps across full cycles. Treat this initial year as a shakedown cruise on rough roads.

What problems can happen?

+Investment is always a risk—below are the key considerations:

- High Volatility: Small businesses can have great swings. Expect 20–30% drops on bad days.

- Concentration Bias: Quality screens can predispose you to finance or pharma; momentum screens can predispose you to cyclicals. Sector shocks can still hurt.

- Tracking Error: Factor bets ensure that you will not exactly replicate vanilla small-cap returns. You won't necessarily outperform.

- Underlying Liquidity: The ETF trades smoothly, but underlying shares can get choppy in panics and widen spreads.

- Macro Shocks: Any fundamental economic downturn or credit squeeze will hurt small businesses the most, independent of quality scores.

If you have the heebie-jeebies looking at red on your screen, risk only what you can afford to lose—perhaps 5–10% of your shares.

How to Begin Investing in This ETF

+- Long‑Term Mindset: Target 5+ years. Strategies take time to bear fruit.

- SIP (Systematic Investment Plan): Averaging monthly can even out entry points and minimize regret.

- Phased Buying: If you like lump sums, consider breaking up into quarterly tranches.

- Tactical Entry: If you observe small-cap corrections, you can time big purchases on declines—but don't try to "time the market" too accurately.

- Alternate FoF Route: Mirae's Fund‑of‑Fund invests in this ETF—convenient if you would rather mutual funds structure (at slightly higher cost).

A Realistic Case Study

Meet Neha, a 32-year-old IT professional. Neha invested ₹75,000 as a lump sum in March 2024, and followed it up with ₹10,000 a month.

When small-cap stocks dipped 15% in December 2024, she upped her monthly contribution to ₹20,000 for three months, thinking it was "paying less per unit." Halfway through 2025, a gentle recovery had her balance exceeding what she had contributed.

More significantly, she feels in control—her step-by-step plan and conservative decisions kept her from panicking and selling out. Neha views this as a 7-year ride, not a short-term gain, and sleeps peacefully knowing she didn't buy at the absolute top.

Is this ETF your next move?

It's up to you, but I'll leave you with my last words: If you hunger for growth and can stomach heart-stopping plunges, this ETF deserves a spot in your satellite portfolio. If you like solid large companies, keep this as a minority share—say 5% of your total stocks.

If you are new to markets, start slowly with an SIP, learn its rhythm, and experiment with how comfortable you are with volatility. This fund is a rollercoaster with improved safety harnesses: just as exciting, but with extra protection that pure small caps lack. Over time, that harness could keep you from the most destructive falls, and enable you to enjoy the exhilarating climbs.

But remember, no harness is foolproof—do your own homework or consult a trusted guru before boarding. Here's to intelligent choices, secure investing, and riding the tide!

Pingback: HDFC Nifty Smallcap 250 ETF Portfolio Overview