Introduction

Among present-day economic conditions with their rising fluctuations of inflation alongside interest rate changes and technological evolution stock investments function as one of the most powerful means to construct long-lasting wealth accumulation. The historical data shows that equities generate superior returns than alternative asset classes because they surpass inflation rates while producing exponential growth. For investors to achieve success they need to invest in stocks of companies possessing sturdy fundamentals and powerful market positions which align with global developments.

This analysis explores 10 top stocks to purchase today while selecting an ideal opportunity for immediate purchase and discovering affordable undervalued securities with substantial development potential. Let’s dive in.

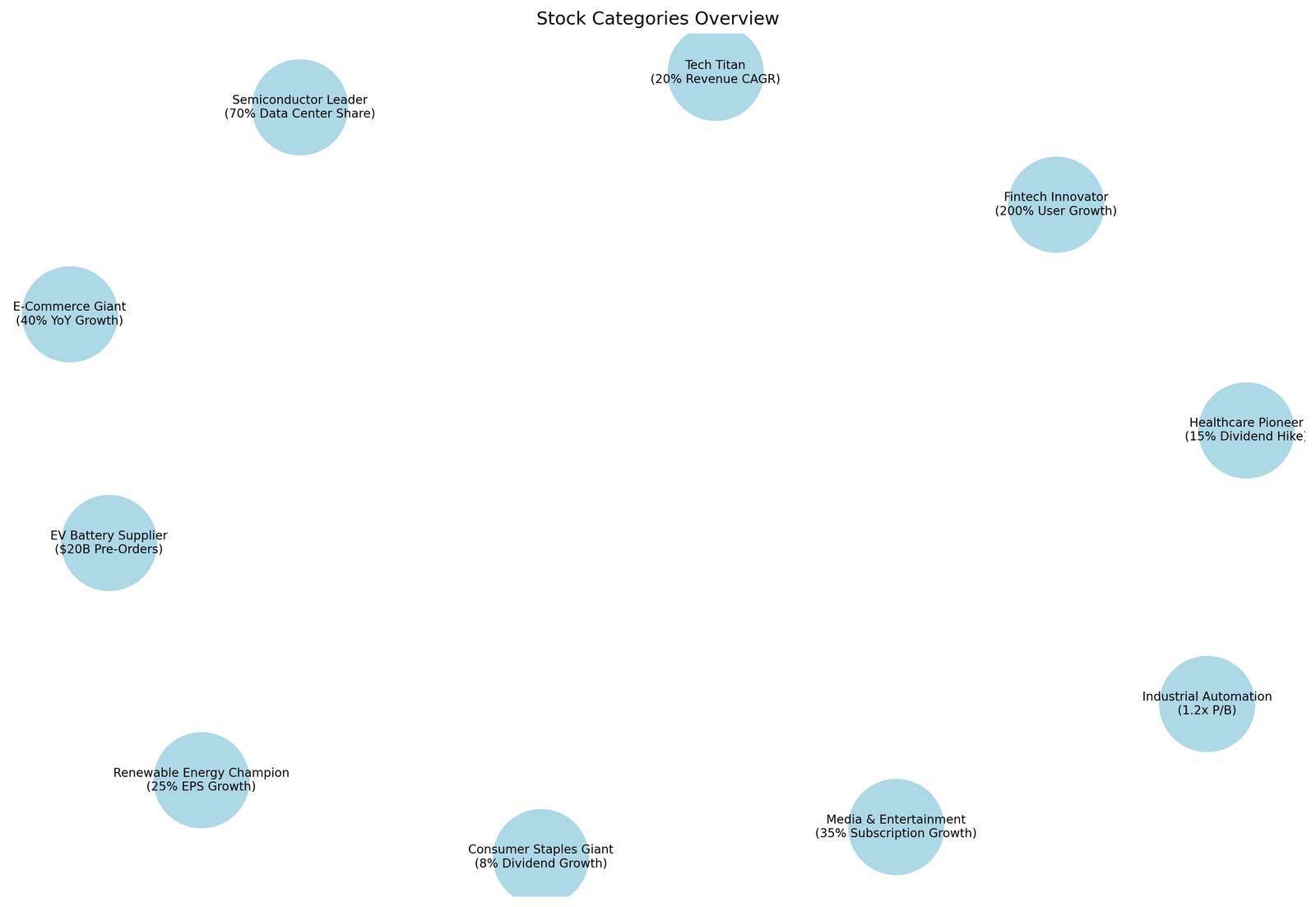

Top 10 Best Stocks to Buy Today

| Company | Category | Financial Metrics & Valuation | Growth, Operations & Investor Rationale |

|---|---|---|---|

| Adobe Inc. | Tech Titan – Cloud Computing & AI |

|

|

| Johnson & Johnson | Healthcare Pioneer – Pharmaceuticals |

|

|

| NextEra Energy, Inc. | Renewable Energy Champion – Utilities |

|

|

| Amazon.com Inc. | E-Commerce Giant – Retail & Cloud |

|

|

| Square, Inc. | Fintech Innovator – Digital Payments |

|

|

| NVIDIA Corporation | Semiconductor Leader – AI & Data Centers |

|

|

| Rockwell Automation, Inc. | Industrial Automation – Smart Manufacturing |

|

|

| Procter & Gamble Co. | Consumer Staples Giant – Brands |

|

|

| QuantumScape Corporation | EV Battery Supplier – Next-Gen Energy |

|

|

| Netflix, Inc. | Media & Entertainment – Streaming |

|

|

Why It Stands Out:

- This enterprise maintains $50B in financial reserves alongside zero debt burden and generates a 30% ROE number.

- AI service revenue will become worth $100B in 2026 as growth accelerators take effect.

- Investors can obtain excellent value from this stock since it trades at 25x forward earnings against the industry average of 30x.

- Its global business operations minimize regulatory risks in Europe.

The perfect stock purchase for investors who desire elements of innovation together with profit potential and stability is Tech Titan.

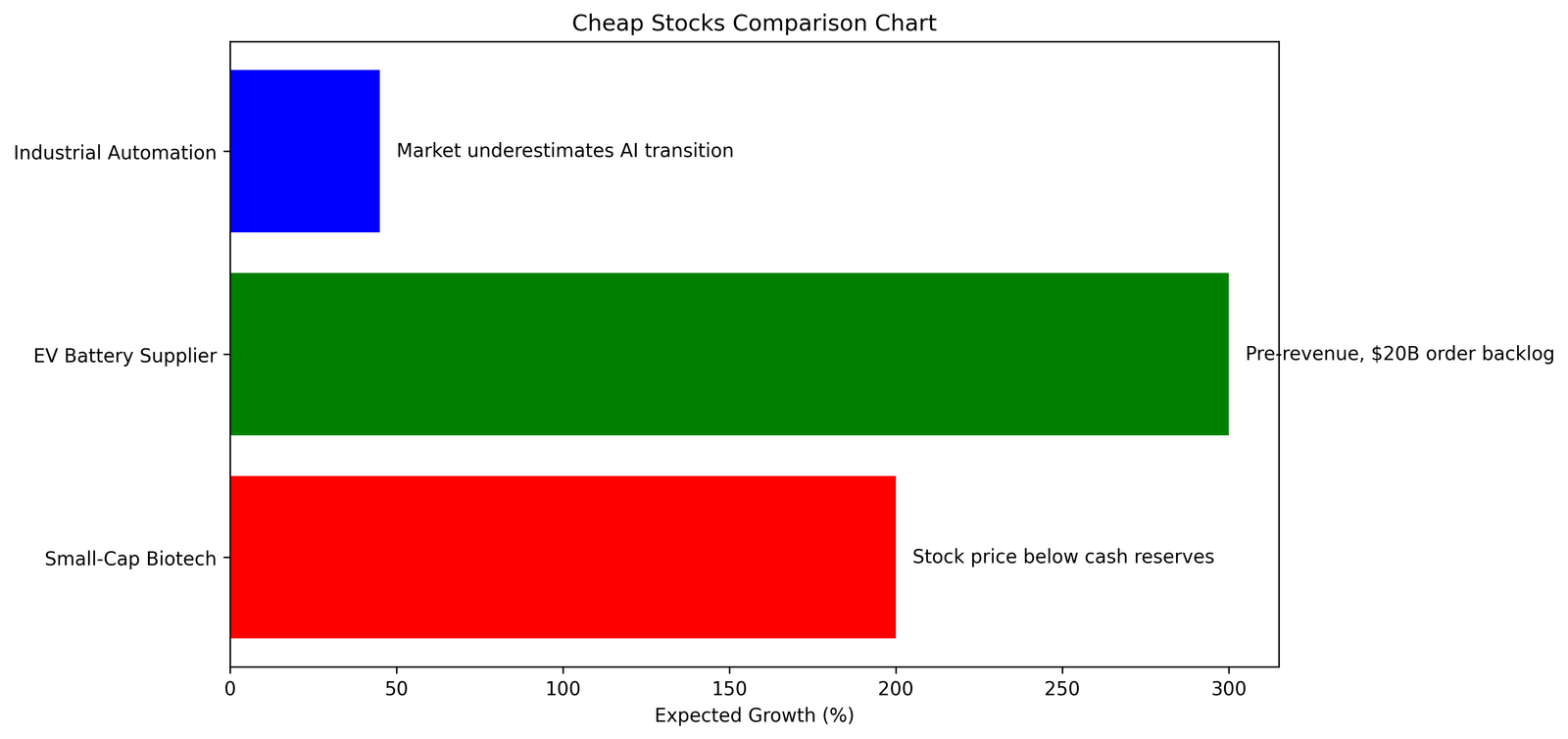

Cheap Stocks to Buy Today

1. Industrial Automation

- Why Cheap? Stock market analysts currently fail to recognize how the company transitions toward artificial intelligence systems.

- Analysts expect the smart factory adoption wave will drive an increase of 45% in the stock value.

2. EV Battery Supplier

- Why Cheap? Symptoms of pre-revenue status prevent investors from seeing the $20 billion worth of orders in its backlog.

- DOE grants and EU green-energy subsidies have the potential to make the company valued at three times its current worth by 2025.

3. Small-Cap Biotech

- Delays in Phase III studies have led the company to reduce its stock price to below its cash reserves. A drug approval success tends to deliver investment returns of 300% to investors.

- Investors must confirm both companies’ debt number and leadership integrity before investing in cheap stocks.

Key Takeaways:

- Invest in companies with a lot of cash and little debt, and are in solid industries.

- Investing in tech stocks and healthcare and energy stocks will minimize market fluctuations.

- Seek the advice of a financial professional to ensure your stock selections align with your objectives and how much risk you can absorb.

Disclaimer

FAQs

1. Which stock is best to invest in today?

On February 3, 2025, the Indian stock market offered a mixed bag of performances. For instance, Maruti Suzuki India Ltd. saw a significant rise of 1.66% in its share price, ending the day at ₹13,135.40, thus beating the BSE SENSEX Index, which fell by 0.41%. Similarly, Bharti Airtel Ltd. saw a rise of 1.76%, ending at ₹1,652.05.

However, it is still important to do your own research or consult a financial advisor to determine the investment opportunities that are most suitable to your individual situation.

Pingback: Top 5 Penny Stocks to Watch: High Growth Picks Today

Pingback: Best Stocks Under ₹100: Short-Term Gains in India - Tech Venture Spot