Table of Contents

Introduction

India’s electric vehicle (EV) revolution is taking place at a rapid rate, providing excellent investment opportunities in the battery market. With government incentives, new technology, and increasing adoption of electric vehicles, electric vehicle battery stocks in India are drawing investors.

This article provides information on the EV battery market, key players, investment opportunities, and future trends, providing a comprehensive guide for investors who want to gain from this new market.

I. The Emergence of Electric Cars in India

Growing EV Market

India’s electric vehicle industry is expanding at a rapid pace. According to industry reports:

- Sales of EVs have increased more than 50% YoY.

- The 30% penetration by 2030 is government of India’s target.

- Battery costs have dropped by almost 80% in the past decade, reducing the cost of EVs.

- The electric vehicle industry is expected to pull in over $20 billion worth of investments by 2025.

- The government is keen to construct 50,000 charging points for electric vehicles across the nation to enable development.

Drivers of EV Growth

- Declining Battery Prices: Lithium-ion battery prices are decreasing, making EVs affordable.

- Government Subsidies: PLI scheme and FAME II scheme offer incentives and subsidies to battery makers.

- Environmental Issues: Increased awareness of pollution is driving consumers and companies towards EVs.

- Corporate Adoption: Fleet operators, logistics firms, and ride-sharing operators are fast embracing EVs.

- Technological Developments: Developments in battery management systems and energy-dense batteries are increasing EV range and lifespan.

Impact on Battery Market

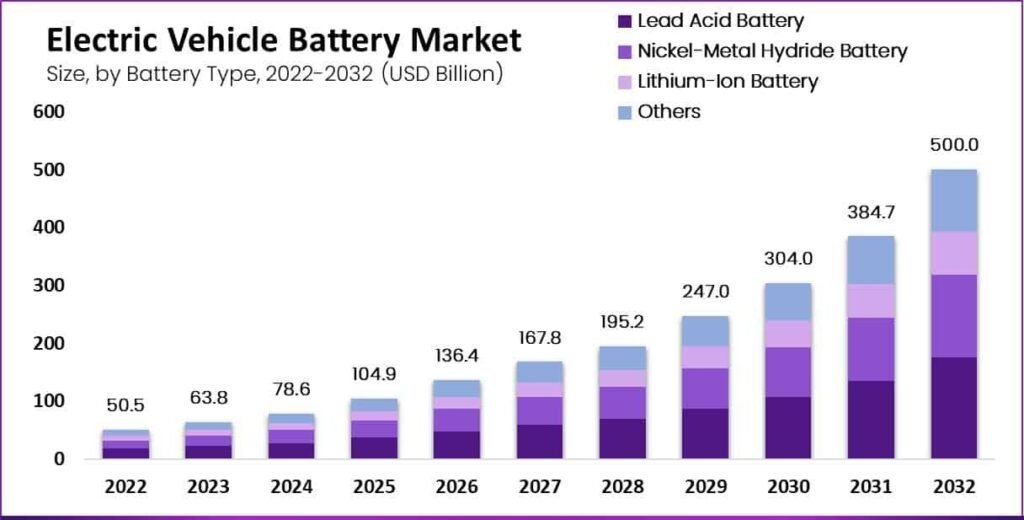

The market for EV batteries is booming with a forecasted CAGR of 16.8%, rising to USD 15.65 billion by 2029. This offers enormous opportunities for electric vehicle battery stocks in India. The initiative for self-reliance under Make in India has also helped local battery production, mitigating import dependence.

II. Key Players in the Indian EV Battery Market

Leading Battery Manufacturers

| Company | Market Focus | Key Strengths | External Link |

|---|---|---|---|

| Exide Industries | Lead-acid & Lithium-ion batteries | Strong brand presence, global reach | External Link |

| Amara Raja Energy & Mobility | Automotive & industrial batteries | Supplies to top automakers | External Link |

| HBL Power Systems | Defence, railways, and telecom | Expertise in specialized batteries | External Link |

| Eveready Industries | Consumer & industrial batteries | Extensive distribution network | External Link |

| Indo National (Nippo) | Zinc-carbon & alkaline batteries | Wide product range | External Link |

| Tata Chemicals | Lithium-ion batteries | Large-scale R&D in battery storage solutions | External Link |

| Ola Electric | EV battery technology | Building a lithium-ion cell manufacturing plant | External Link |

New Players

New firms are developing new concepts for solid-state batteries, sodium-ion, and battery recycling. Tata Chemicals and Ola Electric are heavily investing in large manufacturing units to produce lithium-ion batteries. Reliance Industries is entering the race for developing new battery technology.

Investment Prospect in EV Battery Stocks

Financial Analysis of Battery Firms

Investors must consider:

- Revenue Growth: Firms with greater sales indicate robust demand.

- Profit Margins: Lower costs result from higher margins.

- Debt Levels: Reduced debt indicates financial health.

- Cash Flow and R&D Spending: Firms which spend heavily on research and new concepts tend to perform well in the long run.

- Market Position & Competitive Advantage: Firms holding patents, distinctive technology, or effective distribution networks are likely to dominate.

Key Stock Metrics

| Metric | Why It Matters |

|---|---|

| P/E Ratio | Lower values suggest undervaluation |

| ROE (Return on Equity) | Higher ROE indicates profitability |

| Market Cap | Large caps are stable; small caps have high growth potential |

| Debt-to-Equity Ratio | Helps assess financial stability |

| Earnings Growth Rate | Indicates future profitability potential |

Risks and Issues

- Global competition: Global battery giants such as CATL and Panasonic are vying.

- Raw Material Dependence: Prices of lithium and cobalt are volatile, impacting cost.

- Technological Disruptions: Innovation like solid-state batteries may revolutionize the industry.

- Supply Chain Issues: India sources the majority of its lithium-ion battery cells from overseas, which may be a problem.

- Regulatory Adjustments: Government regulations on battery safety, recycling, and emissions can affect the way shares react.

IV. Government Policies and Regulations

Government Assistance to EV Batteries

- Production-Linked Incentive (PLI) Scheme: Promotes local production of batteries.

- Battery Swapping Policy: Encourages convenient means to swap batteries.

- Tax Incentives for EVs: Reduction in GST and subsidy to the producers and buyers of EVs.

- Import Duties: Measures being taken towards decreasing dependence on imported battery parts.

Safety and Quality Regulations

- BIS Certification: Ensures battery quality standards.

- Recycling Needs: Promotes eco-friendly recycling and disposal of batteries.

- Battery Performance Test Standards: Long-term use and safety tests required.

V. Future Developments in EV Battery Technology

Advancements in Battery Technology

- Lithium-Ion Advances: Greater energy density and rapid recharging.

- Solid-State Batteries: Safer, longer-lasting, and more efficient.

- Sodium-Ion Batteries: A cheap alternative to lithium-ion.

- Battery-as-a-Service (BaaS): Subscription battery ownership trends on the rise.

Sustainability and Recycling

- Businesses are investing in battery recycling facilities to recycle nickel, cobalt, and lithium.

- Government incentives are fueling circular economy models. Recycling batteries for solar storage is becoming popular.

VI. How to Invest Electric Vehicle Battery Stocks in India

Investment Methods

- Direct Stocks: Buying shares of battery manufacturers.

- Mutual Funds & ETFs: Diversified exposure to EV and battery sectors.

- Smallcases: Thematic investment in renewable energy and EV stocks.

Investors can fund sustainable government-backed projects through the issuance of Green Bonds.

Actionable Investment Tips

- Your investment portfolio should contain multiple types of successful established battery companies and upcoming up-and-coming battery companies.

- The stocks of batteries depend strongly on governmental policies that alter or transform existing regulations.

- Organizations which dedicate funds to research and development of next-generation battery technologies produce better growth opportunities.

- The Indian battery sector responds to global EV adoption patterns observed in China together with the United States and European nations.

Conclusion

The electric vehicle battery stocks in India present exciting opportunities for investors. The process of shifting toward sustainable mobility requires battery companies to take an essential part in Indian market transformation. To succeed investors need to do extensive market research while following trends closely alongside making safe investments that build value over time.

Key Takeaways:

- EV market growth in India continues to increase battery requirements across the nation.

- The leading battery manufacturing companies operating in India are Exide alongside Amara Raja together with HBL Power.

- The government implements policies which promote battery production within the national territory.

- People investing in this sector need to assess financial stability alongside technological progress and market evolution.

- The future trends in this industry include battery recycling alongside alternative power systems.

India is experiencing a promising outlook for electric vehicle battery stocks. Today marks the perfect time for investors to participate in the electric vehicle market expansion.

Pingback: Tata Motors PE Ratio Guide: Discover Hidden Value Today

Keep up the remarkable work !! Lovin’ it!

thank you !!

Pingback: Top EV Penny Stocks in India 2025 List

Pingback: Best IT Sector Penny Stocks in India to Watch in 2025