📈 INBS Stock Forecast Analysis (NYSE: INBS)

| Previous Close | 1.2200 |

| Day's Range | 1.1820 - 1.3000 |

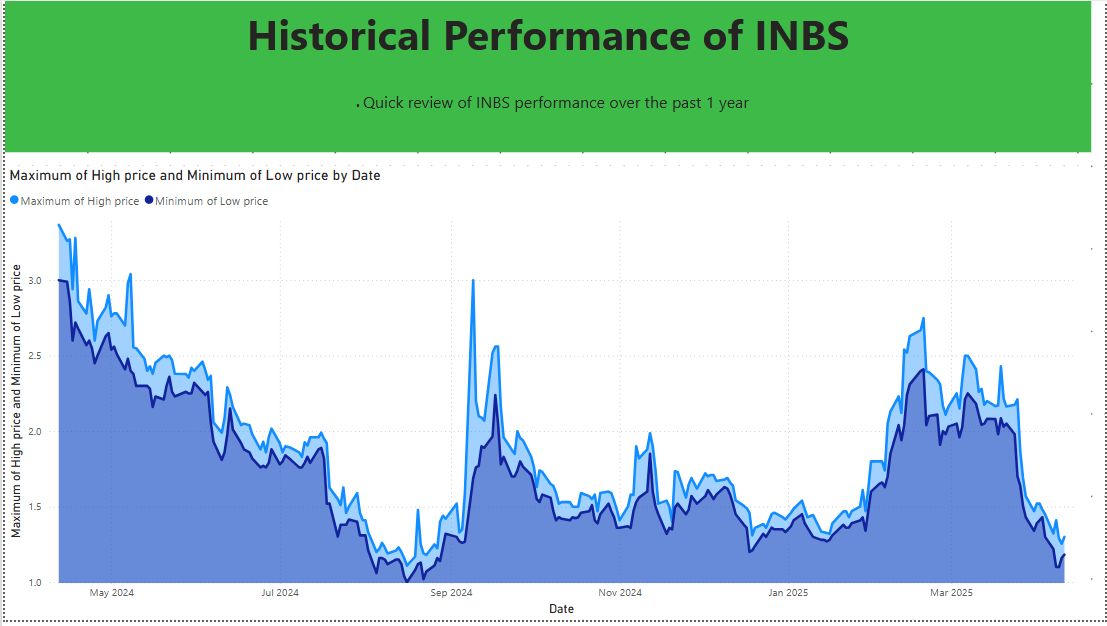

| 52 Week Range | 1.0000 - 3.2800 |

| Volume | 34,290 |

| Avg. Volume | 210,112 |

INBS Stock Forecast 2025

$1.21 -4.72%

NASDAQ: INBS | Updated: April 11, 2025

Key Metrics

52-Week Range

$1.03 - $3.35

Market Cap

$8.21M

Volume

62,883

2025 Monthly Forecast

| Month | Low | Avg | High | ROI |

|---|---|---|---|---|

| Apr 2025 | $1.23 | $1.23 | $1.23 | 3.15% |

| May 2025 | $1.22 | $1.22 | $1.23 | 3.42% |

| Jun 2025 | $1.225104 | $1.2269 | $1.228413 | 3.27% |

| Jul 2025 | $1.224603 | $1.225633 | $1.227406 | 3.35% |

| Aug 2025 | $1.224085 | $1.225042 | $1.226903 | 3.39% |

| Sep 2025 | $1.223072 | $1.224197 | $1.225704 | 3.49% |

| Oct 2025 | $1.222488 | $1.22277 | $1.223243 | 3.68% |

| Nov 2025 | $1.221553 | $1.222016 | $1.222828 | 3.71% |

| Dec 2025 | $1.220938 | $1.221445 | $1.221786 | 3.80% |

📉 INBS 2025 Technical Outlook: Storm Clouds Ahead

📉 Moving Averages

🔴 50-Day SMA: $1.94 (Sell)

🔴 200-Day SMA: $1.63 (Sell)

⚖️ Momentum Indicators

📉 MACD: Bearish Crossover

🚨 RSI(14): 27.08 (Oversold)

🎢 Volatility

🛑 Immediate Support

🛑 Strong Support

🚧 Resistance Zone

✅ Potential Upsides

💊 Med-tech innovation plays

📈 99.58% below ATH

🚀 Oversold rebound potential

❌ Major Risks

📉 Consistent losses (EPS -$0.50)

🌪️ High volatility

🚫 No dividend history

🔭 2025 Price Projections

⚠️ Investor Alert: High-Risk Profile

Suitable for: 🎢 Volatility traders | ⏱️ Short-term speculators | 💡 Biotech believers

Not for: 🛌 Conservative investors | 💰 Income seekers | 🧘♂️ Risk-averse individuals

🔔 Essential: Set price alerts and monitor news flow constantly.

Will the stock of INBS increase in 2026?

Conclusion: Can You Rely on the INBS Stock Prediction for 2025?

The INBS stock forecast 2025 is a conservative one. While the stock is oversold, with short-term hopes of recovery, the long-term trend is very bearish. If you are a high-risk investor, there may be possibilities of profiting from short-term technical recoveries.

⚠️ Friendly Reminder: Do Your Own Research (DYOR) Always invest based on good research. Refer to this article as a guide but also do your own research, such as reading company reports, news flash, and expert opinions.

Stay Informed as with FDA approvals, product releases, and collaborations occuring INBS news watching will come in handy to you. Install alert settings or employ a tracker program for that.